- Canada

- /

- Metals and Mining

- /

- TSXV:LAB

Amex Exploration And 2 Other TSX Penny Stocks To Consider

Reviewed by Simply Wall St

As Canadian and U.S. stocks continue to reach new highs, buoyed by trade optimism and strong corporate earnings, the market shows signs of stability despite potential volatility on the horizon. For investors considering smaller or newer companies, penny stocks—though an outdated term—still hold potential for value discovery. This article explores three Canadian penny stocks that exhibit financial strength and could offer intriguing opportunities in today's market landscape.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.66 | CA$66.76M | ✅ 3 ⚠️ 3 View Analysis > |

| Fintech Select (TSXV:FTEC) | CA$0.035 | CA$2.4M | ✅ 2 ⚠️ 3 View Analysis > |

| Foraco International (TSX:FAR) | CA$1.72 | CA$172.6M | ✅ 4 ⚠️ 1 View Analysis > |

| Findev (TSXV:FDI) | CA$0.435 | CA$12.03M | ✅ 2 ⚠️ 4 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.76 | CA$518.93M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$0.91 | CA$18.23M | ✅ 2 ⚠️ 4 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.65 | CA$183.23M | ✅ 2 ⚠️ 1 View Analysis > |

| ACT Energy Technologies (TSX:ACX) | CA$4.89 | CA$164.23M | ✅ 4 ⚠️ 2 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.94 | CA$184.26M | ✅ 3 ⚠️ 1 View Analysis > |

| McChip Resources (TSXV:MCS) | CA$1.58 | CA$9.02M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 455 stocks from our TSX Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Amex Exploration (TSXV:AMX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Amex Exploration Inc., along with its subsidiaries, is involved in exploring gold mining properties in Canada and has a market cap of approximately CA$214.22 million.

Operations: Amex Exploration Inc. does not report distinct revenue segments.

Market Cap: CA$214.22M

Amex Exploration Inc. is a pre-revenue company with no significant revenue streams, focusing on gold exploration in Canada. The company recently announced a non-brokered private placement to raise CA$29.97 million, with Eldorado Gold Corporation participating as a lead investor for CA$17.6 million, subject to stock exchange approval. Amex's board has seen changes with the appointment of experienced directors Phillip S. Brumit Sr. and Peter Damouni, enhancing its strategic capabilities in mining operations and corporate strategies. Despite being debt-free and having sufficient short-term assets to cover liabilities, Amex remains unprofitable without immediate prospects for profitability within three years.

- Unlock comprehensive insights into our analysis of Amex Exploration stock in this financial health report.

- Gain insights into Amex Exploration's future direction by reviewing our growth report.

Labrador Gold (TSXV:LAB)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Labrador Gold Corp. is involved in the acquisition and exploration of gold properties in the Americas, with a market cap of CA$14.45 million.

Operations: Labrador Gold Corp. currently does not report any revenue segments.

Market Cap: CA$14.45M

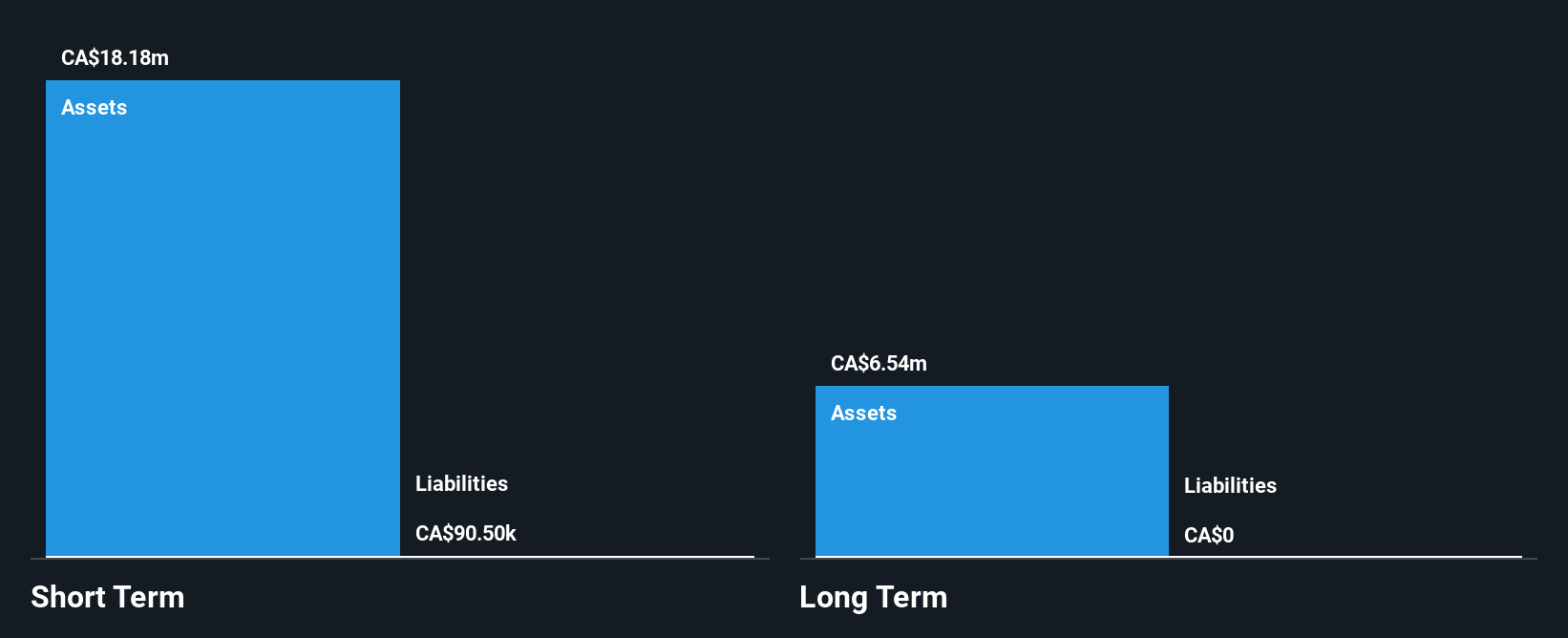

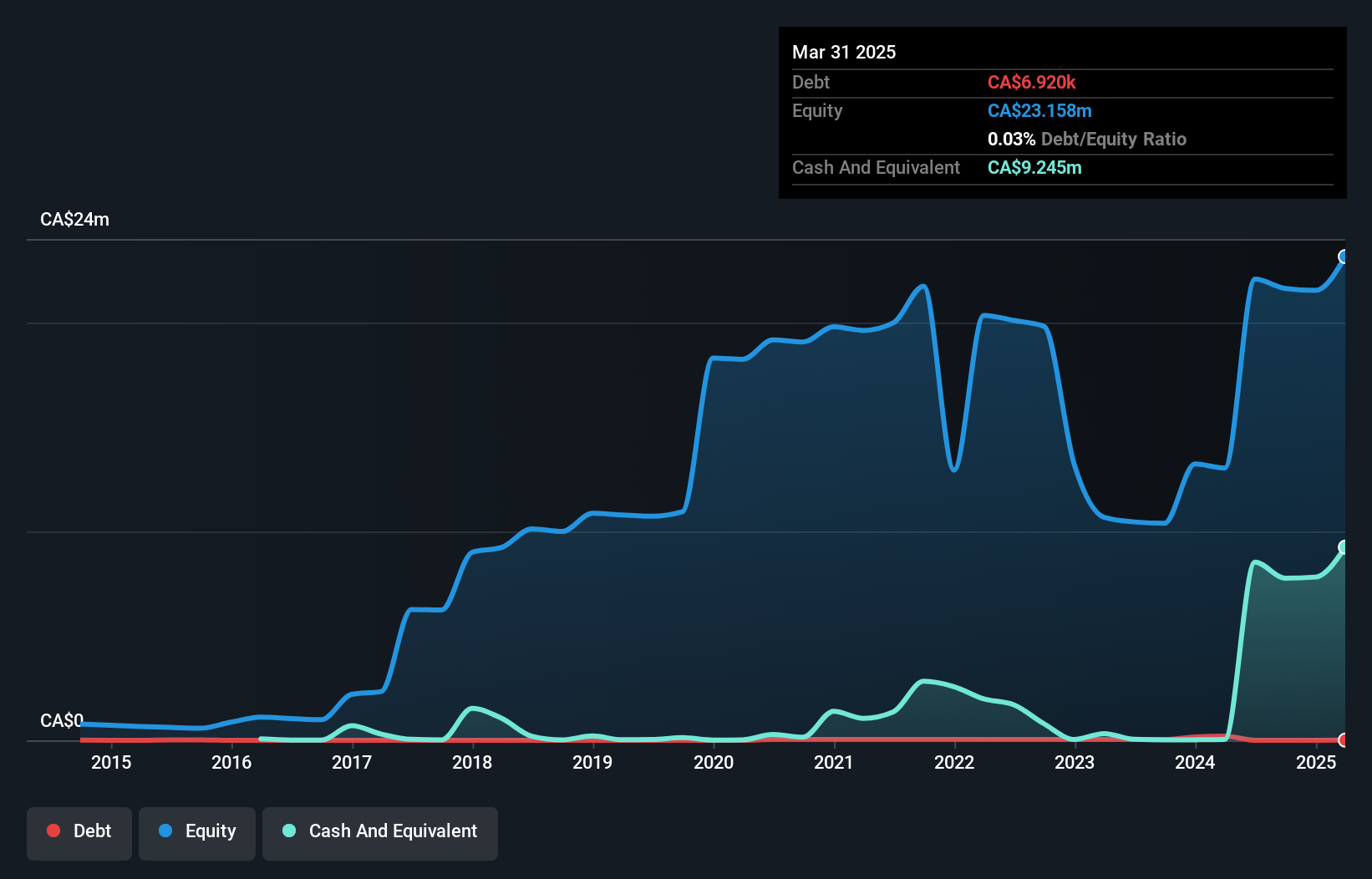

Labrador Gold Corp. is a pre-revenue company focused on gold exploration in the Americas, with a market cap of CA$14.45 million. The firm has mobilized field crews for its 2025 exploration program at the Hopedale project, targeting significant gold occurrences along the Thurber Gold trend and Fire Ant occurrence. Despite being unprofitable with increasing losses over five years, Labrador Gold maintains financial stability through sufficient short-term assets and no debt obligations. The management team is experienced, providing strategic direction as they continue to explore underexplored greenstone belts for potential gold discoveries amidst high share price volatility.

- Navigate through the intricacies of Labrador Gold with our comprehensive balance sheet health report here.

- Gain insights into Labrador Gold's past trends and performance with our report on the company's historical track record.

Midnight Sun Mining (TSXV:MMA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Midnight Sun Mining Corp. focuses on acquiring and exploring mineral properties in Africa, with a market cap of CA$117.21 million.

Operations: The company has not reported any specific revenue segments.

Market Cap: CA$117.21M

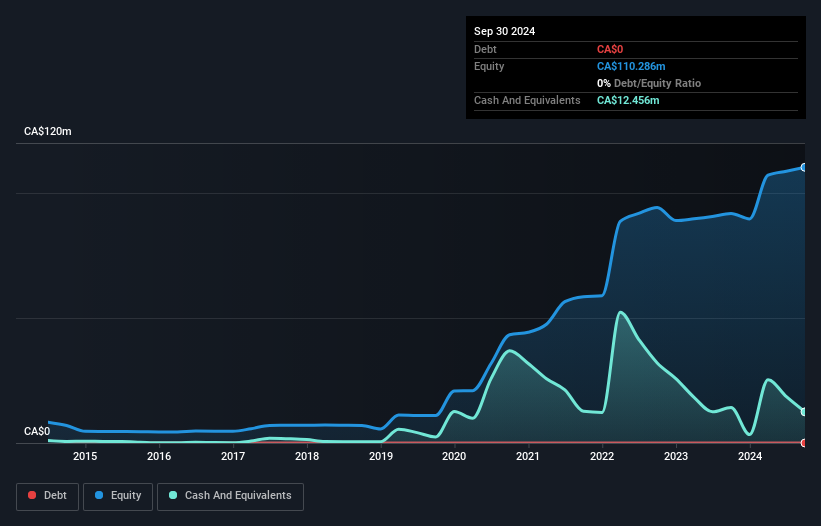

Midnight Sun Mining Corp., with a market cap of CA$117.21 million, is pre-revenue and engaged in mineral exploration in Africa. Recent developments include the expansion drilling program at Kazhiba-Main on its Solwezi Project in Zambia, aiming to complete an NI 43-101 compliant maiden resource estimate. The company has sufficient cash runway for over two years and has not experienced significant shareholder dilution recently. Despite being unprofitable with increasing losses over five years, Midnight Sun is advancing its exploration efforts under an experienced management team while maintaining financial stability through adequate short-term assets exceeding liabilities.

- Get an in-depth perspective on Midnight Sun Mining's performance by reading our balance sheet health report here.

- Evaluate Midnight Sun Mining's historical performance by accessing our past performance report.

Taking Advantage

- Access the full spectrum of 455 TSX Penny Stocks by clicking on this link.

- Contemplating Other Strategies? Uncover 15 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:LAB

Labrador Gold

Engages in the acquisition and exploration of gold properties in the Americas.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives