- Canada

- /

- Energy Services

- /

- TSX:CFW

January 2025 TSX Penny Stocks With Promising Potential

Reviewed by Simply Wall St

As we enter 2025, the Canadian market is navigating a complex landscape marked by shifting political dynamics and central-bank policies that have influenced government bond yields. In this context, penny stocks—often representing smaller or newer companies—continue to attract interest for their potential to combine value and growth opportunities. Despite being considered a niche area, these stocks can offer promising prospects when backed by strong financials, making them appealing options for investors looking to uncover hidden gems in the market.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Mandalay Resources (TSX:MND) | CA$4.18 | CA$392.54M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.46 | CA$13.18M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.46 | CA$125.06M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.36 | CA$948.57M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.69 | CA$629.3M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.29 | CA$225.41M | ★★★★★☆ |

| NamSys (TSXV:CTZ) | CA$1.11 | CA$29.82M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.045 | CA$4.07M | ★★★★★★ |

| Hemisphere Energy (TSXV:HME) | CA$1.85 | CA$180.43M | ★★★★★☆ |

| Tornado Infrastructure Equipment (TSXV:TGH) | CA$0.97 | CA$133.43M | ★★★★★☆ |

Click here to see the full list of 944 stocks from our TSX Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Calfrac Well Services (TSX:CFW)

Simply Wall St Financial Health Rating: ★★★★☆☆

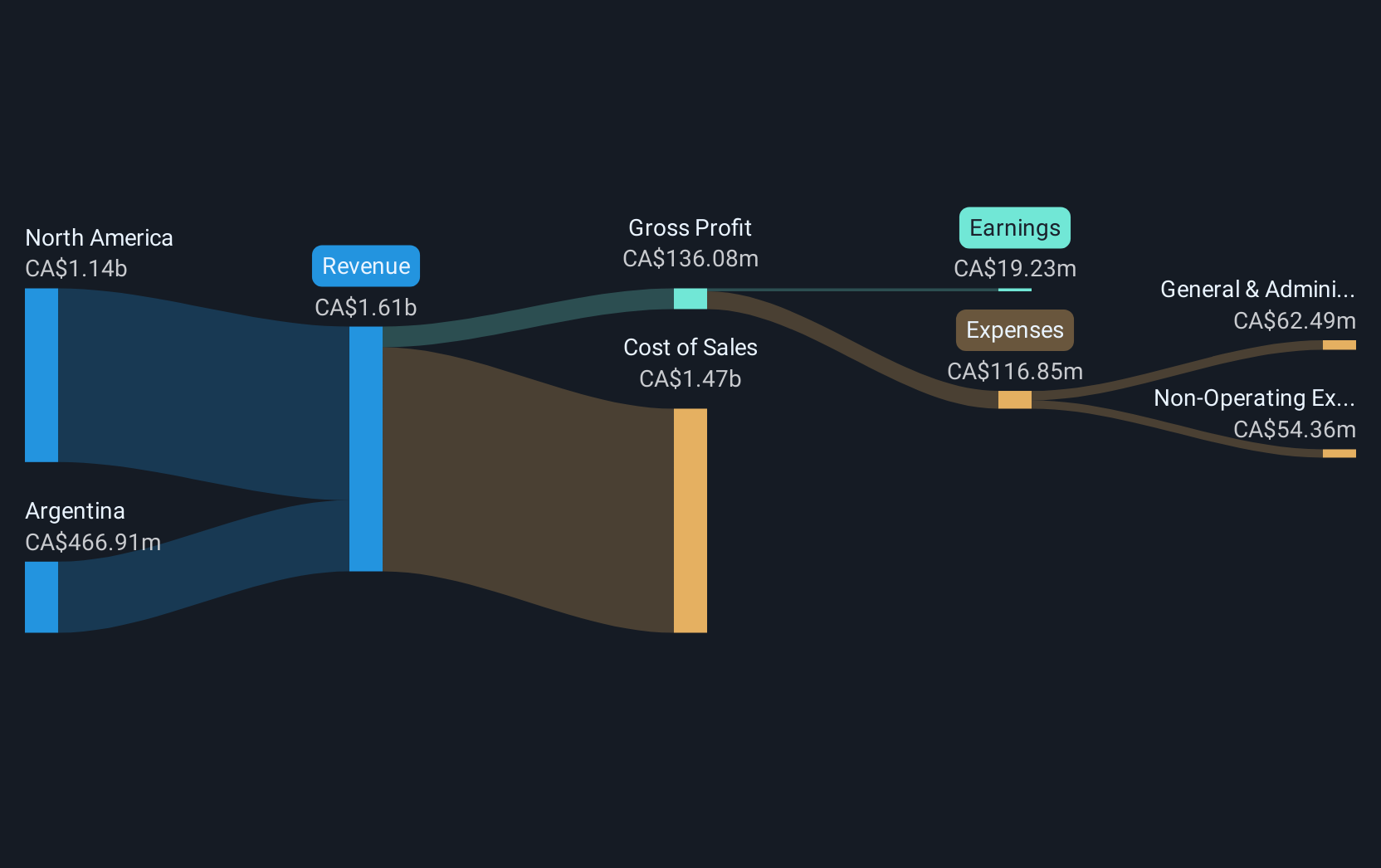

Overview: Calfrac Well Services Ltd. is a company that, along with its subsidiaries, offers specialized oilfield services in Canada, the United States, and Argentina, with a market capitalization of CA$328.88 million.

Operations: The company's revenue is generated from its Oil Well Equipment & Services segment, totaling CA$1.61 billion.

Market Cap: CA$328.88M

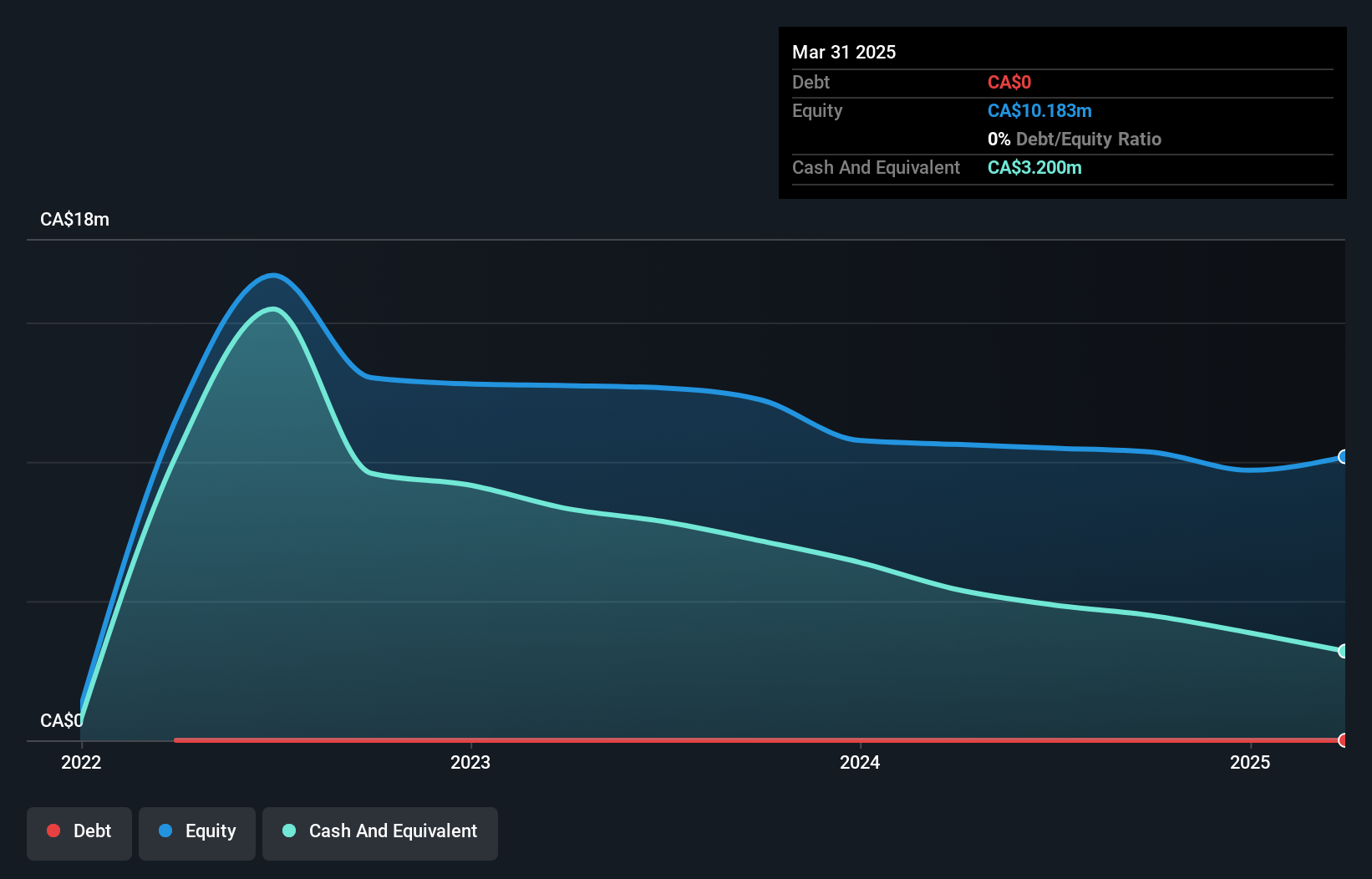

Calfrac Well Services Ltd., with a market cap of CA$328.88 million, has faced challenges as reflected in its recent earnings report showing a net loss of CA$5.43 million for Q3 2024, compared to a net income of CA$86.57 million the previous year. Despite this, the company maintains strong short-term financial health with assets exceeding liabilities and has reduced its debt-to-equity ratio significantly over five years. Leadership changes aim to drive operational improvements, while analysts suggest potential stock price growth, though profitability remains under pressure due to low return on equity and interest coverage issues.

- Jump into the full analysis health report here for a deeper understanding of Calfrac Well Services.

- Gain insights into Calfrac Well Services' future direction by reviewing our growth report.

Helium Evolution (TSXV:HEVI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Helium Evolution Incorporated focuses on the exploration and production of helium in southern Saskatchewan, with a market cap of CA$12.00 million.

Operations: Currently, there are no reported revenue segments for the company.

Market Cap: CA$12M

Helium Evolution Incorporated, with a market cap of CA$12 million, is pre-revenue and heavily engaged in helium exploration in southern Saskatchewan. Recent developments include the spudding of the 10-36 Well, part of a series of high-potential wells along the Mankota helium fairway. The company holds a 20% working interest in these projects alongside North American Helium Inc. Despite being unprofitable and experiencing high share price volatility, HEVI benefits from no debt and sufficient cash runway for over a year. Its short-term assets significantly exceed liabilities, supporting ongoing exploratory efforts without financial strain.

- Click to explore a detailed breakdown of our findings in Helium Evolution's financial health report.

- Gain insights into Helium Evolution's outlook and expected performance with our report on the company's earnings estimates.

Midland Exploration (TSXV:MD)

Simply Wall St Financial Health Rating: ★★★★★★

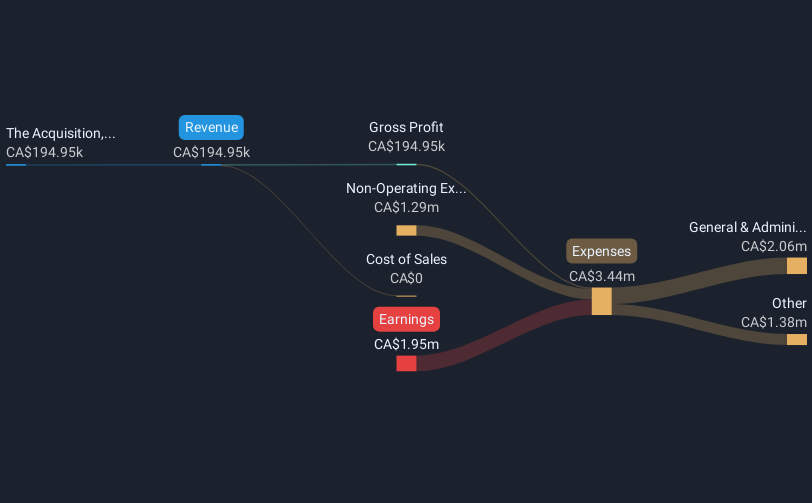

Overview: Midland Exploration Inc. is a mineral exploration company focused on acquiring, exploring, and evaluating mineral properties in Canada with a market cap of CA$29.96 million.

Operations: The company's revenue segment is derived entirely from the acquisition, exploration, and evaluation of exploration properties, amounting to CA$0.19 million.

Market Cap: CA$29.96M

Midland Exploration Inc., with a market cap of CA$29.96 million, is pre-revenue and focused on mineral exploration in Canada. The company remains debt-free and has a seasoned management team with an average tenure of 15 years. Recent activities include promising lithium assay results from the Galinée project, indicating significant spodumene pegmatite discoveries that remain open for further exploration. Despite shareholder dilution over the past year, Midland maintains sufficient cash runway to support its exploratory ventures. The company's strategic partnerships and ongoing drilling campaigns position it for potential future resource development in key mineral-rich regions.

- Take a closer look at Midland Exploration's potential here in our financial health report.

- Assess Midland Exploration's previous results with our detailed historical performance reports.

Seize The Opportunity

- Jump into our full catalog of 944 TSX Penny Stocks here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CFW

Calfrac Well Services

Provides specialized oilfield services in Canada, the United States, and Argentina.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion