- Canada

- /

- Metals and Mining

- /

- TSXV:STRR

Mawson Gold And 2 Other TSX Penny Stocks To Consider

Reviewed by Simply Wall St

In the last week, the Canadian market has stayed flat, though it is up 27% over the past year with earnings expected to grow by 16% annually in coming years. For investors willing to explore beyond established names, penny stocks—often smaller or newer companies—can offer intriguing opportunities. Although the term 'penny stock' may seem outdated, these investments remain relevant as they can provide a blend of affordability and growth potential when supported by strong financials.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| PetroTal (TSX:TAL) | CA$0.67 | CA$593.34M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.34 | CA$117.59M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.42 | CA$12.03M | ★★★★★☆ |

| Winshear Gold (TSXV:WINS) | CA$0.16 | CA$4.56M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$3.36 | CA$313.02M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.74 | CA$291.81M | ★★★★★☆ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$4.07M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.14 | CA$30.62M | ★★★★★★ |

| Vox Royalty (TSX:VOXR) | CA$4.25 | CA$210.95M | ★★★★★★ |

| Enterprise Group (TSX:E) | CA$2.14 | CA$137.16M | ★★★★☆☆ |

Click here to see the full list of 953 stocks from our TSX Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Mawson Gold (TSXV:MAW)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Mawson Gold Limited focuses on the acquisition and exploration of mineral properties in Australia and Sweden, with a market cap of CA$333.69 million.

Operations: Mawson Gold Limited does not report any revenue segments.

Market Cap: CA$333.69M

Mawson Gold, with a market cap of CA$333.69 million, remains pre-revenue and unprofitable. Despite this, its short-term assets of CA$15.9 million comfortably cover both short- and long-term liabilities. The company was recently added to the S&P/TSX Venture Composite Index, signaling increased visibility in the market. Notably, Mawson's exploration at the Sunday Creek project in Australia has shown promising mineralization results aided by AI technology, particularly for antimony—a critical mineral facing global supply constraints due to China’s export limits. However, limited cash runway and shareholder dilution are potential concerns for investors.

- Unlock comprehensive insights into our analysis of Mawson Gold stock in this financial health report.

- Review our historical performance report to gain insights into Mawson Gold's track record.

Magna Mining (TSXV:NICU)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Magna Mining Inc. is involved in the acquisition, exploration, and development of mineral properties in Canada, with a market cap of CA$204.37 million.

Operations: Magna Mining Inc. currently does not report any revenue segments.

Market Cap: CA$204.37M

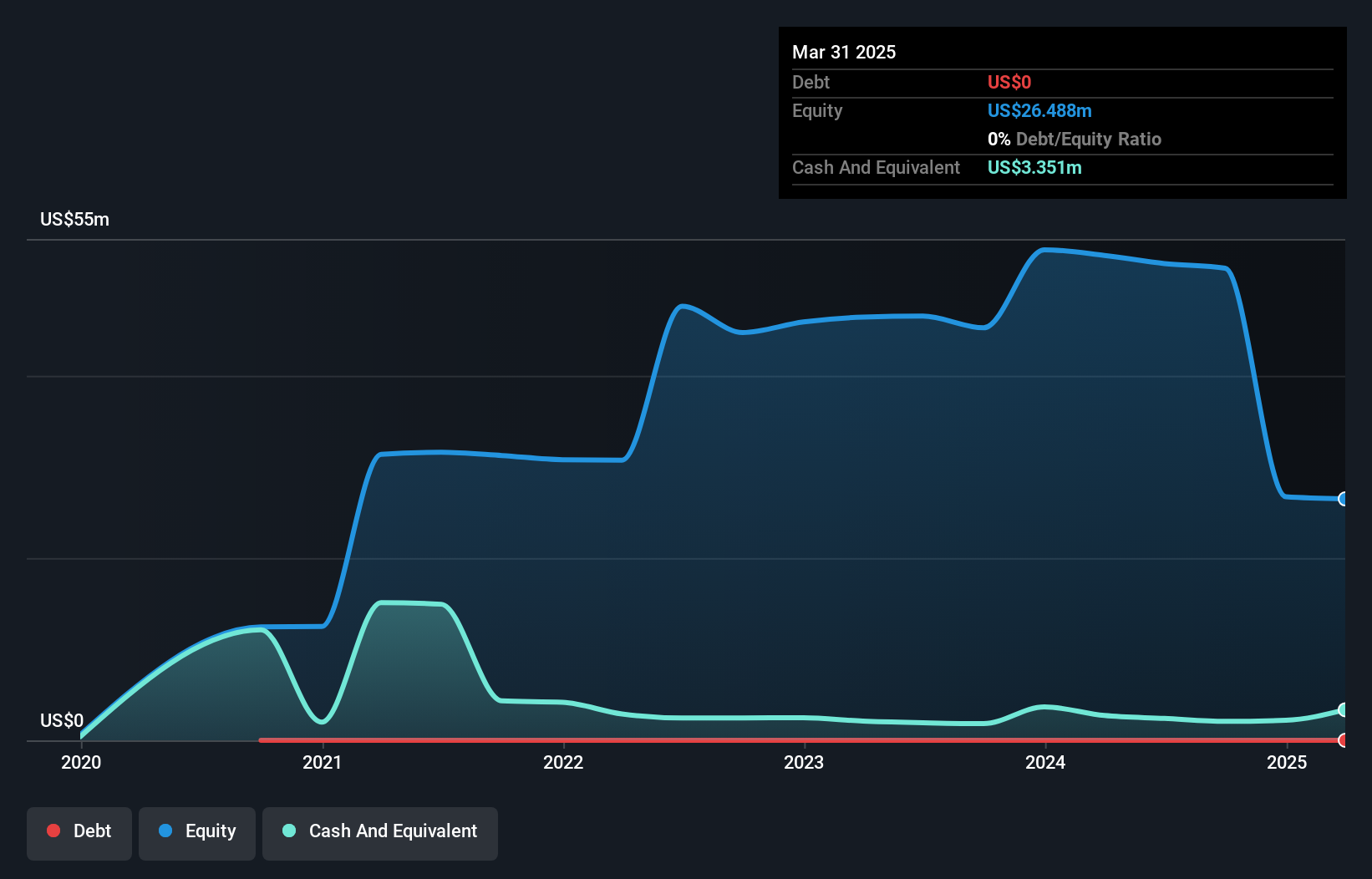

Magna Mining Inc., with a market cap of CA$204.37 million, is pre-revenue and currently unprofitable. The company has been actively advancing its Crean Hill Project in Sudbury, Ontario, completing an updated Preliminary Economic Assessment that envisions a low-capital underground mining operation. Recent developments include successful completion of a surface bulk sample and conditional funding approval from Natural Resources Canada for infrastructure initiatives. However, shareholder dilution occurred over the past year and the company raised additional capital through a private placement to support ongoing projects, highlighting potential financial constraints despite being debt-free.

- Dive into the specifics of Magna Mining here with our thorough balance sheet health report.

- Gain insights into Magna Mining's outlook and expected performance with our report on the company's earnings estimates.

Star Royalties (TSXV:STRR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Star Royalties Ltd. operates as a precious metals and carbon credits royalty and streaming company with a market cap of CA$23.61 million.

Operations: The company generates revenue from its acquisition of royalty interests, totaling $1.02 million.

Market Cap: CA$23.61M

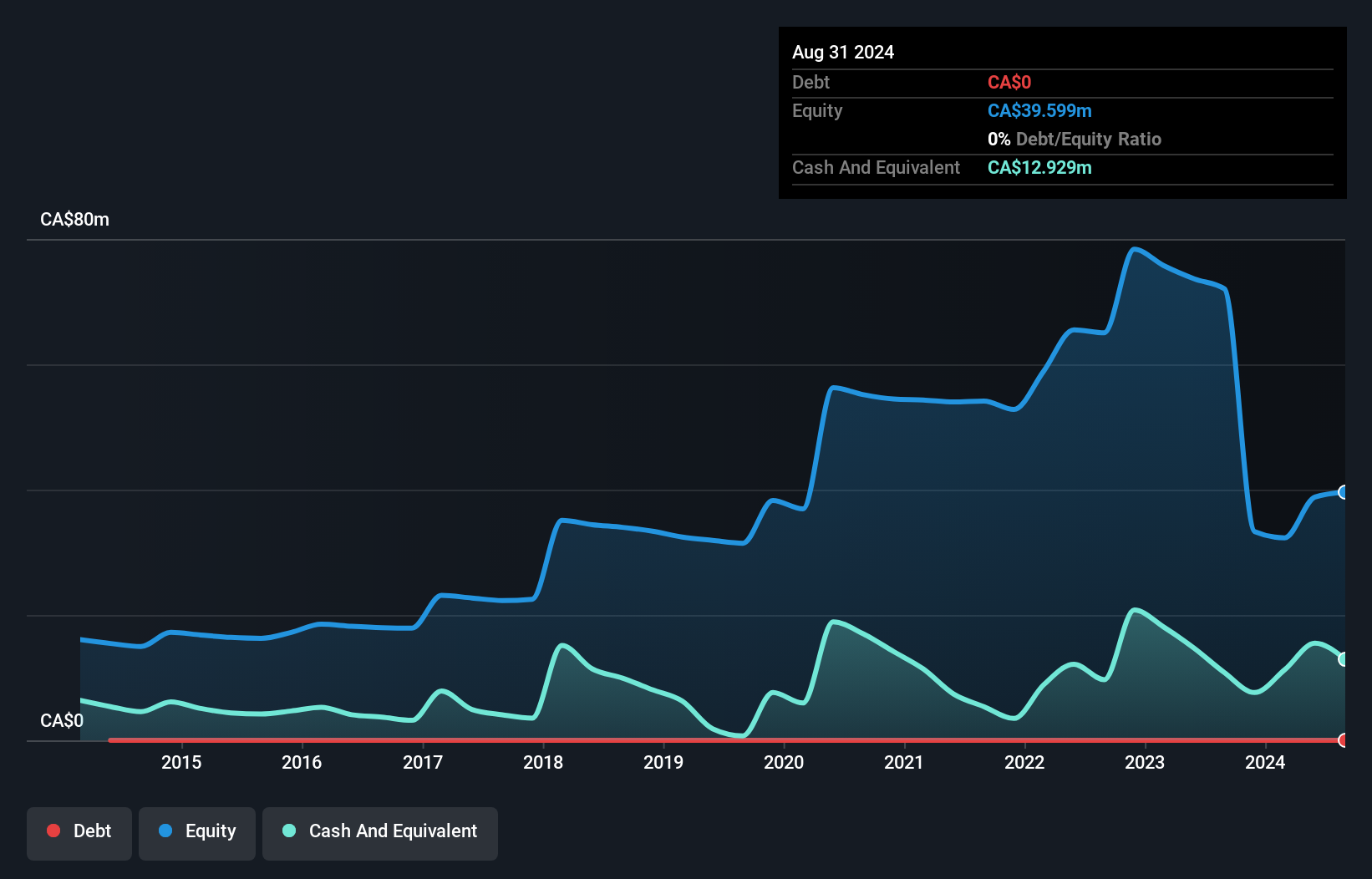

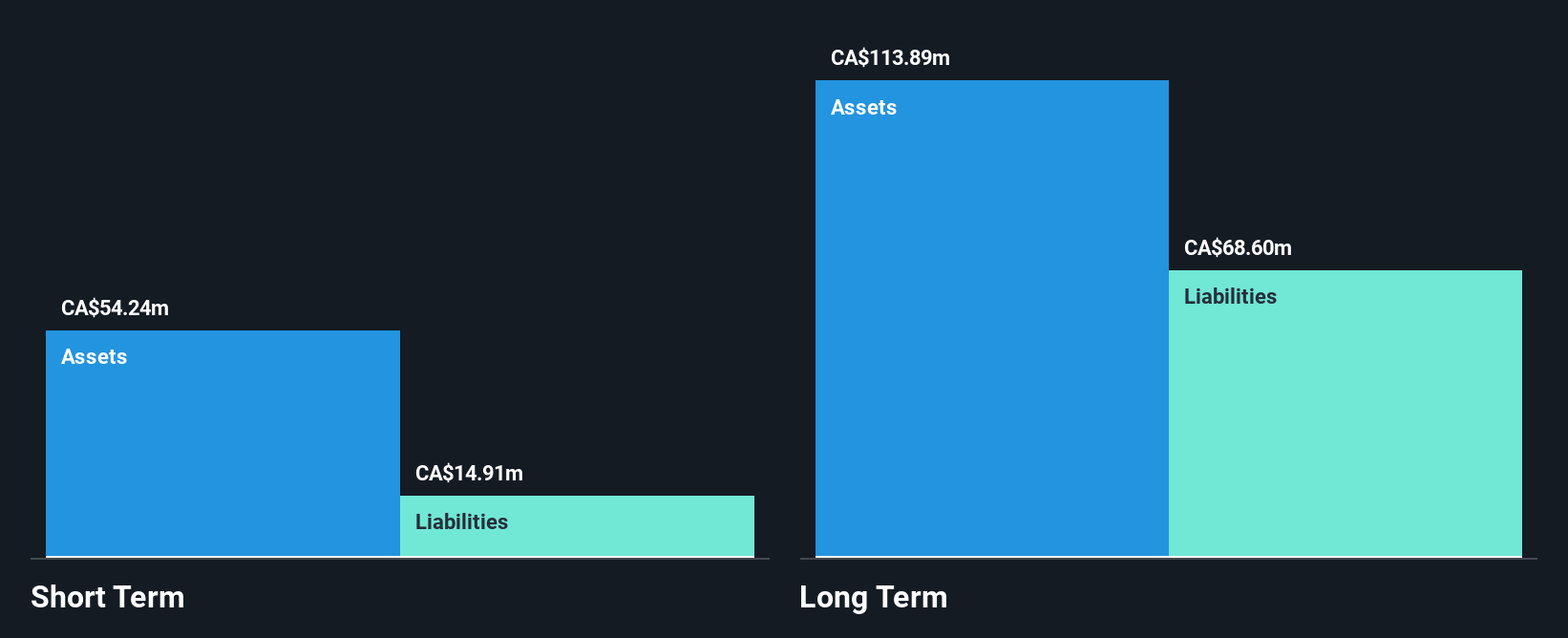

Star Royalties Ltd., with a market cap of CA$23.61 million, is pre-revenue, generating $1.02 million from royalty interests. The company recently became profitable, showing significant earnings growth over the past five years at 42% per year. Its Price-to-Earnings ratio of 3.1x suggests it may be undervalued compared to the broader Canadian market average of 15.3x. Despite shareholder dilution with a 3.3% increase in shares outstanding last year, Star Royalties remains debt-free and has experienced management and board members averaging over four years in tenure, indicating stability and seasoned leadership amidst volatility reduction to 6%.

- Jump into the full analysis health report here for a deeper understanding of Star Royalties.

- Assess Star Royalties' previous results with our detailed historical performance reports.

Make It Happen

- Unlock more gems! Our TSX Penny Stocks screener has unearthed 950 more companies for you to explore.Click here to unveil our expertly curated list of 953 TSX Penny Stocks.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:STRR

Star Royalties

Operates as a precious metals and decarbonization solutions royalty and streaming company.

Flawless balance sheet low.

Market Insights

Community Narratives