- Canada

- /

- Metals and Mining

- /

- TSXV:MAW

3 TSX Penny Stocks With Market Caps At Least CA$300M

Reviewed by Simply Wall St

The Canadian market has recently experienced some volatility, with the TSX index pulling back amid political uncertainties and leadership transitions. Despite these challenges, investors seeking growth opportunities might consider penny stocks, which often represent smaller or newer companies with potential for significant returns. While the term "penny stocks" may seem outdated, these investments can offer surprising value and stability when backed by solid financial foundations.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Mandalay Resources (TSX:MND) | CA$4.19 | CA$393.48M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.445 | CA$12.75M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.29 | CA$116.52M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.36 | CA$948.57M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.54 | CA$492.49M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.31 | CA$227.38M | ★★★★★☆ |

| Vox Royalty (TSX:VOXR) | CA$3.31 | CA$167.46M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.25 | CA$33.58M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| Enterprise Group (TSX:E) | CA$1.88 | CA$115.72M | ★★★★☆☆ |

Click here to see the full list of 956 stocks from our TSX Penny Stocks screener.

We'll examine a selection from our screener results.

NanoXplore (TSX:GRA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: NanoXplore Inc. is a graphene company that manufactures and supplies graphene powder for industrial markets in Australia, with a market cap of CA$380.46 million.

Operations: The company's revenue is primarily derived from its Advanced Materials, Plastics and Composite Products segment, which generated CA$134.69 million, while its Battery Cells segment contributed CA$0.04 million.

Market Cap: CA$380.46M

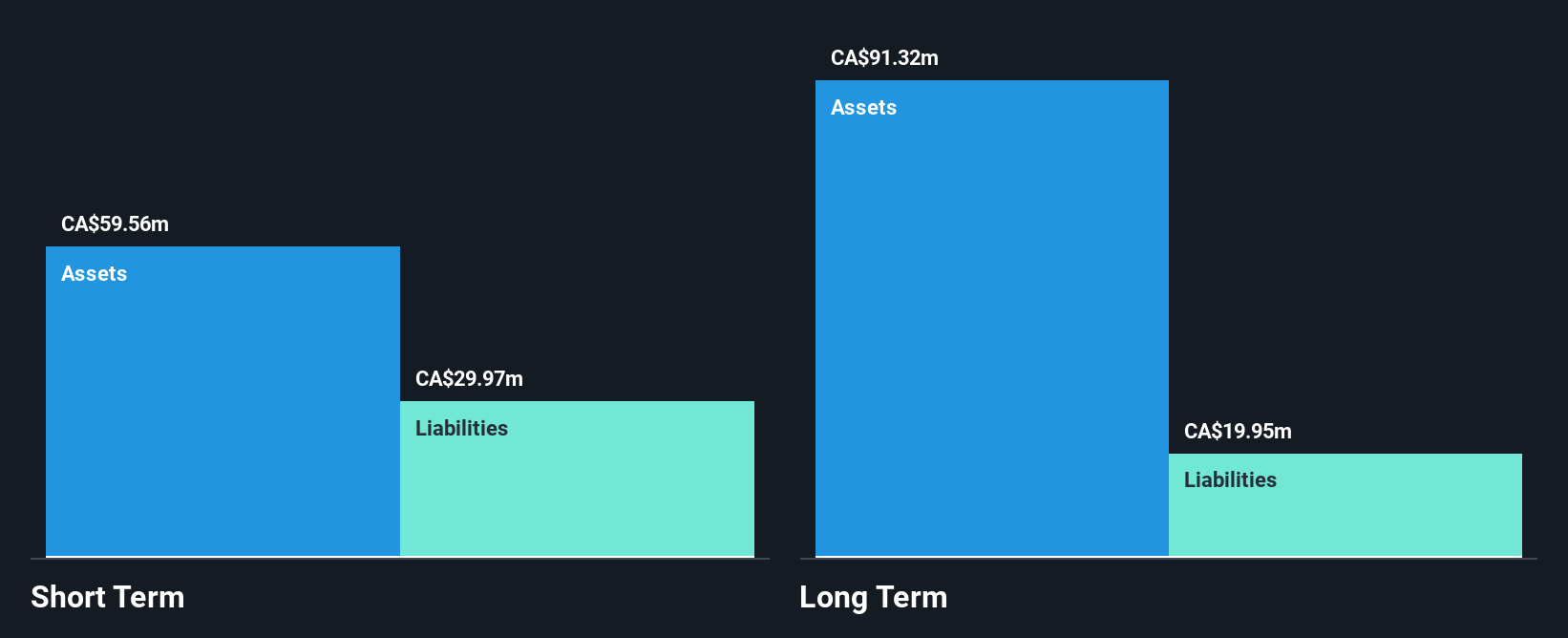

NanoXplore Inc. has a market cap of CA$380.46 million, with its revenue primarily driven by the Advanced Materials, Plastics and Composite Products segment, generating CA$134.69 million annually. Despite being unprofitable, NanoXplore's short-term assets exceed both its short-term and long-term liabilities, indicating financial stability in the near term. The company has reduced its debt-to-equity ratio significantly over five years to 6.8% and maintains a sufficient cash runway for over three years based on current free cash flow levels. Recent earnings show improved revenue but continued net losses, reflecting ongoing challenges in achieving profitability.

- Dive into the specifics of NanoXplore here with our thorough balance sheet health report.

- Learn about NanoXplore's future growth trajectory here.

Solaris Resources (TSX:SLS)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Solaris Resources Inc. is involved in the exploration of mineral properties and has a market capitalization of CA$747.29 million.

Operations: Currently, there are no reported revenue segments for the company.

Market Cap: CA$747.29M

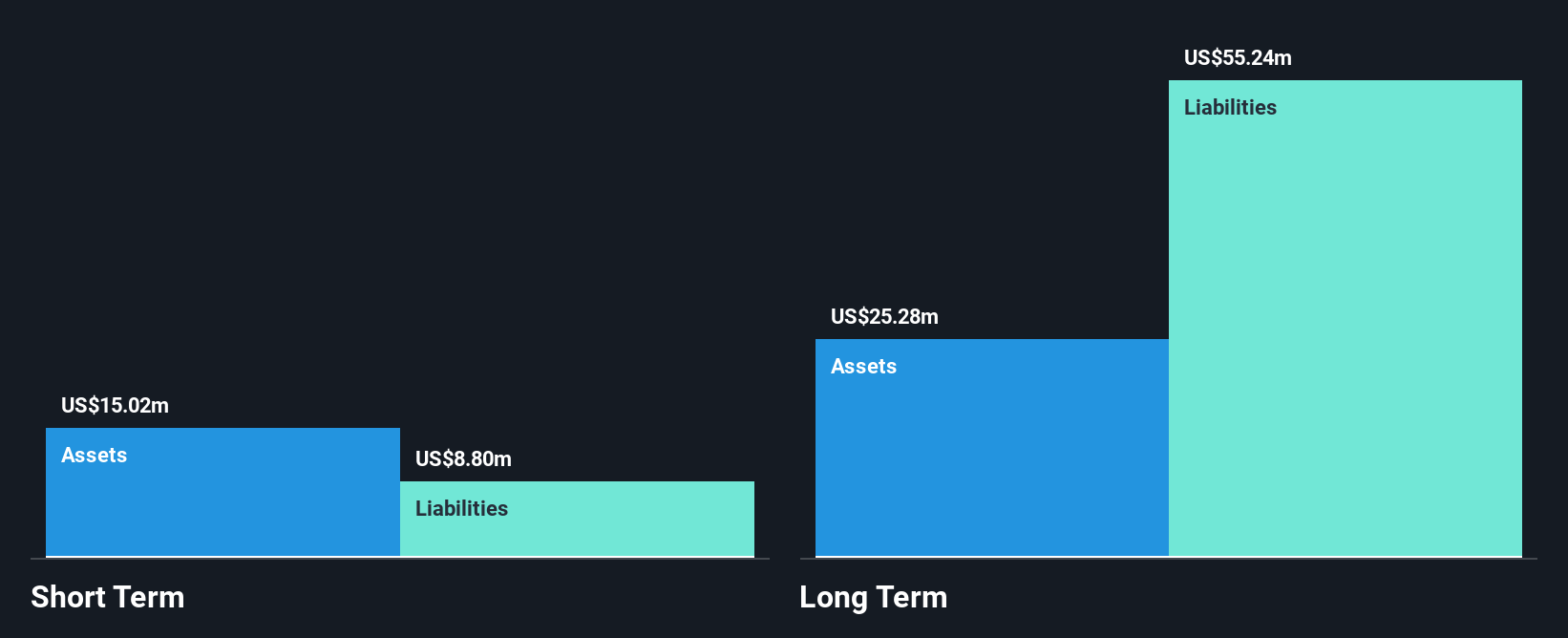

Solaris Resources Inc., with a market cap of CA$747.29 million, remains pre-revenue as it advances its Warintza Project in Ecuador. Despite unprofitability and increasing losses, Solaris has strong short-term assets exceeding liabilities and more cash than debt, suggesting some financial resilience. The company recently appointed Matthew Rowlinson as CEO to lead strategic efforts from Switzerland, leveraging his extensive experience from Glencore to enhance project development. Ongoing drilling at Warintza shows promising mineralization results outside the current resource estimate, yet shareholder dilution persists with a recent increase in shares outstanding by 7.7%.

- Unlock comprehensive insights into our analysis of Solaris Resources stock in this financial health report.

- Examine Solaris Resources' earnings growth report to understand how analysts expect it to perform.

Mawson Gold (TSXV:MAW)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Mawson Gold Limited is involved in the acquisition and exploration of mineral properties in Australia and Sweden, with a market cap of CA$318.38 million.

Operations: No revenue segments have been reported.

Market Cap: CA$318.38M

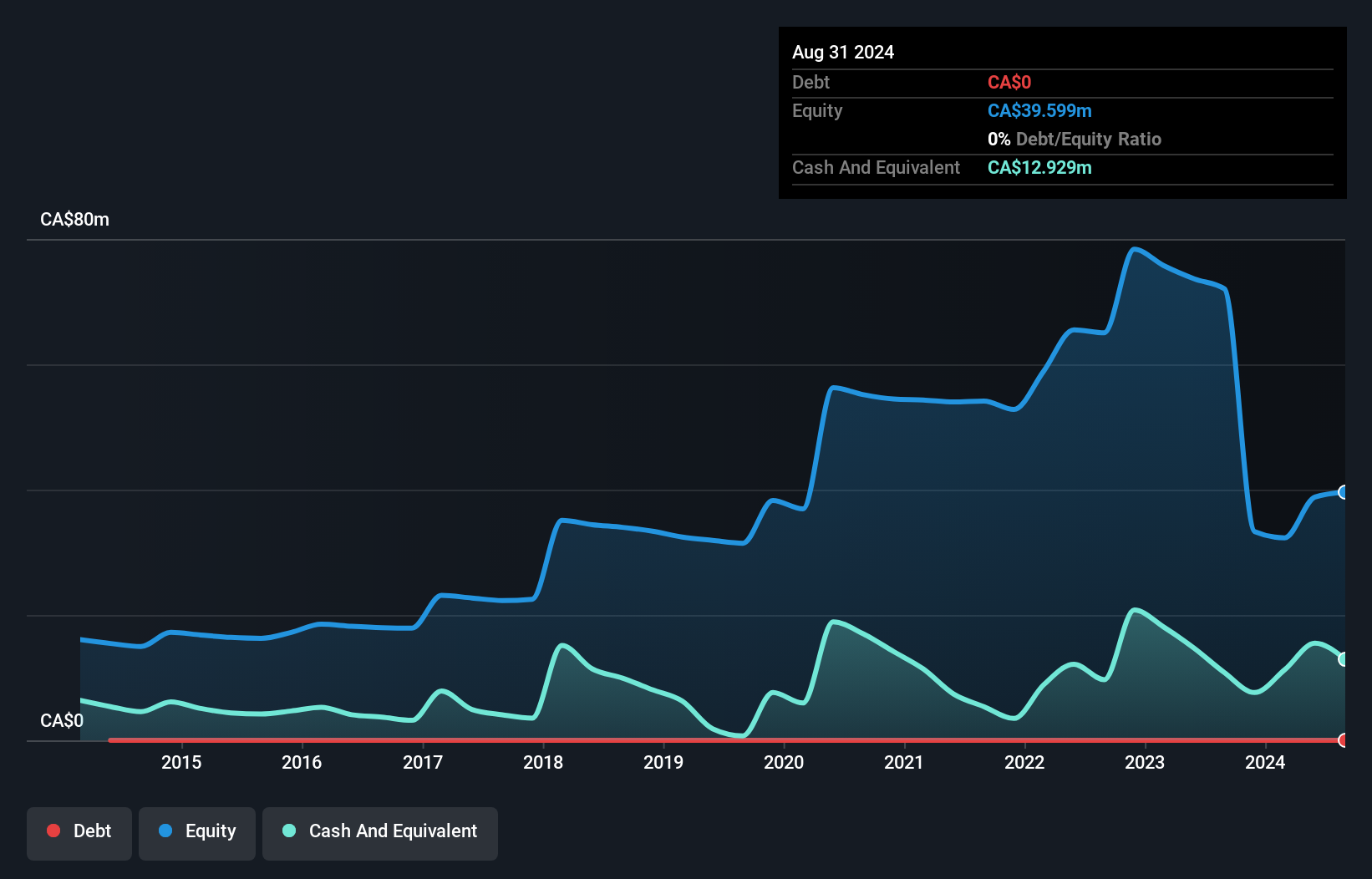

Mawson Gold Limited, with a market cap of CA$318.38 million, is pre-revenue and currently unprofitable, with significant losses reported for the past year. The company has experienced shareholder dilution, increasing shares by 2.5%. Despite these challenges, Mawson maintains a stronger short-term asset position relative to liabilities and remains debt-free. Recent drilling results at the Sunday Creek project in Australia highlight promising mineralization potential, particularly in antimony—a critical mineral facing global supply constraints due to Chinese export limits—offering strategic value amid ongoing exploration efforts. However, auditors have expressed concerns about its ability to continue as a going concern.

- Click here and access our complete financial health analysis report to understand the dynamics of Mawson Gold.

- Explore historical data to track Mawson Gold's performance over time in our past results report.

Key Takeaways

- Gain an insight into the universe of 956 TSX Penny Stocks by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:MAW

Southern Cross Gold Consolidated

Engages in the acquisition and exploration of mineral properties in Australia.

Adequate balance sheet slight.

Market Insights

Community Narratives