Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that Minera Alamos Inc. (CVE:MAI) does use debt in its business. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for Minera Alamos

What Is Minera Alamos's Debt?

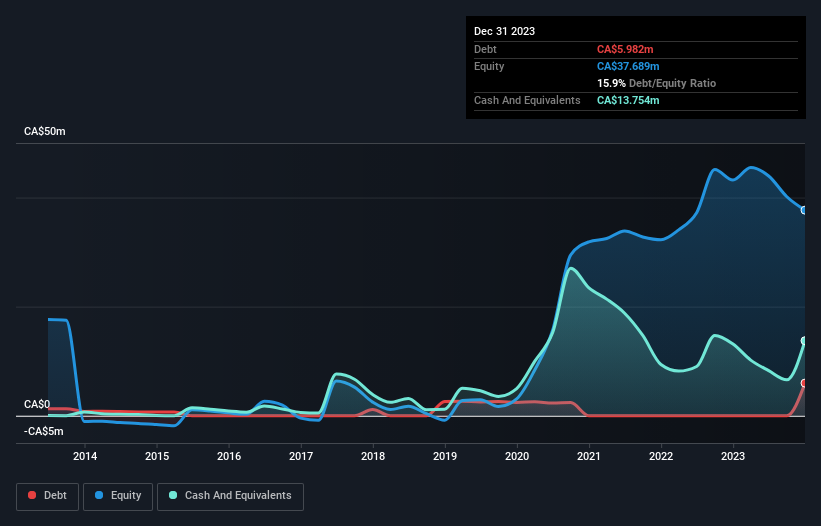

As you can see below, at the end of December 2023, Minera Alamos had CA$5.98m of debt, up from none a year ago. Click the image for more detail. But it also has CA$13.8m in cash to offset that, meaning it has CA$7.77m net cash.

How Healthy Is Minera Alamos' Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Minera Alamos had liabilities of CA$8.00m due within 12 months and liabilities of CA$5.93m due beyond that. Offsetting this, it had CA$13.8m in cash and CA$3.54m in receivables that were due within 12 months. So it actually has CA$3.37m more liquid assets than total liabilities.

Having regard to Minera Alamos' size, it seems that its liquid assets are well balanced with its total liabilities. So while it's hard to imagine that the CA$171.3m company is struggling for cash, we still think it's worth monitoring its balance sheet. Succinctly put, Minera Alamos boasts net cash, so it's fair to say it does not have a heavy debt load! When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if Minera Alamos can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

In the last year Minera Alamos had a loss before interest and tax, and actually shrunk its revenue by 38%, to CA$13m. That makes us nervous, to say the least.

So How Risky Is Minera Alamos?

Statistically speaking companies that lose money are riskier than those that make money. And we do note that Minera Alamos had an earnings before interest and tax (EBIT) loss, over the last year. Indeed, in that time it burnt through CA$4.9m of cash and made a loss of CA$2.9m. With only CA$7.77m on the balance sheet, it would appear that its going to need to raise capital again soon. Overall, its balance sheet doesn't seem overly risky, at the moment, but we're always cautious until we see the positive free cash flow. When I consider a company to be a bit risky, I think it is responsible to check out whether insiders have been reporting any share sales. Luckily, you can click here ito see our graphic depicting Minera Alamos insider transactions.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:MAI

Minera Alamos

Engages in the acquisition, exploration, development, and operation of mineral properties in Mexico.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives