- Canada

- /

- Metals and Mining

- /

- TSXV:LITH

How Important Was Sentiment In Driving Lithium Chile's (CVE:LITH) Fantastic 2200% Share Price Gain?

Some Lithium Chile Inc. (CVE:LITH) shareholders are probably rather concerned to see the share price fall 45% over the last three months. But that doesn't change the fact that the returns over the last half decade have been spectacular. In that time, the share price has soared some 2200% higher! Arguably, the recent fall is to be expected after such a strong rise. Of course what matters most is whether the business can improve itself sustainably, thus justifying a higher price. While the long term returns are impressive, we do have some sympathy for those who bought more recently, given the 78% drop, in the last year.

Anyone who held for that rewarding ride would probably be keen to talk about it.

See our latest analysis for Lithium Chile

We don't think Lithium Chile's revenue of CA$90,506 is enough to establish significant demand. So it seems shareholders are too busy dreaming about the progress to come than dwelling on the current (lack of) revenue. For example, investors may be hoping that Lithium Chile finds some valuable resources, before it runs out of money.

Companies that lack both meaningful revenue and profits are usually considered high risk. There is usually a significant chance that they will need more money for business development, putting them at the mercy of capital markets to raise equity. So the share price itself impacts the value of the shares (as it determines the cost of capital). While some companies like this go on to deliver on their plan, making good money for shareholders, many end in painful losses and eventual de-listing. Some Lithium Chile investors have already had a taste of the sweet taste stocks like this can leave in the mouth, as they gain popularity and attract speculative capital.

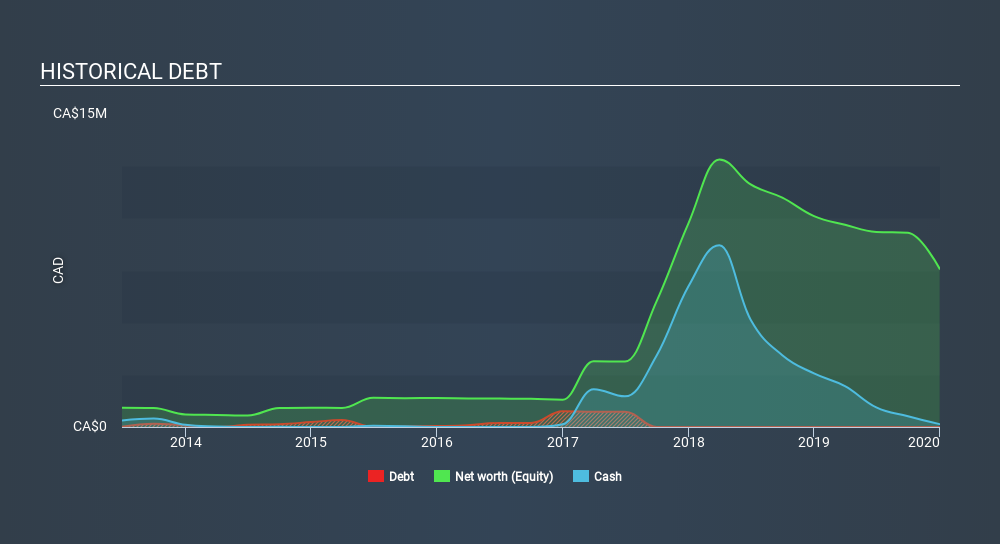

Lithium Chile had cash in excess of all liabilities of just CA$2.8k when it last reported (December 2019). So if it hasn't remedied the situation already, it will almost certainly have to raise more capital soon. Given how low on cash it got, investors must really like its potential for the share price to be up 15% per year, over 5 years. You can see in the image below, how Lithium Chile's cash levels have changed over time (click to see the values).

It can be extremely risky to invest in a company that doesn't even have revenue. There's no way to know its value easily. However you can take a look at whether insiders have been buying up shares. It's often positive if so, assuming the buying is sustained and meaningful. You can click here to see if there are insiders buying.

A Different Perspective

We regret to report that Lithium Chile shareholders are down 78% for the year. Unfortunately, that's worse than the broader market decline of 9.3%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Longer term investors wouldn't be so upset, since they would have made 87%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 5 warning signs with Lithium Chile (at least 4 which are a bit unpleasant) , and understanding them should be part of your investment process.

Of course Lithium Chile may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TSXV:LITH

Lithium Chile

Engages in the acquisition and development of lithium properties in Chile and Argentina.

Adequate balance sheet with acceptable track record.

Market Insights

Community Narratives