- Canada

- /

- Metals and Mining

- /

- TSXV:LI

3 TSX Penny Stocks With Market Caps Under CA$300M To Watch

Reviewed by Simply Wall St

The Canadian market has shown resilience, climbing 1.2% in the last week and posting a 28% gain over the past year, with earnings projected to grow by 16% annually. While penny stocks might seem like a relic from earlier market days, they continue to represent smaller or less-established companies that can offer significant value. By focusing on those with strong financials and clear growth potential, investors may uncover promising opportunities among these lesser-known stocks.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| PetroTal (TSX:TAL) | CA$0.67 | CA$620.84M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.42 | CA$11.75M | ★★★★★☆ |

| Winshear Gold (TSXV:WINS) | CA$0.18 | CA$5.18M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$3.34 | CA$304.56M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.37 | CA$116.65M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.80 | CA$298.44M | ★★★★★☆ |

| Foraco International (TSX:FAR) | CA$2.37 | CA$236.62M | ★★★★★☆ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.17M | ★★★★★★ |

| Newport Exploration (TSXV:NWX) | CA$0.115 | CA$12.14M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.11 | CA$29.82M | ★★★★★★ |

Click here to see the full list of 948 stocks from our TSX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Inventus Mining (TSXV:IVS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Inventus Mining Corp. focuses on the acquisition, exploration, and development of mineral properties in Canada with a market cap of CA$7.56 million.

Operations: Inventus Mining Corp. does not report any revenue segments as it is primarily engaged in the acquisition, exploration, and development of mineral properties in Canada.

Market Cap: CA$7.56M

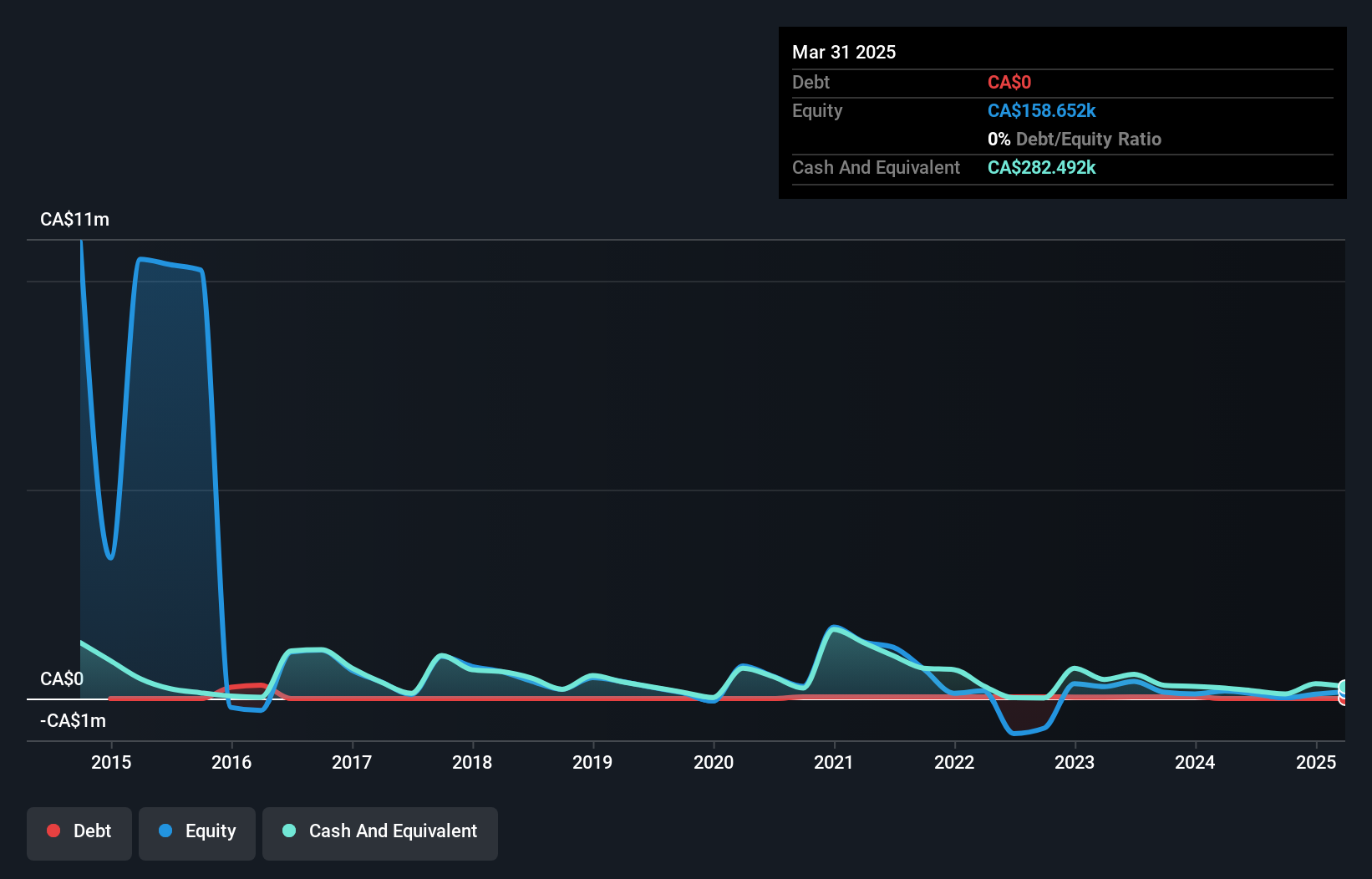

Inventus Mining Corp., with a market cap of CA$7.56 million, remains pre-revenue, focusing on mineral exploration in Canada. Despite its unprofitable status and high share price volatility, the company has managed to maintain short-term assets exceeding liabilities and is debt-free. Recently, Inventus announced significant management changes with experienced geologist Bill Fisher joining as Chairman and Wesley Whymark promoted to President. The company also initiated a private placement to raise up to CA$600,000 for further development, signaling potential growth opportunities despite current financial challenges. These strategic moves could influence investor sentiment amid ongoing exploration activities.

- Click here to discover the nuances of Inventus Mining with our detailed analytical financial health report.

- Learn about Inventus Mining's historical performance here.

American Lithium (TSXV:LI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: American Lithium Corp. is an exploration and development stage company focused on acquiring, exploring, and developing mineral properties in North and South America, with a market cap of CA$228.67 million.

Operations: No revenue segments have been reported for this exploration and development stage company.

Market Cap: CA$228.67M

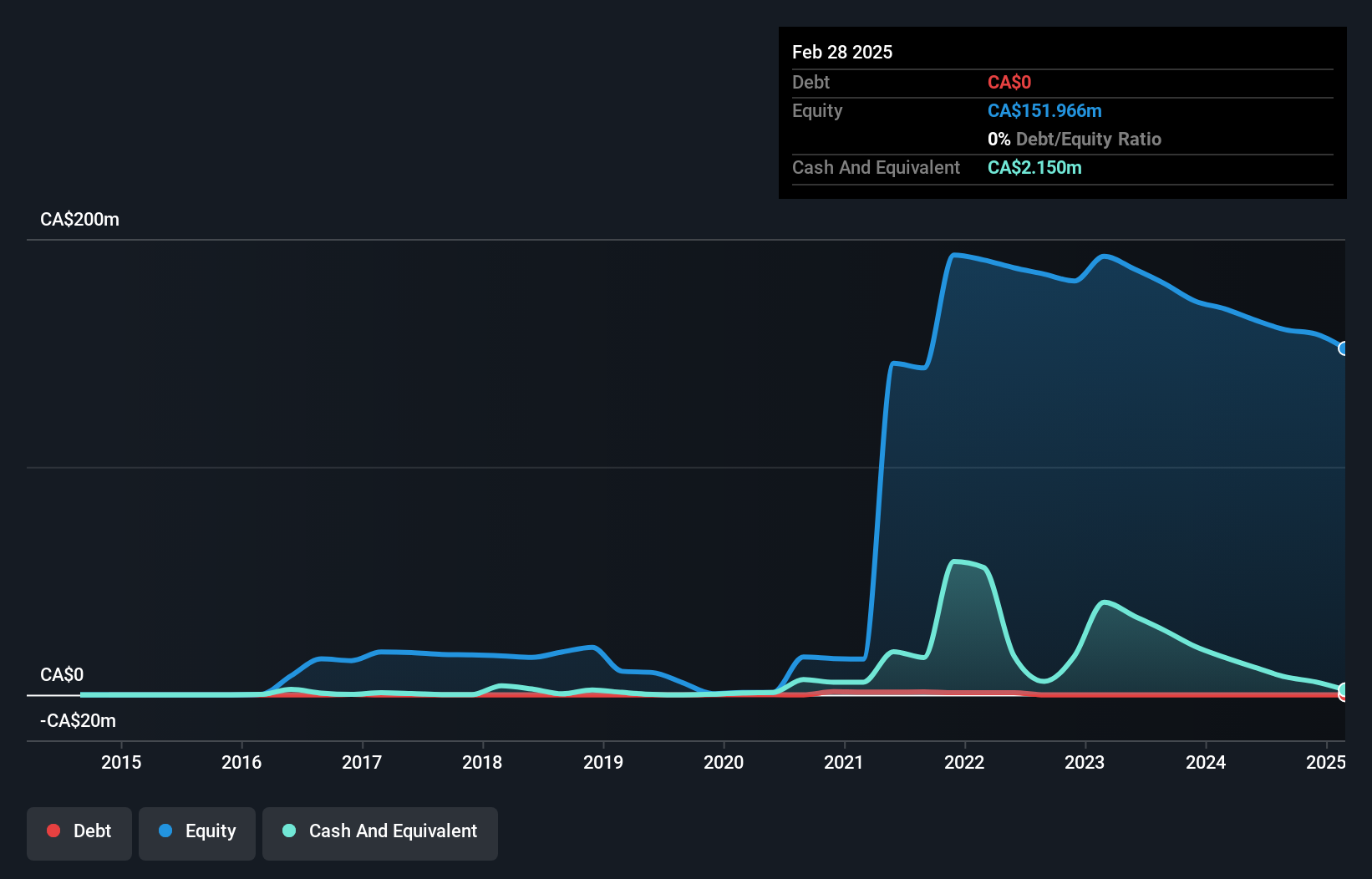

American Lithium Corp., with a market cap of CA$228.67 million, is pre-revenue and unprofitable, facing challenges such as a highly volatile share price and less than one year of cash runway. Despite these hurdles, the company has not significantly diluted shareholders recently and has appointed experienced executives to its board and management team. The recent resignation of its CEO led to Alex Tsakumis stepping in as interim CEO. American Lithium is also addressing compliance issues with Nasdaq's Minimum Bid Price Rule, seeking an extension to regain compliance while maintaining its TSX Venture Exchange listing.

- Get an in-depth perspective on American Lithium's performance by reading our balance sheet health report here.

- Review our growth performance report to gain insights into American Lithium's future.

Stampede Drilling (TSXV:SDI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Stampede Drilling Inc. offers oilfield services to the oil and natural gas industry in North America, with a market cap of CA$45.36 million.

Operations: The company generates revenue primarily through its contract drilling segment, amounting to CA$83.88 million.

Market Cap: CA$45.36M

Stampede Drilling Inc., with a market cap of CA$45.36 million, operates in the oilfield services sector, generating CA$83.88 million in revenue primarily from contract drilling. The company's debt is well-managed, with operating cash flow covering it by 143%, and its net debt to equity ratio at a satisfactory 17.3%. Despite recent negative earnings growth and lower profit margins compared to last year, Stampede's shares are trading below estimated fair value and represent good relative value within the industry. Recent share buybacks indicate management's confidence despite reporting a net loss for the second quarter of 2024.

- Dive into the specifics of Stampede Drilling here with our thorough balance sheet health report.

- Gain insights into Stampede Drilling's outlook and expected performance with our report on the company's earnings estimates.

Where To Now?

- Click here to access our complete index of 948 TSX Penny Stocks.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:LI

American Lithium

An exploration and development stage company, engages in the acquisition, exploration, and development of mineral properties in North and South America.

Moderate with adequate balance sheet.