- Canada

- /

- Metals and Mining

- /

- TSXV:NAM

TSX Penny Stock Opportunities For November 2024

Reviewed by Simply Wall St

As the Canadian economy navigates a period of cooling labor markets and potential rate cuts from the Bank of Canada, investors are eyeing opportunities that may arise in such a climate. Penny stocks, though an older term, still capture interest by representing smaller or newer companies with potential for growth. By focusing on those with robust financials, these stocks may offer both stability and upside in today's market conditions.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.98 | CA$182.69M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.68 | CA$611.57M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.82 | CA$298.44M | ★★★★★☆ |

| Pulse Seismic (TSX:PSD) | CA$2.30 | CA$118.58M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.425 | CA$12.32M | ★★★★★☆ |

| Winshear Gold (TSXV:WINS) | CA$0.14 | CA$4.71M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.39 | CA$231.56M | ★★★★★☆ |

| NamSys (TSXV:CTZ) | CA$1.09 | CA$28.74M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| Enterprise Group (TSX:E) | CA$2.19 | CA$135.82M | ★★★★☆☆ |

Click here to see the full list of 963 stocks from our TSX Penny Stocks screener.

Let's explore several standout options from the results in the screener.

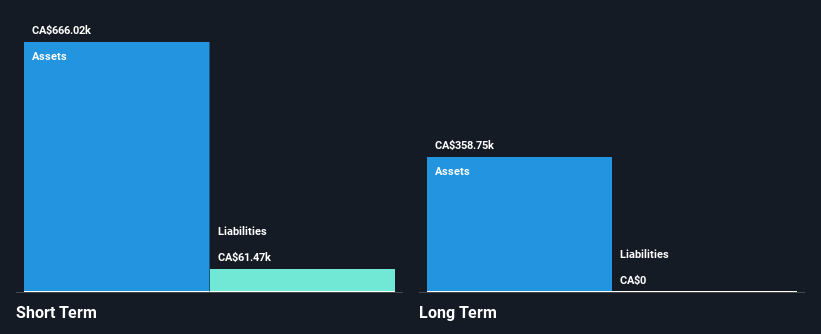

Kingsmen Resources (TSXV:KNG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Kingsmen Resources Ltd. is a junior mineral exploration company focused on acquiring and exploring mineral properties, with a market cap of CA$6.39 million.

Operations: Kingsmen Resources Ltd. currently has no reported revenue segments.

Market Cap: CA$6.39M

Kingsmen Resources Ltd., with a market cap of CA$6.39 million, is pre-revenue and has experienced earnings declines of 22.1% annually over the past five years. Despite its unprofitability, it remains debt-free and has sufficient cash runway for over a year. Recent developments include high-grade mineral findings at its Las Coloradas project in Mexico, which could be promising for future exploration efforts. Additionally, the company announced a private placement financing to raise CA$1 million and appointed Mark J. Pryor to its board, bringing significant expertise in advancing mining projects within the Mexican silver belt.

- Dive into the specifics of Kingsmen Resources here with our thorough balance sheet health report.

- Explore historical data to track Kingsmen Resources' performance over time in our past results report.

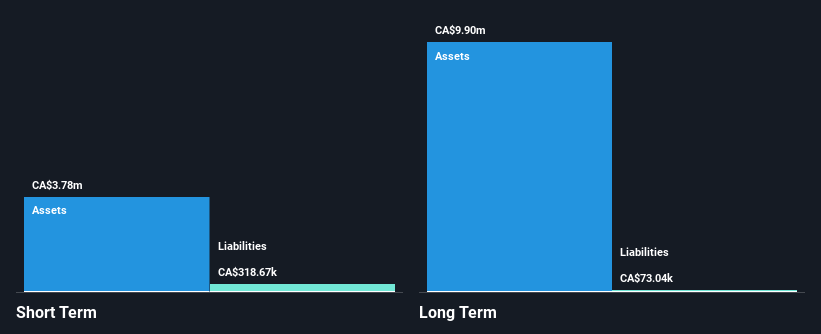

New Age Metals (TSXV:NAM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: New Age Metals Inc. is a mineral exploration company focused on acquiring, exploring, and developing platinum group metals, precious metals, and base metals properties in Canada and the United States with a market cap of CA$7.50 million.

Operations: New Age Metals Inc. has not reported any revenue segments.

Market Cap: CA$7.5M

New Age Metals Inc., with a market cap of CA$7.50 million, is pre-revenue and has experienced increasing losses over the past five years. The company remains debt-free and has sufficient cash runway for more than a year, providing some stability despite its unprofitability. Recent exploration results from the Winnipeg River-Cat Lake Lithium Projects highlight promising high-grade tantalum and lithium mineralization, which could enhance future prospects. The board and management team are seasoned, offering valuable experience in navigating the challenges of mineral exploration. However, volatility remains high compared to most Canadian stocks.

- Jump into the full analysis health report here for a deeper understanding of New Age Metals.

- Gain insights into New Age Metals' past trends and performance with our report on the company's historical track record.

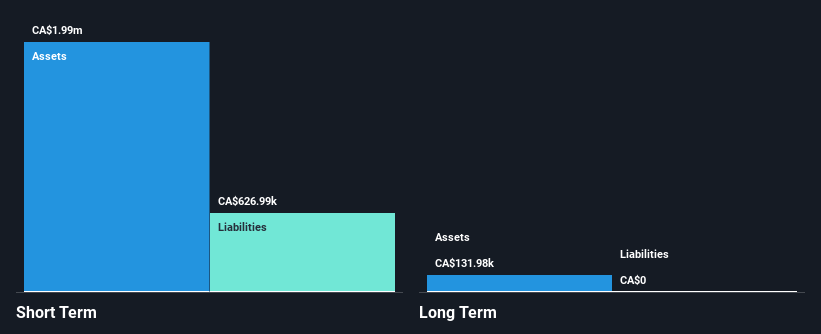

Radius Gold (TSXV:RDU)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Radius Gold Inc. is involved in the acquisition and exploration of mineral properties, with a market cap of CA$9.42 million.

Operations: Currently, there are no reported revenue segments for the company.

Market Cap: CA$9.42M

Radius Gold Inc., with a market cap of CA$9.42 million, is pre-revenue and has been reducing its losses by 13.5% annually over the past five years. The company remains debt-free, with sufficient cash runway for over a year, providing some financial stability amid its unprofitability. Despite stable weekly volatility compared to last year, the stock's price remains highly volatile in the short term. Recent private placements raised CA$580,500 to support ongoing exploration activities. Radius is expanding its portfolio by pursuing an exploration-stage copper project in Peru's prolific copper belt while continuing efforts on existing properties like Holly and Motagua Norte in Guatemala.

- Click here and access our complete financial health analysis report to understand the dynamics of Radius Gold.

- Evaluate Radius Gold's historical performance by accessing our past performance report.

Next Steps

- Jump into our full catalog of 963 TSX Penny Stocks here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade New Age Metals, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if New Age Metals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:NAM

New Age Metals

A mineral exploration company, engages in the acquisition, exploration, and development of platinum group metals (PGMs), precious, and base metals properties in Canada and the United States.

Flawless balance sheet slight.

Market Insights

Community Narratives