- Canada

- /

- Metals and Mining

- /

- TSXV:KGC

Kestrel Gold And 2 Other TSX Penny Stocks To Watch

Reviewed by Simply Wall St

The Canadian market has shown resilience, with stocks benefiting from the outperformance of financials and materials sectors, while inflation trends have allowed central banks to ease monetary policies. In this context, penny stocks—though an outdated term—remain a relevant investment area for those seeking opportunities in smaller or newer companies. By focusing on robust financials and clear growth trajectories, investors can uncover potential value in these often-overlooked stocks.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.36 | CA$158.19M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.71 | CA$283.52M | ★★★★★☆ |

| Pulse Seismic (TSX:PSD) | CA$2.33 | CA$121.61M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.47 | CA$13.32M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$3.61 | CA$324.12M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.63 | CA$574.88M | ★★★★★★ |

| Vox Royalty (TSX:VOXR) | CA$3.69 | CA$188.71M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.13 | CA$208.8M | ★★★★★☆ |

| Winshear Gold (TSXV:WINS) | CA$0.165 | CA$4.71M | ★★★★★★ |

| Hemisphere Energy (TSXV:HME) | CA$1.88 | CA$181.41M | ★★★★★☆ |

Click here to see the full list of 953 stocks from our TSX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Kestrel Gold (TSXV:KGC)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Kestrel Gold Inc. is an early-stage exploration company focused on acquiring, exploring, and evaluating mineral properties in Canada, with a market cap of CA$3.73 million.

Operations: Kestrel Gold Inc. currently does not report any revenue segments as it is in the early stages of exploration and development.

Market Cap: CA$3.73M

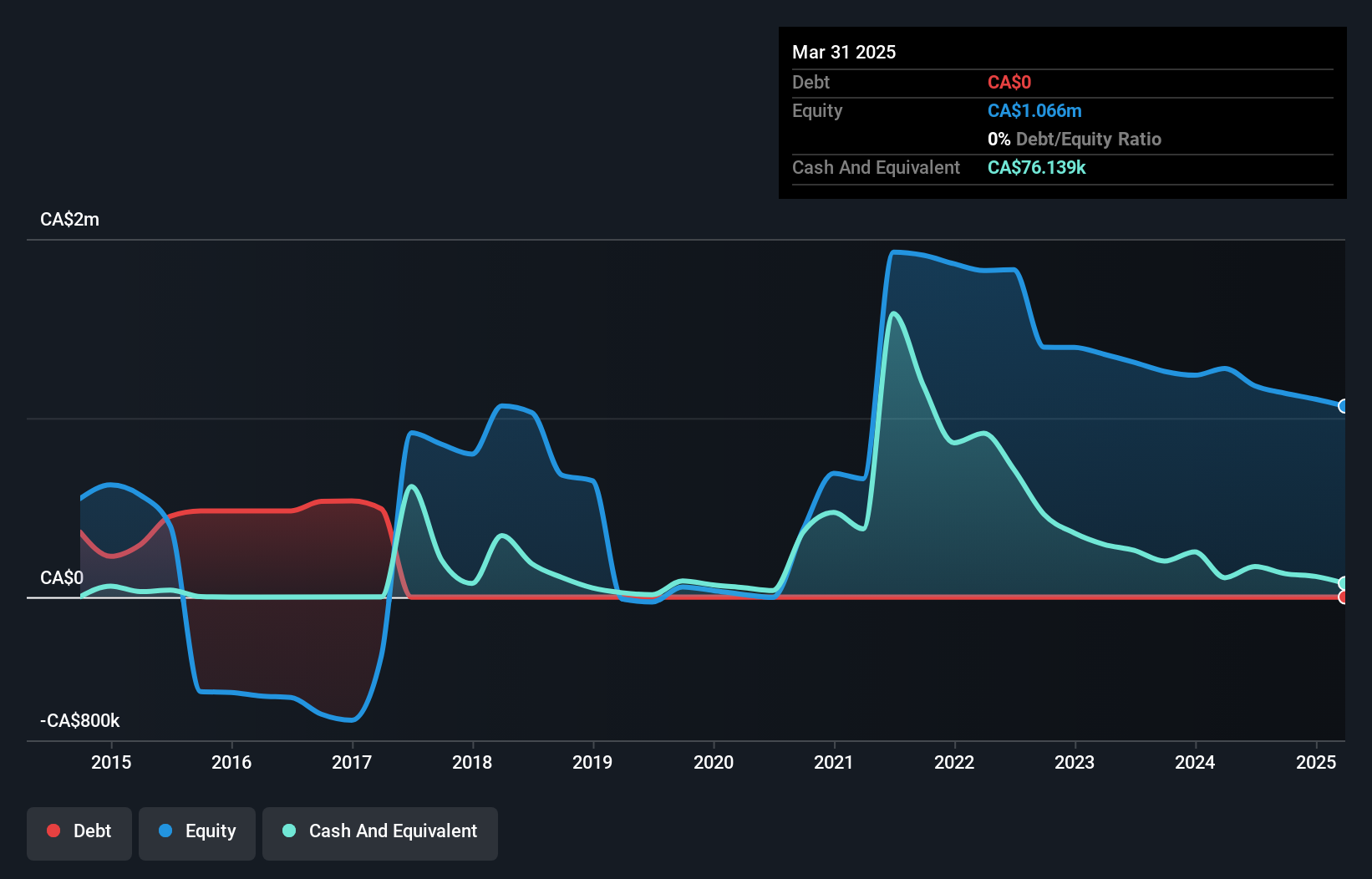

Kestrel Gold Inc., with a market cap of CA$3.73 million, is a pre-revenue exploration company focusing on mineral properties in Canada. The company's financial position reveals less than one year of cash runway and increased share volatility over the past year. Despite being debt-free, shareholders experienced dilution with an increase in shares outstanding by 3.9%. Recent developments include collaboration with Centerra Gold Inc., which is undertaking significant exploration work on Kestrel's QCM gold property, enhancing its potential value through drilling and infrastructure improvements. However, Kestrel remains unprofitable as it progresses through early-stage exploration activities.

- Take a closer look at Kestrel Gold's potential here in our financial health report.

- Explore historical data to track Kestrel Gold's performance over time in our past results report.

KORE Mining (TSXV:KORE)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: KORE Mining Ltd. is involved in the acquisition, exploration, and development of gold projects in North America with a market cap of CA$7.08 million.

Operations: KORE Mining Ltd. has not reported any revenue segments.

Market Cap: CA$7.08M

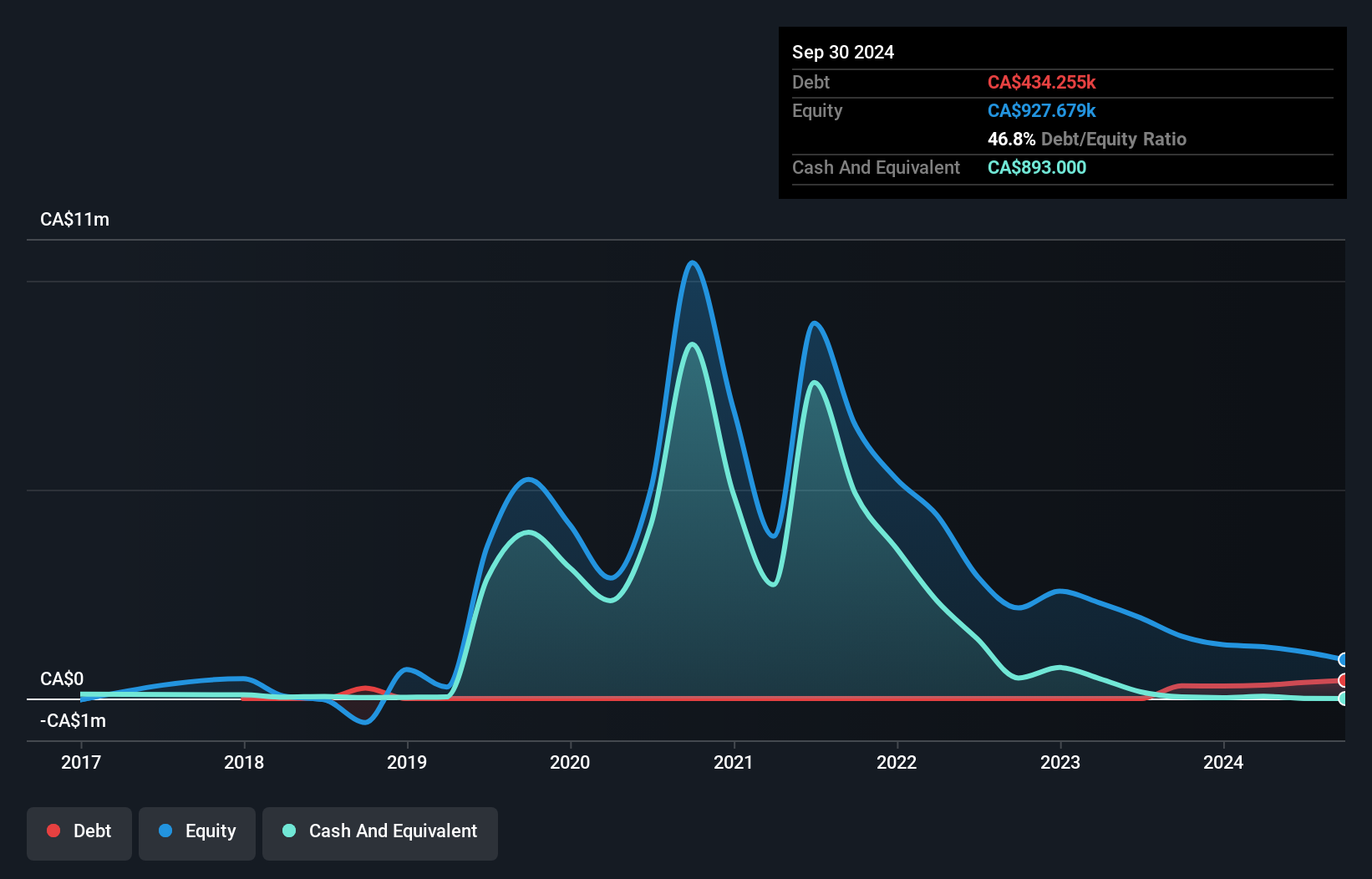

KORE Mining Ltd., with a market cap of CA$7.08 million, is a pre-revenue company focused on gold exploration in North America. Recently, it announced a private placement to raise up to CA$1 million, indicating efforts to secure additional capital amid zero cash runway based on free cash flow estimates. Despite reducing losses over the past five years at 9.6% annually, KORE remains unprofitable with negative return on equity and volatile share price performance. Short-term liabilities exceed assets significantly, although the absence of long-term liabilities provides some financial relief. The board's average tenure suggests limited experience in navigating industry challenges.

- Jump into the full analysis health report here for a deeper understanding of KORE Mining.

- Understand KORE Mining's track record by examining our performance history report.

Metallic Minerals (TSXV:MMG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Metallic Minerals Corp. is involved in the acquisition, exploration, and development of mineral properties in Canada and the United States, with a market cap of CA$24.62 million.

Operations: Metallic Minerals Corp. currently does not report any revenue segments.

Market Cap: CA$24.62M

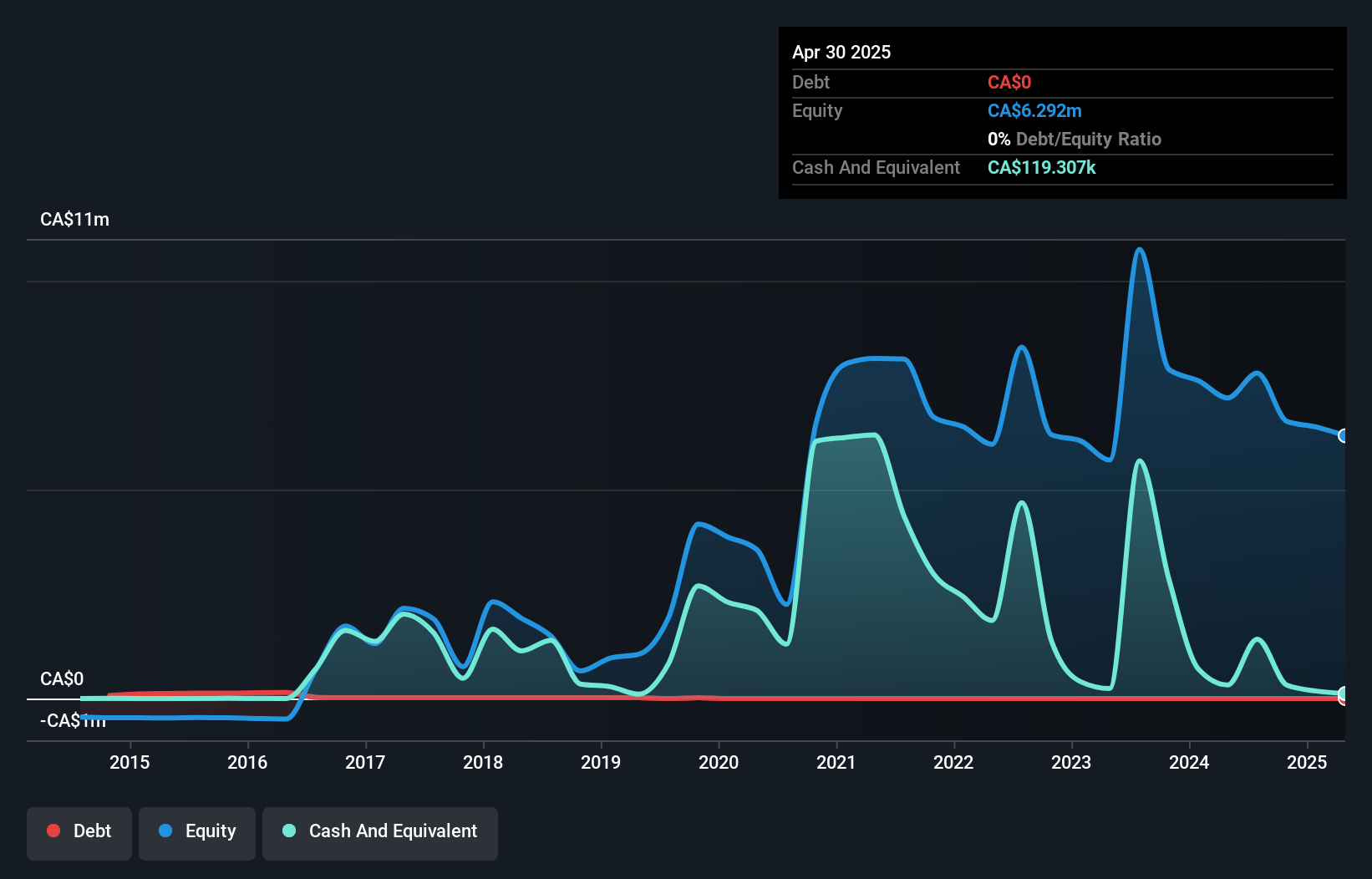

Metallic Minerals Corp., with a market cap of CA$24.62 million, is a pre-revenue entity focused on mineral exploration. The company remains debt-free and has no long-term liabilities, but its financial position is strained with only a one-month cash runway based on previous free cash flow estimates before recent capital raises. Shareholders experienced dilution over the past year, and the stock has been highly volatile recently. Despite an experienced management team and board, Metallic Minerals reported increased net losses of CA$6.01 million for the year ended July 31, 2024, highlighting ongoing profitability challenges in its operations.

- Dive into the specifics of Metallic Minerals here with our thorough balance sheet health report.

- Evaluate Metallic Minerals' historical performance by accessing our past performance report.

Taking Advantage

- Unlock more gems! Our TSX Penny Stocks screener has unearthed 950 more companies for you to explore.Click here to unveil our expertly curated list of 953 TSX Penny Stocks.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kestrel Gold might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:KGC

Kestrel Gold

An early-stage exploration company, engages in the acquisition, exploration, and evaluation of mineral properties in Canada.

Flawless balance sheet slight.

Similar Companies

Market Insights

Community Narratives