- Canada

- /

- Electrical

- /

- TSXV:GRD

TSX Penny Stocks To Watch In November 2024

Reviewed by Simply Wall St

The Canadian market has been experiencing significant shifts following the recent U.S. election, with a decisive outcome removing uncertainty and contributing to a robust rally for both the S&P 500 and TSX indices. In this evolving landscape, investors are increasingly looking at smaller or newer companies as potential opportunities. Penny stocks, though an older term, continue to represent these smaller entities that can offer substantial value when backed by strong financials and growth potential.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| PetroTal (TSX:TAL) | CA$0.67 | CA$611.57M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.72 | CA$285.18M | ★★★★★☆ |

| Pulse Seismic (TSX:PSD) | CA$2.29 | CA$116.54M | ★★★★★★ |

| Alvopetro Energy (TSXV:ALV) | CA$5.00 | CA$182.67M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.41 | CA$11.75M | ★★★★★☆ |

| Winshear Gold (TSXV:WINS) | CA$0.155 | CA$4.87M | ★★★★★★ |

| Vox Royalty (TSX:VOXR) | CA$3.77 | CA$190.72M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.40 | CA$237.5M | ★★★★★☆ |

| NamSys (TSXV:CTZ) | CA$1.09 | CA$29.28M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

Click here to see the full list of 958 stocks from our TSX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Alvopetro Energy (TSXV:ALV)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Alvopetro Energy Ltd. is an independent upstream and midstream operator with a market cap of CA$182.67 million.

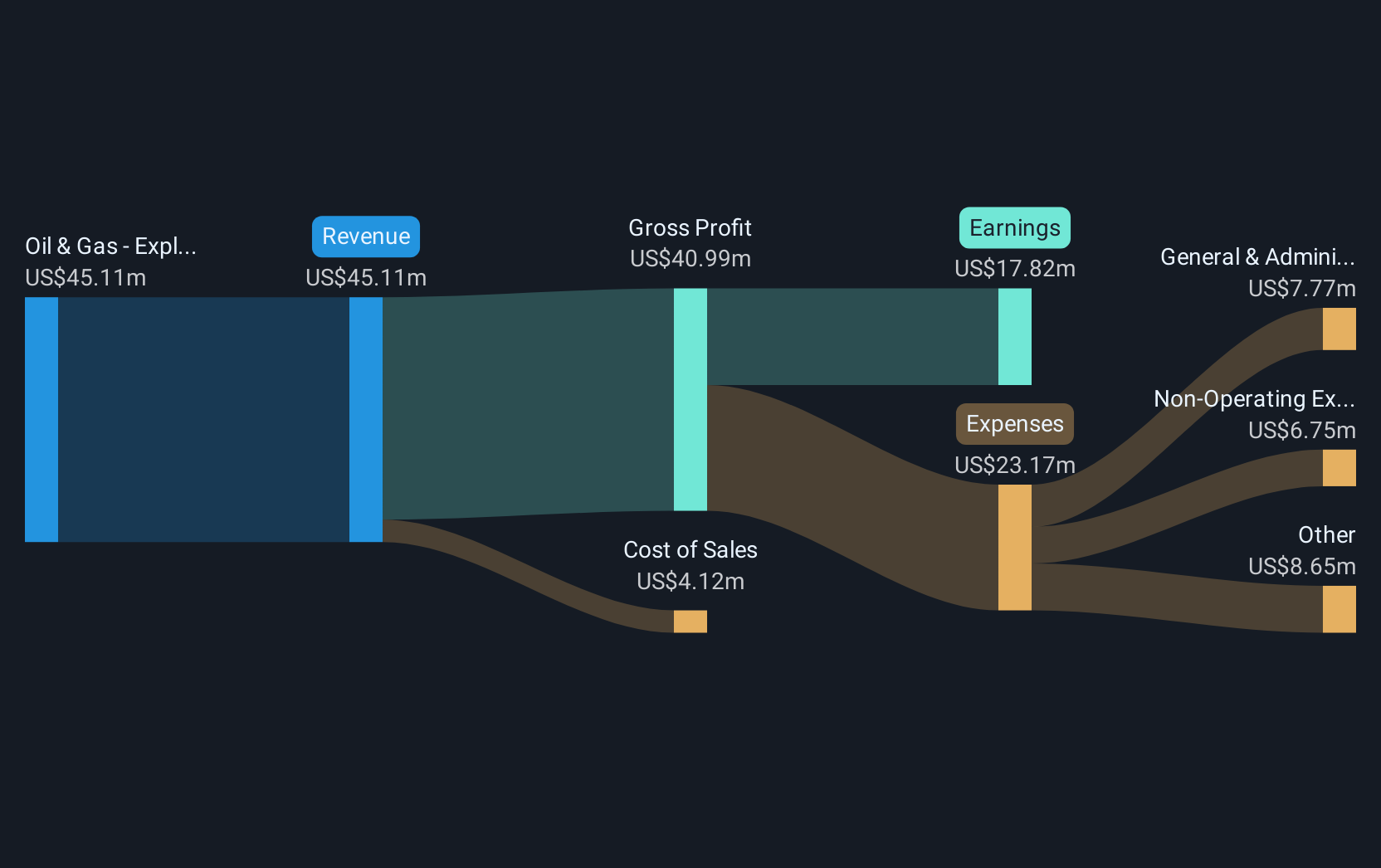

Operations: The company's revenue is derived entirely from its Oil & Gas - Exploration & Production segment, totaling $49.24 million.

Market Cap: CA$182.67M

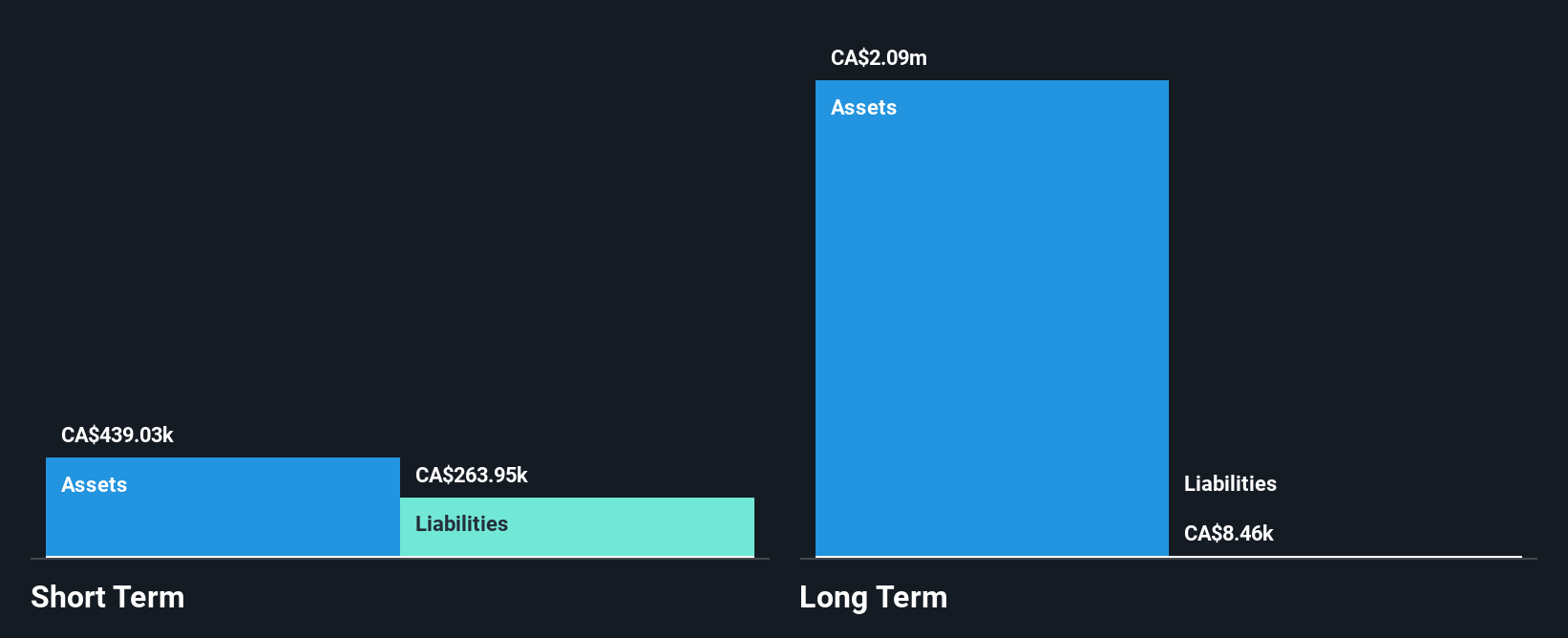

Alvopetro Energy Ltd., with a market cap of CA$182.67 million, reported third-quarter revenue of US$12.97 million, slightly up from the previous year. Despite a decline in net income for the nine months ending September 2024 compared to 2023, the company remains debt-free and has stable short-term assets exceeding liabilities. However, its profit margins have decreased significantly from last year and earnings growth has been negative over the past year. The dividend yield is high but not well covered by earnings. Alvopetro's management team is experienced with an average tenure of 11 years, providing stability amidst market volatility.

- Jump into the full analysis health report here for a deeper understanding of Alvopetro Energy.

- Gain insights into Alvopetro Energy's outlook and expected performance with our report on the company's earnings estimates.

Grounded Lithium (TSXV:GRD)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Grounded Lithium Corp. is involved in the exploration and development of mineral properties in Canada, with a market cap of CA$4.70 million.

Operations: The company generates revenue from its Metals & Mining - Miscellaneous segment, amounting to CA$0.01 million.

Market Cap: CA$4.7M

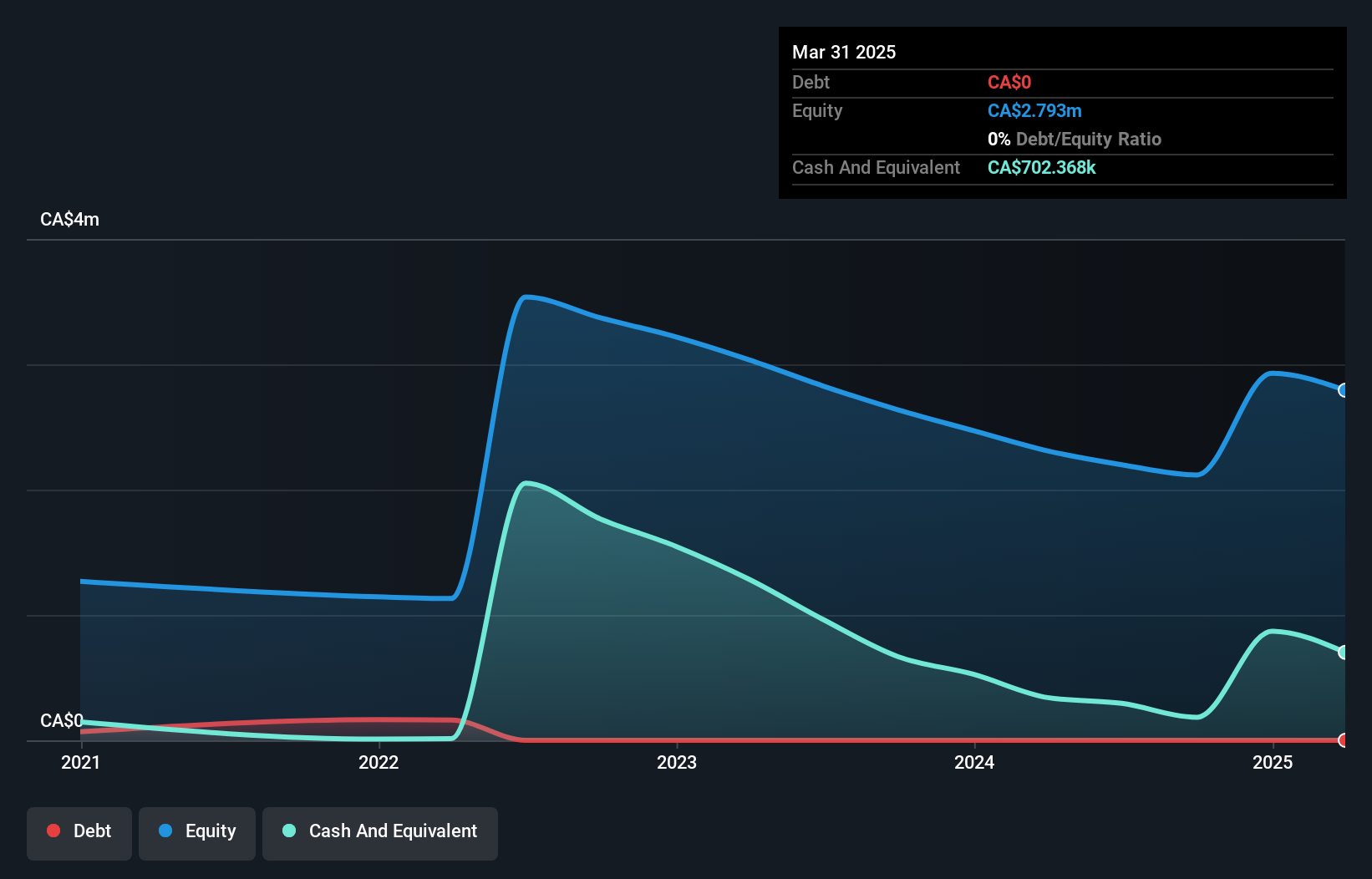

Grounded Lithium Corp., with a market cap of CA$4.70 million, is pre-revenue, generating minimal income from its operations. Recent developments include the initiation of a Pre-Feasibility Study for its Kindersley Lithium Project and commencement of the 2024 field program aimed at enhancing lithium extraction technologies. The company remains debt-free but faces challenges with high share price volatility and limited cash runway, potentially leading to further shareholder dilution. While short-term assets cover liabilities, Grounded Lithium's unprofitable status and inexperienced board suggest potential risks for investors in this speculative sector.

- Click to explore a detailed breakdown of our findings in Grounded Lithium's financial health report.

- Gain insights into Grounded Lithium's past trends and performance with our report on the company's historical track record.

Kapa Gold (TSXV:KAPA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Kapa Gold Inc. is engaged in the acquisition and exploration of mineral properties, with a market cap of CA$4.46 million.

Operations: Kapa Gold Inc. has not reported any revenue segments.

Market Cap: CA$4.46M

Kapa Gold Inc., with a market cap of CA$4.46 million, is pre-revenue and currently unprofitable. The company recently closed a non-brokered private placement, raising CA$1 million to bolster its cash runway, previously estimated at five months. Kapa Gold's strategic focus includes advancing its Blackhawk Mine project through data-driven 3D modeling for resource certification. Despite no long-term liabilities and adequate short-term asset coverage, the company's high share price volatility and inexperienced board present potential risks. The recent addition of seasoned mining executive Joanna-Josephine Pantazidou to the board could enhance strategic oversight as exploration efforts continue.

- Click here and access our complete financial health analysis report to understand the dynamics of Kapa Gold.

- Learn about Kapa Gold's historical performance here.

Turning Ideas Into Actions

- Unlock our comprehensive list of 958 TSX Penny Stocks by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:GRD

Grounded Lithium

Engages in the acquisition, exploration, and development of mineral properties in Canada.

Excellent balance sheet with slight risk.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.