- Canada

- /

- Metals and Mining

- /

- TSXV:IPT

Shareholders Will Probably Hold Off On Increasing IMPACT Silver Corp.'s (CVE:IPT) CEO Compensation For The Time Being

Under the guidance of CEO Fred Davidson, IMPACT Silver Corp. (CVE:IPT) has performed reasonably well recently. In light of this performance, CEO compensation will probably not be the main focus for shareholders as they go into the AGM on 21 May 2021. However, some shareholders may still want to keep CEO compensation within reason.

See our latest analysis for IMPACT Silver

Comparing IMPACT Silver Corp.'s CEO Compensation With the industry

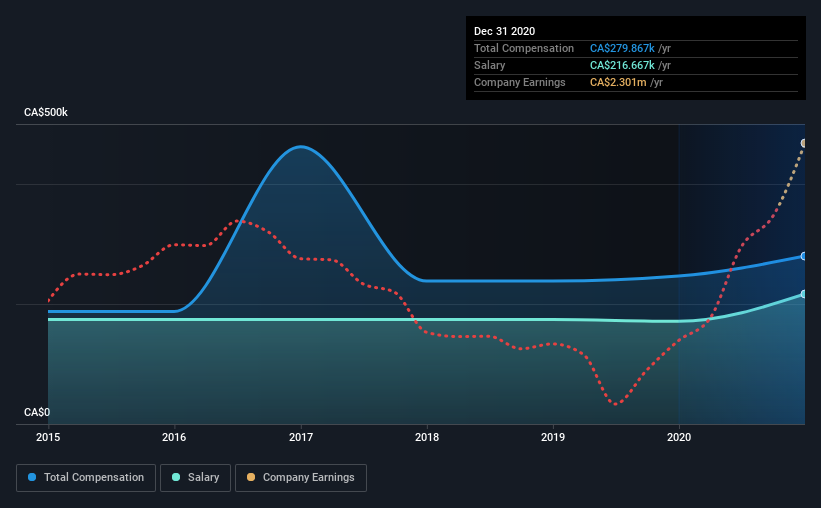

At the time of writing, our data shows that IMPACT Silver Corp. has a market capitalization of CA$101m, and reported total annual CEO compensation of CA$280k for the year to December 2020. That's a notable increase of 14% on last year. We note that the salary portion, which stands at CA$216.7k constitutes the majority of total compensation received by the CEO.

On comparing similar-sized companies in the industry with market capitalizations below CA$242m, we found that the median total CEO compensation was CA$147k. Hence, we can conclude that Fred Davidson is remunerated higher than the industry median. Furthermore, Fred Davidson directly owns CA$346k worth of shares in the company.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | CA$217k | CA$171k | 77% |

| Other | CA$63k | CA$75k | 23% |

| Total Compensation | CA$280k | CA$246k | 100% |

On an industry level, around 93% of total compensation represents salary and 7% is other remuneration. In IMPACT Silver's case, non-salary compensation represents a greater slice of total remuneration, in comparison to the broader industry. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

IMPACT Silver Corp.'s Growth

Over the past three years, IMPACT Silver Corp. has seen its earnings per share (EPS) grow by 44% per year. It achieved revenue growth of 17% over the last year.

Shareholders would be glad to know that the company has improved itself over the last few years. It's also good to see decent revenue growth in the last year, suggesting the business is healthy and growing. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has IMPACT Silver Corp. Been A Good Investment?

Most shareholders would probably be pleased with IMPACT Silver Corp. for providing a total return of 80% over three years. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

In Summary...

The company's decent performance might have made most shareholders happy, possibly making CEO remuneration the least of the concerns to be discussed in the upcoming AGM. Still, not all shareholders might be in favor of a pay raise to the CEO, seeing that they are already being paid higher than the industry.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. That's why we did some digging and identified 3 warning signs for IMPACT Silver that you should be aware of before investing.

Switching gears from IMPACT Silver, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSXV:IPT

IMPACT Silver

Engages in the exploration, development, and mineral processing activities in Mexico.

Flawless balance sheet with low risk.

Market Insights

Community Narratives