Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about. So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that Inca One Gold Corp. (CVE:IO) does use debt in its business. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Inca One Gold

What Is Inca One Gold's Debt?

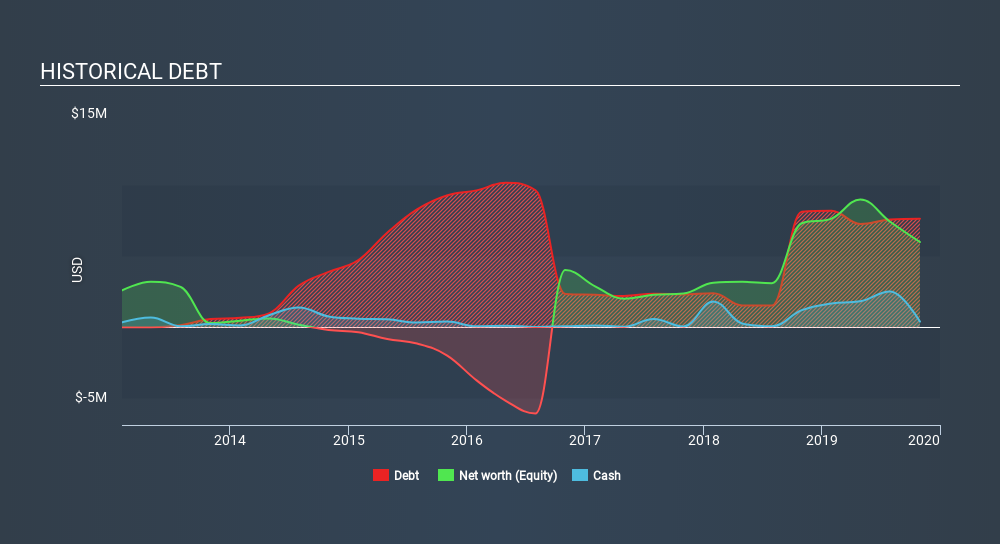

The image below, which you can click on for greater detail, shows that at October 2019 Inca One Gold had debt of US$7.63m, up from US$8.1 in one year. However, it also had US$397.3k in cash, and so its net debt is US$7.23m.

How Healthy Is Inca One Gold's Balance Sheet?

The latest balance sheet data shows that Inca One Gold had liabilities of US$10.0m due within a year, and liabilities of US$4.42m falling due after that. Offsetting this, it had US$397.3k in cash and US$1.45m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$12.6m.

The deficiency here weighs heavily on the US$4.86m company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we definitely think shareholders need to watch this one closely. After all, Inca One Gold would likely require a major re-capitalisation if it had to pay its creditors today. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Inca One Gold's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Over 12 months, Inca One Gold reported revenue of US$36m, which is a gain of 70%, although it did not report any earnings before interest and tax. With any luck the company will be able to grow its way to profitability.

Caveat Emptor

Despite the top line growth, Inca One Gold still had negative earnings before interest and tax (EBIT), over the last year. Indeed, it lost a very considerable US$1.8m at the EBIT level. Combining this information with the significant liabilities we already touched on makes us very hesitant about this stock, to say the least. That said, it is possible that the company will turn its fortunes around. Nevertheless, we would not bet on it given that it lost US$1.6m in just last twelve months, and it doesn't have much by way of liquid assets. So while it will probably survive, we think it's risky; we'd treat it like chicken pox and try to avoid it. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. Consider for instance, the ever-present spectre of investment risk. We've identified 4 warning signs with Inca One Gold (at least 2 which don't sit too well with us) , and understanding them should be part of your investment process.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TSXV:INCA.H

Inca One Gold

Engages in the business of operating and developing of gold-bearing mineral processing operations in Peru.

Moderate and fair value.

Market Insights

Community Narratives