- Canada

- /

- Metals and Mining

- /

- TSXV:ILI

Top 3 TSX Penny Stocks To Consider In November 2024

Reviewed by Simply Wall St

The Canadian market is currently navigating a complex landscape influenced by shifting Federal Reserve expectations and concerns over U.S. debt, which have led to adjustments in interest rate projections. Amid these broader economic dynamics, penny stocks—often representing smaller or newer companies—continue to capture investor interest as they can offer unique opportunities for growth. While the term "penny stock" may seem outdated, these stocks still hold potential for investors who are willing to explore beyond the mainstream, focusing on those with strong financial foundations and growth potential.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| PetroTal (TSX:TAL) | CA$0.65 | CA$602.45M | ★★★★★★ |

| Alvopetro Energy (TSXV:ALV) | CA$4.85 | CA$182.69M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.39 | CA$119.63M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.40 | CA$11.46M | ★★★★★☆ |

| Winshear Gold (TSXV:WINS) | CA$0.18 | CA$5.66M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$3.40 | CA$327.12M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.71 | CA$291.81M | ★★★★★☆ |

| NamSys (TSXV:CTZ) | CA$1.07 | CA$28.74M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.045 | CA$4.07M | ★★★★★★ |

| Enterprise Group (TSX:E) | CA$2.10 | CA$129.82M | ★★★★☆☆ |

Click here to see the full list of 954 stocks from our TSX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Imagine Lithium (TSXV:ILI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Imagine Lithium Inc. is a junior mineral exploration company focused on acquiring, exploring, and evaluating mineral properties in North America, with a market cap of CA$8.31 million.

Operations: Imagine Lithium Inc. does not report any revenue segments as it is primarily engaged in the exploration and evaluation of mineral properties.

Market Cap: CA$8.31M

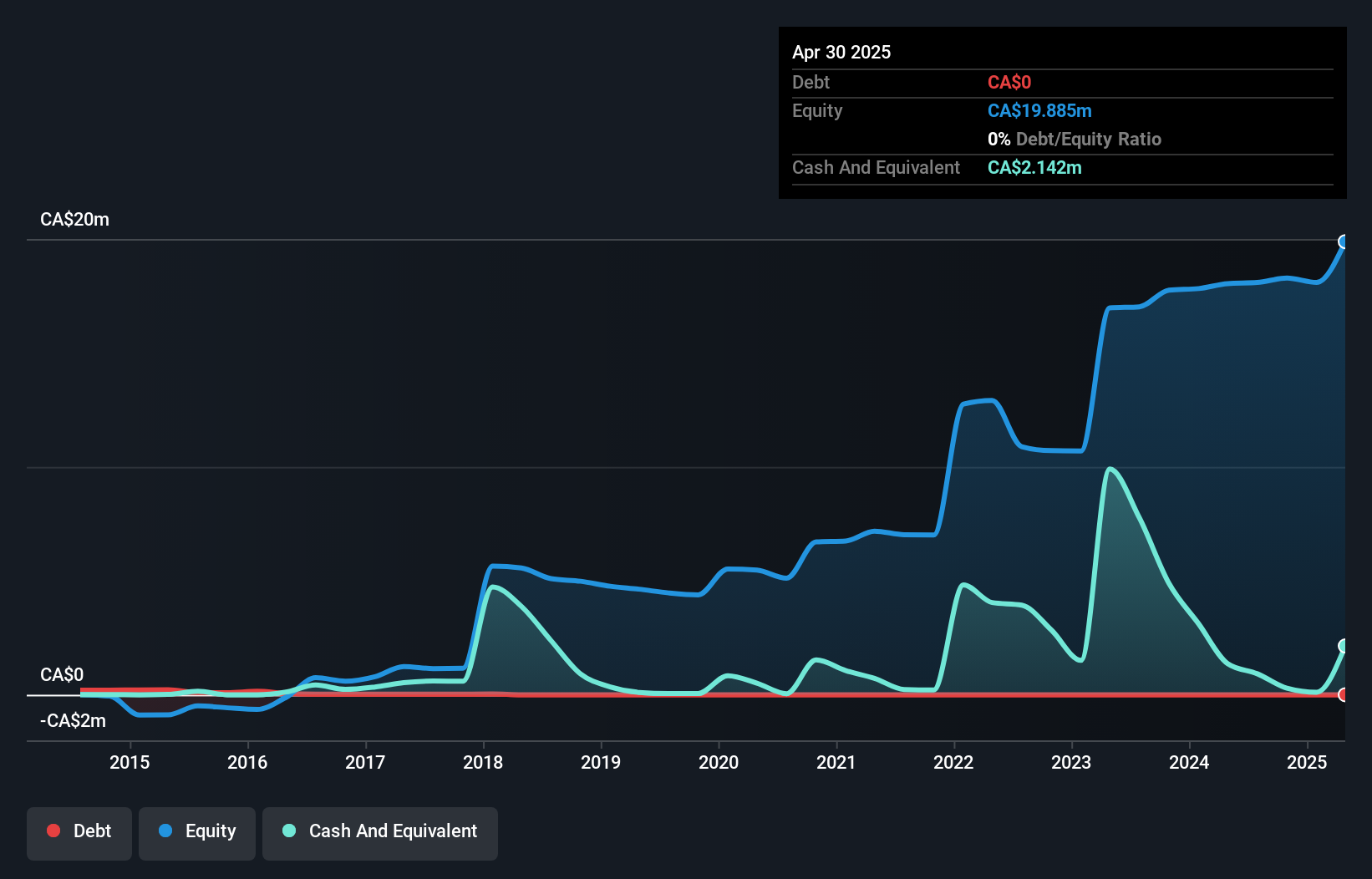

Imagine Lithium Inc., with a market cap of CA$8.31 million, is pre-revenue but recently achieved profitability, reporting net income for the first half of 2024. The company has no debt and its short-term assets exceed liabilities, indicating strong financial management. A recent NI 43-101 compliant Mineral Resource Estimate for its Jackpot Property highlights significant lithium potential with promising expansion prospects. Despite high volatility in share price and low return on equity at 6.8%, Imagine Lithium's experienced management team and strategic location near key infrastructure could be advantageous as it continues exploration efforts.

- Unlock comprehensive insights into our analysis of Imagine Lithium stock in this financial health report.

- Examine Imagine Lithium's past performance report to understand how it has performed in prior years.

Quisitive Technology Solutions (TSXV:QUIS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Quisitive Technology Solutions, Inc., through its subsidiaries, delivers Microsoft solutions mainly in North America and South Asia with a market cap of CA$108.20 million.

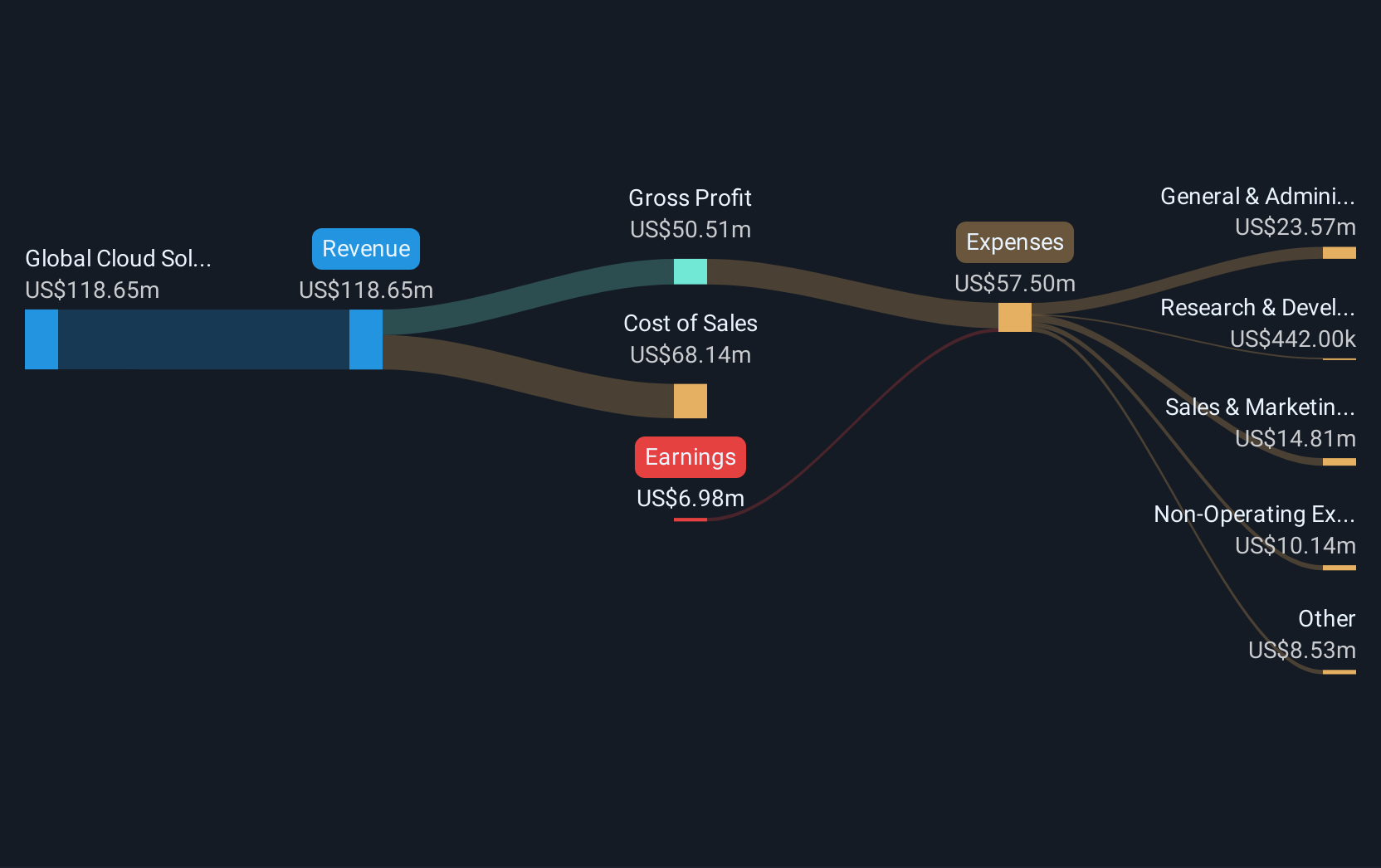

Operations: The company generates revenue of $118.62 million from its Global Cloud Solutions segment.

Market Cap: CA$108.2M

Quisitive Technology Solutions, with a market cap of CA$108.20 million, is currently unprofitable but demonstrates potential in its financial management and strategic positioning. The company has maintained stable weekly volatility over the past year and reports sufficient cash runway for more than three years due to positive free cash flow growth. Despite an inexperienced board, Quisitive's short-term assets exceed both its short- and long-term liabilities, reflecting sound financial health. Recent earnings showed improved net income compared to the previous year despite a slight decrease in sales. The stock trades at a significant discount to estimated fair value, indicating potential undervaluation relative to peers and industry benchmarks.

- Click to explore a detailed breakdown of our findings in Quisitive Technology Solutions' financial health report.

- Review our growth performance report to gain insights into Quisitive Technology Solutions' future.

Snipp Interactive (TSXV:SPN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Snipp Interactive Inc. offers mobile marketing, rebates, and loyalty solutions across the United States, Canada, Ireland, and internationally with a market cap of CA$18.60 million.

Operations: The company generates $25.93 million from its comprehensive range of mobile marketing and loyalty services.

Market Cap: CA$18.6M

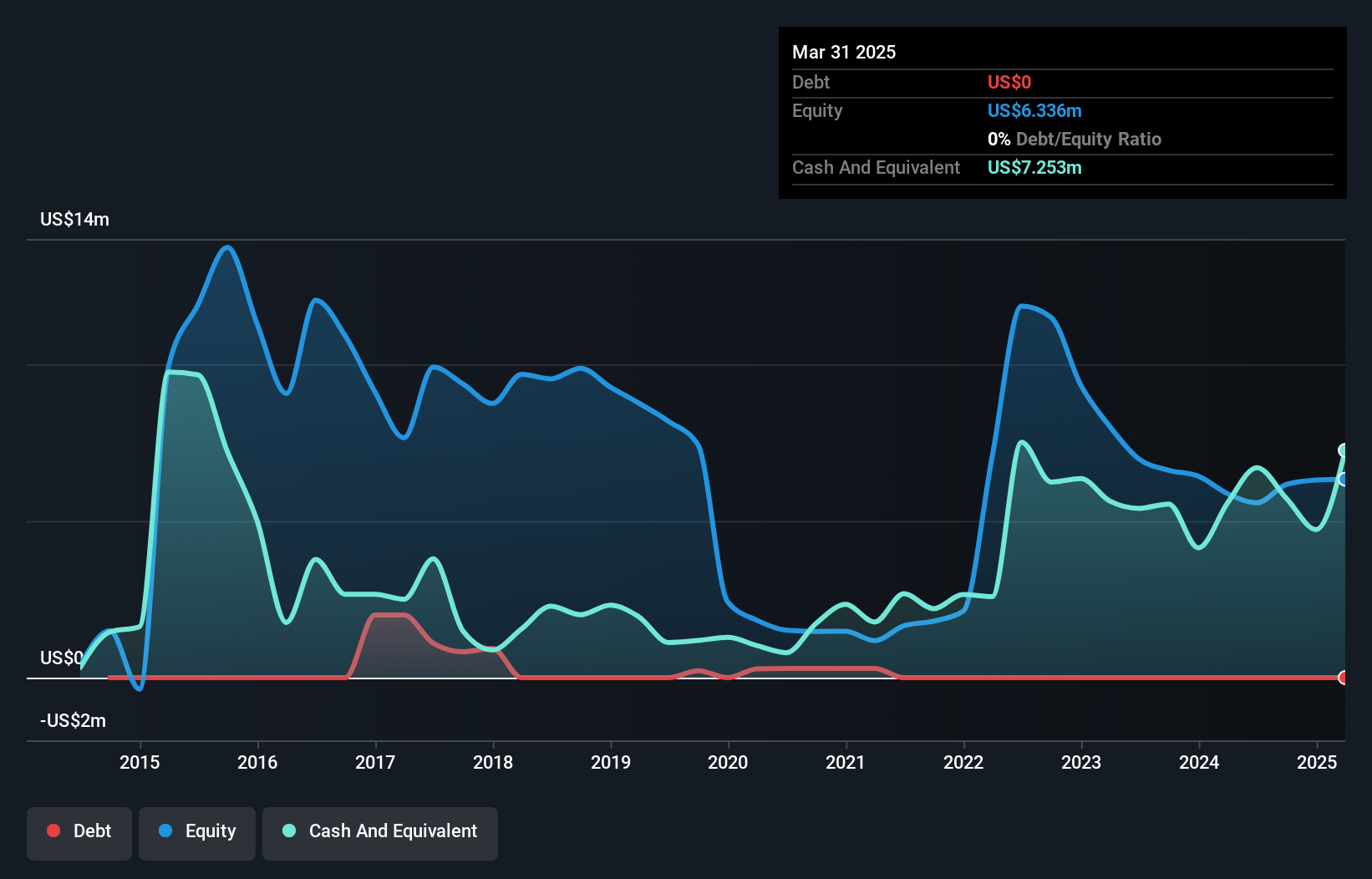

Snipp Interactive Inc., with a market cap of CA$18.60 million, is currently unprofitable but exhibits financial resilience through positive free cash flow and a sufficient cash runway exceeding three years. Despite recent sales decline to US$4.75 million in Q2 2024 from US$7.45 million the previous year, losses have narrowed significantly, reflecting improved cost management. The company's debt-free status and experienced board provide stability amid executive changes, including the interim appointment of Richard Pistilli as CFO following Jaisun Garcha's departure. Trading below estimated fair value suggests potential undervaluation against industry standards despite high share price volatility.

- Dive into the specifics of Snipp Interactive here with our thorough balance sheet health report.

- Understand Snipp Interactive's earnings outlook by examining our growth report.

Summing It All Up

- Get an in-depth perspective on all 954 TSX Penny Stocks by using our screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:ILI

Imagine Lithium

A junior mineral exploration company, acquires, explores, and evaluates mineral properties in North America.

Excellent balance sheet moderate.

Market Insights

Community Narratives