The harsh reality for HTC Purenergy Inc. (CVE:HTC) shareholders is that its auditors, Manning Elliott, expressed doubts about its ability to continue as a going concern, in its reported results to March 2021. It is therefore fair to assume that, based on those financials, the company should strengthen its balance sheet in the short term, perhaps by issuing shares.

If the company does have to issue more shares, potential investors will be sure to consider how desperate it is for capital. So shareholders should absolutely be taking a close look at how risky the balance sheet is. Debt is always a risk factor in these cases, as creditors could be in a position to wind up the company, in the worst case scenario.

View our latest analysis for HTC Purenergy

How Much Debt Does HTC Purenergy Carry?

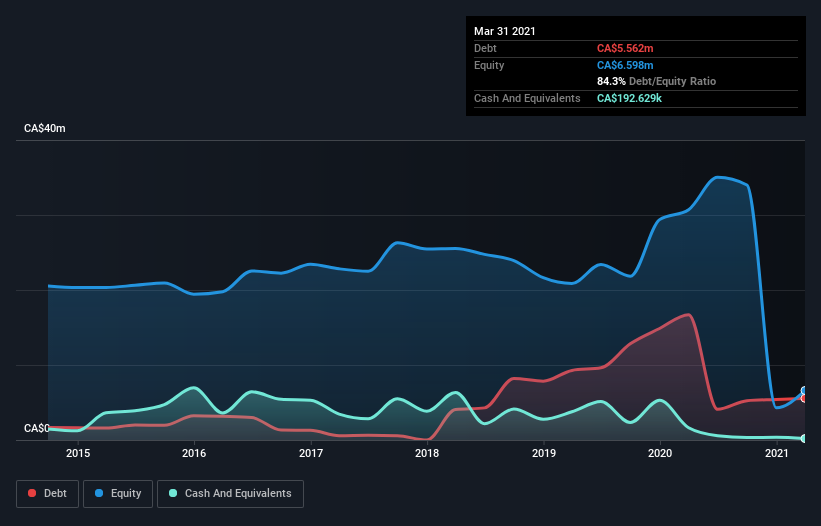

You can click the graphic below for the historical numbers, but it shows that HTC Purenergy had CA$5.56m of debt in March 2021, down from CA$16.7m, one year before. However, it does have CA$192.6k in cash offsetting this, leading to net debt of about CA$5.37m.

How Healthy Is HTC Purenergy's Balance Sheet?

We can see from the most recent balance sheet that HTC Purenergy had liabilities of CA$1.53m falling due within a year, and liabilities of CA$5.78m due beyond that. On the other hand, it had cash of CA$192.6k and CA$71.2k worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by CA$7.04m.

This deficit isn't so bad because HTC Purenergy is worth CA$16.6m, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. But it's clear that we should definitely closely examine whether it can manage its debt without dilution. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since HTC Purenergy will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

It seems likely shareholders hope that HTC Purenergy can significantly advance the business plan before too long, because it doesn't have any significant revenue at the moment.

Caveat Emptor

Over the last twelve months HTC Purenergy produced an earnings before interest and tax (EBIT) loss. Indeed, it lost a very considerable CA$18m at the EBIT level. Considering that alongside the liabilities mentioned above does not give us much confidence that company should be using so much debt. So we think its balance sheet is a little strained, though not beyond repair. We would feel better if it turned its trailing twelve month loss of CA$31m into a profit. So to be blunt we do think it is risky. We prefer to avoid a company after its auditor has expressed any uncertainty about its ability to continue as a going concern. That's because companies should always make sure the auditor has confidence that the company will continue as a going concern, in our view. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. For example, we've discovered 3 warning signs for HTC Purenergy (2 are a bit unpleasant!) that you should be aware of before investing here.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if HTC Purenergy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSXV:HTC.H

HTC Purenergy

HTC Purenergy Inc., doing business as HTC Extraction Systems, a hemp biomass extraction and formulation company, develops proprietary technologies for the extraction of biomass, gas, and liquids in Canada.

Moderate with weak fundamentals.

Market Insights

Community Narratives