- Canada

- /

- Metals and Mining

- /

- TSXV:HSTR

A Look at Heliostar Metals (TSXV:HSTR) Valuation Following Major Drill Program Updates at Ana Paula

Reviewed by Kshitija Bhandaru

Heliostar Metals (TSXV:HSTR) just shared fresh results from its ongoing 15,000 metre drill program at the Ana Paula project in Mexico. The company has ramped up activity by adding a third drill, reporting promising gold intercepts and progress on resource classification.

See our latest analysis for Heliostar Metals.

After a relatively quiet start to the year, Heliostar Metals has seen its momentum build rapidly. The company’s 90-day share price return of 75.63% and a staggering 260.34% share price return year-to-date highlight how quickly sentiment can shift when new exploration results impress investors. Over the last twelve months, total shareholder return stands at 211.94%. This reflects both recent progress at Ana Paula and the market’s growing confidence in the longer-term story.

If Heliostar’s surge has you scanning the market for strong momentum elsewhere, now’s a great time to discover fast growing stocks with high insider ownership

With shares up more than 75% in just three months, investors may wonder if Heliostar Metals still trades at a discount, or if the rapid gains mean the market has already priced in future growth potential.

Price-to-Earnings of 14.9x: Is it justified?

Heliostar Metals is currently trading at a price-to-earnings (P/E) ratio of 14.9x, which is substantially below both its peer average and the broader industry benchmarks. This makes its valuation appear attractive at the last closing price of CA$2.09.

The price-to-earnings ratio is a widely used measure of how much investors are willing to pay per dollar of earnings. It is especially relevant for evaluating established or newly profitable companies in the metals and mining sector. For Heliostar Metals, the low multiple may reflect skepticism or simply an opportunity missed by the market so far.

Compared to the Canadian Metals and Mining industry average of 23.8x and a peer average of 38.9x, Heliostar's lower P/E signals significant relative value. In addition, the estimated fair P/E ratio for the company is 33.4x, which is much higher than where the shares currently trade. If the market begins to recognize the company’s underlying growth story, there could be room for a considerable re-rating toward that fair multiple.

Explore the SWS fair ratio for Heliostar Metals

Result: Price-to-Earnings of 14.9x (UNDERVALUED)

However, risks remain, such as volatile gold prices and the need for consistent production growth. These factors could challenge Heliostar's current momentum.

Find out about the key risks to this Heliostar Metals narrative.

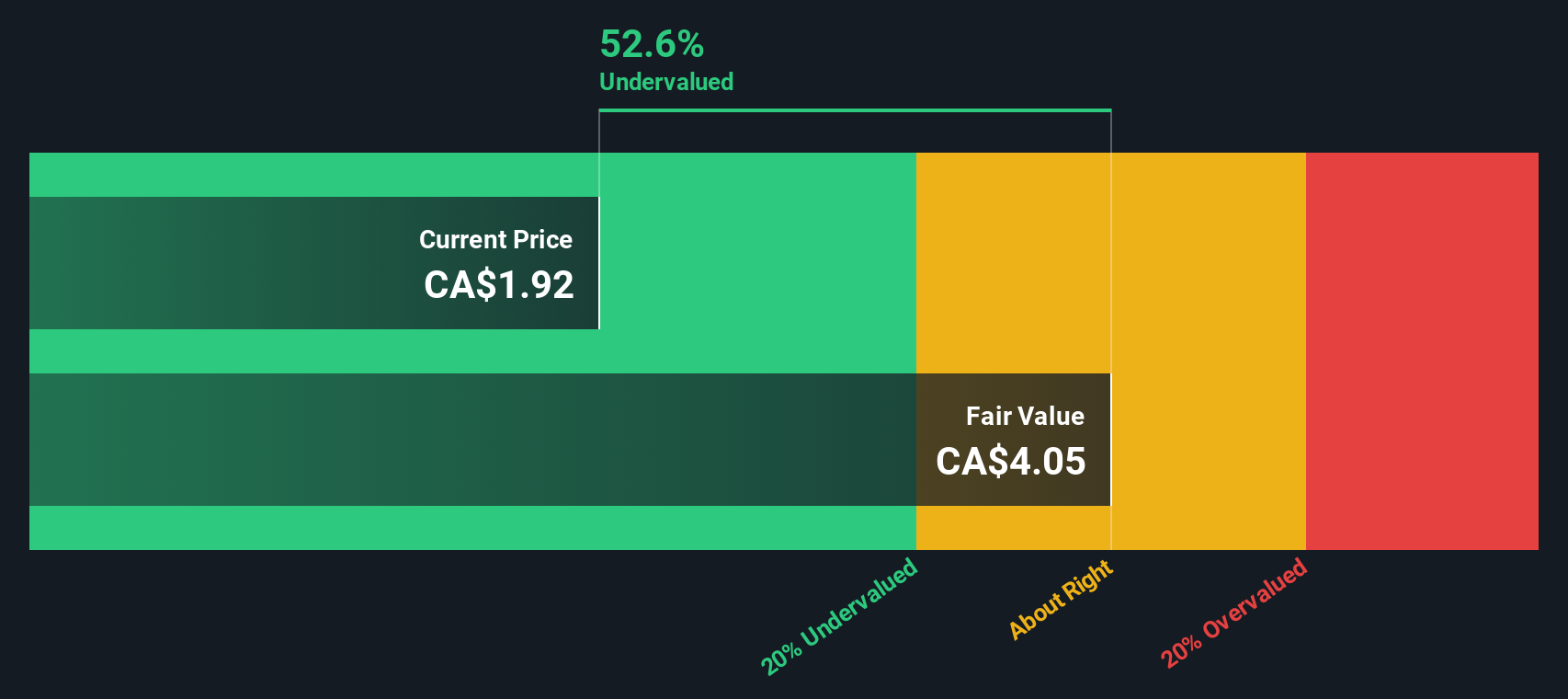

Another View: Discounted Cash Flow Says Shares Are Still Undervalued

Looking at Heliostar Metals from a different angle, our SWS DCF model estimates the fair value at CA$4.02 per share, which is nearly double the current trading price. This suggests that, based on future cash flows, the stock could offer even more upside than the earnings multiple alone implies. Are investors underestimating this growth story?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Heliostar Metals for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Heliostar Metals Narrative

If you want to dig into the numbers and arrive at your own view, creating a personalized analysis is fast and flexible. Do it your way

A great starting point for your Heliostar Metals research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never stop searching for opportunities. Use the Simply Wall Street Screener to uncover stocks with strong potential, unique technology, or powerful market trends today. Don’t let the next winner pass you by.

- Capture growth potential with these 874 undervalued stocks based on cash flows, packed with stocks trading below their true worth and ready for a market re-rating.

- Tap into emerging trends and review these 24 AI penny stocks, poised to benefit from breakthroughs in artificial intelligence across industries.

- Maximize passive income and financial stability by targeting these 20 dividend stocks with yields > 3%, offering reliable yields and robust cash flows for your portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Heliostar Metals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:HSTR

Heliostar Metals

Engages in the identification, acquisition, evaluation, and exploration of mineral properties in North America.

Very undervalued with exceptional growth potential.

Market Insights

Community Narratives