- Canada

- /

- Metals and Mining

- /

- TSXV:GUS

Spotlight On 3 TSX Penny Stocks With Market Caps Under CA$200M

Reviewed by Simply Wall St

As markets navigate conflicting forces with inflation remaining stubborn and corporations posting strong earnings, investors are seeking opportunities that align with solid fundamentals. Penny stocks, a term that might seem outdated, still represent an intriguing investment area for those interested in smaller or newer companies. These stocks can offer surprising value and potential growth when backed by strong financial health.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.92 | CA$182.79M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.50 | CA$14.9M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.71 | CA$438.56M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$1.86 | CA$220.49M | ★★★★★☆ |

| PetroTal (TSX:TAL) | CA$0.70 | CA$647.19M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.16 | CA$31.16M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.045 | CA$3.62M | ★★★★★★ |

| Orezone Gold (TSX:ORE) | CA$0.90 | CA$397.63M | ★★★★★☆ |

| Hemisphere Energy (TSXV:HME) | CA$1.83 | CA$180.58M | ★★★★★☆ |

| DIRTT Environmental Solutions (TSX:DRT) | CA$1.16 | CA$230.15M | ★★★★☆☆ |

Click here to see the full list of 938 stocks from our TSX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

illumin Holdings (TSX:ILLM)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: illumin Holdings Inc. is a technology company offering digital media solutions across the United States, Canada, Europe, Latin America, and other international markets with a market cap of CA$158.33 million.

Operations: The company's revenue is primarily generated from its Internet Information Providers segment, amounting to CA$127.47 million.

Market Cap: CA$158.33M

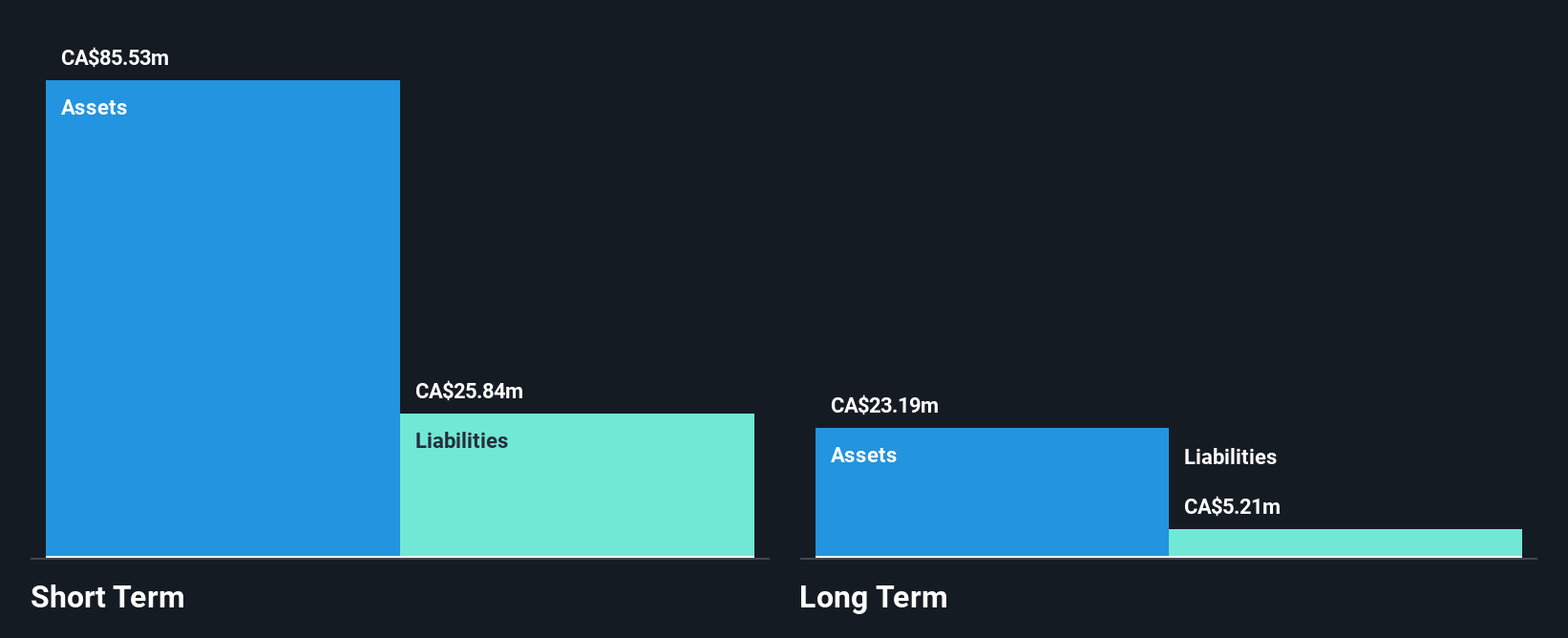

illumin Holdings Inc., with a market cap of CA$158.33 million, offers digital media solutions and is currently unprofitable but trades at 70.7% below estimated fair value. The company has strong financial stability, with short-term assets exceeding both short- and long-term liabilities and a reduced debt-to-equity ratio from 177.5% to 0.1% over five years. Recent integration with Adsquare enhances its platform by providing advanced footfall attribution, linking online campaigns to in-store visits while maintaining privacy compliance, thus reinforcing illumin's role in programmatic advertising across various industries like retail and automotive sectors.

- Dive into the specifics of illumin Holdings here with our thorough balance sheet health report.

- Gain insights into illumin Holdings' outlook and expected performance with our report on the company's earnings estimates.

Dynasty Gold (TSXV:DYG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Dynasty Gold Corp. is an exploration stage company focused on acquiring, exploring, and developing mineral properties in the United States and Canada, with a market cap of CA$8.31 million.

Operations: Dynasty Gold Corp. has not reported any revenue segments as it is currently in the exploration stage, concentrating on mineral property development in the United States and Canada.

Market Cap: CA$8.31M

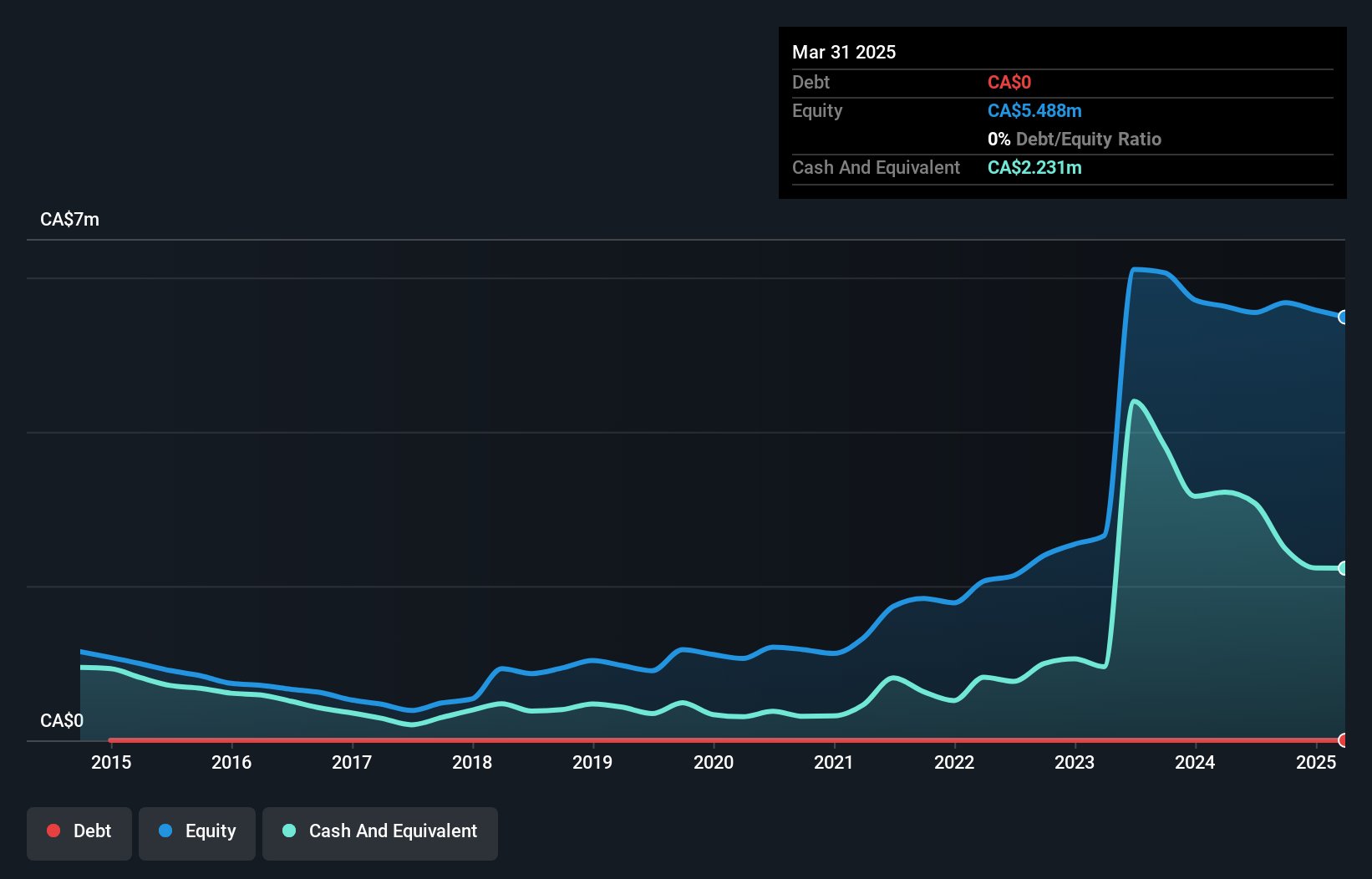

Dynasty Gold Corp., with a market cap of CA$8.31 million, is in the exploration stage focusing on mineral properties in North America and remains pre-revenue. The company has no debt and maintains a strong financial position, with short-term assets of CA$2.6 million exceeding liabilities of CA$147.1K, offering a cash runway exceeding three years based on current free cash flow trends. Despite being unprofitable with increasing losses over five years, recent earnings show improvement; net income for Q3 2024 was CA$0.086878 million compared to a loss the previous year, indicating potential operational progress amidst high volatility reduction from 15% to 10%.

- Take a closer look at Dynasty Gold's potential here in our financial health report.

- Assess Dynasty Gold's previous results with our detailed historical performance reports.

Angus Gold (TSXV:GUS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Angus Gold Inc. is a gold exploration company engaged in acquiring, exploring, and developing mineral properties, with a market cap of CA$28.36 million.

Operations: Currently, there are no revenue segments reported for this gold exploration company.

Market Cap: CA$28.36M

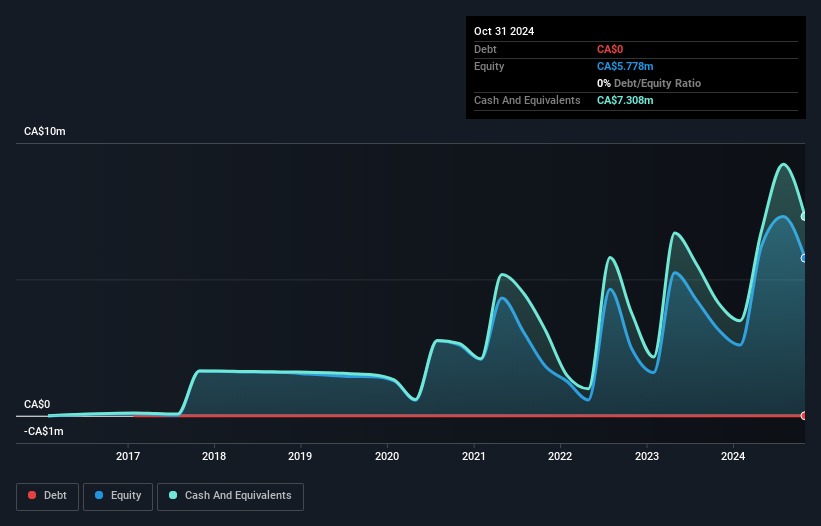

Angus Gold Inc., with a market cap of CA$28.36 million, is pre-revenue and focuses on gold exploration in Canada. Recent drilling at the Golden Sky Project revealed promising results, notably extending the Dorset Gold Zone's strike length to 2 kilometers, with high-grade intersections like 13.7 meters grading 3.2 g/t Au and 9.1 meters grading 4.3 g/t Au in new zones. The company is debt-free and has sufficient cash runway for over a year despite being unprofitable with increasing losses over five years, reflecting its early-stage exploration status amidst ongoing volatility of approximately 9%.

- Navigate through the intricacies of Angus Gold with our comprehensive balance sheet health report here.

- Examine Angus Gold's past performance report to understand how it has performed in prior years.

Next Steps

- Investigate our full lineup of 938 TSX Penny Stocks right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:GUS

Angus Gold

A gold exploration company, acquires, explores, and develops mineral properties.

Moderate with adequate balance sheet.

Market Insights

Community Narratives