- Canada

- /

- Metals and Mining

- /

- TSXV:WML

3 TSX Penny Stocks With Market Caps Below CA$300M

Reviewed by Simply Wall St

Amid ongoing trade uncertainties, the Canadian market has shown resilience, with both the S&P 500 and TSX seeing gains in May. In this context, penny stocks—often seen as relics of past trading eras—still hold potential for investors seeking affordability and growth. These smaller or newer companies can offer unique opportunities when backed by strong financials, and we'll explore three such examples from the TSX that stand out for their financial strength.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.71 | CA$75.86M | ✅ 3 ⚠️ 3 View Analysis > |

| NTG Clarity Networks (TSXV:NCI) | CA$2.50 | CA$116.41M | ✅ 4 ⚠️ 2 View Analysis > |

| Intermap Technologies (TSX:IMP) | CA$2.27 | CA$131.52M | ✅ 3 ⚠️ 2 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.70 | CA$446.12M | ✅ 3 ⚠️ 2 View Analysis > |

| Orezone Gold (TSX:ORE) | CA$1.40 | CA$669.5M | ✅ 4 ⚠️ 2 View Analysis > |

| McChip Resources (TSXV:MCS) | CA$0.82 | CA$4.8M | ✅ 2 ⚠️ 5 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.76 | CA$168.18M | ✅ 3 ⚠️ 1 View Analysis > |

| PetroTal (TSX:TAL) | CA$0.62 | CA$530.69M | ✅ 3 ⚠️ 3 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$2.62 | CA$134.5M | ✅ 1 ⚠️ 2 View Analysis > |

| Findev (TSXV:FDI) | CA$0.425 | CA$11.6M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 874 stocks from our TSX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Colonial Coal International (TSXV:CAD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Colonial Coal International Corp. focuses on acquiring, exploring, and developing coal properties in Canada, with a market cap of CA$285.28 million.

Operations: Colonial Coal International Corp. does not report specific revenue segments.

Market Cap: CA$285.28M

Colonial Coal International Corp., with a market cap of CA$285.28 million, remains pre-revenue, making it challenging to assess profitability or growth compared to industry peers. The company benefits from a strong cash position, providing a runway exceeding three years even if cash flow declines modestly. Despite its seasoned management and board, Colonial Coal has faced increasing losses over the past five years, with recent reports showing net losses of CA$0.62 million for Q3 2025 and CA$6.18 million for the nine months ended April 30, 2025. The company remains debt-free and has not diluted shareholders recently.

- Click to explore a detailed breakdown of our findings in Colonial Coal International's financial health report.

- Examine Colonial Coal International's past performance report to understand how it has performed in prior years.

Grande Portage Resources (TSXV:GPG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Grande Portage Resources Ltd. is an exploration stage company focused on exploring and developing natural resource properties in the United States, with a market cap of CA$25.21 million.

Operations: Grande Portage Resources Ltd. does not have reported revenue segments as it is an exploration stage company.

Market Cap: CA$25.21M

Grande Portage Resources Ltd., with a market cap of CA$25.21 million, is pre-revenue and has faced increasing losses over the past five years. The company is debt-free and its short-term assets exceed liabilities, though it has less than a year of cash runway. Recent developments include staking new claims at the New Amalga Gold project in Alaska to support potential underground mining operations, while ongoing infrastructure advancements at Cascade Point aim to facilitate ore transportation. Test results from ore sorting suggest cost efficiencies and reduced environmental impact, enhancing the project's economic viability without chemical processing.

- Navigate through the intricacies of Grande Portage Resources with our comprehensive balance sheet health report here.

- Review our historical performance report to gain insights into Grande Portage Resources' track record.

Wealth Minerals (TSXV:WML)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Wealth Minerals Ltd. focuses on the acquisition, exploration, and development of mineral properties across Canada, Chile, Peru, and Mexico with a market cap of CA$15.39 million.

Operations: Wealth Minerals Ltd. does not report any revenue segments.

Market Cap: CA$15.39M

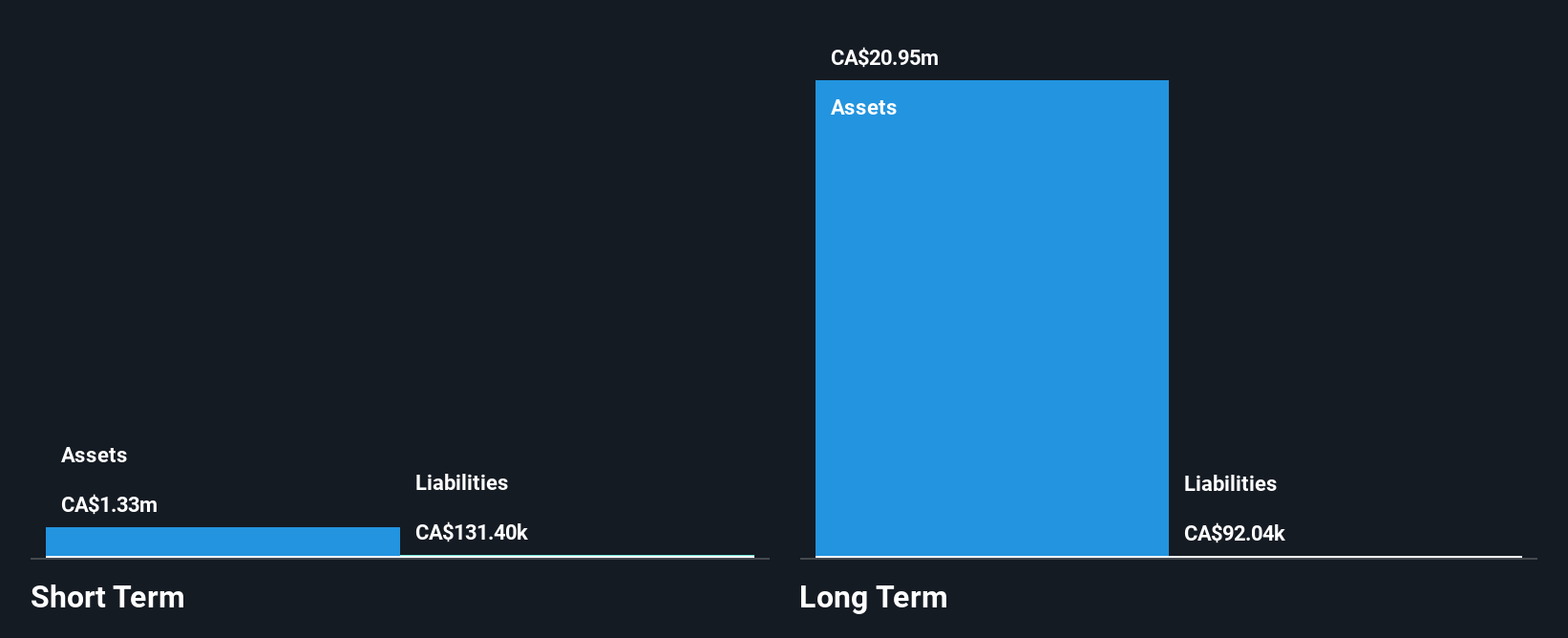

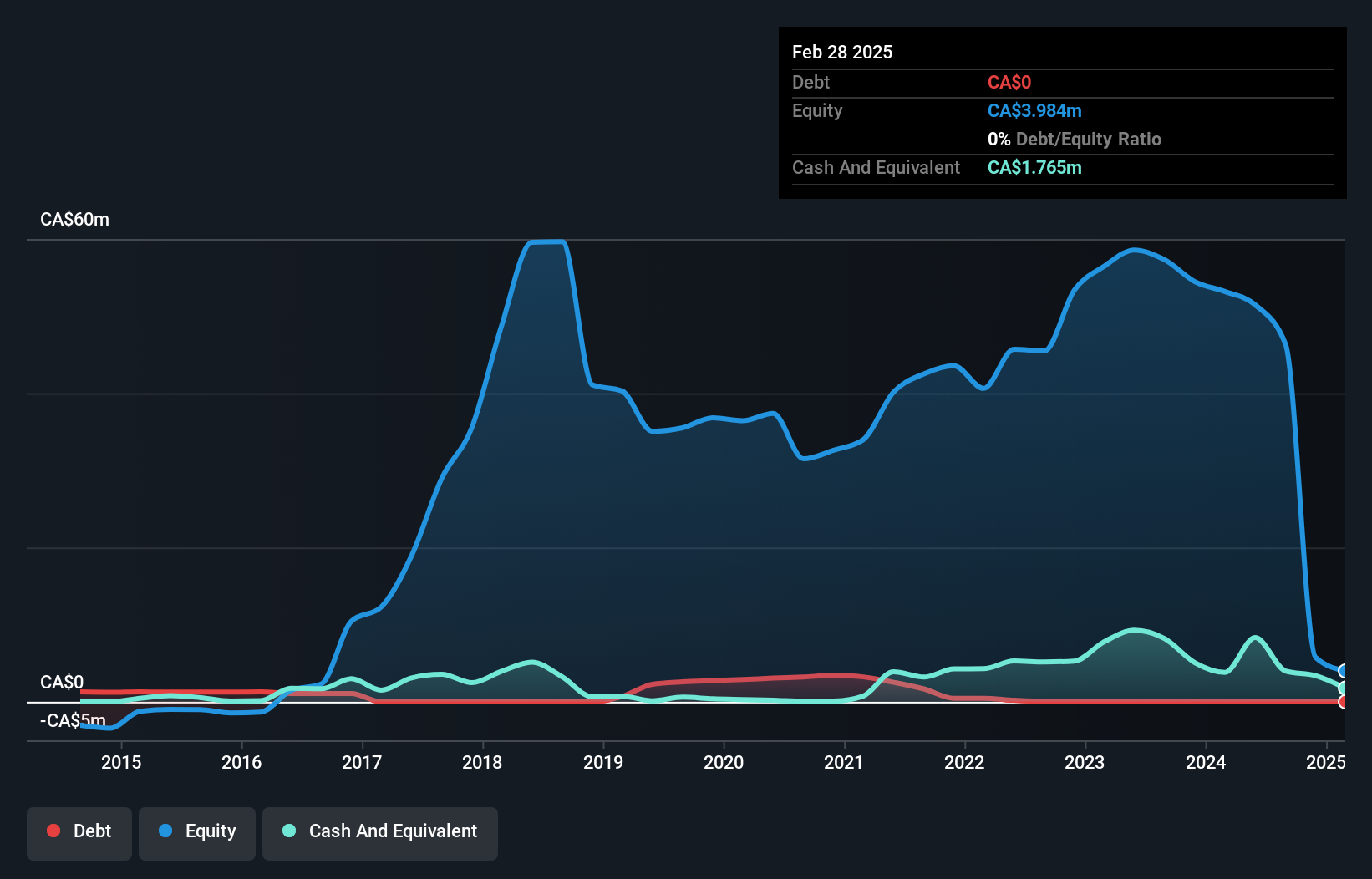

Wealth Minerals Ltd., with a market cap of CA$15.39 million, is pre-revenue and faces challenges with less than a year of cash runway. Despite no debt and short-term assets exceeding liabilities, the company struggles with increasing losses over five years. Recent strategic moves include forming Kuska Minerals SpA in partnership with the Quechua Indigenous Community to advance lithium exploration at the Kuska Project in Chile's Ollague area. Although its initial application for a special lithium operation contract was declined, Wealth continues to pursue alternative permitting processes while leveraging its seasoned management team for future growth opportunities.

- Jump into the full analysis health report here for a deeper understanding of Wealth Minerals.

- Assess Wealth Minerals' previous results with our detailed historical performance reports.

Turning Ideas Into Actions

- Unlock our comprehensive list of 874 TSX Penny Stocks by clicking here.

- Seeking Other Investments? Explore 22 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wealth Minerals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:WML

Wealth Minerals

Engages in the acquisition, exploration, and development of mineral properties in Canada, Chile, Peru, and Mexico.

Moderate with adequate balance sheet.

Market Insights

Community Narratives