We've lost count of how many times insiders have accumulated shares in a company that goes on to improve markedly. On the other hand, we'd be remiss not to mention that insider sales have been known to precede tough periods for a business. So before you buy or sell Goldeneye Resources Corp. (CVE:GOE), you may well want to know whether insiders have been buying or selling.

Do Insider Transactions Matter?

Most investors know that it is quite permissible for company leaders, such as directors of the board, to buy and sell stock on the market. However, most countries require that the company discloses such transactions to the market.

We don't think shareholders should simply follow insider transactions. But it is perfectly logical to keep tabs on what insiders are doing. For example, a Harvard University study found that 'insider purchases earn abnormal returns of more than 6% per year.'

View our latest analysis for Goldeneye Resources

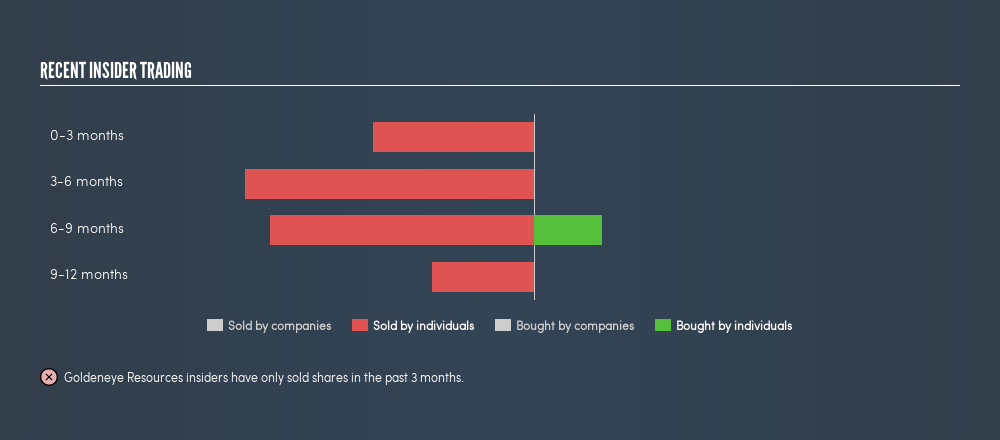

Goldeneye Resources Insider Transactions Over The Last Year

The CEO & Director, Jatinder Bal, made the biggest insider sale in the last 12 months. That single transaction was for CA$195k worth of shares at a price of CA$0.15 each. While we don't usually like to see insider selling, it's more concerning if the sales take price at a lower price. The good news is that this large sale was at well above current price of CA$0.09. So it is hard to draw any strong conclusion from it. The only individual insider seller over the last year was Jatinder Bal. Notably Jatinder Bal was also the biggest buyer, having purchased CA$42k worth of shares.

Jatinder Bal ditched 4.0m shares over the year. The average price per share was CA$0.12. You can see the insider transactions (by individuals) over the last year depicted in the chart below. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

If you are like me, then you will not want to miss this freelist of growing companies that insiders are buying.

Insider Ownership of Goldeneye Resources

Many investors like to check how much of a company is owned by insiders. A high insider ownership often makes company leadership more mindful of shareholder interests. It appears that Goldeneye Resources insiders own 18% of the company, worth about CA$381k. We've certainly seen higher levels of insider ownership elsewhere, but these holdings are enough to suggest alignment between insiders and the other shareholders.

So What Do The Goldeneye Resources Insider Transactions Indicate?

An insider sold Goldeneye Resources shares recently, but they didn't buy any. Despite some insider buying, the longer term picture doesn't make us feel much more positive. Insiders own shares, but we're still pretty cautious, given the history of sales. We're in no rush to buy! Along with insider transactions, I recommend checking if Goldeneye Resources is growing revenue. This free chart of historic revenue and earnings should make that easy.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this freelist of interesting companies.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About TSXV:GOE

Goldeneye Resources

Goldeneye Resources Corp., a mineral exploration company, focuses on the acquisition, exploration, and development of precious and base metal projects in North America.

Adequate balance sheet with weak fundamentals.

Market Insights

Community Narratives