- Canada

- /

- Metals and Mining

- /

- CNSX:FREE

Uncovering Opportunities: Free Battery Metal And 2 Other TSX Penny Stocks

Reviewed by Simply Wall St

The Canadian market has shown resilience, supported by strong consumer spending and positive wage growth, despite challenges like elevated inflation and higher interest rates. In this context, penny stocks—often associated with smaller or newer companies—continue to offer intriguing opportunities for investors seeking growth potential at lower price points. While the term "penny stocks" might seem outdated, their ability to combine affordability with robust financial health can make them appealing options in today's market landscape.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Findev (TSXV:FDI) | CA$0.465 | CA$13.32M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.34 | CA$118.05M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.59 | CA$556.63M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.30 | CA$223.45M | ★★★★★☆ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.475 | CA$968.15M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.23 | CA$32.24M | ★★★★★★ |

| New Gold (TSX:NGD) | CA$4.08 | CA$3.22B | ★★★★★☆ |

| Hemisphere Energy (TSXV:HME) | CA$1.87 | CA$185.31M | ★★★★★☆ |

| Enterprise Group (TSX:E) | CA$1.85 | CA$116.34M | ★★★★☆☆ |

Click here to see the full list of 930 stocks from our TSX Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Free Battery Metal (CNSX:FREE)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Free Battery Metal Limited focuses on the acquisition, exploration, and development of mineral properties in Canada with a market cap of CA$1.40 million.

Operations: Currently, there are no reported revenue segments for the company.

Market Cap: CA$1.4M

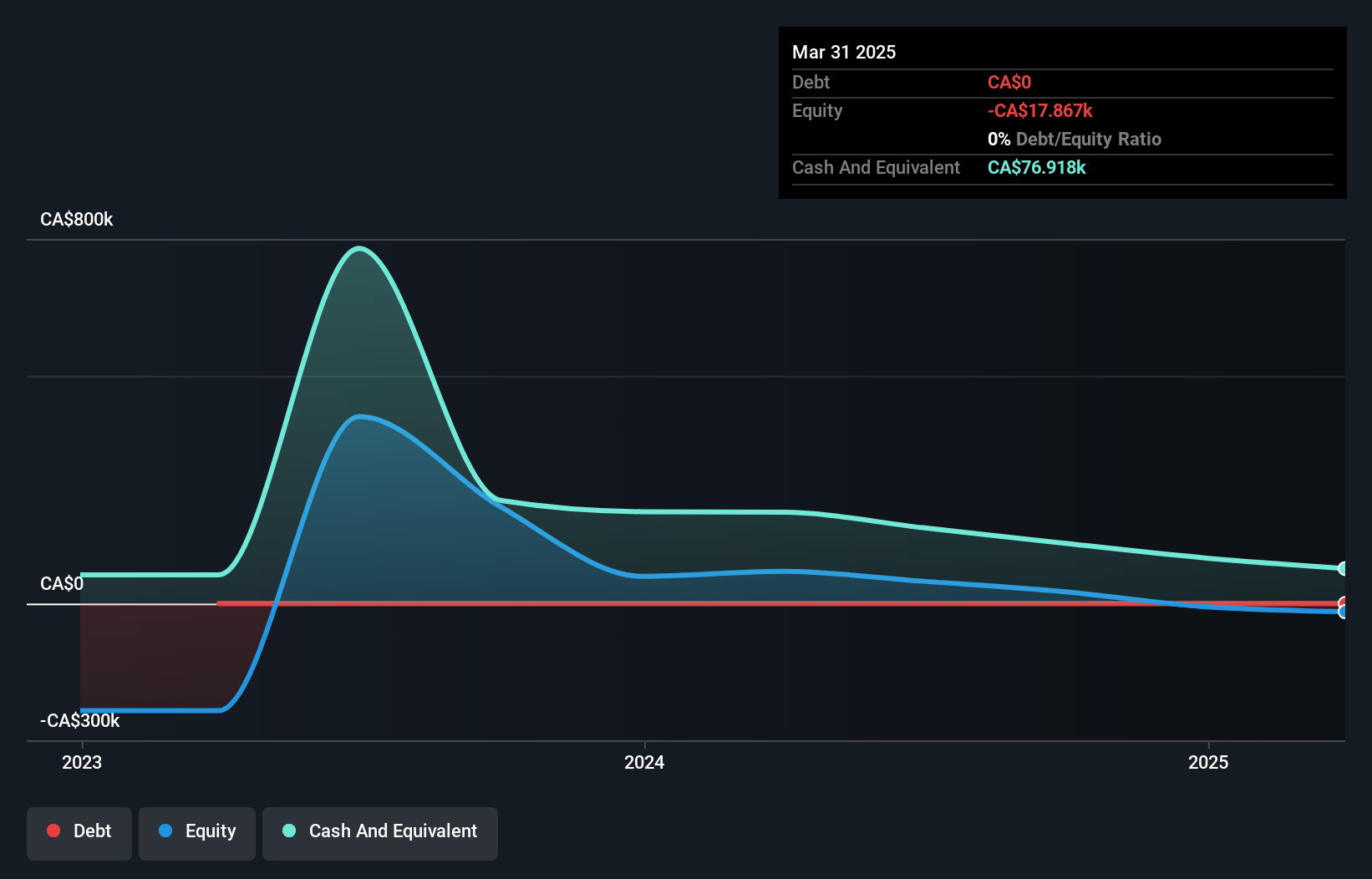

Free Battery Metal Limited, with a market cap of CA$1.40 million, remains a speculative investment due to its pre-revenue status and high volatility, which has increased from 68% to 92% over the past year. Despite being debt-free for five years and having short-term assets exceeding liabilities, the company faces challenges with an inexperienced management team and board. The recent earnings report showed reduced net losses compared to last year but highlighted ongoing unprofitability. Additionally, the company's cash runway is limited if free cash flow continues to decline at historical rates of 40.7% annually.

- Unlock comprehensive insights into our analysis of Free Battery Metal stock in this financial health report.

- Examine Free Battery Metal's past performance report to understand how it has performed in prior years.

BTU Metals (TSXV:BTU)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: BTU Metals Corp. is involved in the identification, exploration, and evaluation of mineral properties in Canada and Ireland, with a market cap of CA$3.70 million.

Operations: Currently, there are no reported revenue segments for this company.

Market Cap: CA$3.7M

BTU Metals Corp., with a market cap of CA$3.70 million, is a pre-revenue company facing challenges typical of penny stocks, including high volatility and shareholder dilution. The firm remains debt-free, with short-term assets significantly exceeding liabilities. However, it reported an increased net loss for the first quarter ended July 31, 2024 (CA$0.26 million), reflecting ongoing unprofitability and declining earnings over the past five years by 23.9% annually. Despite these hurdles, BTU benefits from an experienced management team and board, alongside a sufficient cash runway for approximately 1.7 years if current free cash flow trends persist.

- Take a closer look at BTU Metals' potential here in our financial health report.

- Understand BTU Metals' track record by examining our performance history report.

Geomega Resources (TSXV:GMA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Geomega Resources Inc. is involved in the acquisition, evaluation, and exploration of mining properties in Canada with a market cap of CA$12.91 million.

Operations: Geomega Resources Inc. currently has no reported revenue segments.

Market Cap: CA$12.91M

Geomega Resources Inc., with a market cap of CA$12.91 million, is a pre-revenue company navigating the complexities of penny stocks. Despite being debt-free and having short-term assets that exceed liabilities, Geomega faces challenges with increased losses over the past five years at 4.7% annually and high share price volatility recently rising to 19%. The company's cash runway is limited to less than a year under current conditions. Recent updates on its rare earth magnets recycling demonstration plant indicate significant progress in engineering and procurement, although it remains unprofitable with no meaningful revenue streams reported yet.

- Click here to discover the nuances of Geomega Resources with our detailed analytical financial health report.

- Review our historical performance report to gain insights into Geomega Resources' track record.

Key Takeaways

- Take a closer look at our TSX Penny Stocks list of 930 companies by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CNSX:FREE

Free Battery Metal

Engages in the acquisition, exploration, and development of mineral properties in Canada.

Moderate risk with mediocre balance sheet.

Market Insights

Community Narratives