- Canada

- /

- Personal Products

- /

- TSXV:LOVE

Commerce Resources And 2 Other TSX Penny Stocks To Watch

Reviewed by Simply Wall St

The Canadian market is navigating a complex landscape influenced by international tariffs and shifting economic policies, which are reshaping investment strategies. In this context, penny stocks continue to capture attention as they offer a unique blend of affordability and growth potential. These smaller or newer companies can be particularly appealing when they demonstrate strong financials, making them worth watching for investors seeking opportunities beyond traditional large-cap stocks.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.74 | CA$73.84M | ✅ 3 ⚠️ 3 View Analysis > |

| illumin Holdings (TSX:ILLM) | CA$2.35 | CA$112M | ✅ 4 ⚠️ 1 View Analysis > |

| Fintech Select (TSXV:FTEC) | CA$0.03 | CA$2.4M | ✅ 2 ⚠️ 3 View Analysis > |

| Findev (TSXV:FDI) | CA$0.425 | CA$12.03M | ✅ 2 ⚠️ 4 View Analysis > |

| Mandalay Resources (TSX:MND) | CA$4.62 | CA$436.01M | ✅ 4 ⚠️ 0 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.75 | CA$508.95M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$0.93 | CA$18.63M | ✅ 2 ⚠️ 4 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.63 | CA$178.66M | ✅ 1 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.91 | CA$179.43M | ✅ 3 ⚠️ 1 View Analysis > |

| McChip Resources (TSXV:MCS) | CA$2.35 | CA$11.31M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 446 stocks from our TSX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Commerce Resources (TSXV:CCE)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Commerce Resources Corp. focuses on acquiring, exploring, developing, and evaluating mineral resource properties in Canada with a market cap of CA$20.14 million.

Operations: Commerce Resources Corp. does not report any specific revenue segments.

Market Cap: CA$20.14M

Commerce Resources Corp., with a market cap of CA$20.14 million, remains pre-revenue and faces challenges typical for penny stocks, such as high volatility and limited cash runway, which is currently estimated at one month. However, recent capital infusion through convertible notes totaling CAD 2.15 million provides some financial leeway. The appointment of seasoned executives like Joel Ives as CFO and Nicholas Holthouse as CEO could enhance strategic direction, especially with the planned merger with Mont Royal Resources by late July. Despite its unprofitability and increased losses over five years, the company's debt-free status offers some stability in a volatile sector.

- Click here and access our complete financial health analysis report to understand the dynamics of Commerce Resources.

- Review our historical performance report to gain insights into Commerce Resources' track record.

Geomega Resources (TSXV:GMA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Geomega Resources Inc. is involved in the acquisition, evaluation, and exploration of mining properties in Canada with a market cap of CA$38.72 million.

Operations: Geomega Resources Inc. does not report any distinct revenue segments.

Market Cap: CA$38.72M

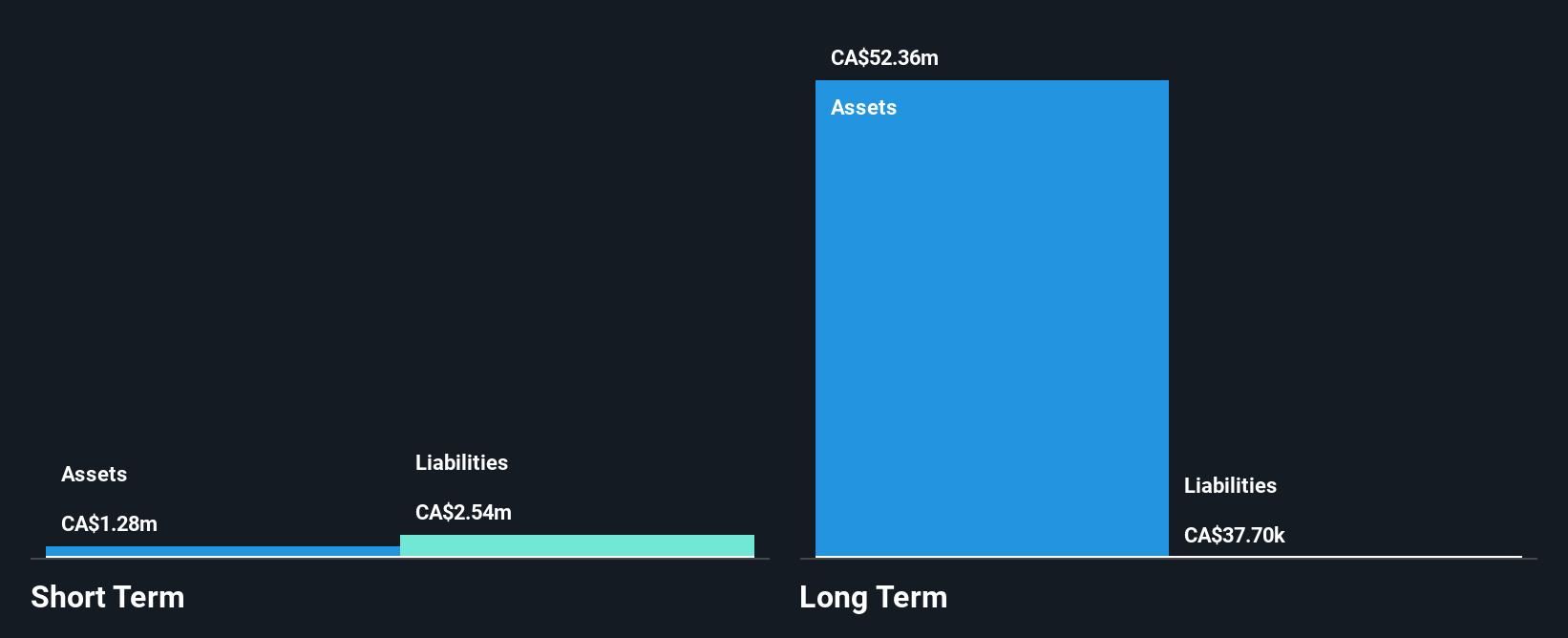

Geomega Resources Inc., with a market cap of CA$38.72 million, is pre-revenue and faces typical penny stock challenges like high volatility and limited cash runway. Despite these hurdles, the company has made significant strides in its Montviel rare earth deposit project by improving hydrometallurgical processes to enhance economic viability and reduce environmental impact. Progress on its rare earth magnet recycling plant in Quebec also marks a positive development, with construction expected to conclude by late 2025. While unprofitable, Geomega benefits from an experienced management team and remains debt-free, providing some stability amidst sector volatility.

- Navigate through the intricacies of Geomega Resources with our comprehensive balance sheet health report here.

- Examine Geomega Resources' past performance report to understand how it has performed in prior years.

Cannara Biotech (TSXV:LOVE)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Cannara Biotech Inc., along with its subsidiaries, focuses on the indoor cultivation, processing, and sale of cannabis and cannabis-derived products in Canada, with a market cap of CA$160.01 million.

Operations: The company's revenue is primarily derived from CA$89.87 million in cannabis operations and CA$4.11 million in real estate operations.

Market Cap: CA$160.01M

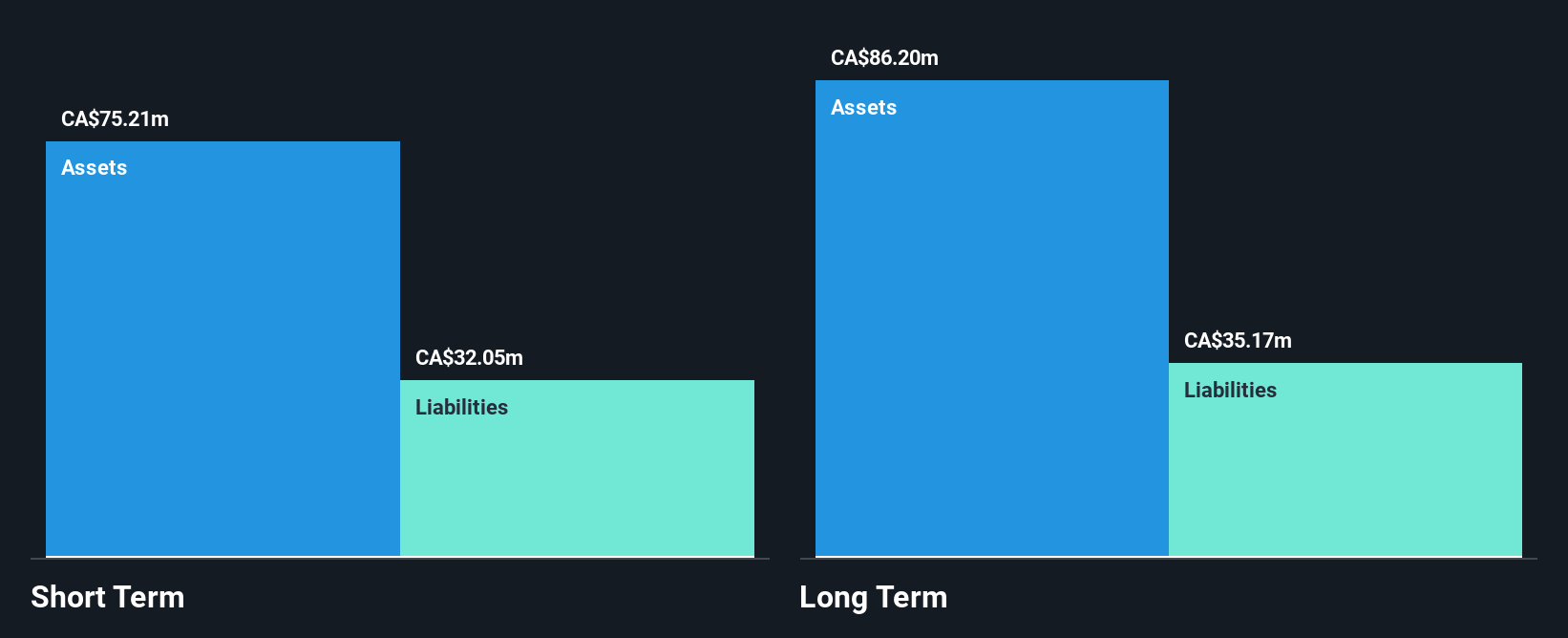

Cannara Biotech, with a market cap of CA$160.01 million, has shown strong financial growth despite being categorized as a penny stock. Recent earnings reports indicate revenue growth from CA$19.68 million to CA$26.59 million year-over-year for the second quarter ending February 28, 2025, and net income improvement from a loss of CA$3.45 million to a profit of CA$3.31 million in the same period. The company benefits from an experienced management team and board, stable weekly volatility at 7%, and well-covered interest payments by EBIT (3.7x). However, its high net debt to equity ratio of 45.9% warrants caution for potential investors seeking stability in this volatile sector.

- Click here to discover the nuances of Cannara Biotech with our detailed analytical financial health report.

- Assess Cannara Biotech's future earnings estimates with our detailed growth reports.

Make It Happen

- Jump into our full catalog of 446 TSX Penny Stocks here.

- Contemplating Other Strategies? Rare earth metals are the new gold rush. Find out which 25 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:LOVE

Cannara Biotech

Engages in the indoor cultivation, processing, and sale of cannabis and cannabis-derivated products in Canada.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives