- Canada

- /

- Oil and Gas

- /

- TSX:GRN

3 TSX Penny Stocks With Market Caps Under CA$20M

Reviewed by Simply Wall St

The Canadian market has been experiencing a notable rally, buoyed by the removal of election-related uncertainties and favorable economic fundamentals. Despite the vintage feel of the term "penny stocks," these investments remain relevant by offering opportunities in smaller or newer companies that can provide both affordability and growth potential when backed by strong financials. In this context, we explore several penny stocks that exhibit financial strength, potentially offering investors hidden value and long-term prospects.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| PetroTal (TSX:TAL) | CA$0.68 | CA$611.57M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.82 | CA$285.18M | ★★★★★☆ |

| Alvopetro Energy (TSXV:ALV) | CA$4.98 | CA$183.06M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.30 | CA$116.54M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.425 | CA$11.75M | ★★★★★☆ |

| Vox Royalty (TSX:VOXR) | CA$3.90 | CA$190.72M | ★★★★★★ |

| Winshear Gold (TSXV:WINS) | CA$0.14 | CA$4.87M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.39 | CA$237.5M | ★★★★★☆ |

| Mandalay Resources (TSX:MND) | CA$3.35 | CA$317.69M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.09 | CA$29.28M | ★★★★★★ |

Click here to see the full list of 954 stocks from our TSX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Sharc International Systems (CNSX:SHRC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Sharc International Systems Inc. offers wastewater energy transfer products and services for various sectors in Canada and the United States, with a market cap of CA$19.03 million.

Operations: The company's revenue is primarily generated from the sales and marketing of WET equipment, amounting to CA$1.96 million.

Market Cap: CA$19.03M

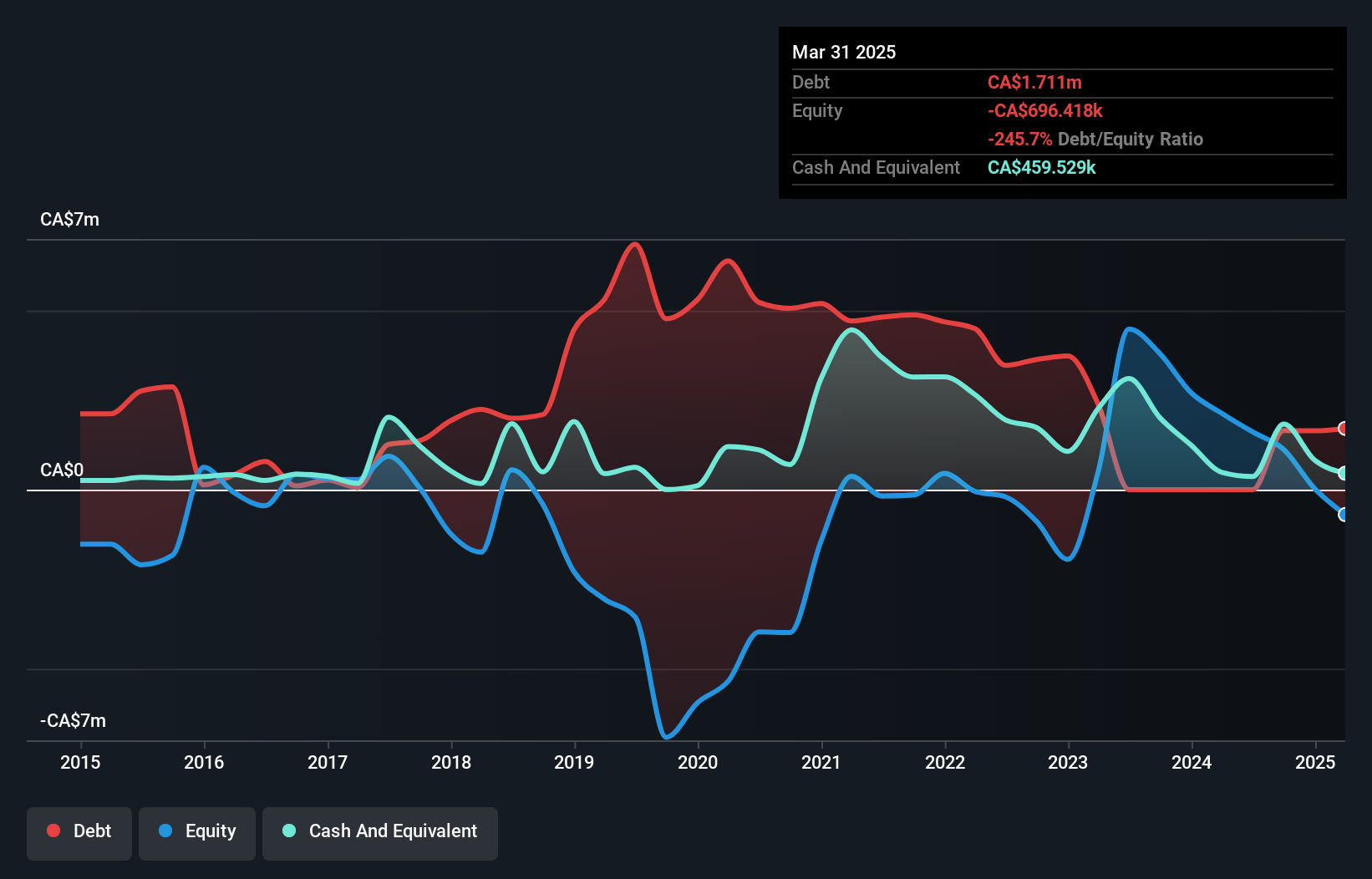

Sharc International Systems Inc. operates with a market cap of CA$19.03 million, generating CA$1.96 million in revenue primarily from its wastewater energy transfer products and services. Despite being unprofitable, the company has experienced stable weekly volatility over the past year and remains debt-free, with short-term assets exceeding liabilities. Recent board changes include the appointment of Fred Andriano, whose extensive experience in finance and renewable energy could bolster strategic growth efforts. Although Sharc faces challenges such as limited cash runway and negative return on equity, it continues to focus on expanding its sustainable solutions portfolio.

- Get an in-depth perspective on Sharc International Systems' performance by reading our balance sheet health report here.

- Review our historical performance report to gain insights into Sharc International Systems' track record.

Greenlane Renewables (TSX:GRN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Greenlane Renewables Inc. provides biogas upgrading systems worldwide and has a market cap of CA$11.57 million.

Operations: Greenlane Renewables Inc. has not reported any specific revenue segments.

Market Cap: CA$11.57M

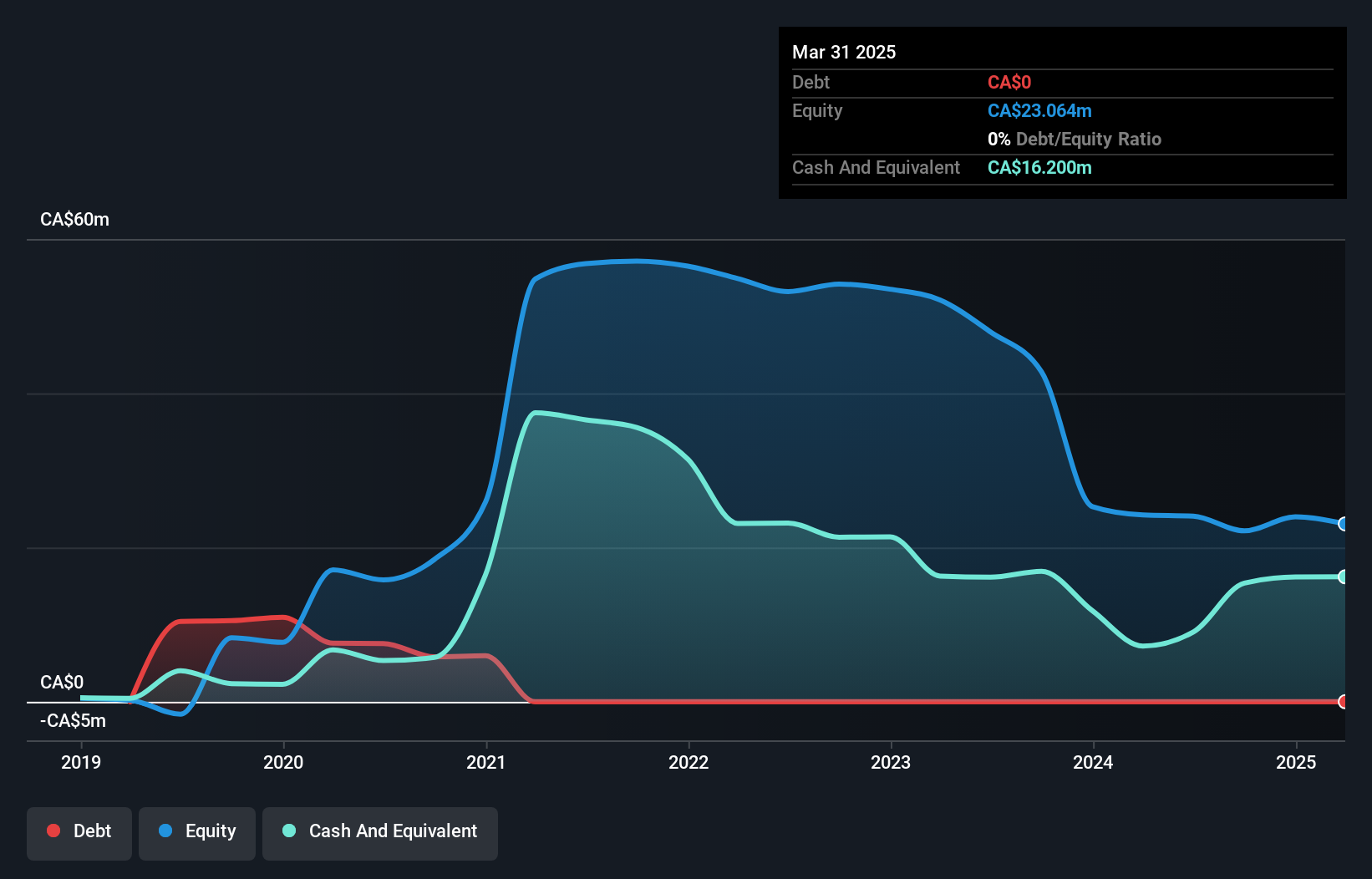

Greenlane Renewables Inc., with a market cap of CA$11.57 million, reported sales of CA$10.54 million for Q3 2024, marking an increase from the previous year while reducing its net loss significantly. The company has no debt and maintains a cash runway exceeding three years, indicating financial stability despite being unprofitable. Recent strategic moves include expanding service agreements in North and South America and entering the South American market with biogas desulfurization equipment sales in Brazil. However, management changes may impact strategic continuity as the team is relatively inexperienced with an average tenure of 0.8 years.

- Dive into the specifics of Greenlane Renewables here with our thorough balance sheet health report.

- Gain insights into Greenlane Renewables' historical outcomes by reviewing our past performance report.

Giga Metals (TSXV:GIGA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Giga Metals Corporation is involved in the acquisition, exploration, and development of mineral properties in Canada, with a market cap of CA$15.31 million.

Operations: Giga Metals Corporation does not report any revenue segments.

Market Cap: CA$15.31M

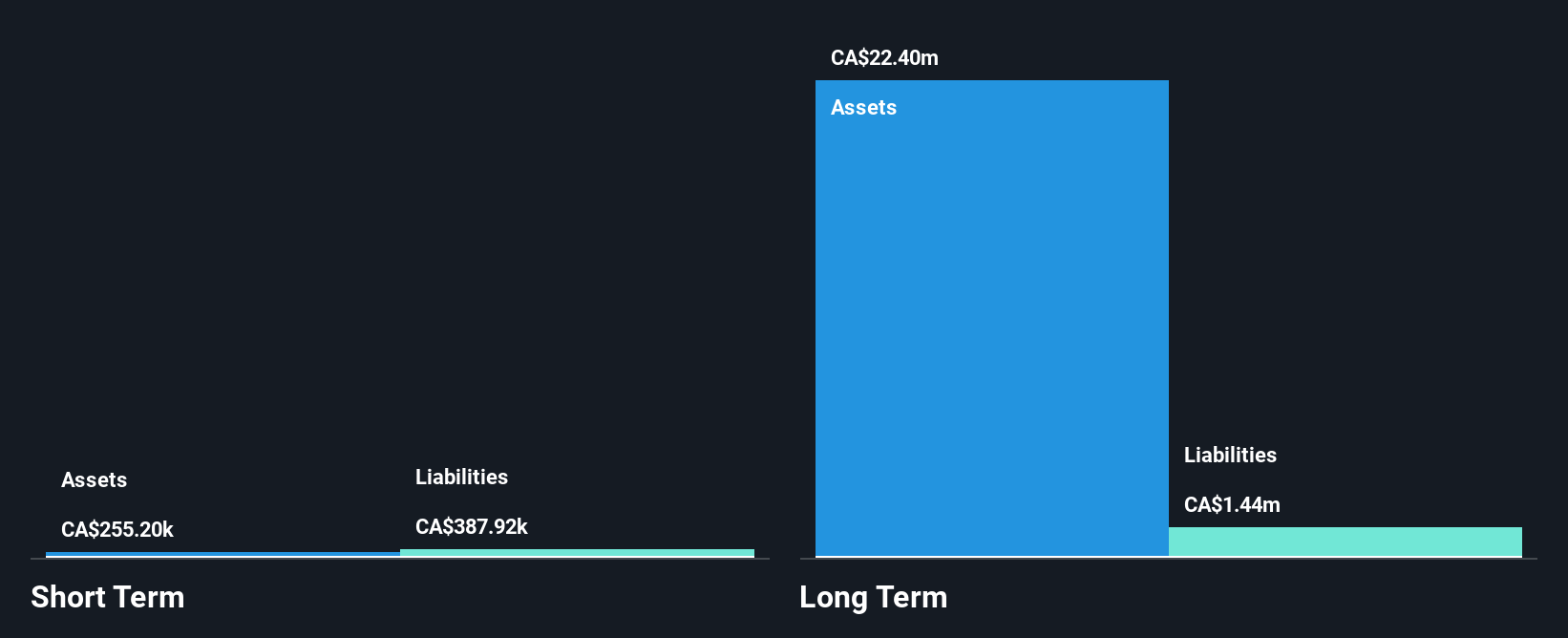

Giga Metals Corporation, with a market cap of CA$15.31 million, remains pre-revenue and unprofitable, facing challenges typical of early-stage mining ventures. Despite this, the company has managed to secure additional funding through private placements, which included participation from its CEO. The firm is debt-free and maintains sufficient short-term assets to cover liabilities but only has a cash runway for several months without further capital inflow. Recent activities include presenting at investor conferences and reporting reduced net losses compared to the previous year. Management and board members are experienced with average tenures exceeding six years.

- Jump into the full analysis health report here for a deeper understanding of Giga Metals.

- Understand Giga Metals' track record by examining our performance history report.

Turning Ideas Into Actions

- Navigate through the entire inventory of 954 TSX Penny Stocks here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:GRN

Greenlane Renewables

Provides biogas desulfurization and upgrading systems and services worldwide.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives