- Canada

- /

- Metals and Mining

- /

- TSX:GTWO

TSX Spotlight: G2 Goldfields And 2 Other Promising Penny Stocks

Reviewed by Simply Wall St

In Canada, recent economic indicators suggest a stabilization in the labor market and inflation rates within the Bank of Canada's target range, even as investors remain cautious about potential market volatility. Amidst these conditions, penny stocks—often representing smaller or newer companies—continue to offer intriguing opportunities for growth at lower price points. By focusing on strong financials and solid fundamentals, investors can uncover hidden gems with the potential for impressive returns.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$3.22 | CA$79.63M | ✅ 3 ⚠️ 4 View Analysis > |

| Canso Select Opportunities (TSXV:CSOC.A) | CA$4.50 | CA$22.73M | ✅ 2 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.285 | CA$2.42M | ✅ 2 ⚠️ 4 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.365 | CA$54.82M | ✅ 2 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.32 | CA$838.27M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.16 | CA$21.6M | ✅ 2 ⚠️ 3 View Analysis > |

| Amerigo Resources (TSX:ARG) | CA$2.70 | CA$439.26M | ✅ 3 ⚠️ 2 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.56 | CA$180.18M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$2.25 | CA$209.8M | ✅ 3 ⚠️ 1 View Analysis > |

| Matachewan Consolidated Mines (TSXV:MCM.A) | CA$0.86 | CA$10.7M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 413 stocks from our TSX Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

G2 Goldfields (TSX:GTWO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: G2 Goldfields Inc. is involved in the acquisition and exploration of mineral properties in Canada and Guyana, with a market cap of CA$955.71 million.

Operations: The company's revenue is derived entirely from mineral exploration, amounting to CA$0.63 million.

Market Cap: CA$955.71M

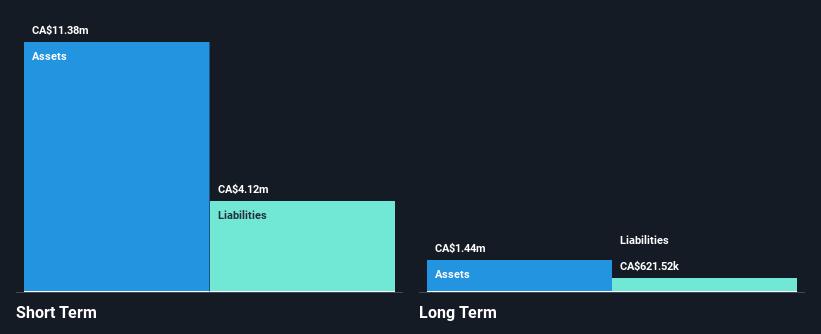

G2 Goldfields Inc., a pre-revenue company with a market cap of CA$955.71 million, is actively exploring mineral properties in Canada and Guyana. Recent developments include the issuance of two large-scale prospecting licenses for its high-grade Oko-Ghanie Gold Deposit in Guyana, which encompasses 17,451 acres. The company has also been added to the S&P Global BMI Index and completed a fully subscribed private placement raising CA$49.5 million. Despite having no debt and sufficient short-term assets to cover liabilities, G2 remains unprofitable with increasing losses over the past five years but continues to focus on exploration successes.

- Get an in-depth perspective on G2 Goldfields' performance by reading our balance sheet health report here.

- Explore G2 Goldfields' analyst forecasts in our growth report.

BeWhere Holdings (TSXV:BEW)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: BeWhere Holdings Inc. is an industrial Internet of Things (IIoT) solutions company that designs, manufactures, and sells hardware with sensors and software applications for tracking real-time information on equipment, tools, and inventory in-transit and at facilities, with a market cap of CA$65.18 million.

Operations: The company's revenue is derived entirely from its Software & Programming segment, which generated CA$19.45 million.

Market Cap: CA$65.18M

BeWhere Holdings Inc., with a market cap of CA$65.18 million, focuses on IIoT solutions, notably through its BeSol+ solar-powered trackers and BeMini asset trackers. Recent collaborations with Speedy Transport and integration into FirstNet highlight the company's capability in providing cost-effective, real-time tracking solutions across North America. Despite a low return on equity (6%) and negative earnings growth over the past year, the company maintains high-quality earnings and has become profitable over five years. Short-term assets cover liabilities well, but operating cash flow remains negative, indicating challenges in debt coverage.

- Jump into the full analysis health report here for a deeper understanding of BeWhere Holdings.

- Examine BeWhere Holdings' past performance report to understand how it has performed in prior years.

Golconda Gold (TSXV:GG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Golconda Gold Ltd. is engaged in the exploration, development, and operation of gold mining properties across Canada, the United States, and South Africa with a market capitalization of CA$129.31 million.

Operations: The company generates $22.95 million from its activities in exploring, developing, and operating gold mining properties.

Market Cap: CA$129.31M

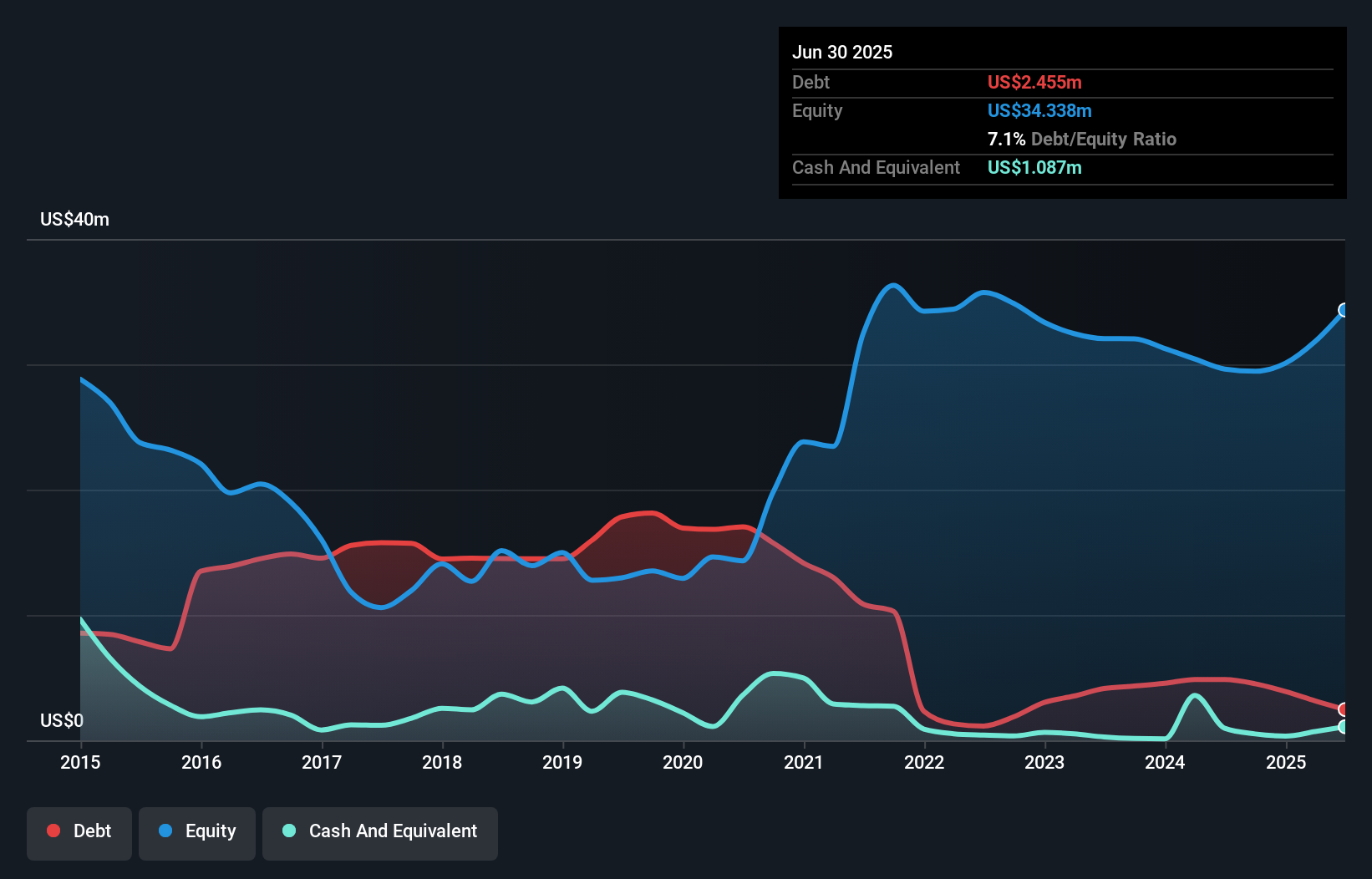

Golconda Gold Ltd., with a market cap of CA$129.31 million, has shown significant financial improvement, reporting US$7.67 million in sales for Q2 2025 compared to US$2.98 million the previous year, and achieving net income of US$2.36 million from a prior loss. The company's management and board are experienced, and its debt is well-managed with operating cash flow covering it by 268.7%. However, short-term assets do not cover liabilities, posing potential liquidity challenges. Despite recent profitability and high-quality earnings, insider selling raises concerns about future confidence among key stakeholders.

- Click to explore a detailed breakdown of our findings in Golconda Gold's financial health report.

- Assess Golconda Gold's previous results with our detailed historical performance reports.

Next Steps

- Click through to start exploring the rest of the 410 TSX Penny Stocks now.

- Ready To Venture Into Other Investment Styles? We've found 18 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:GTWO

G2 Goldfields

Engages in the acquisition and exploration of mineral properties.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion