- Canada

- /

- Metals and Mining

- /

- TSXV:AU

TSX Penny Stocks Under CA$200M Market Cap: 3 Picks To Consider

Reviewed by Simply Wall St

As the Canadian market navigates through concerns about inflation and a softening labor market, investors are keenly watching for opportunities amidst potential volatility. Penny stocks, though often seen as a vestige of past market eras, continue to offer intriguing possibilities for growth when backed by solid financials. In this article, we explore several promising penny stocks that stand out for their financial strength and potential to deliver impressive returns in the current economic landscape.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.21 | CA$55.63M | ✅ 3 ⚠️ 4 View Analysis > |

| Canso Select Opportunities (TSXV:CSOC.A) | CA$4.80 | CA$22.99M | ✅ 2 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.32 | CA$2.51M | ✅ 2 ⚠️ 4 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.28 | CA$43.56M | ✅ 2 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.11 | CA$765.09M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$0.95 | CA$18.83M | ✅ 2 ⚠️ 3 View Analysis > |

| Amerigo Resources (TSX:ARG) | CA$2.30 | CA$366.59M | ✅ 3 ⚠️ 2 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.70 | CA$187.79M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.96 | CA$186.53M | ✅ 3 ⚠️ 1 View Analysis > |

| Matachewan Consolidated Mines (TSXV:MCM.A) | CA$0.66 | CA$8.46M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 411 stocks from our TSX Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Alpha Exploration (TSXV:ALEX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Alpha Exploration Ltd., with a market cap of CA$61.90 million, focuses on the acquisition, exploration, and development of mineral resource properties in Eritrea through its subsidiary.

Operations: Currently, there are no reported revenue segments for Alpha Exploration Ltd.

Market Cap: CA$61.9M

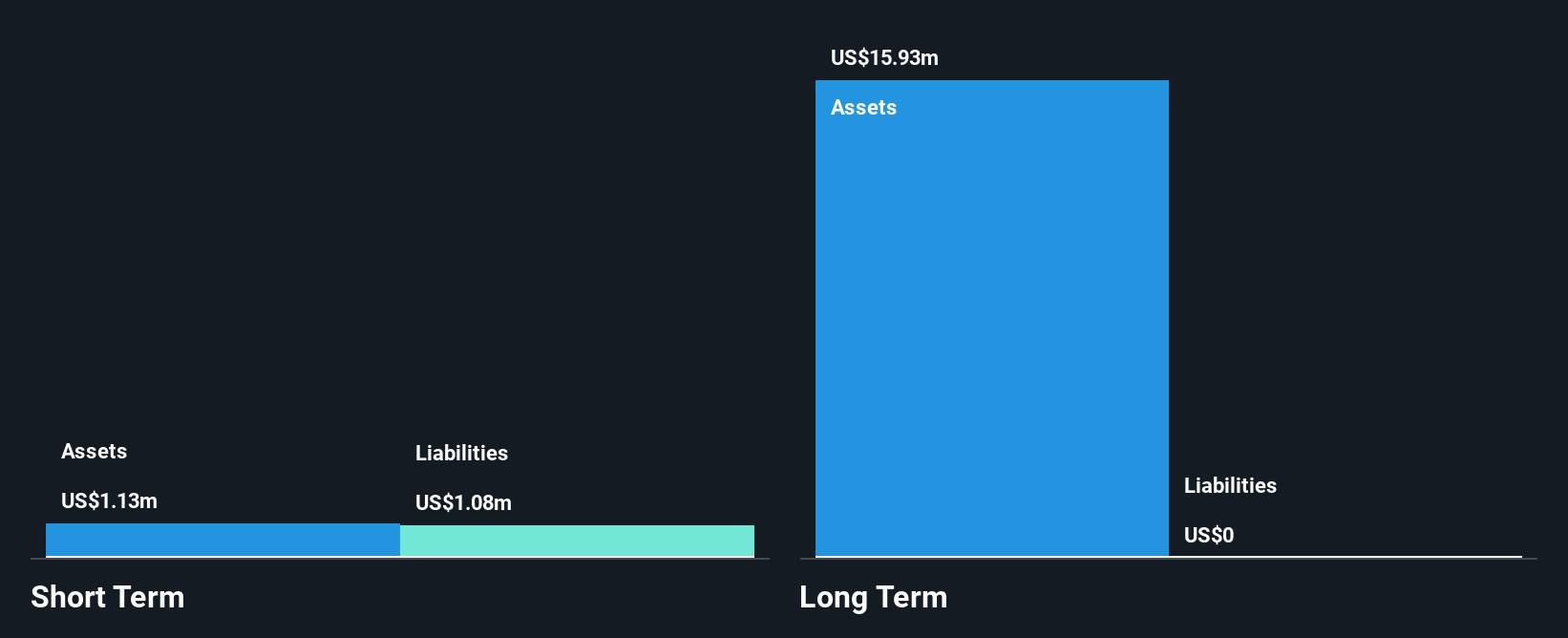

Alpha Exploration Ltd., with a market cap of CA$61.90 million, is a pre-revenue company that recently became profitable, reporting net income of US$0.11599 million for Q2 2025. Despite having no significant revenue streams, it maintains financial stability with short-term assets of US$2.4 million exceeding liabilities and no debt burden. The company's experienced management and board teams are noteworthy, alongside stable weekly volatility at 6%. Recent private placements raised CA$3.20 million in gross proceeds, showcasing investor interest despite its low return on equity of 11%.

- Dive into the specifics of Alpha Exploration here with our thorough balance sheet health report.

- Gain insights into Alpha Exploration's past trends and performance with our report on the company's historical track record.

Aurion Resources (TSXV:AU)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Aurion Resources Ltd. focuses on acquiring, exploring, and evaluating mineral properties in Finland with a market cap of CA$157.45 million.

Operations: Aurion Resources Ltd. does not report any revenue segments as it is primarily engaged in the acquisition, exploration, and evaluation of mineral properties in Finland.

Market Cap: CA$157.45M

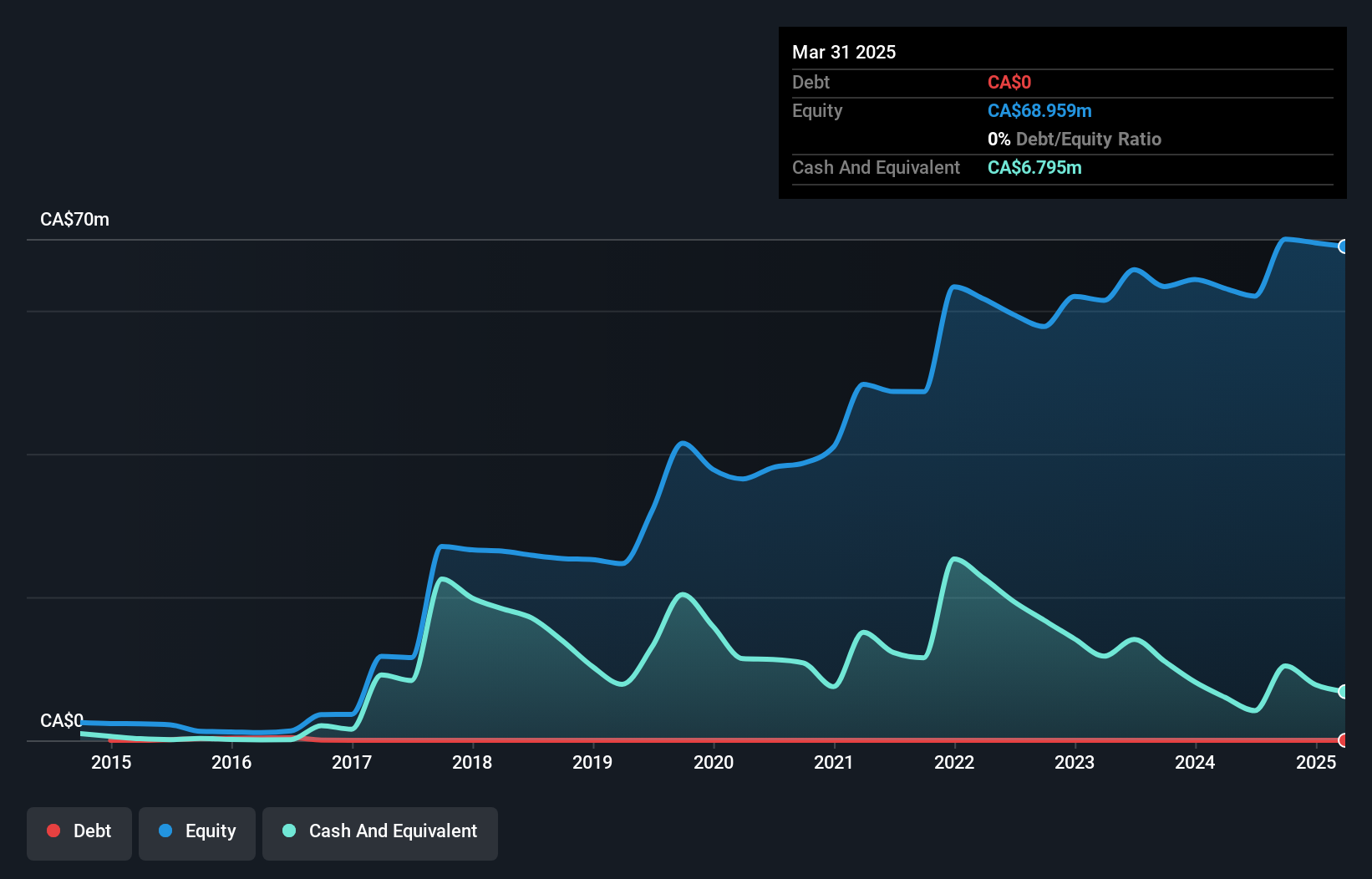

Aurion Resources Ltd., with a market cap of CA$157.45 million, is pre-revenue and primarily focused on mineral exploration in Finland. Recent private placements raised CA$9.29 million, indicating investor confidence, including Kinross Gold Corporation acquiring a significant stake. Although unprofitable, the company has reduced losses year-over-year and maintains financial stability with short-term assets exceeding liabilities and no debt burden. The management team is experienced, and recent drilling results at the Kaaresselka area show promising gold mineralization extensions. Despite its challenges, Aurion's strategic moves suggest potential for future growth in the mining sector.

- Navigate through the intricacies of Aurion Resources with our comprehensive balance sheet health report here.

- Understand Aurion Resources' earnings outlook by examining our growth report.

FPX Nickel (TSXV:FPX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: FPX Nickel Corp. is a junior mining company focused on acquiring, exploring, and developing nickel mineral resource properties in Canada, with a market cap of CA$77.13 million.

Operations: FPX Nickel Corp. does not report any revenue segments.

Market Cap: CA$77.13M

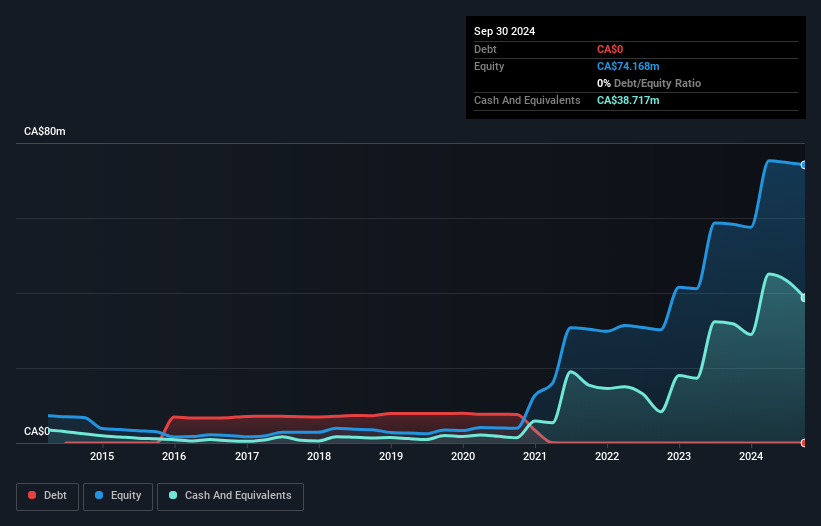

FPX Nickel Corp., with a market cap of CA$77.13 million, is pre-revenue and focused on developing its Baptiste Nickel Project in British Columbia. Recent large-scale mineral processing tests have successfully produced awaruite concentrate, which can be used directly in stainless steel fabrication or refined into battery-grade nickel sulphate for the EV supply chain. The company has no debt and maintains financial stability with short-term assets exceeding liabilities. Despite ongoing losses, FPX's strategic partnerships and inclusion in British Columbia's Critical Minerals Office initiative underscore its potential within the nickel sector as it advances towards feasibility studies and environmental assessments.

- Take a closer look at FPX Nickel's potential here in our financial health report.

- Examine FPX Nickel's past performance report to understand how it has performed in prior years.

Key Takeaways

- Reveal the 411 hidden gems among our TSX Penny Stocks screener with a single click here.

- Interested In Other Possibilities? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:AU

Aurion Resources

Engages in the acquisition, exploration, and evaluation of mineral properties in Finland.

Flawless balance sheet and good value.

Market Insights

Community Narratives