- Canada

- /

- Metals and Mining

- /

- TSXV:GMV

TSX Penny Stock Highlights For October 2024

Reviewed by Simply Wall St

The Canadian stock market has been experiencing a robust year, with the TSX up more than 17%, reflecting broader economic growth and favorable central bank policies. In this context, penny stocks—though sometimes seen as a niche investment area—remain relevant for investors seeking opportunities in smaller or newer companies. By focusing on those with strong financials and growth potential, investors can uncover promising candidates within this sector.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| PetroTal (TSX:TAL) | CA$0.67 | CA$620.84M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.42 | CA$11.75M | ★★★★★☆ |

| Winshear Gold (TSXV:WINS) | CA$0.18 | CA$5.18M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$3.34 | CA$304.56M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.37 | CA$116.65M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.80 | CA$298.44M | ★★★★★☆ |

| Foraco International (TSX:FAR) | CA$2.37 | CA$236.62M | ★★★★★☆ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.17M | ★★★★★★ |

| Newport Exploration (TSXV:NWX) | CA$0.115 | CA$12.14M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.11 | CA$29.82M | ★★★★★★ |

Click here to see the full list of 948 stocks from our TSX Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

McCoy Global (TSX:MCB)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: McCoy Global Inc. provides equipment and technologies for tubular running operations to enhance wellbore integrity and data collection in the energy industry, with a market cap of CA$82.36 million.

Operations: The company's revenue segment is Energy Products & Services (EP&S), generating CA$73.03 million.

Market Cap: CA$82.36M

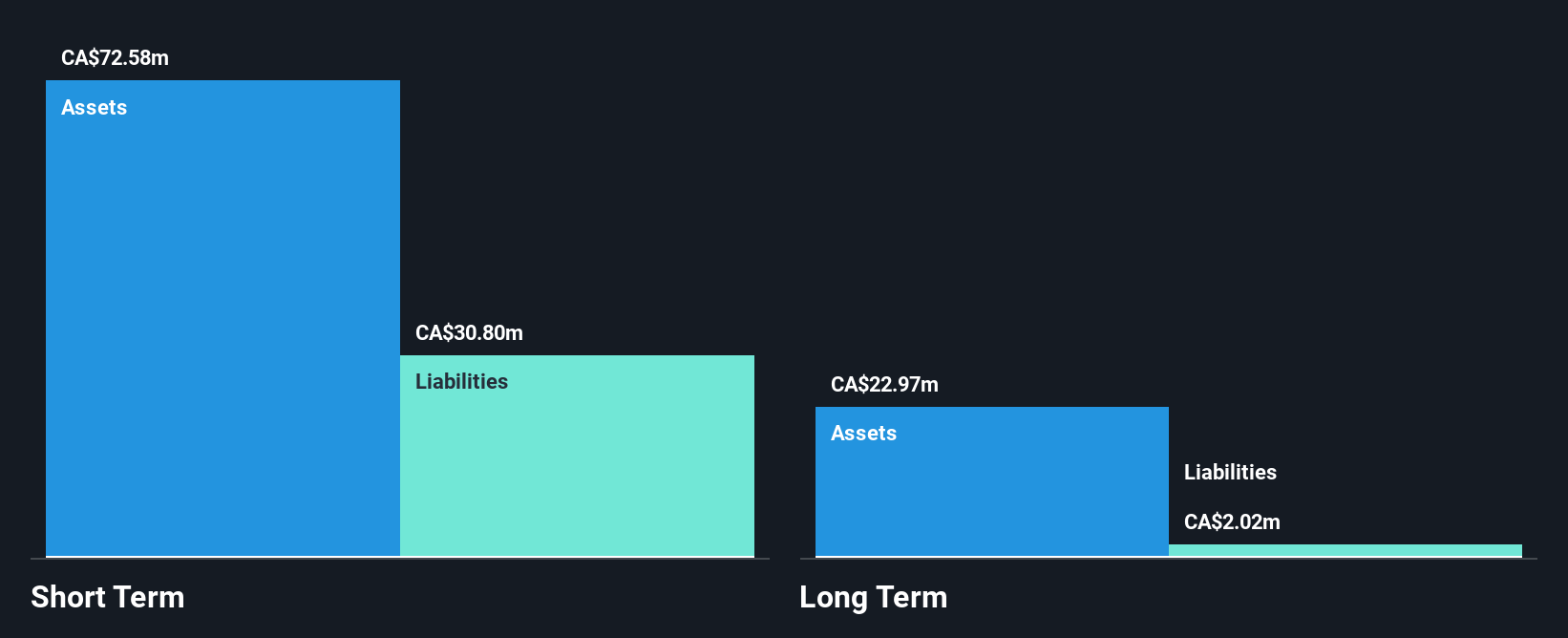

McCoy Global Inc., with a market cap of CA$82.36 million, has shown resilience in the energy sector despite recent challenges. The company reported sales of CA$19.91 million in Q2 2024, up from CA$16.25 million a year ago, and net income rose to CA$3.13 million from CA$1.43 million. A contract award for smart casing running tools worth CAD 4.3 million indicates potential growth in the Middle East market despite earlier order intake issues due to new CRT requirements. McCoy's strategic initiatives include a share buyback program and maintaining no debt, contributing to financial stability amidst industry volatility.

- Click to explore a detailed breakdown of our findings in McCoy Global's financial health report.

- Understand McCoy Global's track record by examining our performance history report.

Freeman Gold (TSXV:FMAN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Freeman Gold Corp. is involved in the exploration and evaluation of mineral properties in Canada, with a market cap of CA$15.15 million.

Operations: Freeman Gold Corp. has not reported any revenue segments.

Market Cap: CA$15.15M

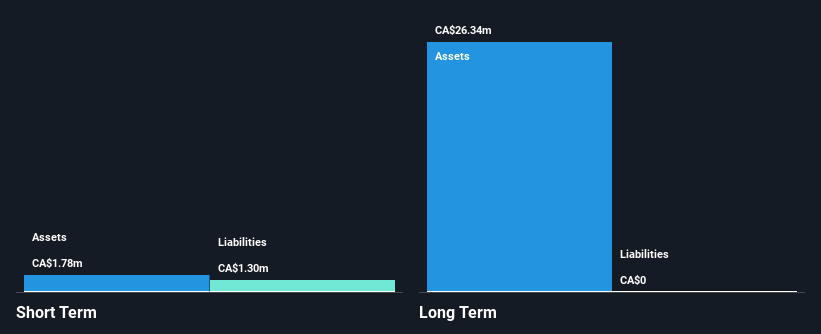

Freeman Gold Corp., with a market cap of CA$15.15 million, remains pre-revenue and unprofitable, yet has seen improvements in reducing losses over the past five years. The company's recent private placements have bolstered its cash position, raising CA$850,000.02 through unit offerings that include common shares and warrants exercisable at CA$0.08 per share within nine months. Despite high volatility in its stock price over the past three months, Freeman Gold's short-term assets exceed liabilities by CA$0.7 million, providing some financial stability as it continues exploration activities without long-term debt obligations.

- Click here and access our complete financial health analysis report to understand the dynamics of Freeman Gold.

- Examine Freeman Gold's past performance report to understand how it has performed in prior years.

GMV Minerals (TSXV:GMV)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: GMV Minerals Inc. is an exploration stage company focused on sourcing and exploring mineral properties in the United States, with a market cap of CA$14.65 million.

Operations: The company has not reported any revenue segments.

Market Cap: CA$14.65M

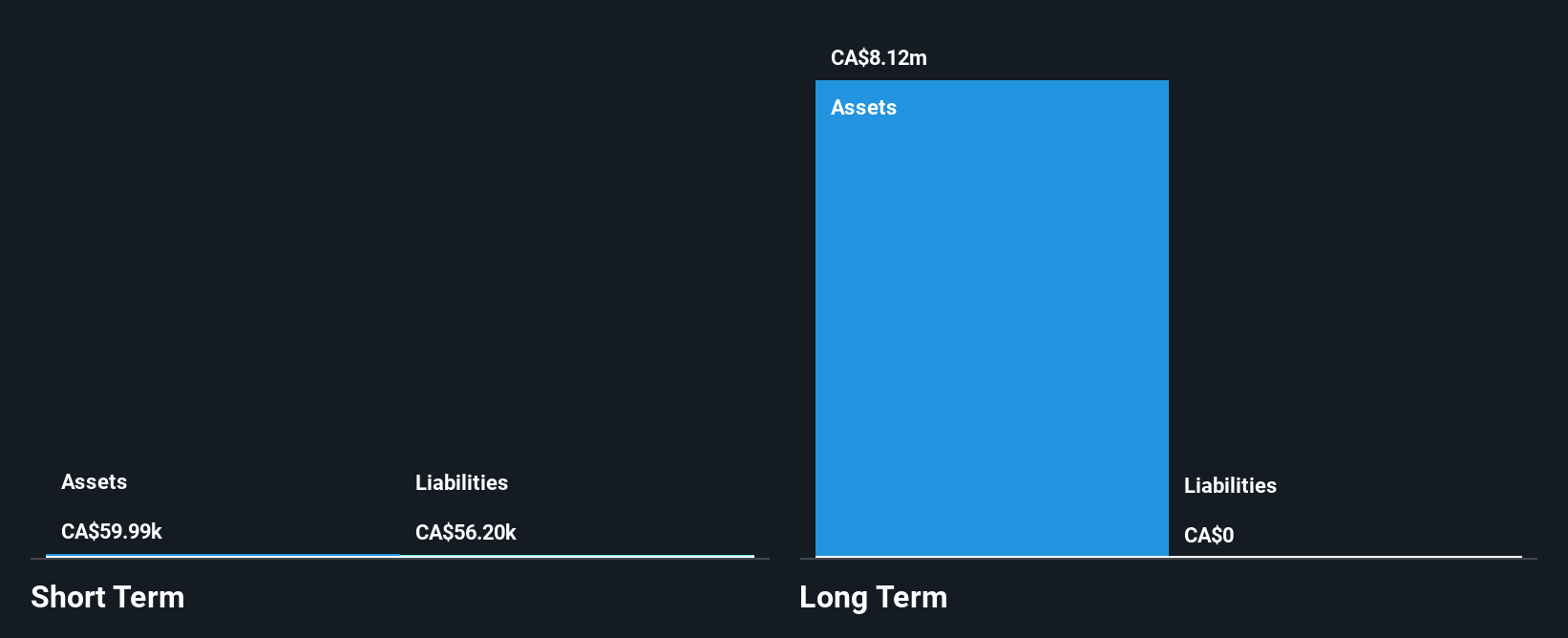

GMV Minerals Inc., with a market cap of CA$14.65 million, is a pre-revenue exploration company focused on mineral properties in the U.S. Despite being unprofitable and experiencing shareholder dilution, GMV maintains financial stability with no debt and short-term assets exceeding liabilities by CA$344.9K. Recent developments include completing an initial drill program at its Daisy Project in Nevada and advancing the Mexican Hat gold deposit in Arizona, which boasts an inferred resource of 688,000 ounces of gold. The seasoned management team continues to drive exploration efforts amidst high stock volatility and limited cash runway extended through recent capital raises.

- Unlock comprehensive insights into our analysis of GMV Minerals stock in this financial health report.

- Evaluate GMV Minerals' historical performance by accessing our past performance report.

Make It Happen

- Take a closer look at our TSX Penny Stocks list of 948 companies by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:GMV

GMV Minerals

An exploration stage company, engages in the sourcing and exploration of mineral properties in the United States.

Moderate with adequate balance sheet.

Market Insights

Community Narratives