- Canada

- /

- Basic Materials

- /

- TSXV:FBF

Investors Still Waiting For A Pull Back In Fab-Form Industries Ltd. (CVE:FBF)

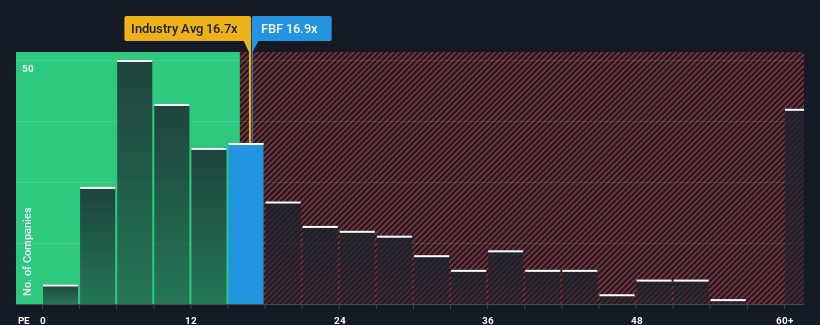

There wouldn't be many who think Fab-Form Industries Ltd.'s (CVE:FBF) price-to-earnings (or "P/E") ratio of 16.9x is worth a mention when the median P/E in Canada is similar at about 15x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

For example, consider that Fab-Form Industries' financial performance has been poor lately as its earnings have been in decline. It might be that many expect the company to put the disappointing earnings performance behind them over the coming period, which has kept the P/E from falling. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

See our latest analysis for Fab-Form Industries

How Is Fab-Form Industries' Growth Trending?

The only time you'd be comfortable seeing a P/E like Fab-Form Industries' is when the company's growth is tracking the market closely.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 17%. Still, the latest three year period has seen an excellent 82% overall rise in EPS, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Comparing that to the market, which is predicted to deliver 25% growth in the next 12 months, the company's momentum is pretty similar based on recent medium-term annualised earnings results.

In light of this, it's understandable that Fab-Form Industries' P/E sits in line with the majority of other companies. It seems most investors are expecting to see average growth rates continue into the future and are only willing to pay a moderate amount for the stock.

The Key Takeaway

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Fab-Form Industries maintains its moderate P/E off the back of its recent three-year growth being in line with the wider market forecast, as expected. At this stage investors feel the potential for an improvement or deterioration in earnings isn't great enough to justify a high or low P/E ratio. If recent medium-term earnings trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

It is also worth noting that we have found 2 warning signs for Fab-Form Industries that you need to take into consideration.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:FBF

Fab-Form Industries

Develops, manufactures, and distributes technology to form concrete footings, columns, foundations, and walls for building structures in Canada.

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026