- Canada

- /

- Metals and Mining

- /

- TSXV:ETL

TSX Penny Stock Picks: McCoy Global And Two More To Consider

Reviewed by Simply Wall St

The Canadian market has experienced a rollercoaster first half of the year, with the TSX reaching all-time highs despite earlier volatility and policy uncertainties. Amidst these fluctuations, investors may find value in penny stocks—an investment area that continues to offer intriguing opportunities. These smaller or newer companies, often overlooked, can present growth potential when paired with strong financial health and sound fundamentals.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.59 | CA$60.69M | ✅ 3 ⚠️ 3 View Analysis > |

| PetroTal (TSX:TAL) | CA$0.69 | CA$612.77M | ✅ 3 ⚠️ 4 View Analysis > |

| illumin Holdings (TSX:ILLM) | CA$1.95 | CA$98.55M | ✅ 4 ⚠️ 1 View Analysis > |

| Fintech Select (TSXV:FTEC) | CA$0.035 | CA$2.8M | ✅ 2 ⚠️ 3 View Analysis > |

| Findev (TSXV:FDI) | CA$0.425 | CA$12.18M | ✅ 2 ⚠️ 4 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.78 | CA$498.97M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$0.97 | CA$19.62M | ✅ 2 ⚠️ 4 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.15 | CA$156.33M | ✅ 1 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.85 | CA$176.45M | ✅ 3 ⚠️ 1 View Analysis > |

| McChip Resources (TSXV:MCS) | CA$1.10 | CA$5.65M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 448 stocks from our TSX Penny Stocks screener.

Let's review some notable picks from our screened stocks.

McCoy Global (TSX:MCB)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: McCoy Global Inc. offers equipment and technologies for tubular running operations to improve wellbore integrity and data collection in the energy industry across various global regions, with a market cap of CA$107.03 million.

Operations: The Energy Products & Services segment generated CA$80.32 million in revenue.

Market Cap: CA$107.03M

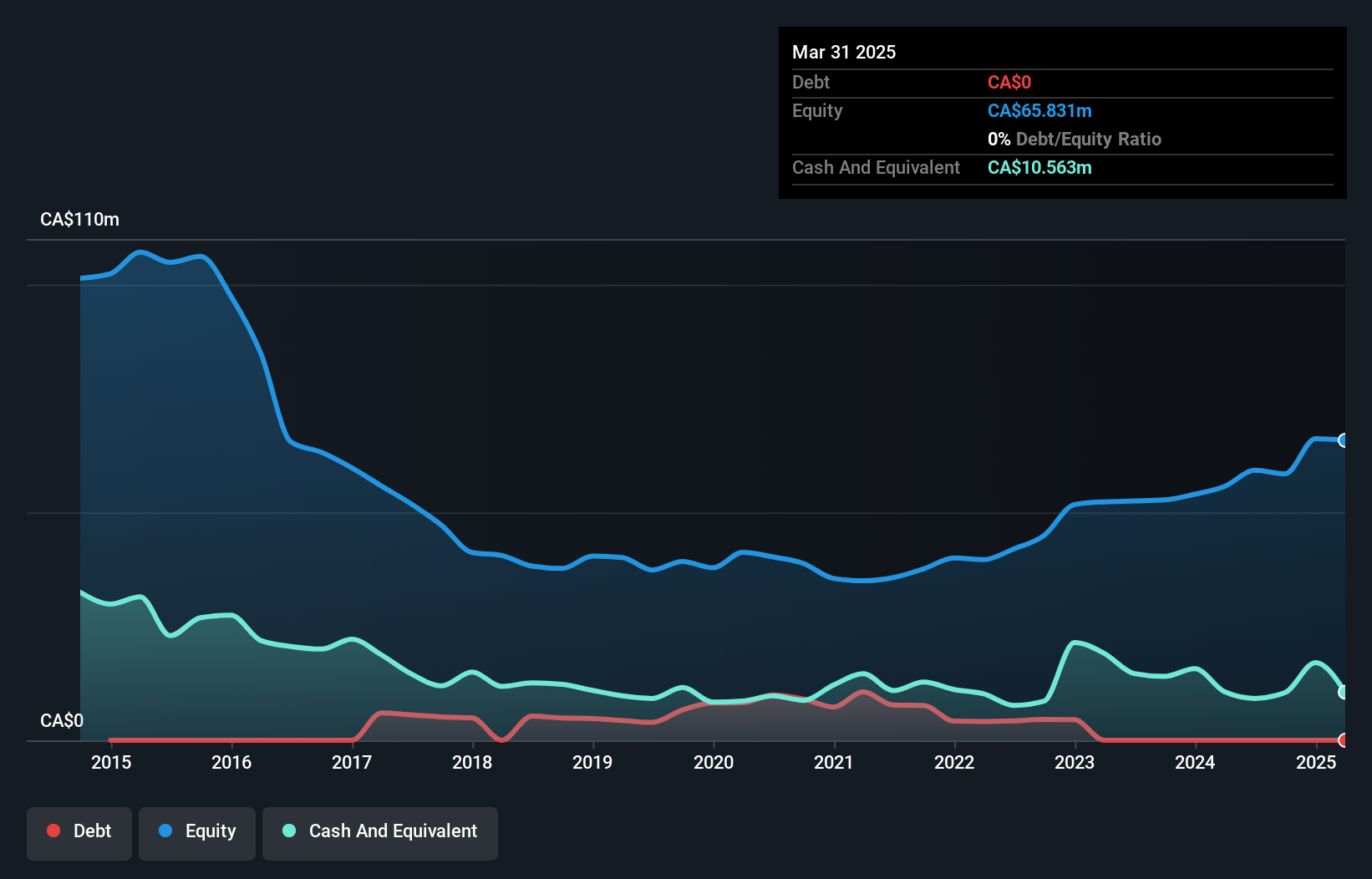

McCoy Global Inc., with a market cap of CA$107.03 million, has shown robust financial performance, achieving a 26.7% earnings growth over the past year, surpassing the industry average decline of 9.2%. The company remains debt-free and has successfully commercialized its smarTR™ technology, securing $11 million in contracts alongside potential SaaS revenue streams. Despite an unstable dividend track record, McCoy's short-term assets comfortably cover liabilities, and recent share buybacks indicate confidence in its valuation. However, its Return on Equity remains low at 13.4%, and earnings growth has decelerated compared to its five-year average.

- Dive into the specifics of McCoy Global here with our thorough balance sheet health report.

- Review our growth performance report to gain insights into McCoy Global's future.

E3 Lithium (TSXV:ETL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: E3 Lithium Limited focuses on developing and extracting lithium resources in Alberta, with a market cap of CA$65.65 million.

Operations: Currently, there are no reported revenue segments for this company.

Market Cap: CA$65.65M

E3 Lithium Limited, with a market cap of CA$65.65 million, is currently pre-revenue and focuses on developing lithium resources in Alberta. The company recently appointed Brian Newmarch as CFO, bringing extensive experience in capital projects and financing. E3's updated mineral resource report for its Garrington District estimates 5 million tonnes of lithium carbonate equivalent, supporting its Clearwater Project development. Despite having short-term assets that exceed liabilities, E3 faces financial challenges with less than a year of cash runway and increased volatility. The company's demonstration facility aims to validate technology for battery-grade lithium production at scale.

- Take a closer look at E3 Lithium's potential here in our financial health report.

- Gain insights into E3 Lithium's future direction by reviewing our growth report.

Wilton Resources (TSXV:WIL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Wilton Resources Inc. is a Canadian oil and gas exploration and development company with a market cap of CA$44.50 million.

Operations: The company generates revenue from its oil and gas exploration and development segment, which amounts to CA$0.01 million.

Market Cap: CA$44.5M

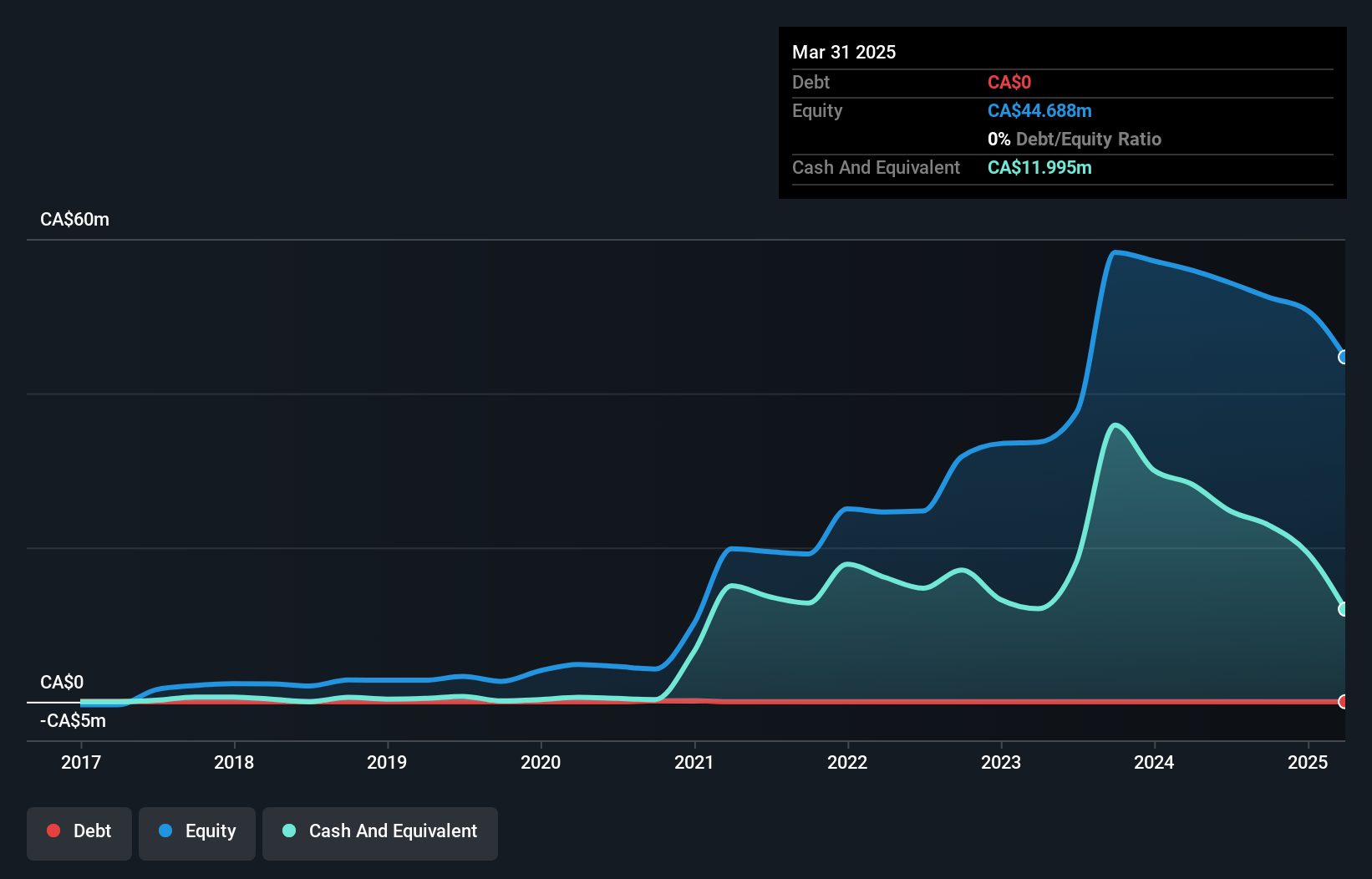

Wilton Resources Inc., with a market cap of CA$44.50 million, is pre-revenue and faces significant financial challenges, including a net loss of CA$1.02 million for Q1 2025 and auditor concerns about its viability as a going concern. Despite being debt-free and having short-term assets exceeding liabilities, the company has less than a year of cash runway if current cash flow trends continue. The management team is experienced, but recent insider selling raises questions about internal confidence. Wilton's stock remains highly volatile compared to most Canadian stocks, reflecting uncertainty in its operational prospects.

- Unlock comprehensive insights into our analysis of Wilton Resources stock in this financial health report.

- Explore historical data to track Wilton Resources' performance over time in our past results report.

Where To Now?

- Click through to start exploring the rest of the 445 TSX Penny Stocks now.

- Searching for a Fresh Perspective? Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if E3 Lithium might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:ETL

E3 Lithium

Engages in the development and extraction of lithium resources in Alberta.

Moderate with adequate balance sheet.

Market Insights

Community Narratives