- Canada

- /

- Metals and Mining

- /

- TSXV:EPL

TSX Penny Stocks With Market Caps Over CA$10M To Watch

Reviewed by Simply Wall St

The Canadian stock market has shown resilience, bolstered by easing monetary policies and strong performance in sectors like financials and materials. Amid these conditions, penny stocks—though a somewhat outdated term—continue to present intriguing opportunities for investors interested in smaller or newer companies with growth potential. By focusing on those with solid financial health, investors can uncover hidden gems that might offer substantial returns while navigating the broader economic landscape.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.33 | CA$157.09M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.70 | CA$280.2M | ★★★★★☆ |

| Findev (TSXV:FDI) | CA$0.43 | CA$12.46M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.27 | CA$112.45M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.63 | CA$565.76M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$3.99 | CA$347.6M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.34 | CA$210.78M | ★★★★★☆ |

| Silvercorp Metals (TSX:SVM) | CA$4.57 | CA$981.2M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.13 | CA$30.36M | ★★★★★★ |

| Winshear Gold (TSXV:WINS) | CA$0.165 | CA$5.03M | ★★★★★★ |

Click here to see the full list of 915 stocks from our TSX Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Eagle Plains Resources (TSXV:EPL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Eagle Plains Resources Ltd. is a junior resource company focused on acquiring, exploring, and developing mineral resource properties in Western Canada, with a market cap of CA$11.51 million.

Operations: There are no reported revenue segments for Eagle Plains Resources.

Market Cap: CA$11.51M

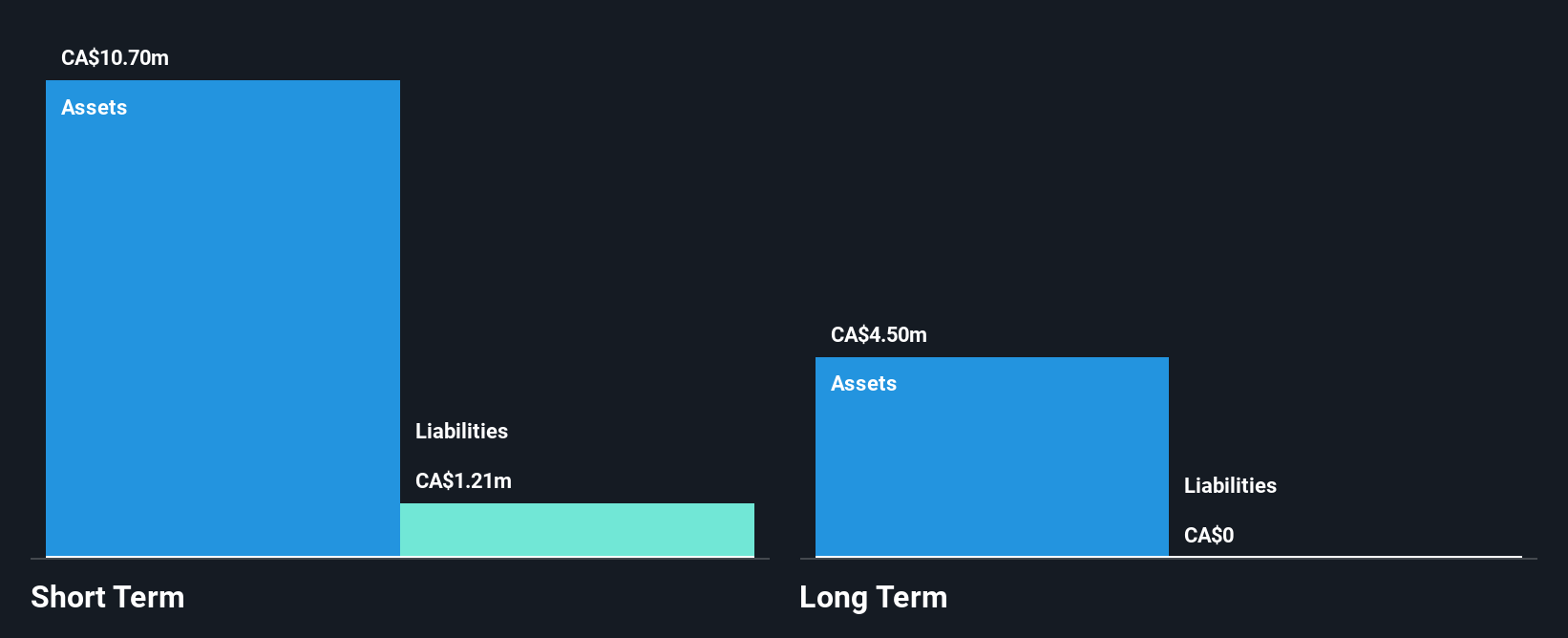

Eagle Plains Resources, with a market cap of CA$11.51 million, has recently become profitable and remains debt-free, providing a stable financial base for its exploration activities. The company has been actively expanding its mineral resource properties in Western Canada, including significant developments at the Snowstorm and Adamant properties. Recent fieldwork at these sites has revealed promising mineralization results, particularly in precious metals like gold and silver. Despite being pre-revenue with no significant income streams reported yet, Eagle Plains' strategic partnerships and exploration agreements indicate potential growth opportunities within the mining sector.

- Dive into the specifics of Eagle Plains Resources here with our thorough balance sheet health report.

- Learn about Eagle Plains Resources' historical performance here.

Titan Logix (TSXV:TLA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Titan Logix Corp. develops, manufactures, and markets technology fluid management solutions in Canada, the United States, and internationally with a market cap of CA$22.54 million.

Operations: The company's revenue is derived from its Mobile Liquid Measurement Solutions segment, totaling CA$6.86 million.

Market Cap: CA$22.54M

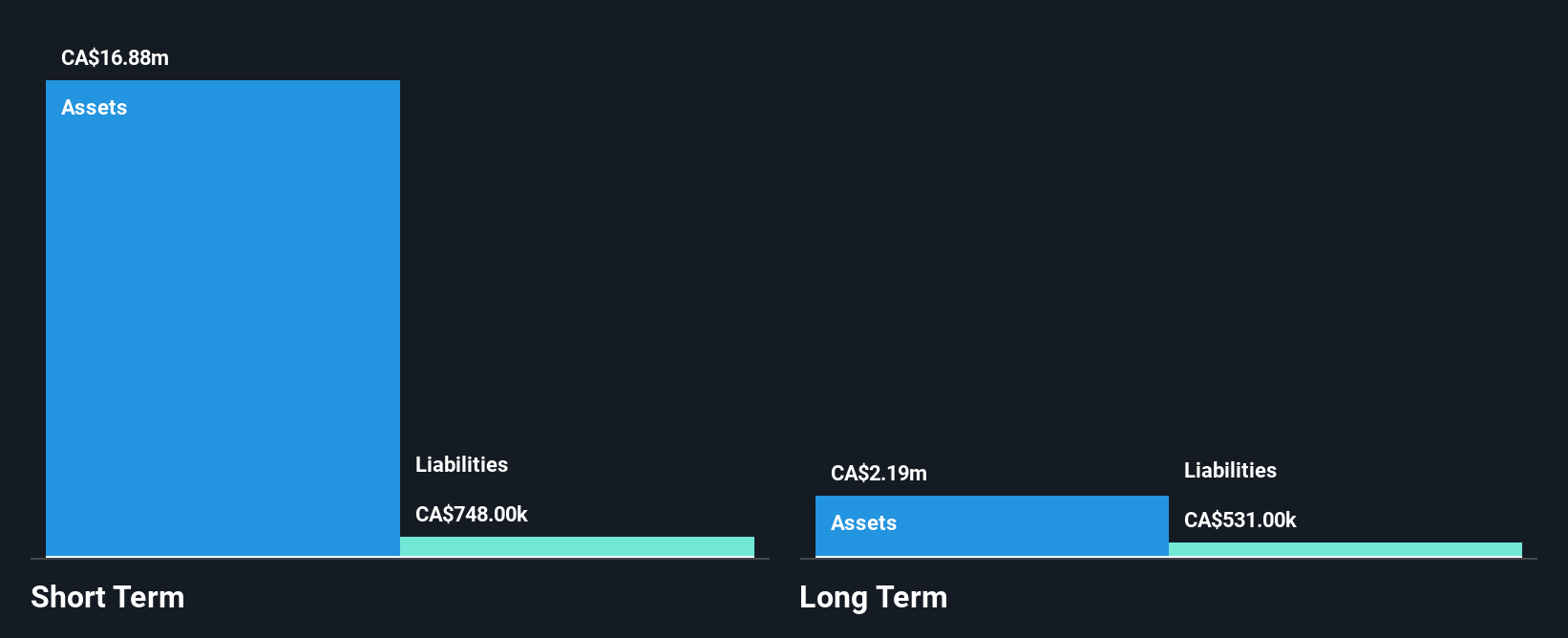

Titan Logix Corp., with a market cap of CA$22.54 million, has shown significant earnings growth, with a 557.8% increase over the past year, surpassing its five-year average of 23.1% annually. The company reported sales of CA$6.86 million for the year ended August 31, 2024, up from CA$6.21 million the previous year, and net income rose to CA$0.546 million from CA$0.083 million last year. Titan Logix remains debt-free and boasts strong short-term asset coverage over liabilities but has a relatively inexperienced management team with an average tenure of 1.7 years.

- Click to explore a detailed breakdown of our findings in Titan Logix's financial health report.

- Examine Titan Logix's past performance report to understand how it has performed in prior years.

TriStar Gold (TSXV:TSG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: TriStar Gold, Inc. focuses on acquiring, exploring, and developing precious metal prospects in the Americas and has a market cap of CA$29.39 million.

Operations: There are no reported revenue segments for this company.

Market Cap: CA$29.39M

TriStar Gold, Inc., with a market cap of CA$29.39 million, is a pre-revenue company focused on precious metal exploration in the Americas. Despite its unprofitable status, TriStar maintains a robust financial position with no debt and sufficient cash runway for over three years, supported by positive free cash flow growth. The company's board and management team are seasoned, contributing to strategic stability amid recent executive changes. However, investors should note its high share price volatility and ongoing net losses—USD 0.171 million for Q3 2024—highlighting the inherent risks associated with penny stocks in early-stage mining ventures.

- Click here and access our complete financial health analysis report to understand the dynamics of TriStar Gold.

- Gain insights into TriStar Gold's historical outcomes by reviewing our past performance report.

Taking Advantage

- Explore the 915 names from our TSX Penny Stocks screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eagle Plains Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:EPL

Eagle Plains Resources

A junior resource company, engages in acquiring, exploring, and developing mineral resource properties in Western Canada.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives