- Canada

- /

- Metals and Mining

- /

- CNSX:KUYA

Discovering Opportunities: Kuya Silver And 2 Other TSX Penny Stocks

Reviewed by Simply Wall St

The Canadian market continues to show resilience, driven by strong consumer spending and positive real wage gains, despite challenges like inflation and higher interest rates. In this context, penny stocks—though a somewhat outdated term—remain an intriguing area for investors seeking growth opportunities in smaller or newer companies with solid financial foundations. We'll explore three such TSX-listed penny stocks that stand out for their potential to offer hidden value and long-term success.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.87 | CA$180.96M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.465 | CA$12.32M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.32 | CA$117.54M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.61 | CA$547.51M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.35 | CA$230.34M | ★★★★★☆ |

| Silvercorp Metals (TSX:SVM) | CA$4.67 | CA$1.02B | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.20 | CA$31.97M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| Hemisphere Energy (TSXV:HME) | CA$1.90 | CA$181.41M | ★★★★★☆ |

| Enterprise Group (TSX:E) | CA$1.89 | CA$117.57M | ★★★★☆☆ |

Click here to see the full list of 926 stocks from our TSX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Kuya Silver (CNSX:KUYA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Kuya Silver Corporation is a mineral exploration and development company focused on acquiring, exploring, and advancing precious metal assets in Canada and Peru, with a market cap of CA$31.99 million.

Operations: Currently, there are no reported revenue segments for the company.

Market Cap: CA$31.99M

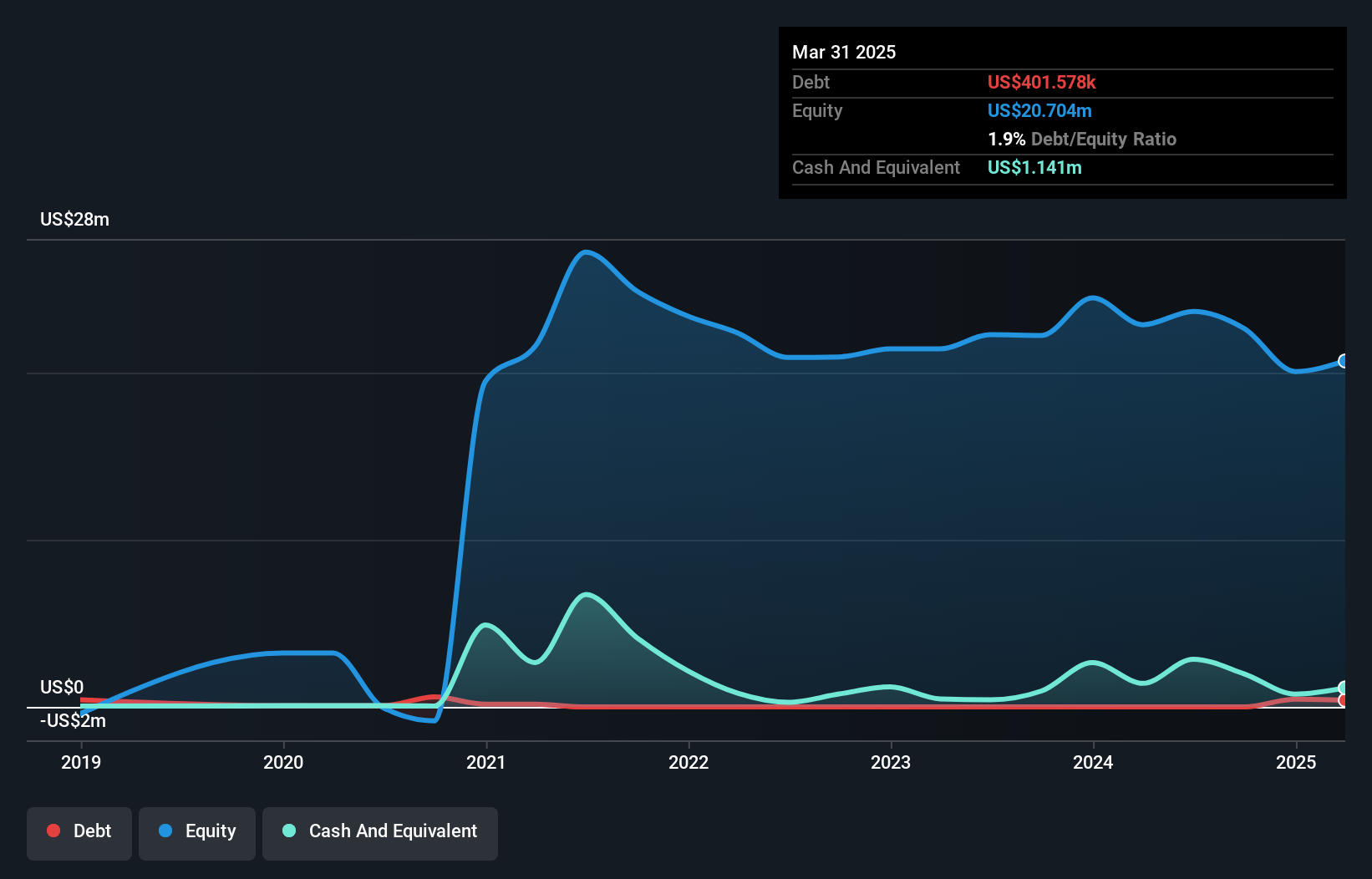

Kuya Silver Corporation, with a market cap of CA$31.99 million, is pre-revenue and unprofitable but remains debt-free. The company recently reported a net loss of US$1.55 million for Q3 2024, reflecting an increase from the previous year. Despite financial challenges, Kuya has identified significant mineralization potential at its Silver Kings Project in Canada, including high-grade cobalt-nickel-silver veins that could expand the scope for development beyond initial expectations. Recent private placements have bolstered its cash position temporarily; however, shareholder dilution has occurred over the past year as shares outstanding increased by 8.7%.

- Click to explore a detailed breakdown of our findings in Kuya Silver's financial health report.

- Review our historical performance report to gain insights into Kuya Silver's track record.

Dynasty Gold (TSXV:DYG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Dynasty Gold Corp. is an exploration stage company focused on acquiring, exploring, and developing mineral properties in the United States and Canada, with a market cap of CA$7.95 million.

Operations: Dynasty Gold Corp. currently does not report any revenue segments as it is in the exploration stage, concentrating on mineral property acquisition and development in the United States and Canada.

Market Cap: CA$7.95M

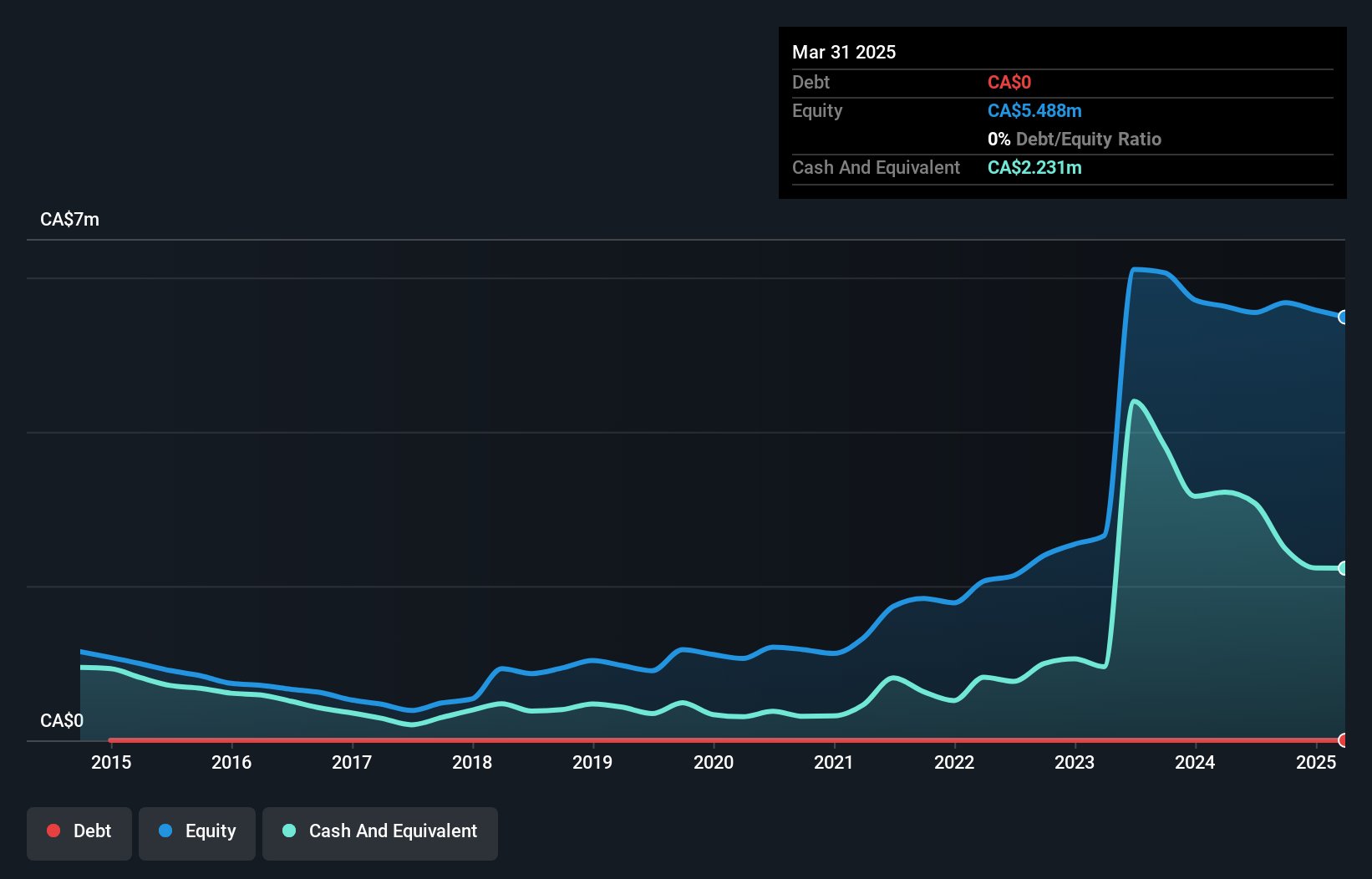

Dynasty Gold Corp., with a market cap of CA$7.95 million, is pre-revenue and debt-free, focusing on mineral property acquisition in the U.S. and Canada. The company reported a net income of CA$0.086878 million for Q3 2024, reversing a loss from the previous year, but remains unprofitable overall with losses increasing over five years at 2.4% annually. Despite financial hurdles, it has maintained a stable cash runway exceeding three years without significant shareholder dilution recently. The board's average tenure is 7.2 years, reflecting experienced governance amidst its exploration endeavors.

- Click here and access our complete financial health analysis report to understand the dynamics of Dynasty Gold.

- Gain insights into Dynasty Gold's historical outcomes by reviewing our past performance report.

Wishpond Technologies (TSXV:WISH)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Wishpond Technologies Ltd. offers marketing-focused online business solutions across the United States, Canada, and internationally, with a market cap of CA$14.66 million.

Operations: The company generates CA$23.00 million in revenue from its Internet Software & Services segment.

Market Cap: CA$14.66M

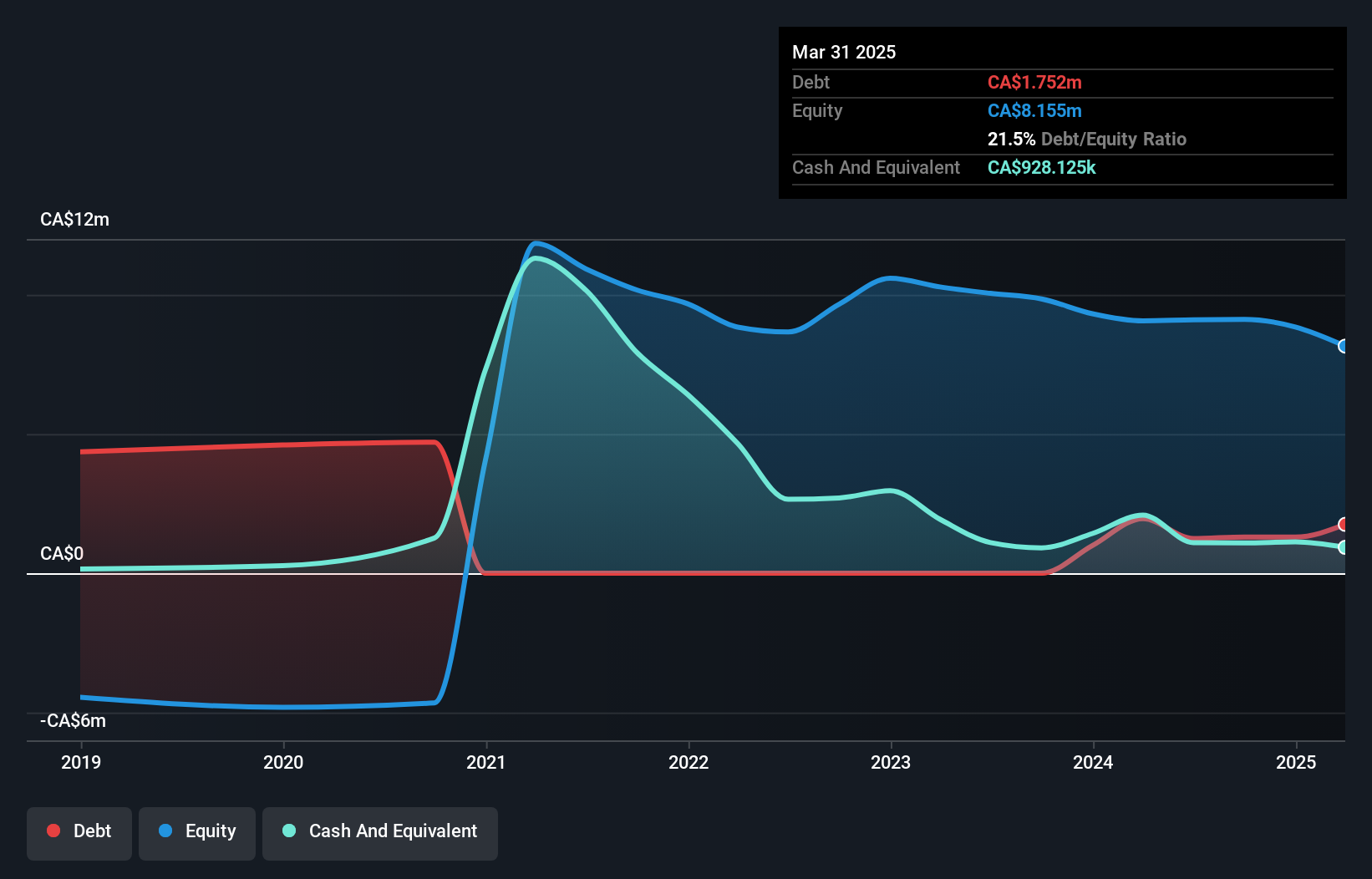

Wishpond Technologies Ltd., with a market cap of CA$14.66 million, operates in the Internet Software & Services sector, generating CA$23.00 million in revenue. Despite being unprofitable, it has reduced losses over five years and maintains a positive cash flow runway exceeding three years. The company reported Q3 2024 sales of CA$5.06 million and a net income decrease to CA$0.08618 million from the previous year, highlighting ongoing profitability challenges. However, Wishpond's debt management shows improvement with positive shareholder equity and no long-term liabilities, while its stock trades below estimated fair value without recent shareholder dilution concerns.

- Jump into the full analysis health report here for a deeper understanding of Wishpond Technologies.

- Examine Wishpond Technologies' earnings growth report to understand how analysts expect it to perform.

Summing It All Up

- Unlock our comprehensive list of 926 TSX Penny Stocks by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kuya Silver might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CNSX:KUYA

Kuya Silver

A mineral exploration and development company, engages in the acquisition, exploration, evaluation, and advancement of precious metal assets in Canada and Peru.

Excellent balance sheet slight.

Market Insights

Community Narratives