- Canada

- /

- Metals and Mining

- /

- TSXV:DEX

February 2025's TSX Penny Stocks To Watch

Reviewed by Simply Wall St

As we move into February 2025, the Canadian market is navigating a landscape of mixed signals, with inflation showing signs of stabilization and corporate earnings demonstrating resilience despite global uncertainties. Amid these conditions, investors are increasingly interested in smaller companies that can offer both value and growth potential. Although the term "penny stock" might seem outdated, it remains relevant for identifying promising investments; we've highlighted three such stocks that stand out for their strong financials and potential to deliver significant returns over time.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.92 | CA$182.79M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.50 | CA$14.9M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.71 | CA$438.56M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$1.86 | CA$220.49M | ★★★★★☆ |

| PetroTal (TSX:TAL) | CA$0.70 | CA$647.19M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.16 | CA$31.16M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.045 | CA$3.62M | ★★★★★★ |

| Orezone Gold (TSX:ORE) | CA$0.90 | CA$397.63M | ★★★★★☆ |

| Hemisphere Energy (TSXV:HME) | CA$1.83 | CA$180.58M | ★★★★★☆ |

| DIRTT Environmental Solutions (TSX:DRT) | CA$1.16 | CA$230.15M | ★★★★☆☆ |

Click here to see the full list of 936 stocks from our TSX Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Almadex Minerals (TSXV:DEX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Almadex Minerals Ltd. is involved in acquiring and exploring mineral resource properties across Canada, the United States, and Mexico, with a market cap of CA$10.07 million.

Operations: The company's revenue is primarily derived from the acquisition and exploration of mineral resource properties, amounting to CA$0.04 million.

Market Cap: CA$10.07M

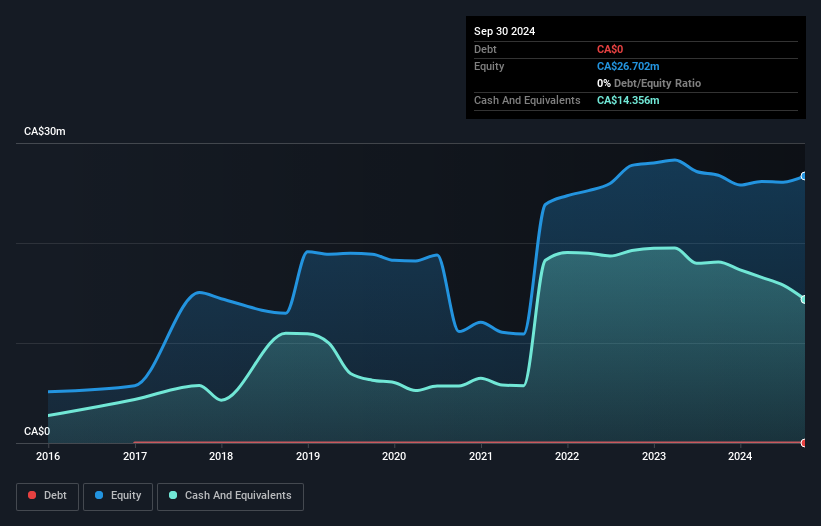

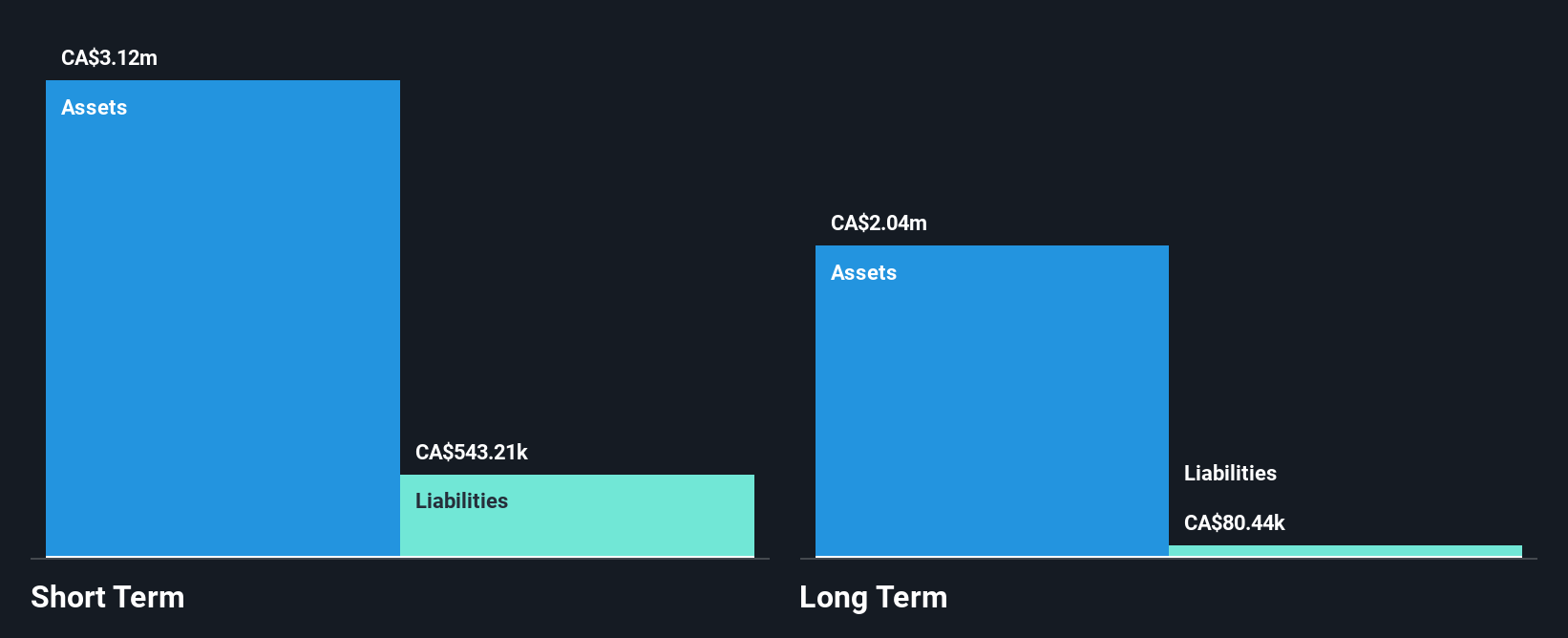

Almadex Minerals Ltd., with a market cap of CA$10.07 million, is a pre-revenue company focused on mineral exploration across North America. Recent exploration efforts in the western USA have identified promising porphyry and epithermal systems, with plans for further drilling and geophysical surveys in 2025. Despite being unprofitable, Almadex has reduced losses over five years by 12.5% annually and maintains a strong cash runway exceeding three years without incurring debt. The company's short-term assets significantly surpass its liabilities, indicating financial stability despite limited revenue generation from its ongoing projects.

- Click here and access our complete financial health analysis report to understand the dynamics of Almadex Minerals.

- Gain insights into Almadex Minerals' historical outcomes by reviewing our past performance report.

Eskay Mining (TSXV:ESK)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Eskay Mining Corp. is a natural resource company focused on acquiring and exploring mineral properties in British Columbia, Canada, with a market cap of CA$34.93 million.

Operations: Eskay Mining Corp. does not report distinct revenue segments as it is primarily engaged in the acquisition and exploration of mineral properties in British Columbia, Canada.

Market Cap: CA$34.93M

Eskay Mining Corp., with a market cap of CA$34.93 million, is a pre-revenue company focused on mineral exploration in British Columbia. Despite being unprofitable, Eskay's financials reveal no debt and sufficient cash to sustain operations for over three years. The company's short-term assets comfortably exceed its liabilities, providing a cushion against financial pressures. Recent earnings showed improvement with reduced quarterly losses compared to the previous year. Although the share price remains volatile and returns on equity are negative due to ongoing losses, Eskay's seasoned management and board offer stability amidst these challenges.

- Get an in-depth perspective on Eskay Mining's performance by reading our balance sheet health report here.

- Explore historical data to track Eskay Mining's performance over time in our past results report.

Fuerte Metals (TSXV:FMT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Fuerte Metals Corp. focuses on the identification, exploration, and evaluation of mineral properties in Chile and the Americas, with a market cap of CA$56.27 million.

Operations: Fuerte Metals Corp. currently does not report any revenue segments.

Market Cap: CA$56.27M

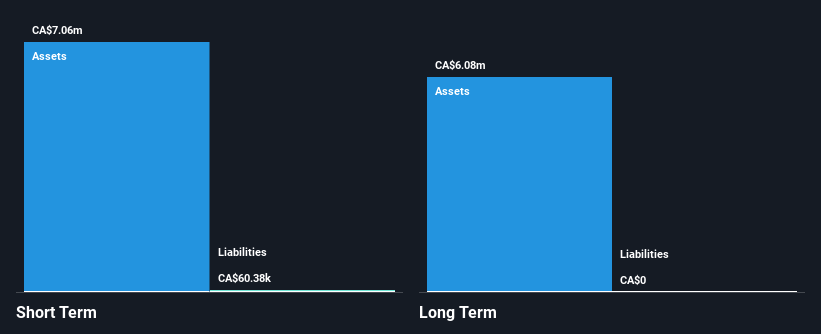

Fuerte Metals Corp., with a market cap of CA$56.27 million, is a pre-revenue company engaged in mineral exploration across Chile and the Americas. Despite its unprofitability, Fuerte maintains a debt-free status and has short-term assets of CA$7.1 million that exceed its liabilities of CA$60.4K, offering some financial stability. Recent geophysical surveys at the Placeton Project in Chile indicate promising copper-gold targets similar to those at the adjacent Nueva Union project, suggesting potential for significant mineralization. The company's strategic focus on these exploration efforts could position it well within the mining sector if successful discoveries are made.

- Unlock comprehensive insights into our analysis of Fuerte Metals stock in this financial health report.

- Learn about Fuerte Metals' historical performance here.

Make It Happen

- Investigate our full lineup of 936 TSX Penny Stocks right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:DEX

Almadex Minerals

Engages in the acquisition and exploration of mineral resource properties in Canada, the United States, and Mexico.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives