- Canada

- /

- Metals and Mining

- /

- TSXV:RSM

Almadex Minerals And 2 Other TSX Penny Stocks To Consider

Reviewed by Simply Wall St

The Canadian stock market has been steadily climbing, supported by trade optimism and solid corporate earnings, with the TSX not registering a single move greater than 1% in either direction for three months. In this context of stability and growth, investors may find opportunities in penny stocks—an investment area that remains relevant despite its somewhat outdated terminology. These smaller or newer companies can offer a mix of affordability and growth potential when they possess strong financials, making them intriguing options for those looking to uncover hidden value.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.66 | CA$66.76M | ✅ 3 ⚠️ 3 View Analysis > |

| Fintech Select (TSXV:FTEC) | CA$0.03 | CA$2.4M | ✅ 2 ⚠️ 3 View Analysis > |

| Foraco International (TSX:FAR) | CA$1.75 | CA$172.6M | ✅ 4 ⚠️ 1 View Analysis > |

| Findev (TSXV:FDI) | CA$0.42 | CA$12.03M | ✅ 2 ⚠️ 4 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.78 | CA$518.93M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$0.92 | CA$18.23M | ✅ 2 ⚠️ 4 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.61 | CA$183.23M | ✅ 2 ⚠️ 1 View Analysis > |

| Avino Silver & Gold Mines (TSX:ASM) | CA$4.88 | CA$708.6M | ✅ 3 ⚠️ 1 View Analysis > |

| ACT Energy Technologies (TSX:ACX) | CA$4.84 | CA$164.2M | ✅ 4 ⚠️ 2 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.93 | CA$184.26M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 456 stocks from our TSX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Almadex Minerals (TSXV:DEX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Almadex Minerals Ltd. focuses on acquiring and exploring mineral resource properties in Canada, the United States, and Mexico, with a market cap of CA$26.84 million.

Operations: The company's revenue is primarily derived from the acquisition and exploration of mineral resource properties, amounting to CA$0.05 million.

Market Cap: CA$26.84M

Almadex Minerals Ltd., with a market cap of CA$26.84 million, remains pre-revenue, focusing on mineral exploration across North America. The company is debt-free and has not diluted shareholders over the past year, indicating financial prudence. Recent developments include commencing diamond drilling at the Paradise Project in Nevada and acquiring the Ruby Hill project, both targeting gold and silver potential. Almadex's board is experienced with an average tenure of 7.4 years. Despite high volatility in its share price, its Price-to-Earnings ratio of 11.9x suggests potential value compared to the broader Canadian market average of 16.4x.

- Click here and access our complete financial health analysis report to understand the dynamics of Almadex Minerals.

- Evaluate Almadex Minerals' historical performance by accessing our past performance report.

Sailfish Royalty (TSXV:FISH)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Sailfish Royalty Corp. focuses on acquiring precious metals royalty and streaming agreements, with a market cap of CA$178.73 million.

Operations: The company generates revenue of $3.07 million from its royalties and stream interests.

Market Cap: CA$178.73M

Sailfish Royalty Corp., with a market cap of CA$178.73 million, has achieved profitability over the past five years, growing earnings by 41.5% annually. Despite recent revenue declines to US$0.59 million in Q1 2025, its strategic focus on precious metals royalties offers potential upside through projects like Spring Valley, where it holds up to a 3% net smelter return royalty. The approval for Spring Valley's construction is significant, potentially enhancing future cash flows and offsetting current challenges such as low interest coverage and declining earnings forecasts. Recent buybacks indicate shareholder value initiatives amid an experienced management team and board.

- Get an in-depth perspective on Sailfish Royalty's performance by reading our balance sheet health report here.

- Review our growth performance report to gain insights into Sailfish Royalty's future.

Resouro Strategic Metals (TSXV:RSM)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Resouro Strategic Metals Inc. is an exploration stage company focused on acquiring and exploring mineral properties in Brazil, with a market cap of CA$21.76 million.

Operations: Resouro Strategic Metals Inc. has not reported any revenue segments.

Market Cap: CA$21.76M

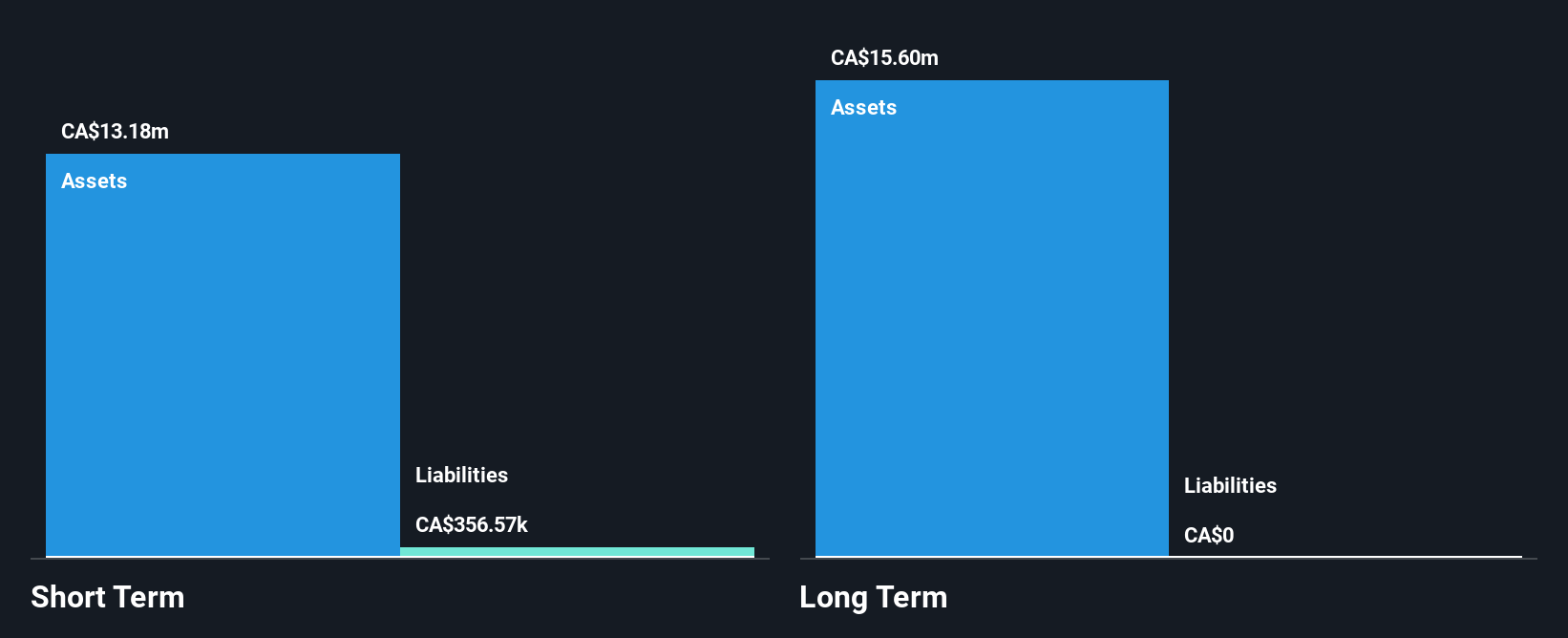

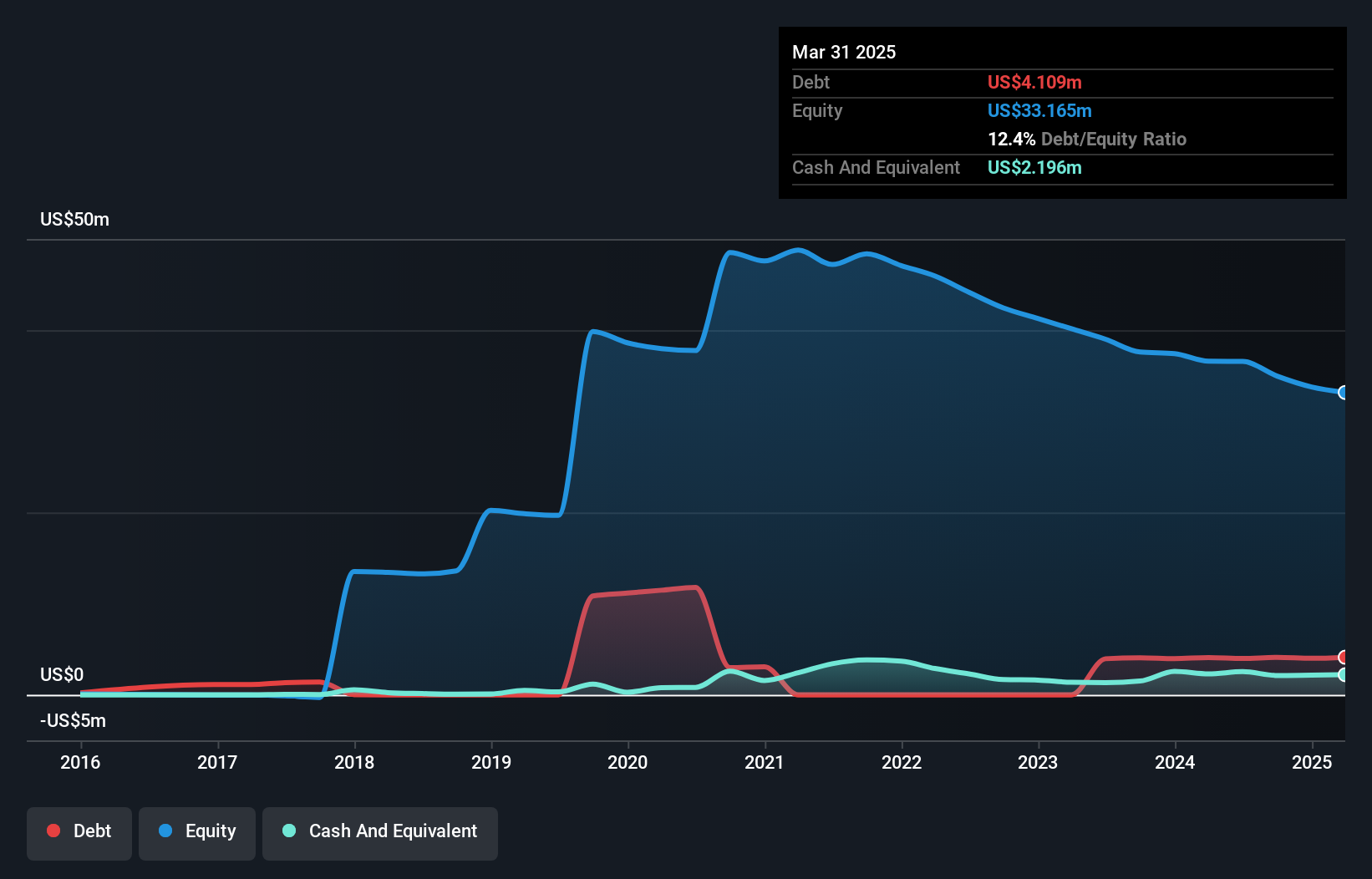

Resouro Strategic Metals Inc., with a market cap of CA$21.76 million, is focused on advancing its Tiros Titanium and Rare Earth Elements Project in Brazil, which has gained strategic support from Brazilian agencies for financial backing. The company is pre-revenue and unprofitable, with increasing losses reported at CA$6.05 million for the year ended March 31, 2025. Resouro's innovative metallurgical processing strategy aims to enhance resource recovery while minimizing environmental impact through the FSAL technology. Despite having less than a year of cash runway and high share price volatility, it remains debt-free with no long-term liabilities.

- Jump into the full analysis health report here for a deeper understanding of Resouro Strategic Metals.

- Understand Resouro Strategic Metals' track record by examining our performance history report.

Summing It All Up

- Jump into our full catalog of 456 TSX Penny Stocks here.

- Want To Explore Some Alternatives? Outshine the giants: these 19 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:RSM

Resouro Strategic Metals

An exploration stage company, engages in the acquisition and exploration of mineral properties in Brazil.

Flawless balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives