- Canada

- /

- Metals and Mining

- /

- TSXV:PGZ

Top TSX Penny Stocks To Watch In December 2024

Reviewed by Simply Wall St

As the Canadian market benefits from easing monetary policies and strong sector performance, investors are increasingly exploring opportunities in various asset classes. Penny stocks, though an older term, still highlight smaller or less-established companies that can offer great value. By focusing on those with robust financials and a clear growth trajectory, investors may uncover potential gems in the market.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.33 | CA$157.09M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.70 | CA$280.2M | ★★★★★☆ |

| Findev (TSXV:FDI) | CA$0.43 | CA$12.46M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.27 | CA$112.45M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.63 | CA$565.76M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$3.99 | CA$347.6M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.34 | CA$210.78M | ★★★★★☆ |

| Silvercorp Metals (TSX:SVM) | CA$4.57 | CA$981.2M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.13 | CA$30.36M | ★★★★★★ |

| Winshear Gold (TSXV:WINS) | CA$0.165 | CA$5.03M | ★★★★★★ |

Click here to see the full list of 916 stocks from our TSX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

INX Digital Company (NEOE:INXD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: The INX Digital Company, Inc. operates a trading platform for cryptocurrencies and digital securities with a market cap of CA$16.53 million.

Operations: The company generates revenue from its Digital Assets segment, totaling $0.93 million.

Market Cap: CA$16.53M

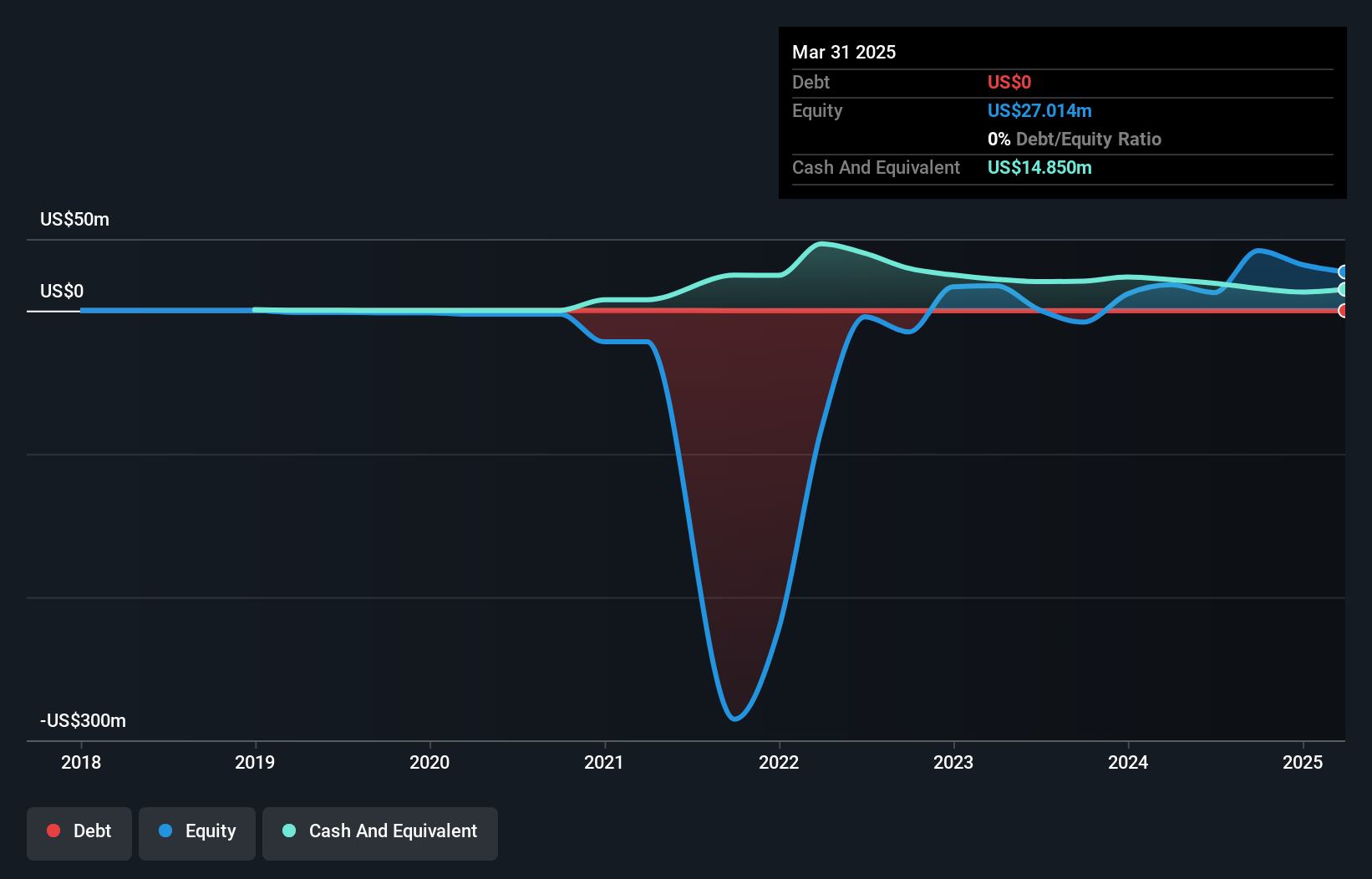

INX Digital Company, Inc. recently reported a net income of US$29.32 million for the third quarter, marking a significant turnaround from a net loss of US$13.64 million the previous year, despite negative revenue figures indicating it remains pre-revenue. The company's outstanding return on equity at 115% and lack of debt are positive indicators for potential investors in penny stocks. Additionally, INX has initiated a share repurchase program aimed at buying back up to 15,185,615 common shares by September 2025, signaling confidence in its future prospects and potentially enhancing shareholder value through reduced dilution.

- Jump into the full analysis health report here for a deeper understanding of INX Digital Company.

- Explore historical data to track INX Digital Company's performance over time in our past results report.

Defense Metals (TSXV:DEFN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Defense Metals Corp. is involved in the acquisition, exploration, development, and evaluation of mineral properties in Canada with a market capitalization of CA$26.02 million.

Operations: Defense Metals Corp. currently does not report any revenue segments.

Market Cap: CA$26.02M

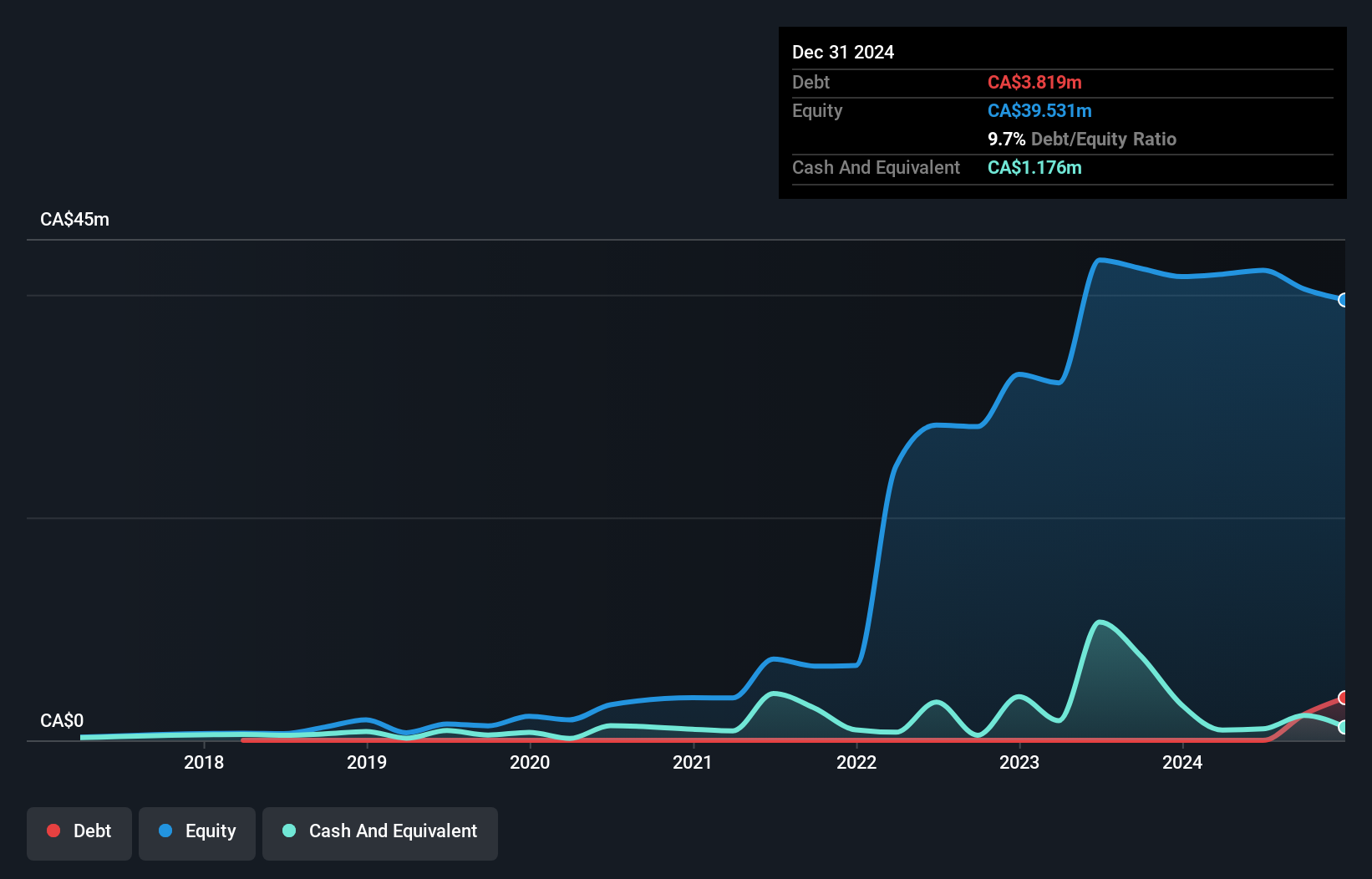

Defense Metals Corp., with a market capitalization of CA$26.02 million, remains pre-revenue and unprofitable, with losses widening over the past five years. Despite this, recent strategic moves include a Memorandum of Understanding with the Saskatchewan Research Council to bolster Canada's rare earth supply chain and a private placement to raise capital. The appointment of Mark Tory as CEO is significant given his extensive experience in rare earths development. However, short-term liabilities exceed assets by CA$3.2 million, highlighting financial challenges despite raising additional funds recently to extend its cash runway beyond three months.

- Navigate through the intricacies of Defense Metals with our comprehensive balance sheet health report here.

- Understand Defense Metals' track record by examining our performance history report.

Pan Global Resources (TSXV:PGZ)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Pan Global Resources Inc. is a mineral exploration company focused on exploring and evaluating mineral properties in Spain, with a market cap of CA$21.85 million.

Operations: No revenue segments have been reported for the company.

Market Cap: CA$21.85M

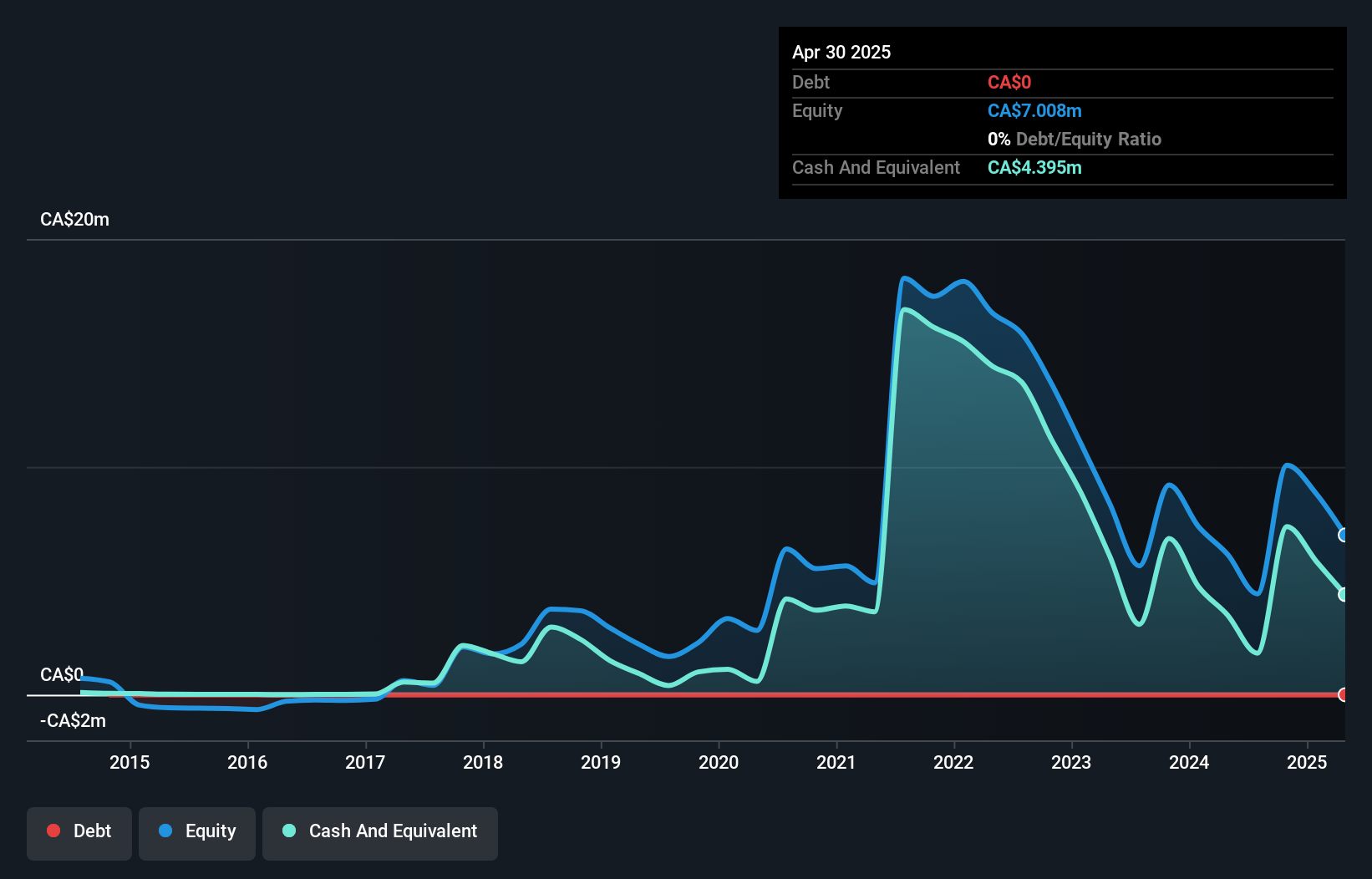

Pan Global Resources Inc., with a market cap of CA$21.85 million, is pre-revenue and focused on mineral exploration in Spain. Recent activities include closing a private placement raising CA$7.25 million, enhancing its short-term financial position with assets exceeding liabilities by CA$1.6 million. The company is debt-free but has limited cash runway, necessitating continued capital raises to sustain operations beyond three months. Exploration efforts at the Escacena Project show potential for significant mineralization, supported by recent geophysical surveys targeting promising anomalies at the Bravo site, yet drilling remains untested and crucial for future valuation growth prospects.

- Take a closer look at Pan Global Resources' potential here in our financial health report.

- Gain insights into Pan Global Resources' past trends and performance with our report on the company's historical track record.

Turning Ideas Into Actions

- Explore the 916 names from our TSX Penny Stocks screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:PGZ

Pan Global Resources

A mineral exploration company, engages in the exploration and evaluation of mineral properties in Spain.

Moderate with adequate balance sheet.

Market Insights

Community Narratives