- Canada

- /

- Basic Materials

- /

- TSX:CEMX

Imagine Owning CEMATRIX And Wondering If The 46% Share Price Slide Is Justified

Want to participate in a short research study? Help shape the future of investing tools and receive a $20 prize!

Many investors define successful investing as beating the market average over the long term. But its virtually certain that sometimes you will buy stocks that fall short of the market average returns. Unfortunately, that's been the case for longer term CEMATRIX Corporation (CVE:CVX) shareholders, since the share price is down 46% in the last three years, falling well short of the market return of around 36%. The falls have accelerated recently, with the share price down 18% in the last three months.

See our latest analysis for CEMATRIX

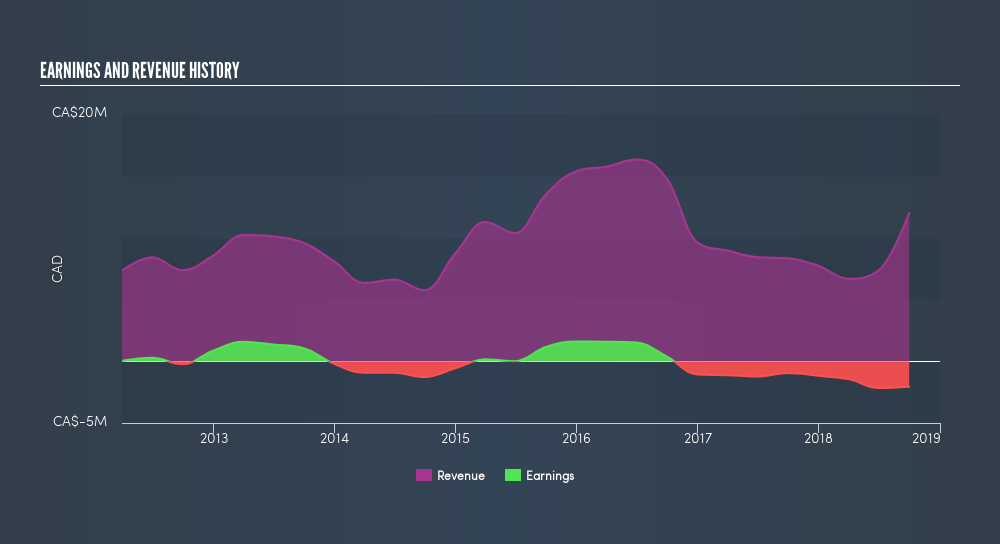

Because CEMATRIX is loss-making, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over the last three years, CEMATRIX's revenue dropped 25% per year. That's definitely a weaker result than most pre-profit companies report. On the face of it we'd posit the share price fall of 19% compound, over three years is well justified by the fundamental deterioration. The key question now is whether the company has the capacity to fund itself to profitability, without more cash. The company will need to return to revenue growth as quickly as possible, if it wants to see some enthusiasm from investors.

The graphic below shows how revenue and earnings have changed as management guided the business forward. If you want to see cashflow, you can click on the chart.

Balance sheet strength is crucual. It might be well worthwhile taking a look at our freereport on how its financial position has changed over time.

A Different Perspective

While the broader market gained around 3.4% in the last year, CEMATRIX shareholders lost 5.3%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Longer term investors wouldn't be so upset, since they would have made 3.7%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. Before spending more time on CEMATRIX it might be wise to click here to see if insiders have been buying or selling shares.

If you are like me, then you will not want to miss this freelist of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About TSX:CEMX

CEMATRIX

Through its subsidiaries, engages in the onsite production of cellular concrete for infrastructure, industrial, and commercial construction markets in North America.

Good value with adequate balance sheet.

Market Insights

Community Narratives