This article will reflect on the compensation paid to Jeff Kendrick who has served as CEO of CEMATRIX Corporation (CVE:CVX) since 2008. This analysis will also assess whether CEMATRIX pays its CEO appropriately, considering recent earnings growth and total shareholder returns.

Check out our latest analysis for CEMATRIX

How Does Total Compensation For Jeff Kendrick Compare With Other Companies In The Industry?

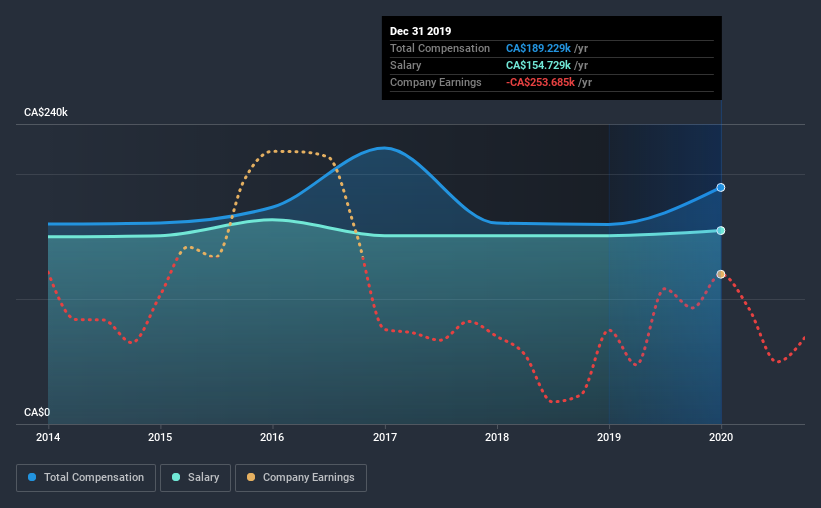

According to our data, CEMATRIX Corporation has a market capitalization of CA$26m, and paid its CEO total annual compensation worth CA$189k over the year to December 2019. That's a notable increase of 19% on last year. In particular, the salary of CA$154.7k, makes up a huge portion of the total compensation being paid to the CEO.

On comparing similar-sized companies in the industry with market capitalizations below CA$261m, we found that the median total CEO compensation was CA$482k. This suggests that Jeff Kendrick is paid below the industry median. Moreover, Jeff Kendrick also holds CA$1.1m worth of CEMATRIX stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2019 | 2018 | Proportion (2019) |

| Salary | CA$155k | CA$151k | 82% |

| Other | CA$35k | CA$9.0k | 18% |

| Total Compensation | CA$189k | CA$160k | 100% |

On an industry level, around 57% of total compensation represents salary and 43% is other remuneration. CEMATRIX pays out 82% of remuneration in the form of a salary, significantly higher than the industry average. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

CEMATRIX Corporation's Growth

CEMATRIX Corporation has seen its earnings per share (EPS) increase by 35% a year over the past three years. In the last year, its revenue is up 17%.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's also good to see decent revenue growth in the last year, suggesting the business is healthy and growing. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has CEMATRIX Corporation Been A Good Investment?

Most shareholders would probably be pleased with CEMATRIX Corporation for providing a total return of 159% over three years. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

In Summary...

As we noted earlier, CEMATRIX pays its CEO lower than the norm for similar-sized companies belonging to the same industry. When taking into account the company's strong EPS growth over the past three years, it appears CEO compensation is modest. And given most shareholders are probably very happy with recent shareholder returns, they might even think Jeff deserves a raise!

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. We did our research and identified 4 warning signs (and 1 which is concerning) in CEMATRIX we think you should know about.

Important note: CEMATRIX is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

When trading CEMATRIX or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TSX:CEMX

CEMATRIX

Through its subsidiaries, engages in the onsite production of cellular concrete for infrastructure, industrial, and commercial construction markets in North America.

Flawless balance sheet with high growth potential.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion