- Canada

- /

- Basic Materials

- /

- TSX:CEMX

At CA$0.50, Is CEMATRIX Corporation (CVE:CVX) Worth Looking At Closely?

CEMATRIX Corporation (CVE:CVX), might not be a large cap stock, but it saw significant share price movement during recent months on the TSXV, rising to highs of CA$0.84 and falling to the lows of CA$0.50. Some share price movements can give investors a better opportunity to enter into the stock, and potentially buy at a lower price. A question to answer is whether CEMATRIX's current trading price of CA$0.50 reflective of the actual value of the small-cap? Or is it currently undervalued, providing us with the opportunity to buy? Let’s take a look at CEMATRIX’s outlook and value based on the most recent financial data to see if there are any catalysts for a price change.

Check out our latest analysis for CEMATRIX

Is CEMATRIX still cheap?

According to my valuation model, CEMATRIX seems to be fairly priced at around 4.7% below my intrinsic value, which means if you buy CEMATRIX today, you’d be paying a fair price for it. And if you believe that the stock is really worth CA$0.52, then there isn’t much room for the share price grow beyond what it’s currently trading. So, is there another chance to buy low in the future? Given that CEMATRIX’s share is fairly volatile (i.e. its price movements are magnified relative to the rest of the market) this could mean the price can sink lower, giving us an opportunity to buy later on. This is based on its high beta, which is a good indicator for share price volatility.

What kind of growth will CEMATRIX generate?

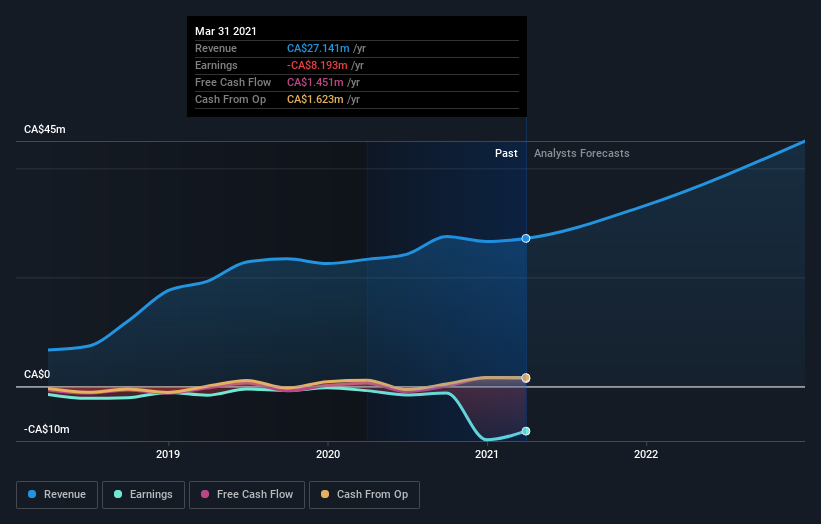

Investors looking for growth in their portfolio may want to consider the prospects of a company before buying its shares. Although value investors would argue that it’s the intrinsic value relative to the price that matter the most, a more compelling investment thesis would be high growth potential at a cheap price. In CEMATRIX's case, its revenues are expected to grow by 33% over the next year, indicating a highly optimistic future ahead. If expense does not increase by the same rate, or higher, this top line growth should lead to stronger cash flows, feeding into a higher share value.

What this means for you:

Are you a shareholder? CVX’s optimistic future growth appears to have been factored into the current share price, with shares trading around its fair value. However, there are also other important factors which we haven’t considered today, such as the track record of its management team. Have these factors changed since the last time you looked at the stock? Will you have enough conviction to buy should the price fluctuates below the true value?

Are you a potential investor? If you’ve been keeping an eye on CVX, now may not be the most advantageous time to buy, given it is trading around its fair value. However, the optimistic prospect is encouraging for the company, which means it’s worth further examining other factors such as the strength of its balance sheet, in order to take advantage of the next price drop.

So if you'd like to dive deeper into this stock, it's crucial to consider any risks it's facing. When we did our research, we found 5 warning signs for CEMATRIX (2 are a bit concerning!) that we believe deserve your full attention.

If you are no longer interested in CEMATRIX, you can use our free platform to see our list of over 50 other stocks with a high growth potential.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:CEMX

CEMATRIX

Through its subsidiaries, engages in the onsite production of cellular concrete for infrastructure, industrial, and commercial construction markets in North America.

Flawless balance sheet with high growth potential.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion