Can We See Significant Insider Ownership On The Cerro Mining Corp. (CVE:CRX.H) Share Register?

A look at the shareholders of Cerro Mining Corp. (CVE:CRX.H) can tell us which group is most powerful. Institutions will often hold stock in bigger companies, and we expect to see insiders owning a noticeable percentage of the smaller ones. I quite like to see at least a little bit of insider ownership. As Charlie Munger said 'Show me the incentive and I will show you the outcome.

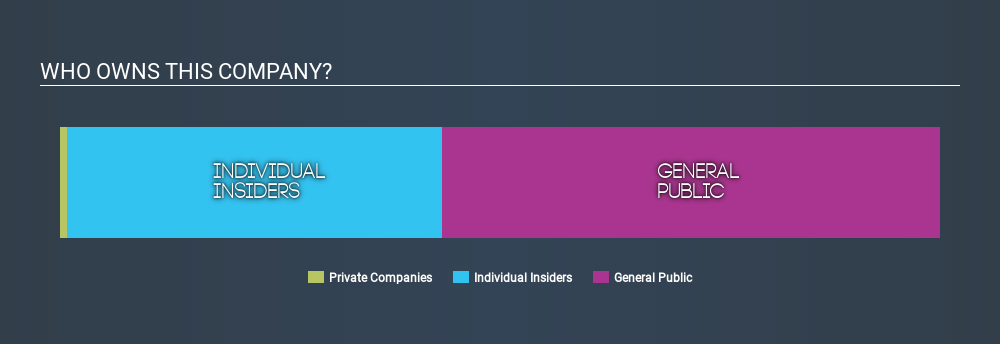

With a market capitalization of CA$724k, Cerro Mining is a small cap stock, so it might not be well known by many institutional investors. Taking a look at our data on the ownership groups (below), it's seems that institutions don't own shares in the company. We can zoom in on the different ownership groups, to learn more about Cerro Mining.

View our latest analysis for Cerro Mining

What Does The Lack Of Institutional Ownership Tell Us About Cerro Mining?

Small companies that are not very actively traded often lack institutional investors, but it's less common to see large companies without them.

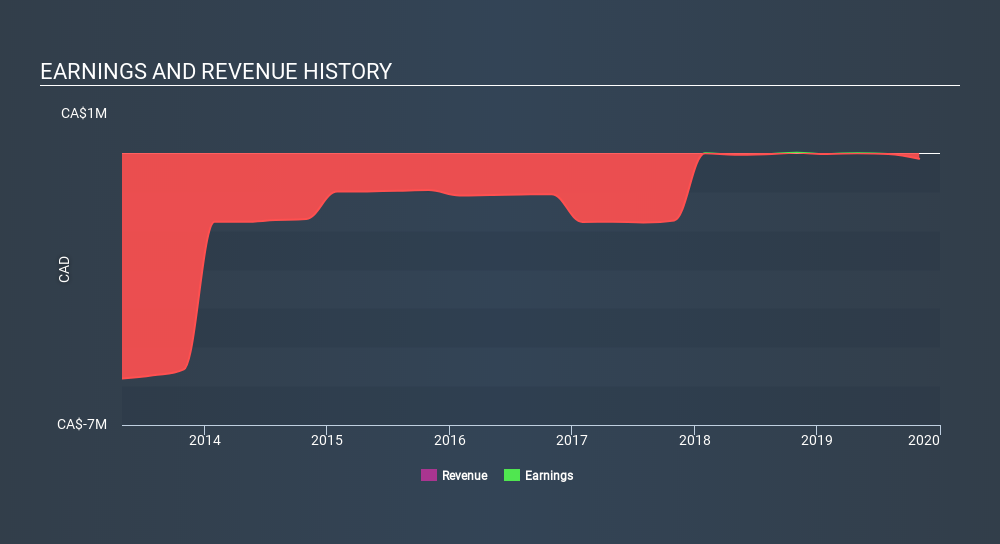

There are multiple explanations for why institutions don't own a stock. The most common is that the company is too small relative to fund under management, so the institition does not bother to look closely at the company. It is also possible that fund managers don't own the stock because they aren't convinced it will perform well. Cerro Mining might not have the sort of past performance institutions are looking for, or perhaps they simply have not studied the business closely.

Hedge funds don't have many shares in Cerro Mining. Looking at our data, we can see that the largest shareholder is David Eaton with 11% of shares outstanding. Xian-Zhang Shu is the second largest shareholder with 7.7% of common stock, followed by Paul Bowering, holding 7.6% of the stock.

On studying our ownership data, we found that 7 of the top shareholders collectively own less than 50% of the share register, implying that no single individual has a majority interest.

While it makes sense to study institutional ownership data for a company, it also makes sense to study analyst sentiments to know which way the wind is blowing. As far I can tell there isn't analyst coverage of the company, so it is probably flying under the radar.

Insider Ownership Of Cerro Mining

While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. Company management run the business, but the CEO will answer to the board, even if he or she is a member of it.

Insider ownership is positive when it signals leadership are thinking like the true owners of the company. However, high insider ownership can also give immense power to a small group within the company. This can be negative in some circumstances.

It seems insiders own a significant proportion of Cerro Mining Corp.. Insiders have a CA$309k stake in this CA$724k business. This may suggest that the founders still own a lot of shares. You can click here to see if they have been buying or selling.

General Public Ownership

The general public, mostly retail investors, hold a substantial 56% stake in CRX.H, suggesting it is a fairly popular stock. With this size of ownership, retail investors can collectively play a role in decisions that affect shareholder returns, such as dividend policies and the appointment of directors. They can also exercise the power to decline an acquisition or merger that may not improve profitability.

Next Steps:

While it is well worth considering the different groups that own a company, there are other factors that are even more important. For example, we've discovered 5 warning signs for Cerro Mining (3 are a bit concerning!) that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026