- Canada

- /

- Metals and Mining

- /

- TSXV:CDB

Here's Why We're A Bit Worried About Cordoba Minerals' (CVE:CDB) Cash Burn Situation

We can readily understand why investors are attracted to unprofitable companies. For example, although software-as-a-service business Salesforce.com lost money for years while it grew recurring revenue, if you held shares since 2005, you'd have done very well indeed. Having said that, unprofitable companies are risky because they could potentially burn through all their cash and become distressed.

So should Cordoba Minerals (CVE:CDB) shareholders be worried about its cash burn? In this article, we define cash burn as its annual (negative) free cash flow, which is the amount of money a company spends each year to fund its growth. The first step is to compare its cash burn with its cash reserves, to give us its 'cash runway'.

Our free stock report includes 5 warning signs investors should be aware of before investing in Cordoba Minerals. Read for free now.How Long Is Cordoba Minerals' Cash Runway?

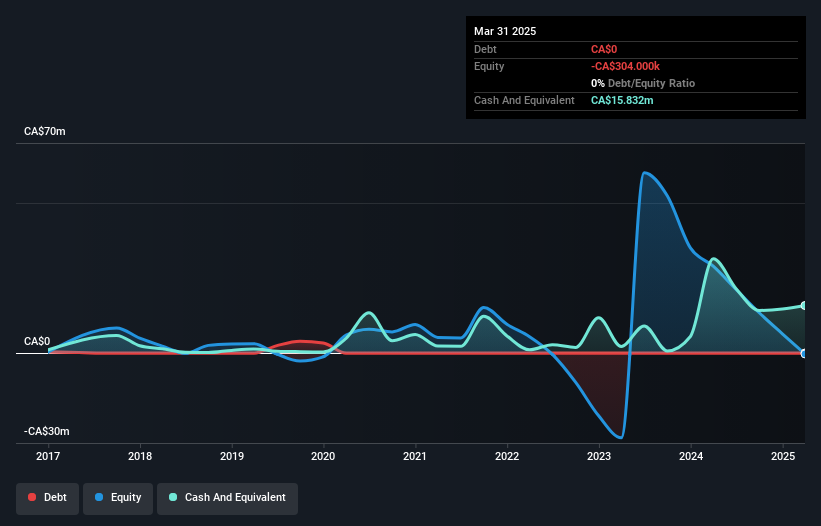

A company's cash runway is calculated by dividing its cash hoard by its cash burn. When Cordoba Minerals last reported its March 2025 balance sheet in May 2025, it had zero debt and cash worth CA$16m. Importantly, its cash burn was CA$26m over the trailing twelve months. Therefore, from March 2025 it had roughly 7 months of cash runway. To be frank, this kind of short runway puts us on edge, as it indicates the company must reduce its cash burn significantly, or else raise cash imminently. The image below shows how its cash balance has been changing over the last few years.

View our latest analysis for Cordoba Minerals

How Is Cordoba Minerals' Cash Burn Changing Over Time?

Cordoba Minerals didn't record any revenue over the last year, indicating that it's an early stage company still developing its business. So while we can't look to sales to understand growth, we can look at how the cash burn is changing to understand how expenditure is trending over time. As it happens, the company's cash burn reduced by 36% over the last year, which suggests that management are mindful of the possibility of running out of cash. Cordoba Minerals makes us a little nervous due to its lack of substantial operating revenue. So we'd generally prefer stocks from this list of stocks that have analysts forecasting growth.

How Hard Would It Be For Cordoba Minerals To Raise More Cash For Growth?

While Cordoba Minerals is showing a solid reduction in its cash burn, it's still worth considering how easily it could raise more cash, even just to fuel faster growth. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. Commonly, a business will sell new shares in itself to raise cash and drive growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

Cordoba Minerals' cash burn of CA$26m is about 39% of its CA$67m market capitalisation. That's not insignificant, and if the company had to sell enough shares to fund another year's growth at the current share price, you'd likely witness fairly costly dilution.

So, Should We Worry About Cordoba Minerals' Cash Burn?

Even though its cash runway makes us a little nervous, we are compelled to mention that we thought Cordoba Minerals' cash burn reduction was relatively promising. Considering all the measures mentioned in this report, we reckon that its cash burn is fairly risky, and if we held shares we'd be watching like a hawk for any deterioration. Taking a deeper dive, we've spotted 5 warning signs for Cordoba Minerals you should be aware of, and 4 of them are a bit concerning.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies, and this list of stocks growth stocks (according to analyst forecasts)

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:CDB

Cordoba Minerals

Engages in the acquisition, exploration, evaluation, and development of base and precious metal properties in Colombia and the United States.

Adequate balance sheet with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026