David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. As with many other companies Canadian Critical Minerals Inc. (CVE:CCMI) makes use of debt. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Canadian Critical Minerals

What Is Canadian Critical Minerals's Debt?

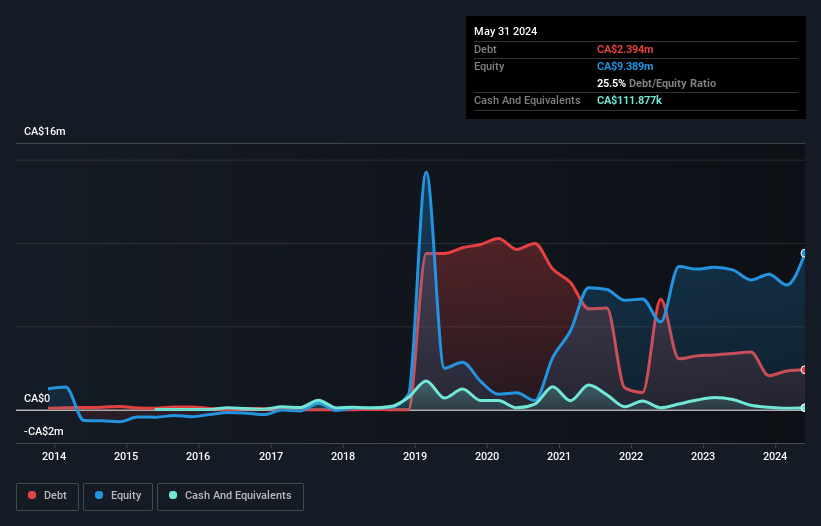

As you can see below, Canadian Critical Minerals had CA$2.39m of debt at May 2024, down from CA$3.37m a year prior. However, it also had CA$111.9k in cash, and so its net debt is CA$2.28m.

How Strong Is Canadian Critical Minerals' Balance Sheet?

The latest balance sheet data shows that Canadian Critical Minerals had liabilities of CA$2.99m due within a year, and liabilities of CA$1.53m falling due after that. On the other hand, it had cash of CA$111.9k and CA$145.4k worth of receivables due within a year. So it has liabilities totalling CA$4.26m more than its cash and near-term receivables, combined.

Canadian Critical Minerals has a market capitalization of CA$10.7m, so it could very likely raise cash to ameliorate its balance sheet, if the need arose. But it's clear that we should definitely closely examine whether it can manage its debt without dilution. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Canadian Critical Minerals will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Given its lack of meaningful operating revenue, investors are probably hoping that Canadian Critical Minerals finds some valuable resources, before it runs out of money.

Caveat Emptor

Over the last twelve months Canadian Critical Minerals produced an earnings before interest and tax (EBIT) loss. Its EBIT loss was a whopping CA$2.8m. Considering that alongside the liabilities mentioned above does not give us much confidence that company should be using so much debt. Quite frankly we think the balance sheet is far from match-fit, although it could be improved with time. Another cause for caution is that is bled CA$1.7m in negative free cash flow over the last twelve months. So suffice it to say we consider the stock very risky. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. These risks can be hard to spot. Every company has them, and we've spotted 5 warning signs for Canadian Critical Minerals (of which 3 shouldn't be ignored!) you should know about.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:CCMI

Canadian Critical Minerals

Engages in the acquisition, exploration, and development of mineral properties in Canada.

Flawless balance sheet with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026