Spotlight On TSX Penny Stocks: Dynamite Blockchain And Two More

Reviewed by Simply Wall St

While the recent shifts in bond yields have influenced bond prices, they also suggest potential for improved performance as yields play a crucial role in driving fixed-income returns. In this context, penny stocks—often associated with smaller or emerging companies—offer unique opportunities for growth at lower price points. Despite being considered a more niche investment area today, these stocks can still present significant value when backed by solid financial health and strong fundamentals.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Pulse Seismic (TSX:PSD) | CA$2.33 | CA$121.5M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.55 | CA$939.87M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.13 | CA$370M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.54 | CA$15.18M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.60 | CA$492.49M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.40 | CA$237.23M | ★★★★★☆ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.15 | CA$30.89M | ★★★★★★ |

| Hemisphere Energy (TSXV:HME) | CA$1.84 | CA$178.48M | ★★★★★☆ |

| Enterprise Group (TSX:E) | CA$2.03 | CA$116.34M | ★★★★☆☆ |

Click here to see the full list of 947 stocks from our TSX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Dynamite Blockchain (CNSX:KAS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Dynamite Blockchain Corp. is dedicated to developing a blockchain ecosystem centered around Kaspa, with a market cap of CA$14.91 million.

Operations: Dynamite Blockchain Corp. has not reported any specific revenue segments.

Market Cap: CA$14.91M

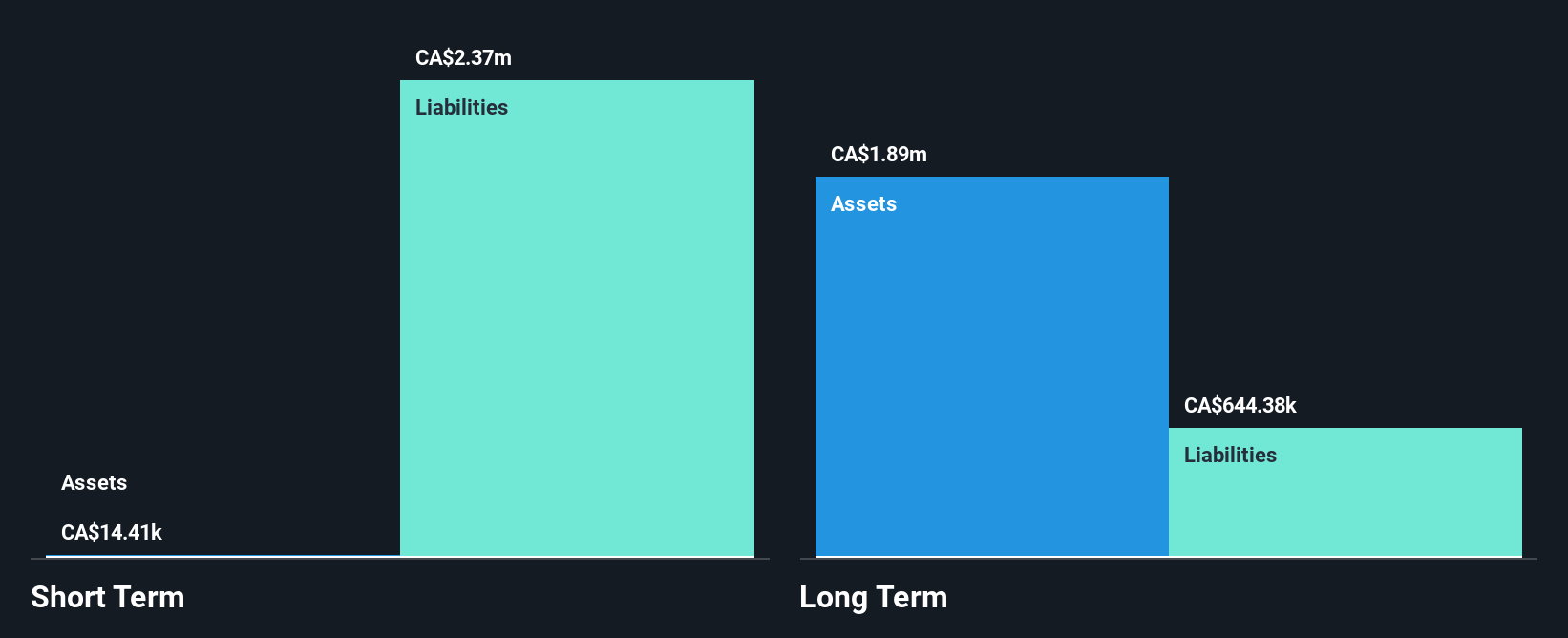

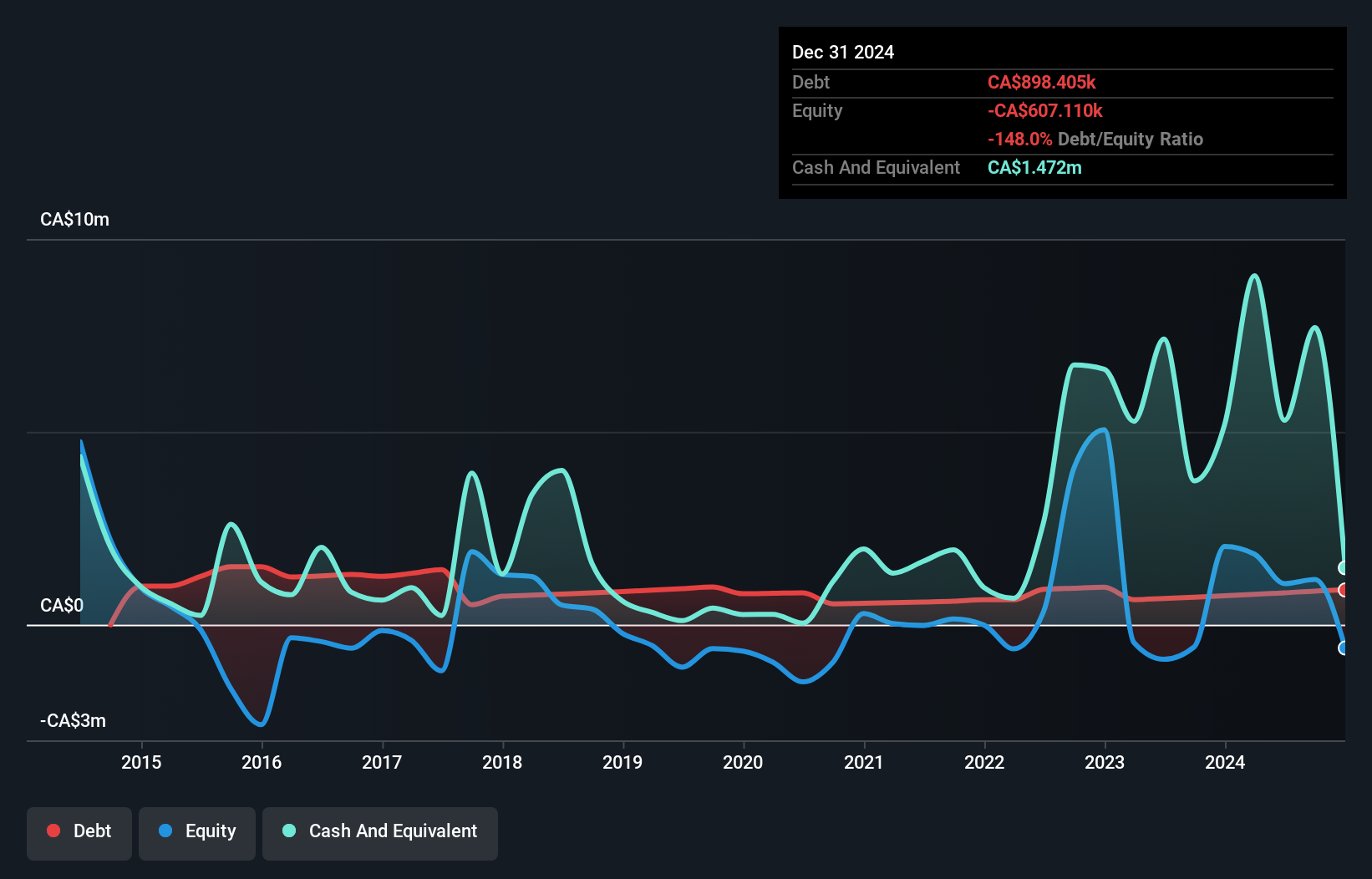

Dynamite Blockchain Corp., now focused on Kaspa's blockchain ecosystem, is a pre-revenue company with a market cap of CA$14.91 million. Despite being unprofitable and experiencing increased losses over the past five years, it maintains a strong cash position with more cash than debt and sufficient runway for over three years. The company's recent expansion into digital asset mining, including acquiring Kaspa mining units, highlights its strategic shift to diversify operations beyond Bitcoin using advanced blockDAG technology. However, its highly volatile share price and negative return on equity remain concerns for potential investors in this speculative space.

- Click to explore a detailed breakdown of our findings in Dynamite Blockchain's financial health report.

- Understand Dynamite Blockchain's track record by examining our performance history report.

Amarc Resources (TSXV:AHR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Amarc Resources Ltd. is involved in the acquisition, exploration, and development of mineral properties in Canada with a market cap of CA$43.06 million.

Operations: Amarc Resources Ltd. has not reported any revenue segments.

Market Cap: CA$43.06M

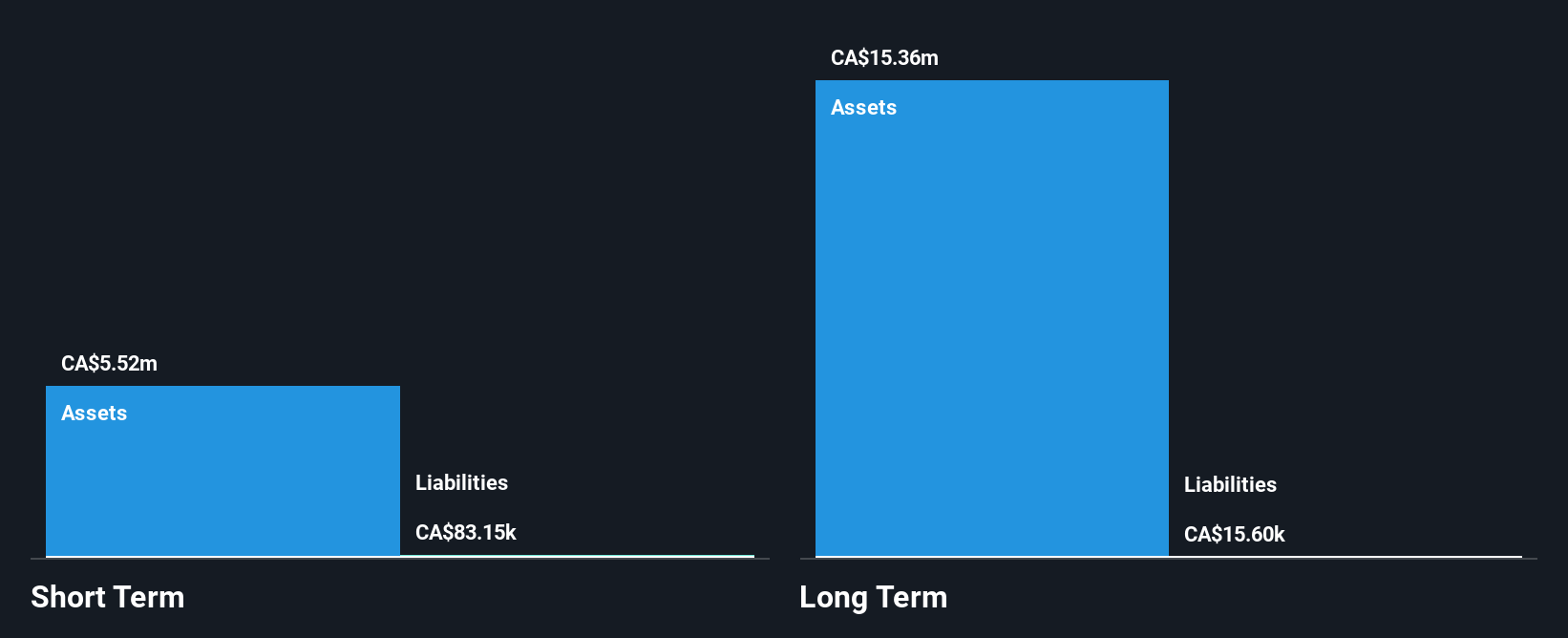

Amarc Resources Ltd., with a market cap of CA$43.06 million, is a pre-revenue company focused on mineral exploration in Canada. Recent developments include an extended loan repayment agreement and ongoing partnerships for exploration projects like the DUKE District, where Boliden Mineral Canada Ltd. committed to investing $10 million in 2025. Despite being unprofitable and experiencing increased losses over five years, Amarc has more cash than debt and maintains a sufficient cash runway exceeding three years due to positive free cash flow growth. However, its share price remains highly volatile, posing risks for investors in this speculative sector.

- Get an in-depth perspective on Amarc Resources' performance by reading our balance sheet health report here.

- Gain insights into Amarc Resources' historical outcomes by reviewing our past performance report.

Colonial Coal International (TSXV:CAD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Colonial Coal International Corp. is involved in the acquisition, exploration, and development of coal properties in Canada, with a market capitalization of CA$330.71 million.

Operations: Colonial Coal International Corp. has not reported any revenue segments.

Market Cap: CA$330.71M

Colonial Coal International Corp., with a market cap of CA$330.71 million, is a pre-revenue company engaged in coal property development in Canada. It remains unprofitable, reporting a net loss of CA$5.5 million for the quarter ended October 31, 2024, and has seen losses increase over five years at a significant rate. Despite this, Colonial Coal benefits from being debt-free and having sufficient short-term assets to cover liabilities. The company also boasts an experienced management team with an average tenure of over 14 years and maintains a cash runway extending beyond three years under current conditions.

- Jump into the full analysis health report here for a deeper understanding of Colonial Coal International.

- Examine Colonial Coal International's past performance report to understand how it has performed in prior years.

Summing It All Up

- Discover the full array of 947 TSX Penny Stocks right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CNSX:KAS

Dynamite Blockchain

Operates as a blockchain technology and infrastructure company.

Moderate risk with mediocre balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion