- Canada

- /

- Metals and Mining

- /

- TSXV:MFG

February 2025 TSX Penny Stocks To Watch

Reviewed by Simply Wall St

The Canadian market is currently navigating a period of economic uncertainty, with the Bank of Canada cutting rates due to potential U.S. tariffs and a recent contraction in GDP. Despite these challenges, the concept of penny stocks—often representing smaller or newer companies—remains relevant for investors seeking opportunities at lower price points. By focusing on those with strong financial fundamentals, penny stocks can offer hidden potential without many of the associated risks, making them an intriguing area for exploration amidst current market conditions.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$5.00 | CA$184.62M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.59 | CA$989.91M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.70 | CA$447.95M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.38 | CA$126.59M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.28 | CA$230.34M | ★★★★★☆ |

| PetroTal (TSX:TAL) | CA$0.68 | CA$619.87M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.46 | CA$14.32M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.00 | CA$28.21M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| Tornado Infrastructure Equipment (TSXV:TGH) | CA$0.98 | CA$138.93M | ★★★★★☆ |

Click here to see the full list of 930 stocks from our TSX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Colonial Coal International (TSXV:CAD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Colonial Coal International Corp. focuses on the acquisition, exploration, and development of coal properties in Canada with a market cap of CA$290.73 million.

Operations: Colonial Coal International Corp. has not reported any revenue segments.

Market Cap: CA$290.73M

Colonial Coal International Corp., with a market cap of CA$290.73 million, is pre-revenue and focuses on coal property development in Canada. Despite being unprofitable, the company has no debt and a robust cash runway exceeding three years, indicating financial stability for ongoing operations. The seasoned management team and board of directors bring significant experience to the table, which could be advantageous for strategic decisions. Recent earnings reported a net loss of CA$5.5 million for Q1 2024, highlighting challenges in achieving profitability as losses have increased over the past five years by 32.1% annually.

- Dive into the specifics of Colonial Coal International here with our thorough balance sheet health report.

- Understand Colonial Coal International's track record by examining our performance history report.

Mayfair Gold (TSXV:MFG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Mayfair Gold Corp. is an exploration-stage company focused on acquiring, exploring, evaluating, and developing mineral properties with a market cap of CA$192.34 million.

Operations: Currently, there are no reported revenue segments for this exploration-stage company.

Market Cap: CA$192.34M

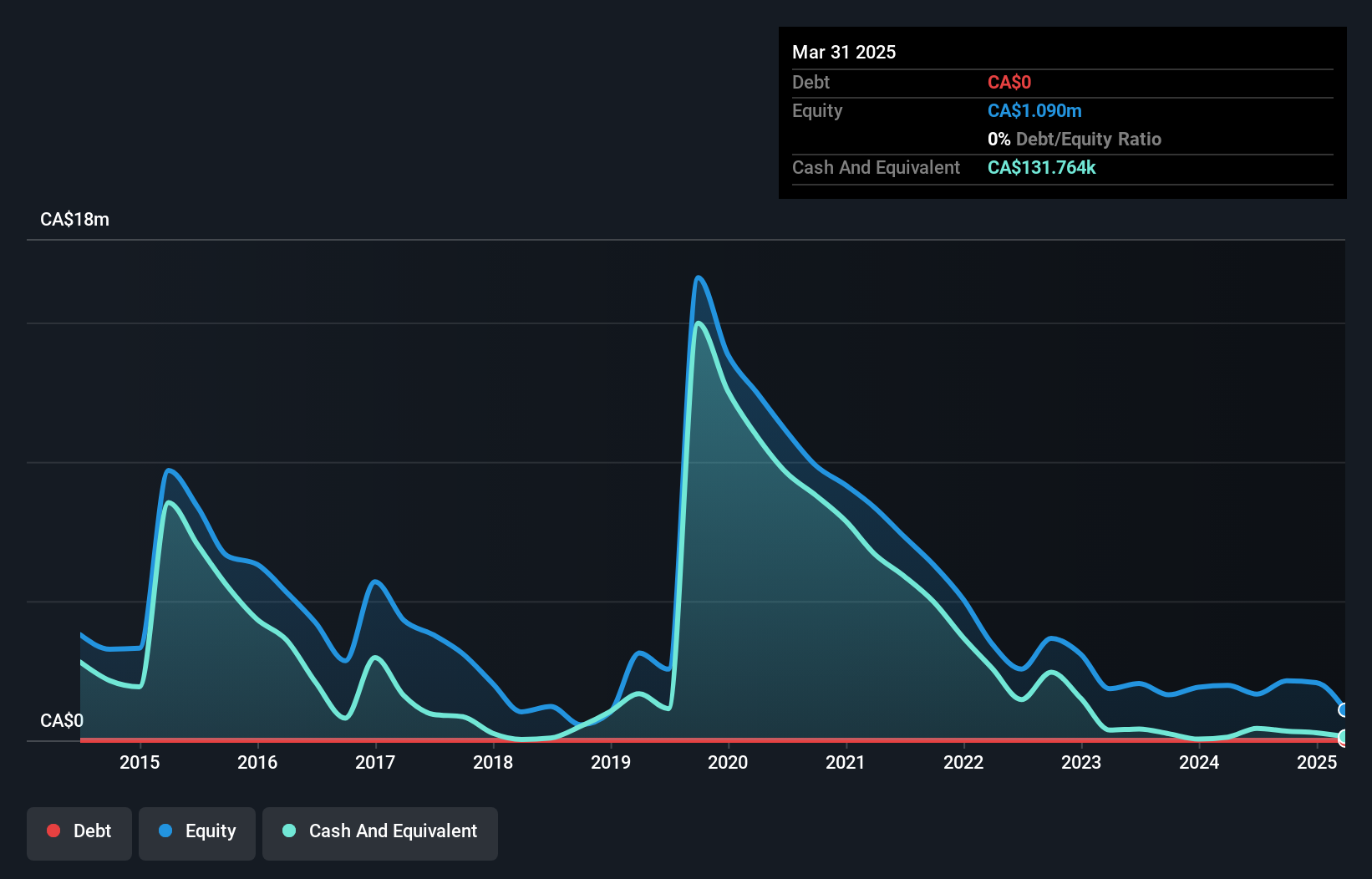

Mayfair Gold Corp., with a market cap of CA$192.34 million, is pre-revenue, focusing on mineral exploration without significant revenue streams. The company remains unprofitable, with losses widening at 28.8% annually over the past five years. Despite this, Mayfair benefits from being debt-free and having short-term assets (CA$5.8M) that exceed its liabilities (CA$388.3K). The recent appointment of Nicholas Campbell as CEO could bring strategic insights given his extensive industry experience; however, both the board and management are relatively inexperienced in their roles. The company's cash runway is limited to four months but has been extended through additional capital raising efforts.

- Unlock comprehensive insights into our analysis of Mayfair Gold stock in this financial health report.

- Evaluate Mayfair Gold's historical performance by accessing our past performance report.

Theralase Technologies (TSXV:TLT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Theralase Technologies Inc. is a clinical stage pharmaceutical company focused on developing light activated photodynamic compounds and drug formulations for treating cancers, bacteria, and viruses, with a market cap of CA$68.14 million.

Operations: The company's revenue segment is derived entirely from its Device business, totaling CA$0.99 million.

Market Cap: CA$68.14M

Theralase Technologies Inc., with a market cap of CA$68.14 million, is pre-revenue, focusing on clinical-stage pharmaceutical developments. The company recently expanded its bladder cancer clinical study to new sites in the US and Canada, showing promising results in patient response rates. Despite being unprofitable with negative equity returns and high volatility, Theralase has managed to reduce losses over five years and remains debt-free. Short-term assets exceed liabilities, but cash runway concerns persist despite recent capital raising efforts. The management team is experienced with an average tenure of 14.5 years, supporting strategic continuity amidst financial challenges.

- Click to explore a detailed breakdown of our findings in Theralase Technologies' financial health report.

- Evaluate Theralase Technologies' prospects by accessing our earnings growth report.

Turning Ideas Into Actions

- Unlock more gems! Our TSX Penny Stocks screener has unearthed 927 more companies for you to explore.Click here to unveil our expertly curated list of 930 TSX Penny Stocks.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:MFG

Mayfair Gold

Acquires, explores, evaluates, and develops mineral properties.

Adequate balance sheet low.

Similar Companies

Market Insights

Community Narratives