- Canada

- /

- Metals and Mining

- /

- TSXV:BRW

Here's Why We're A Bit Worried About Brunswick Exploration's (CVE:BRW) Cash Burn Situation

We can readily understand why investors are attracted to unprofitable companies. For example, although Amazon.com made losses for many years after listing, if you had bought and held the shares since 1999, you would have made a fortune. But while the successes are well known, investors should not ignore the very many unprofitable companies that simply burn through all their cash and collapse.

Given this risk, we thought we'd take a look at whether Brunswick Exploration (CVE:BRW) shareholders should be worried about its cash burn. For the purpose of this article, we'll define cash burn as the amount of cash the company is spending each year to fund its growth (also called its negative free cash flow). First, we'll determine its cash runway by comparing its cash burn with its cash reserves.

See our latest analysis for Brunswick Exploration

When Might Brunswick Exploration Run Out Of Money?

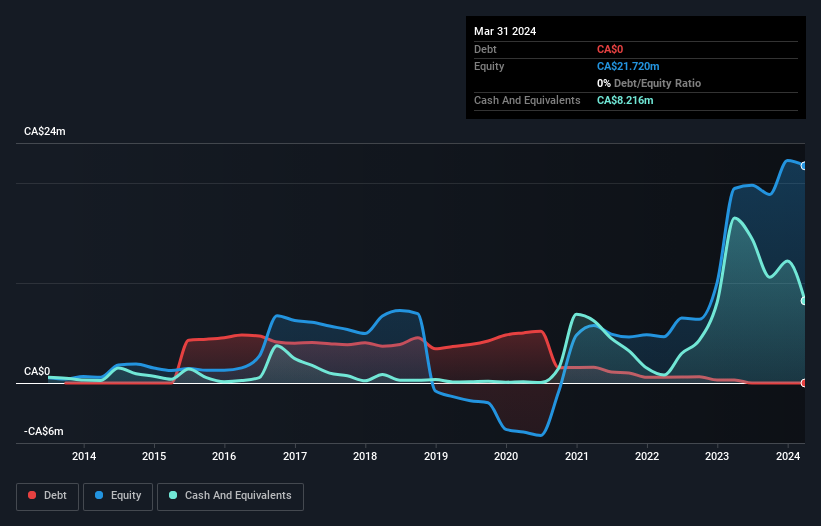

A company's cash runway is the amount of time it would take to burn through its cash reserves at its current cash burn rate. In March 2024, Brunswick Exploration had CA$8.2m in cash, and was debt-free. Looking at the last year, the company burnt through CA$14m. That means it had a cash runway of around 7 months as of March 2024. To be frank, this kind of short runway puts us on edge, as it indicates the company must reduce its cash burn significantly, or else raise cash imminently. Depicted below, you can see how its cash holdings have changed over time.

How Is Brunswick Exploration's Cash Burn Changing Over Time?

Because Brunswick Exploration isn't currently generating revenue, we consider it an early-stage business. Nonetheless, we can still examine its cash burn trajectory as part of our assessment of its cash burn situation. The skyrocketing cash burn up 162% year on year certainly tests our nerves. That sort of spending growth rate can't continue for very long before it causes balance sheet weakness, generally speaking. Admittedly, we're a bit cautious of Brunswick Exploration due to its lack of significant operating revenues. We prefer most of the stocks on this list of stocks that analysts expect to grow.

How Easily Can Brunswick Exploration Raise Cash?

Given its cash burn trajectory, Brunswick Exploration shareholders should already be thinking about how easy it might be for it to raise further cash in the future. Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. One of the main advantages held by publicly listed companies is that they can sell shares to investors to raise cash and fund growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

Brunswick Exploration's cash burn of CA$14m is about 30% of its CA$46m market capitalisation. That's not insignificant, and if the company had to sell enough shares to fund another year's growth at the current share price, you'd likely witness fairly costly dilution.

Is Brunswick Exploration's Cash Burn A Worry?

Brunswick Exploration is not in a great position when it comes to its cash burn situation. Although we can understand if some shareholders find its cash burn relative to its market cap acceptable, we can't ignore the fact that we consider its increasing cash burn to be downright troublesome. Once we consider the metrics mentioned in this article together, we're left with very little confidence in the company's ability to manage its cash burn, and we think it will probably need more money. On another note, Brunswick Exploration has 6 warning signs (and 3 which are potentially serious) we think you should know about.

If you would prefer to check out another company with better fundamentals, then do not miss this free list of interesting companies, that have HIGH return on equity and low debt or this list of stocks which are all forecast to grow.

Valuation is complex, but we're here to simplify it.

Discover if Brunswick Exploration might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:BRW

Brunswick Exploration

A junior exploration and evaluation company, engages in the acquisition and exploration of mineral properties in Canada.

Flawless balance sheet with moderate risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Halyk Bank of Kazakhstan will see revenue grow 11% as their future PE reaches 3.2x soon

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026