- Canada

- /

- Metals and Mining

- /

- TSXV:BMR

Battery Mineral Resources Corp. (CVE:BMR) Stock Catapults 38% Though Its Price And Business Still Lag The Industry

Those holding Battery Mineral Resources Corp. (CVE:BMR) shares would be relieved that the share price has rebounded 38% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 42% over that time.

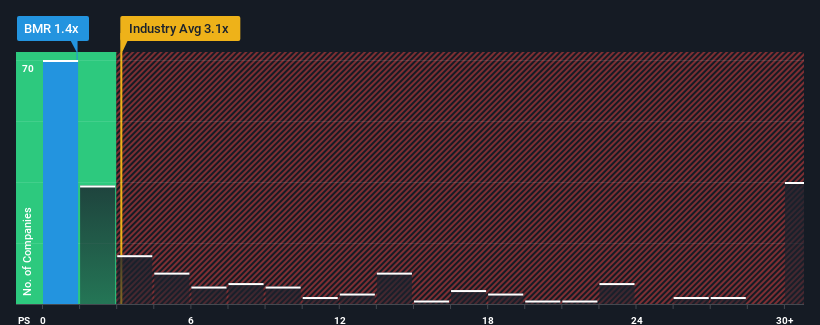

In spite of the firm bounce in price, Battery Mineral Resources' price-to-sales (or "P/S") ratio of 1.4x might still make it look like a buy right now compared to the Metals and Mining industry in Canada, where around half of the companies have P/S ratios above 3.1x and even P/S above 17x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Battery Mineral Resources

What Does Battery Mineral Resources' P/S Mean For Shareholders?

The revenue growth achieved at Battery Mineral Resources over the last year would be more than acceptable for most companies. It might be that many expect the respectable revenue performance to degrade substantially, which has repressed the P/S. Those who are bullish on Battery Mineral Resources will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Battery Mineral Resources' earnings, revenue and cash flow.How Is Battery Mineral Resources' Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Battery Mineral Resources' to be considered reasonable.

Retrospectively, the last year delivered an exceptional 16% gain to the company's top line. Still, revenue has barely risen at all from three years ago in total, which is not ideal. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 17% shows it's noticeably less attractive.

With this in consideration, it's easy to understand why Battery Mineral Resources' P/S falls short of the mark set by its industry peers. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

What Does Battery Mineral Resources' P/S Mean For Investors?

The latest share price surge wasn't enough to lift Battery Mineral Resources' P/S close to the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

In line with expectations, Battery Mineral Resources maintains its low P/S on the weakness of its recent three-year growth being lower than the wider industry forecast. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

You need to take note of risks, for example - Battery Mineral Resources has 3 warning signs (and 1 which is significant) we think you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Battery Mineral Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:BMR

Battery Mineral Resources

A battery minerals company, engages in the acquisition and exploration of mineral exploration and evaluation assets in Canada, the United States, Chile, and South Korea.

Moderate risk and slightly overvalued.

Market Insights

Community Narratives