- Canada

- /

- Metals and Mining

- /

- TSX:GMX

January 2025 TSX Penny Stocks To Watch

Reviewed by Simply Wall St

As 2025 begins, the Canadian market is navigating a landscape shaped by recent policy changes and economic developments, including potential interest rate cuts and evolving trade dynamics under the new U.S. administration. Despite these uncertainties, there remains a solid fundamental backdrop supported by consumer strength and positive growth trends. Penny stocks, often seen as relics of past trading days yet still relevant today, offer intriguing opportunities for investors seeking growth at lower price points. These smaller or newer companies can present hidden value when built on strong financials and clear growth trajectories.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.95 | CA$182.43M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.46 | CA$944.22M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.57 | CA$422.59M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.29 | CA$125.06M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.21 | CA$220.49M | ★★★★★☆ |

| PetroTal (TSX:TAL) | CA$0.67 | CA$619.93M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.48 | CA$14.18M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.00 | CA$26.86M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| Hemisphere Energy (TSXV:HME) | CA$1.84 | CA$177.67M | ★★★★★☆ |

Click here to see the full list of 931 stocks from our TSX Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Globex Mining Enterprises (TSX:GMX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Globex Mining Enterprises Inc. focuses on the acquisition, exploration, and development of mineral properties in North America with a market capitalization of CA$85.22 million.

Operations: The company's revenue is derived entirely from its Metals & Mining segment, specifically Gold & Other Precious Metals, amounting to CA$4.45 million.

Market Cap: CA$85.22M

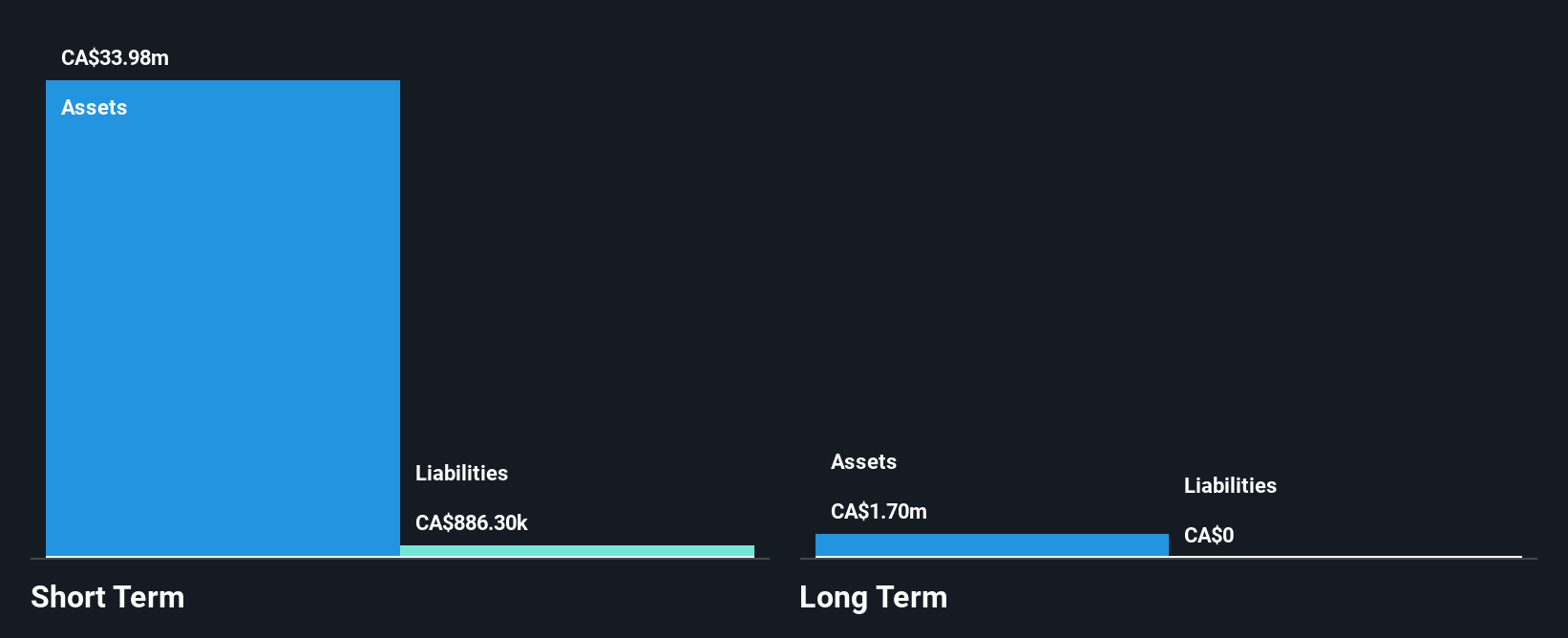

Globex Mining Enterprises, with a market cap of CA$85.22 million, derives its revenue from the Metals & Mining segment, focusing on Gold & Other Precious Metals. Recent developments include promising assay results from their Ironwood Gold Zone and strategic property agreements like the one with Electro Metals for the Magusi-Fabie Mines property. Globex holds several royalties that could yield future income streams as projects advance. Despite limited current revenue (CA$4.45 million), Globex is debt-free, has seasoned board members, and maintains strong short-term financial health with assets significantly exceeding liabilities.

- Click here to discover the nuances of Globex Mining Enterprises with our detailed analytical financial health report.

- Examine Globex Mining Enterprises' past performance report to understand how it has performed in prior years.

Jaguar Mining (TSX:JAG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Jaguar Mining Inc. is a junior gold mining company focused on the acquisition, exploration, development, and operation of gold mineral properties in Brazil with a market cap of CA$182.41 million.

Operations: The company generates revenue of $152.14 million from its activities related to gold producing properties.

Market Cap: CA$182.41M

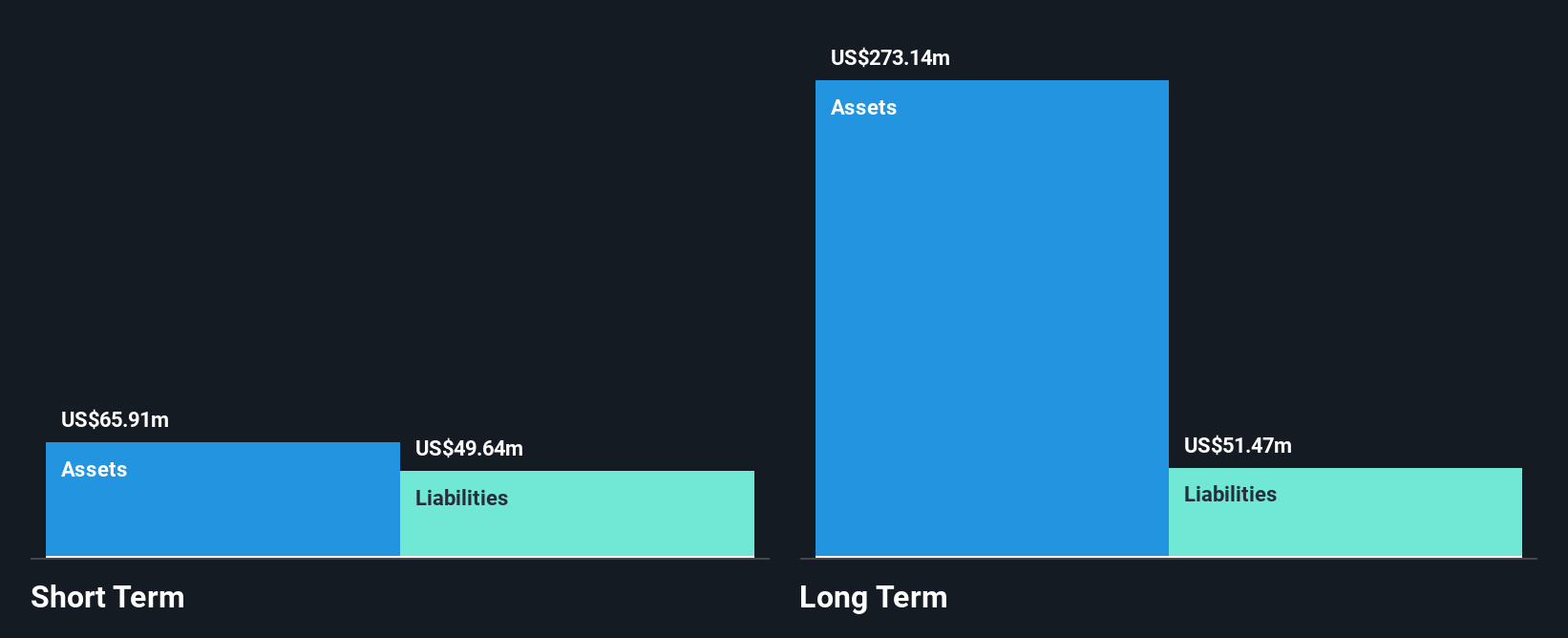

Jaguar Mining, with a market cap of CA$182.41 million, is navigating challenges and opportunities in the gold mining sector. The company reported revenue of US$152.14 million and has improved its net profit margins from 12.2% to 19.3% over the past year, indicating operational efficiency gains despite lower gold production compared to last year due to operational disruptions at the Turmalina mine in Brazil. Jaguar’s financial health is robust, with more cash than total debt and short-term assets exceeding liabilities, although its return on equity remains low at 11.3%. Recent buyback initiatives aim to enhance shareholder value amidst these challenges.

- Get an in-depth perspective on Jaguar Mining's performance by reading our balance sheet health report here.

- Learn about Jaguar Mining's future growth trajectory here.

Hercules Metals (TSXV:BIG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Hercules Metals Corp. is a junior mining company focused on the exploration and development of mineral properties in the United States, with a market cap of CA$139.69 million.

Operations: Hercules Metals Corp. has not reported any revenue segments.

Market Cap: CA$139.69M

Hercules Metals Corp., with a market cap of CA$139.69 million, is a pre-revenue junior mining company focused on exploration in Idaho. Recent drilling results have expanded mineralization zones, revealing promising copper and silver grades at shallow depths. The company's innovative metallurgical testing has improved historical recovery rates, potentially enhancing future project viability. Despite its debt-free status and short-term assets covering liabilities, Hercules faces financial challenges with less than a year of cash runway and increasing losses over the past five years. Management's limited experience may impact strategic decisions as they pursue further exploration efforts.

- Unlock comprehensive insights into our analysis of Hercules Metals stock in this financial health report.

- Understand Hercules Metals' track record by examining our performance history report.

Turning Ideas Into Actions

- Unlock more gems! Our TSX Penny Stocks screener has unearthed 928 more companies for you to explore.Click here to unveil our expertly curated list of 931 TSX Penny Stocks.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:GMX

Globex Mining Enterprises

Engages in the acquisition, exploration, and development of mineral properties in North America.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives