- Canada

- /

- Metals and Mining

- /

- TSXV:TSG

TSX Penny Stocks To Watch In June 2025

Reviewed by Simply Wall St

As the Canadian market navigates ongoing tariff uncertainties, investors have shown resilience, with indices like the TSX experiencing notable growth in May. In such a climate, identifying stocks with strong fundamentals becomes crucial for those seeking value and growth potential. Penny stocks, though an older term, still represent opportunities in smaller or newer companies that may offer stability and upside when backed by solid financials.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.73 | CA$71.82M | ✅ 3 ⚠️ 3 View Analysis > |

| NTG Clarity Networks (TSXV:NCI) | CA$2.52 | CA$106.21M | ✅ 4 ⚠️ 2 View Analysis > |

| Intermap Technologies (TSX:IMP) | CA$2.36 | CA$129.8M | ✅ 3 ⚠️ 2 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.72 | CA$459.25M | ✅ 3 ⚠️ 2 View Analysis > |

| Orezone Gold (TSX:ORE) | CA$1.44 | CA$738.03M | ✅ 4 ⚠️ 2 View Analysis > |

| McChip Resources (TSXV:MCS) | CA$0.82 | CA$4.68M | ✅ 2 ⚠️ 5 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.80 | CA$170.11M | ✅ 3 ⚠️ 1 View Analysis > |

| PetroTal (TSX:TAL) | CA$0.63 | CA$567.29M | ✅ 3 ⚠️ 3 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$2.70 | CA$132.98M | ✅ 1 ⚠️ 2 View Analysis > |

| Findev (TSXV:FDI) | CA$0.445 | CA$12.18M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 874 stocks from our TSX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Allegiant Gold (TSXV:AUAU)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Allegiant Gold Ltd. is involved in the exploration and evaluation of resource properties in the United States, with a market cap of CA$12.20 million.

Operations: The company has not reported any revenue segments.

Market Cap: CA$12.2M

Allegiant Gold Ltd., with a market cap of CA$12.20 million, is pre-revenue and unprofitable but has reduced losses at a rate of 16.8% over five years. The company is debt-free, with short-term assets exceeding both short and long-term liabilities. Allegiant's share price has been volatile, and its return on equity remains negative at -7.36%. Recent developments include a non-brokered private placement aiming to raise up to CA$3.5 million through issuing units priced at CA$0.18 each, potentially providing liquidity for future operations amidst its financial challenges.

- Click here and access our complete financial health analysis report to understand the dynamics of Allegiant Gold.

- Gain insights into Allegiant Gold's historical outcomes by reviewing our past performance report.

Metallic Minerals (TSXV:MMG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Metallic Minerals Corp. focuses on the acquisition, exploration, and development of mineral properties in Canada and the United States, with a market cap of CA$47.55 million.

Operations: Currently, there are no reported revenue segments for Metallic Minerals Corp.

Market Cap: CA$47.55M

Metallic Minerals Corp., with a market cap of CA$47.55 million, remains pre-revenue and unprofitable, facing increased losses over the past five years. It is debt-free, with short-term assets covering its liabilities but has less than a year of cash runway. Recent developments include significant potential for critical minerals at its La Plata project in Colorado and an expanded gold royalty agreement in the Yukon’s Klondike Gold District. These initiatives aim to leverage strategic partnerships, including Newmont's 9.5% stake, to enhance exploration efforts despite high share price volatility and limited financial resources.

- Get an in-depth perspective on Metallic Minerals' performance by reading our balance sheet health report here.

- Examine Metallic Minerals' past performance report to understand how it has performed in prior years.

TriStar Gold (TSXV:TSG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: TriStar Gold, Inc. focuses on acquiring, exploring, and developing precious metal prospects in the Americas with a market cap of CA$50.58 million.

Operations: Currently, there are no reported revenue segments for this company.

Market Cap: CA$50.58M

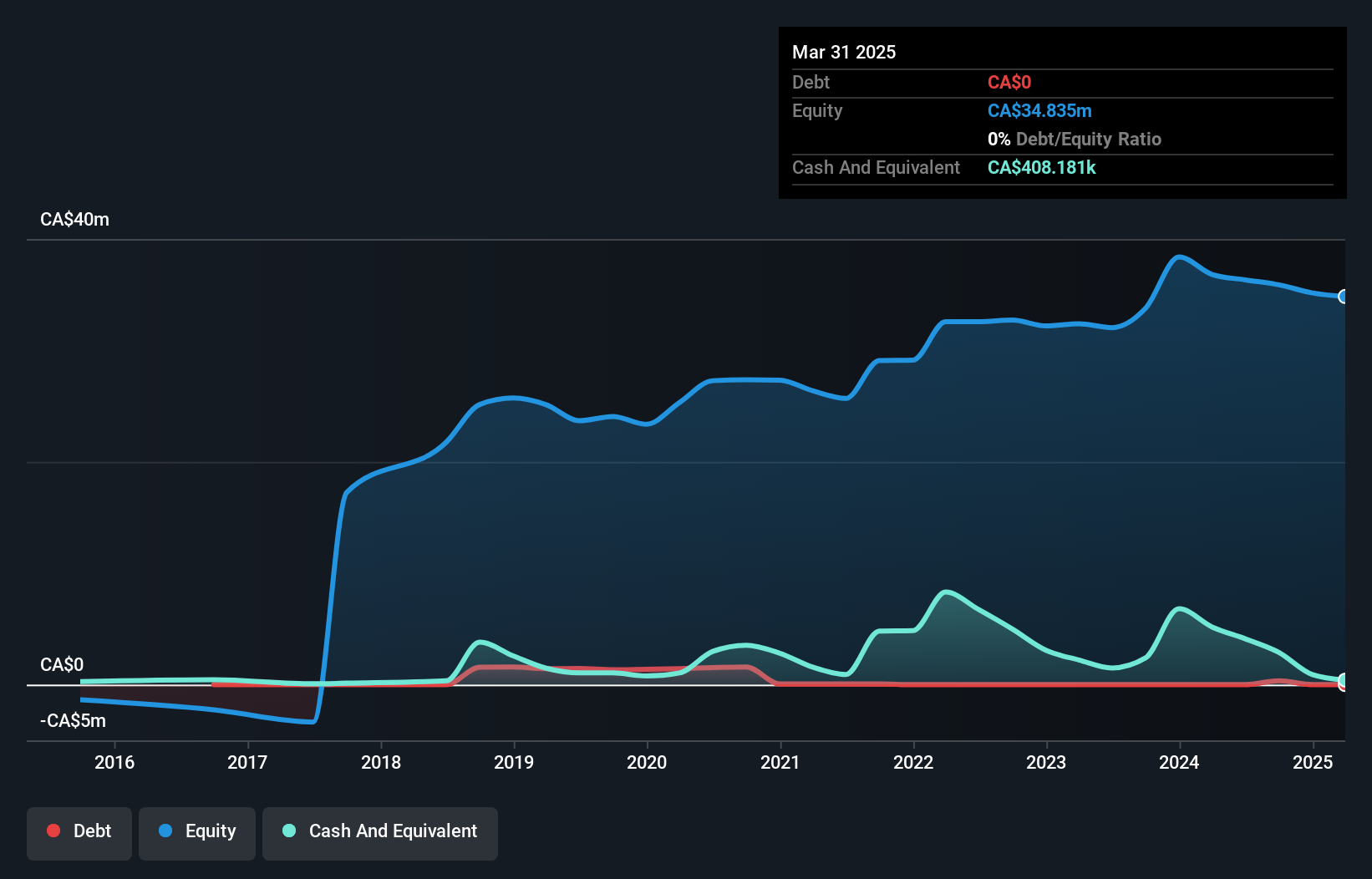

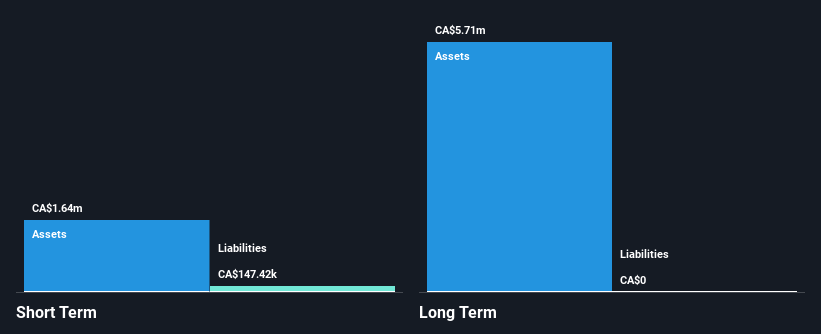

TriStar Gold, Inc., with a market cap of CA$50.58 million, is pre-revenue and unprofitable, experiencing increased losses over the past five years. The company is debt-free but has short-term assets exceeding its liabilities. Despite having only a short cash runway initially, it recently raised CAD 10.09 million through private placements to bolster its financial position. A prefeasibility study update for the Castelo de Sonhos project in Brazil reflects revised economic parameters and cost estimates based on a gold price of USD 2,200/oz. However, auditor concerns about its going concern status highlight potential financial challenges ahead.

- Dive into the specifics of TriStar Gold here with our thorough balance sheet health report.

- Review our historical performance report to gain insights into TriStar Gold's track record.

Seize The Opportunity

- Unlock more gems! Our TSX Penny Stocks screener has unearthed 871 more companies for you to explore.Click here to unveil our expertly curated list of 874 TSX Penny Stocks.

- Curious About Other Options? Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if TriStar Gold might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:TSG

TriStar Gold

Engages in the acquisition, exploration, and development of precious metal prospects in the Americas.

Flawless balance sheet with slight risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)