- Canada

- /

- Metals and Mining

- /

- TSXV:ATY

Here's What Atico Mining Corporation's (CVE:ATY) P/E Ratio Is Telling Us

This article is written for those who want to get better at using price to earnings ratios (P/E ratios). We'll show how you can use Atico Mining Corporation's (CVE:ATY) P/E ratio to inform your assessment of the investment opportunity. What is Atico Mining's P/E ratio? Well, based on the last twelve months it is 9.12. That means that at current prices, buyers pay CA$9.12 for every CA$1 in trailing yearly profits.

See our latest analysis for Atico Mining

How Do You Calculate A P/E Ratio?

The formula for P/E is:

Price to Earnings Ratio = Price per Share (in the reporting currency) ÷ Earnings per Share (EPS)

Or for Atico Mining:

P/E of 9.12 = $0.173 ÷ $0.019 (Based on the trailing twelve months to March 2020.)

(Note: the above calculation uses the share price in the reporting currency, namely USD and the calculation results may not be precise due to rounding.)

Is A High P/E Ratio Good?

A higher P/E ratio means that investors are paying a higher price for each $1 of company earnings. That is not a good or a bad thing per se, but a high P/E does imply buyers are optimistic about the future.

How Does Atico Mining's P/E Ratio Compare To Its Peers?

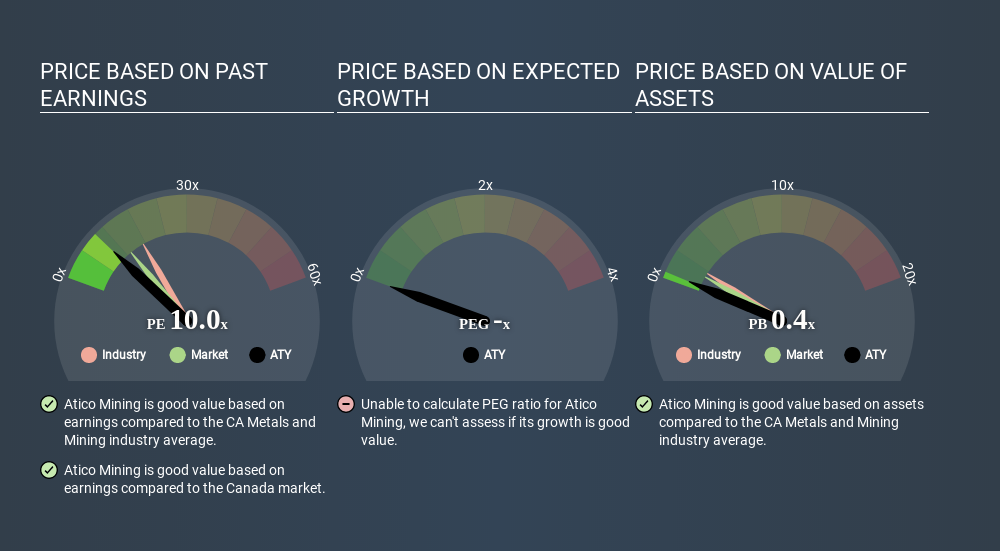

The P/E ratio essentially measures market expectations of a company. If you look at the image below, you can see Atico Mining has a lower P/E than the average (17.6) in the metals and mining industry classification.

Its relatively low P/E ratio indicates that Atico Mining shareholders think it will struggle to do as well as other companies in its industry classification. While current expectations are low, the stock could be undervalued if the situation is better than the market assumes. If you consider the stock interesting, further research is recommended. For example, I often monitor director buying and selling.

How Growth Rates Impact P/E Ratios

Earnings growth rates have a big influence on P/E ratios. Earnings growth means that in the future the 'E' will be higher. And in that case, the P/E ratio itself will drop rather quickly. And as that P/E ratio drops, the company will look cheap, unless its share price increases.

Atico Mining saw earnings per share decrease by 62% last year.

Don't Forget: The P/E Does Not Account For Debt or Bank Deposits

The 'Price' in P/E reflects the market capitalization of the company. That means it doesn't take debt or cash into account. The exact same company would hypothetically deserve a higher P/E ratio if it had a strong balance sheet, than if it had a weak one with lots of debt, because a cashed up company can spend on growth.

Such expenditure might be good or bad, in the long term, but the point here is that the balance sheet is not reflected by this ratio.

Atico Mining's Balance Sheet

Since Atico Mining holds net cash of US$619k, it can spend on growth, justifying a higher P/E ratio than otherwise.

The Bottom Line On Atico Mining's P/E Ratio

Atico Mining's P/E is 9.1 which is below average (13.2) in the CA market. Falling earnings per share are likely to be keeping potential buyers away, but the net cash position means the company has time to improve: if so, the low P/E could be an opportunity.

When the market is wrong about a stock, it gives savvy investors an opportunity. As value investor Benjamin Graham famously said, 'In the short run, the market is a voting machine but in the long run, it is a weighing machine. So this free visualization of the analyst consensus on future earnings could help you make the right decision about whether to buy, sell, or hold.

But note: Atico Mining may not be the best stock to buy. So take a peek at this free list of interesting companies with strong recent earnings growth (and a P/E ratio below 20).

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About TSXV:ATY

Atico Mining

Engages in the acquisition, exploration, and development of copper and gold projects in Latin America.

Good value slight.

Market Insights

Community Narratives