- Canada

- /

- Metals and Mining

- /

- TSXV:ASE

Is Asante Gold’s (TSXV:ASE) Focus on Processing Gains a Game Changer for Long-Term Value?

Reviewed by Sasha Jovanovic

- Asante Gold Corporation recently announced the completion and successful commissioning of its sulphide plant at the Bibiani Gold Mine in Ghana, with around US$32 million spent on the project and full 24-hour operational capacity expected to begin in late September 2025.

- The company reported that process optimization aims to increase gold recovery rates at Bibiani from 60% to 92% by late October 2025, signaling a substantial operational enhancement for the mine.

- We'll explore how achieving higher gold recovery rates from the Bibiani plant shapes Asante Gold's broader investment story.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Asante Gold's Investment Narrative?

For any shareholder in Asante Gold, the core of the investment thesis centers on the company's capacity to sharply boost operational performance at its flagship Bibiani mine. The recent commissioning of the sulphide plant stands out as a major catalyst, as it targets a dramatic lift in gold recovery rates, from 60% to 92%, by late October 2025. This marks a clear potential turning point for production efficiency right as recent results have shown pressure on both earnings and production volumes. However, while the news could help counter some short-term concerns over declining output and rising losses, near-term risks like negative equity, a rising net loss, and dilution over the past year cannot be overlooked. The TSX Venture re-listing may also steer investor sentiment in the immediate future. The calculus for Asante’s next steps may have just changed: the new sulphide plant has the power to shift the risk-reward balance, at least for now. But with negative shareholders’ equity still on the table, there are key financial risks investors need to watch.

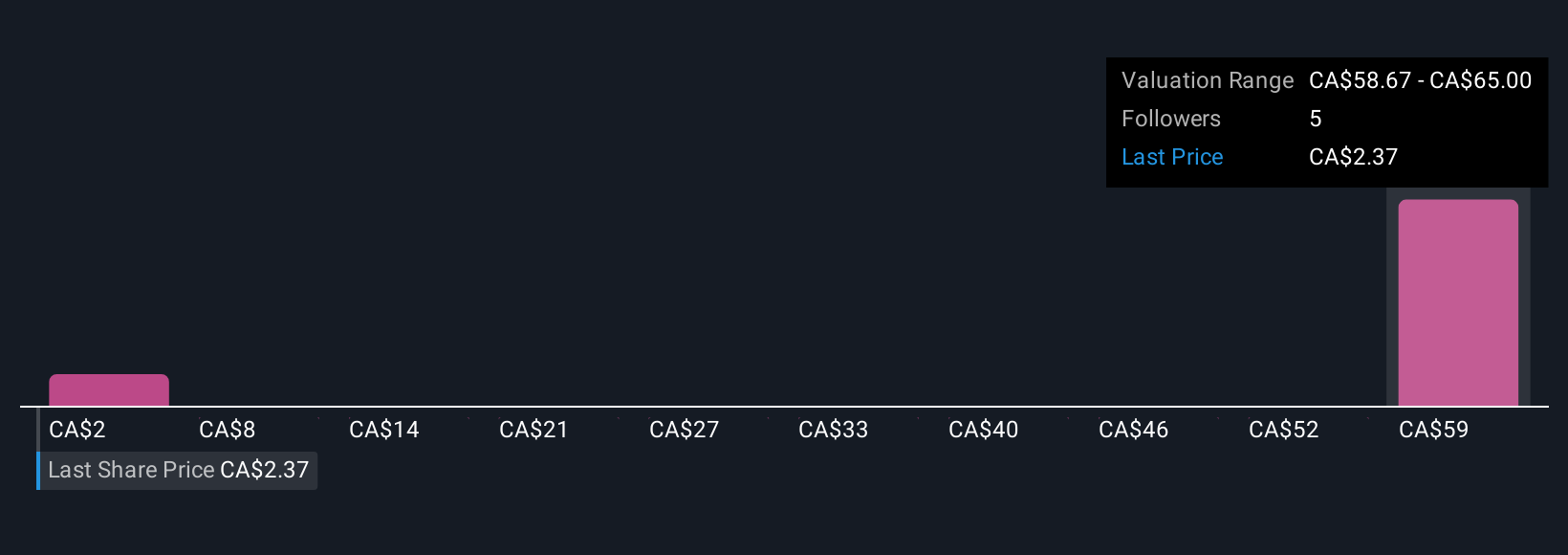

Asante Gold's share price has been on the slide but might be up to 39% below fair value. Find out if it's a bargain.Exploring Other Perspectives

Explore 2 other fair value estimates on Asante Gold - why the stock might be worth 28% less than the current price!

Build Your Own Asante Gold Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Asante Gold research is our analysis highlighting 3 important warning signs that could impact your investment decision.

- Our free Asante Gold research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Asante Gold's overall financial health at a glance.

Looking For Alternative Opportunities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:ASE

Asante Gold

A mineral exploration and gold production company, primarily involved in the assessment, acquisition, development, and operation of mines in the Republic of Ghana.

Low risk and slightly overvalued.

Market Insights

Community Narratives