Stock Analysis

- Canada

- /

- Metals and Mining

- /

- TSX:AAUC

TSX Growth Leaders With High Insider Stakes May 2024

Reviewed by Simply Wall St

Over the past year, the Canadian market has shown a robust increase of 12%, despite remaining flat in the last seven days. In this context, stocks from growth companies with high insider ownership can be particularly appealing, as they suggest confidence from those who know the company best.

Top 10 Growth Companies With High Insider Ownership In Canada

| Name | Insider Ownership | Earnings Growth |

| goeasy (TSX:GSY) | 21.7% | 15.9% |

| Payfare (TSX:PAY) | 15% | 57.7% |

| Vox Royalty (TSX:VOXR) | 12.4% | 77.3% |

| Aritzia (TSX:ATZ) | 19.1% | 51.6% |

| Allied Gold (TSX:AAUC) | 22.4% | 68.1% |

| ROK Resources (TSXV:ROK) | 16.6% | 159.6% |

| Aya Gold & Silver (TSX:AYA) | 10.2% | 51.6% |

| Artemis Gold (TSXV:ARTG) | 31.8% | 45.6% |

| Ivanhoe Mines (TSX:IVN) | 12.3% | 38.5% |

| UGE International (TSXV:UGE) | 35.4% | 63.5% |

Below we spotlight a couple of our favorites from our exclusive screener.

Allied Gold (TSX:AAUC)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Allied Gold Corporation, operating in Africa, focuses on the exploration and production of mineral deposits with a market capitalization of approximately CA$802.32 million.

Operations: The company generates revenue from three primary mines: Agbaou Mine at CA$141.39 million, Bonikro Mine at CA$192.71 million, and Sadiola Mine at CA$342.34 million.

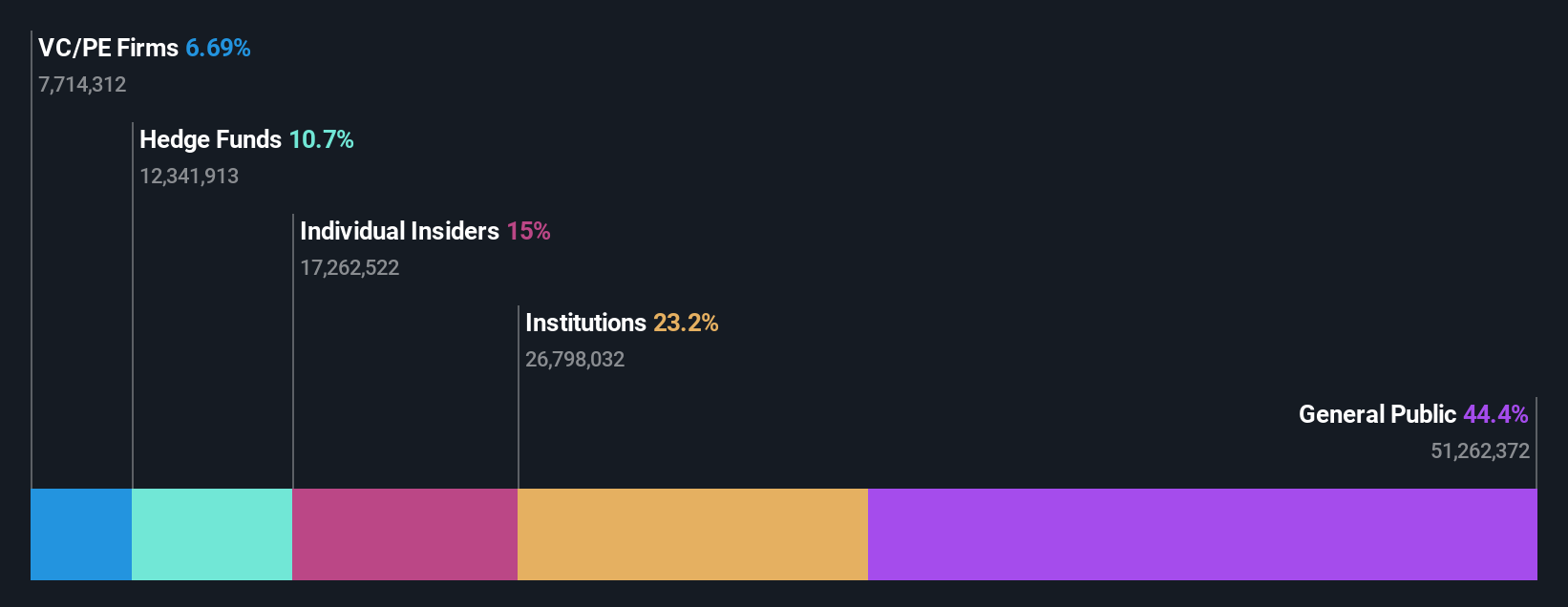

Insider Ownership: 22.4%

Revenue Growth Forecast: 14.7% p.a.

Allied Gold, trading at A$87.9% below its fair value, is poised for substantial growth with an expected revenue increase of 14.7% per year and earnings forecast to grow by 68.12% annually. This performance surpasses the Canadian market projections significantly. Furthermore, the company has demonstrated strong insider confidence with significant buying over recent months and no major selling, underscoring a robust outlook from those closest to its operations. Recent operational updates confirm ongoing production increases and improved financial results compared to previous periods, reinforcing Allied Gold's growth trajectory amidst a competitive industry landscape.

- Click here and access our complete growth analysis report to understand the dynamics of Allied Gold.

- The valuation report we've compiled suggests that Allied Gold's current price could be quite moderate.

Artemis Gold (TSXV:ARTG)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Artemis Gold Inc. is a gold development company engaged in identifying, acquiring, and developing gold properties, with a market capitalization of approximately CA$2.10 billion.

Operations: The company primarily engages in the exploration and potential development of gold properties.

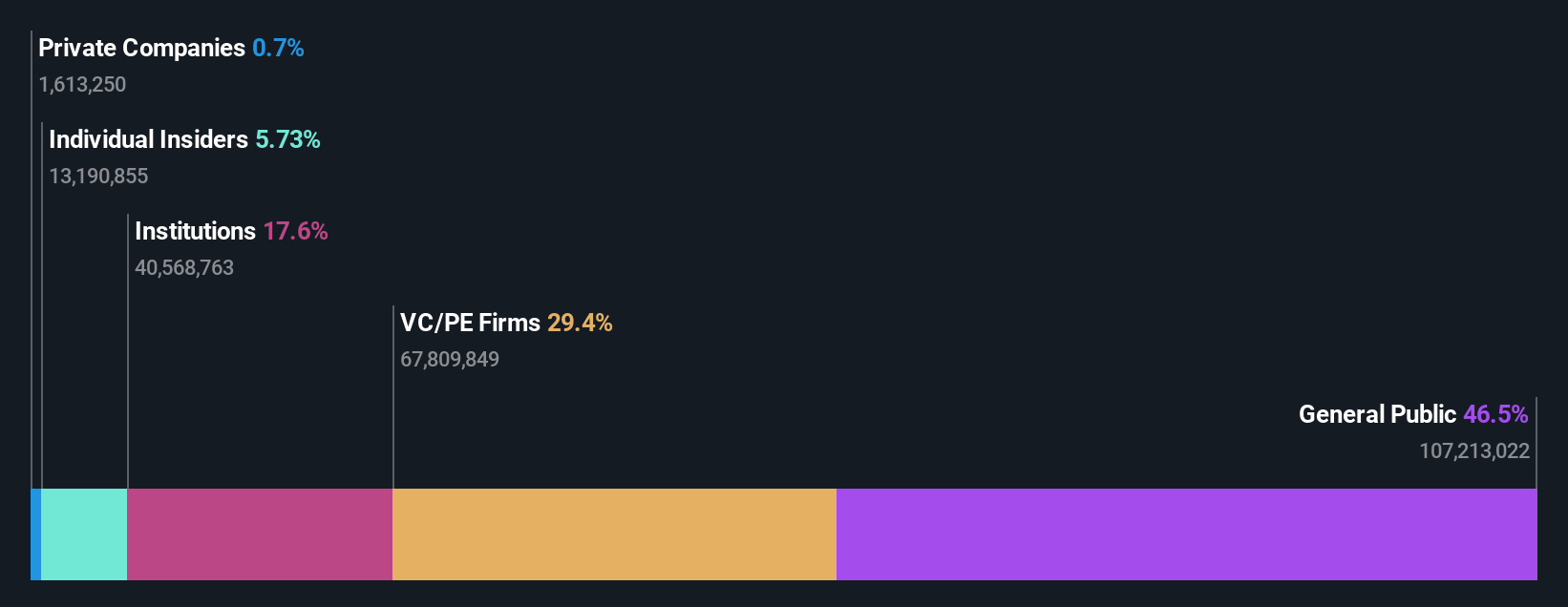

Insider Ownership: 31.8%

Revenue Growth Forecast: 50.8% p.a.

Artemis Gold, despite a net loss of CA$6.65 million in Q1 2024, shows promise with its Blackwater Mine construction on track for completion by H2 2024. The project is largely funded and progressing well, with significant insider buying over the past three months indicating strong internal confidence. Although currently making less than US$1m in revenue and experiencing shareholder dilution last year, Artemis is expected to see high revenue growth (50.8% per year) outpacing the Canadian market significantly.

- Click here to discover the nuances of Artemis Gold with our detailed analytical future growth report.

- Our valuation report unveils the possibility Artemis Gold's shares may be trading at a premium.

Vitalhub (TSX:VHI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Vitalhub Corp. offers technology solutions for health and human service providers across Canada, the U.S., the U.K., Australia, Western Asia, and other international markets, with a market capitalization of approximately CA$353.68 million.

Operations: The company generates revenue by providing technology solutions to health and human service providers in various global markets including Canada, the U.S., the U.K., Australia, and Western Asia.

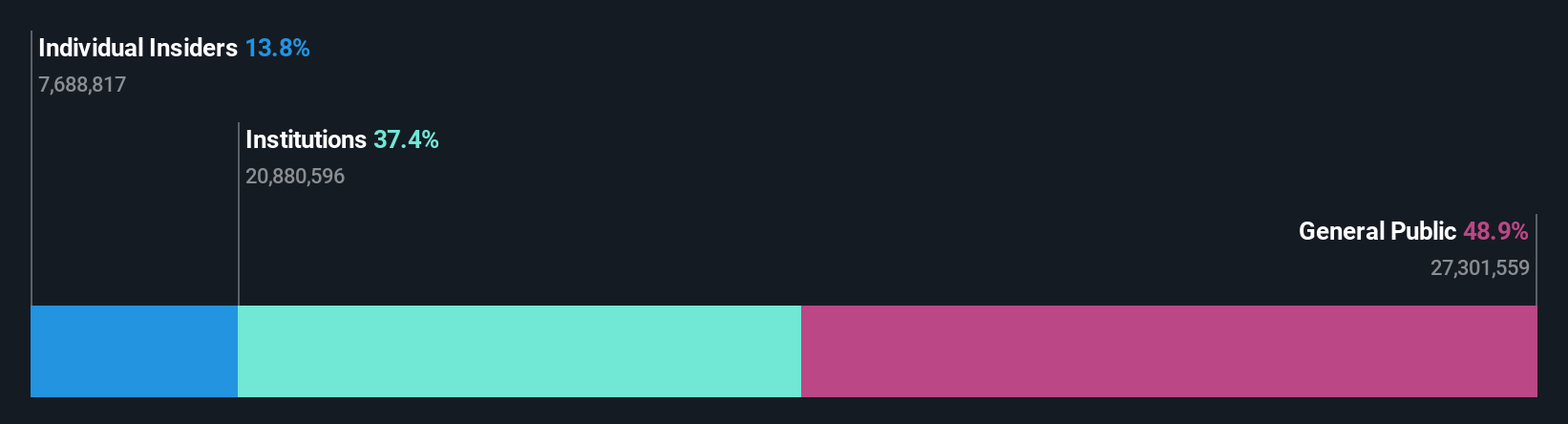

Insider Ownership: 15.1%

Revenue Growth Forecast: 12.8% p.a.

Vitalhub, a Canadian tech firm, reported a revenue increase to CAD 15.26 million and net income of CAD 1.32 million for Q1 2024, signaling strong growth. Recent leadership enhancements aim to boost operational efficiency and expansion in North America. Despite recent shareholder dilution, insider transactions show more buying than selling over the last three months, reflecting confidence from within. The company's earnings are expected to grow by 37.7% annually, outstripping the market forecast of 13.7%.

- Navigate through the intricacies of Vitalhub with our comprehensive analyst estimates report here.

- The valuation report we've compiled suggests that Vitalhub's current price could be inflated.

Next Steps

- Click this link to deep-dive into the 33 companies within our Fast Growing TSX Companies With High Insider Ownership screener.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Allied Gold is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:AAUC

Very undervalued with reasonable growth potential.