- Canada

- /

- Metals and Mining

- /

- TSX:IVN

Top 3 TSX Growth Companies With Strong Insider Ownership

Reviewed by Simply Wall St

The Canadian market has shown robust performance, climbing 1.2% in the last week and up 28% over the past year, with earnings forecasted to grow by 16% annually. In such a thriving environment, growth companies with strong insider ownership can be particularly appealing as they often indicate confidence from those closest to the business and may align well with ongoing market trends.

Top 10 Growth Companies With High Insider Ownership In Canada

| Name | Insider Ownership | Earnings Growth |

| Vox Royalty (TSX:VOXR) | 11.8% | 70.7% |

| Almonty Industries (TSX:AII) | 17.7% | 117.6% |

| goeasy (TSX:GSY) | 21.2% | 16.7% |

| Alvopetro Energy (TSXV:ALV) | 19.4% | 76.5% |

| VersaBank (TSX:VBNK) | 13.3% | 30.4% |

| Aya Gold & Silver (TSX:AYA) | 10.2% | 71.4% |

| Aritzia (TSX:ATZ) | 18.9% | 59.7% |

| Allied Gold (TSX:AAUC) | 17.8% | 73% |

| Ivanhoe Mines (TSX:IVN) | 12.3% | 69.8% |

| Medicenna Therapeutics (TSX:MDNA) | 15.3% | 57.2% |

Underneath we present a selection of stocks filtered out by our screen.

Allied Gold (TSX:AAUC)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Allied Gold Corporation, along with its subsidiaries, is involved in the exploration and production of mineral deposits in Africa and has a market capitalization of CA$1.22 billion.

Operations: The company's revenue segments consist of $142.03 million from the Agbaou Mine, $193.93 million from the Bonikro Mine, and $391.07 million from the Sadiola Mine.

Insider Ownership: 17.8%

Revenue Growth Forecast: 21.5% p.a.

Allied Gold is experiencing substantial insider buying, signaling confidence in its growth prospects. The company's earnings are forecast to grow 72.99% annually, with revenue expected to rise by 21.5% per year, surpassing the Canadian market average. Despite a recent CAD 192.2 million equity offering potentially diluting shares, Allied Gold remains undervalued compared to its peers and industry standards. The Sadiola Gold Mine expansion could further enhance growth by increasing production capacity significantly over the next few years.

- Click to explore a detailed breakdown of our findings in Allied Gold's earnings growth report.

- Our valuation report here indicates Allied Gold may be undervalued.

Ivanhoe Mines (TSX:IVN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Ivanhoe Mines Ltd. is involved in the mining, development, and exploration of minerals and precious metals mainly in Africa, with a market cap of CA$26.19 billion.

Operations: Ivanhoe Mines Ltd. focuses on the extraction and development of mineral resources and precious metals, with operations concentrated in Africa.

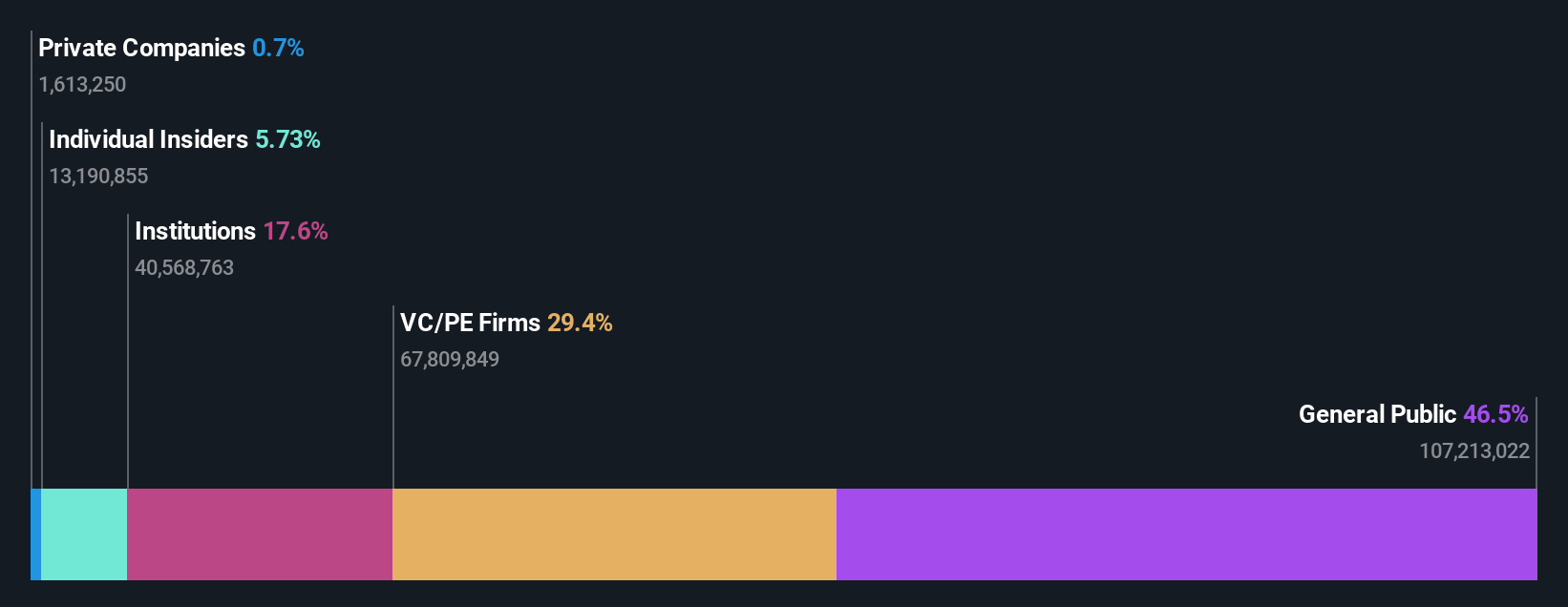

Insider Ownership: 12.3%

Revenue Growth Forecast: 86.7% p.a.

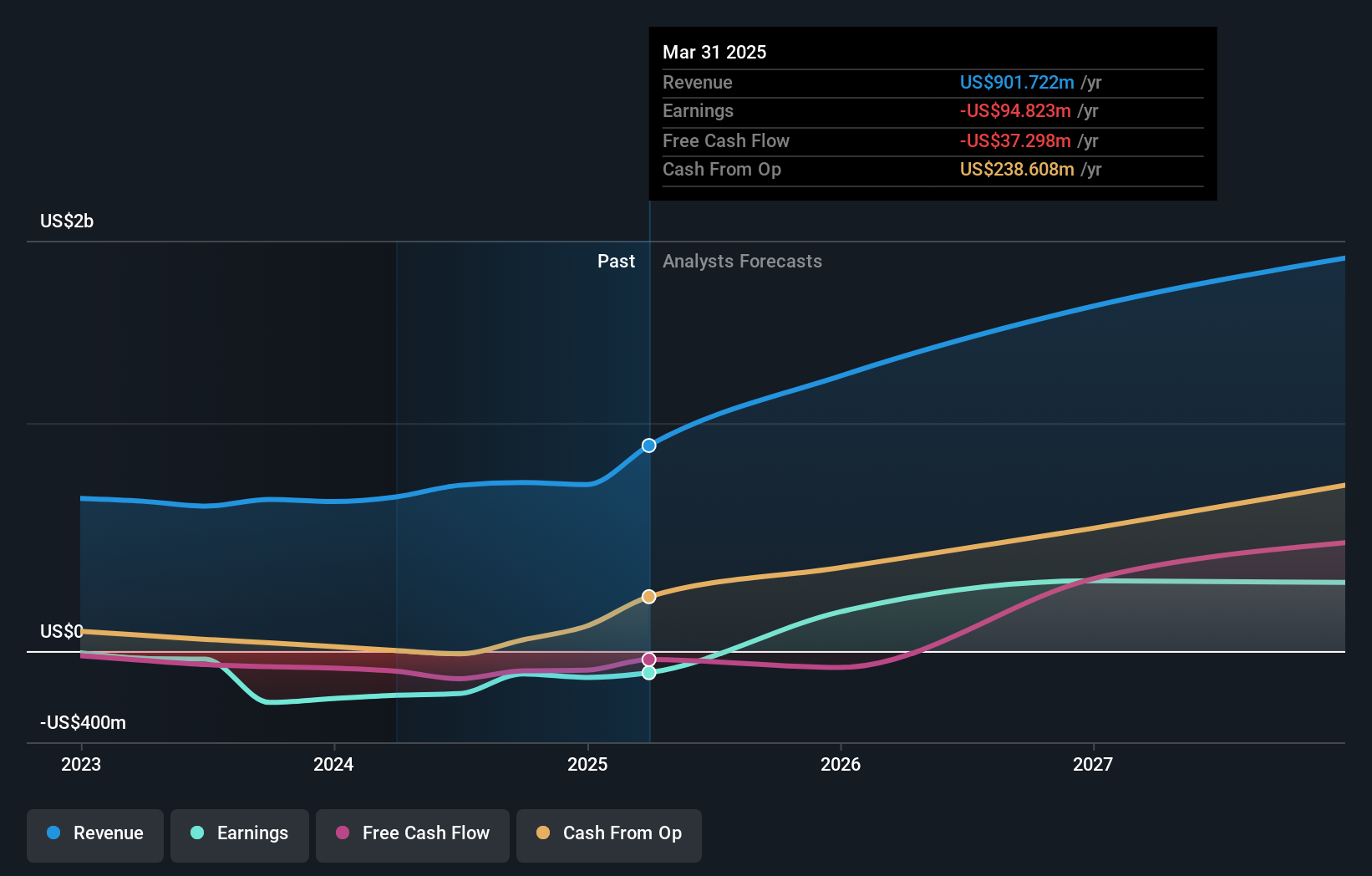

Ivanhoe Mines demonstrates strong growth potential, with revenue expected to grow at 86.7% annually, outpacing the Canadian market. Earnings are projected to increase by 69.8% per year. Despite past shareholder dilution, the stock trades below its estimated fair value and analysts anticipate a price rise of 23.7%. Recent production guidance adjustments for Kamoa-Kakula and Kipushi reflect operational challenges but also highlight ongoing expansion efforts in Zambia through strategic partnerships.

- Unlock comprehensive insights into our analysis of Ivanhoe Mines stock in this growth report.

- Our comprehensive valuation report raises the possibility that Ivanhoe Mines is priced higher than what may be justified by its financials.

Artemis Gold (TSXV:ARTG)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Artemis Gold Inc. is a gold development company that specializes in the identification, acquisition, and development of gold properties, with a market cap of CA$3.33 billion.

Operations: Revenue Segments (in millions of CA$): null

Insider Ownership: 29.9%

Revenue Growth Forecast: 45.9% p.a.

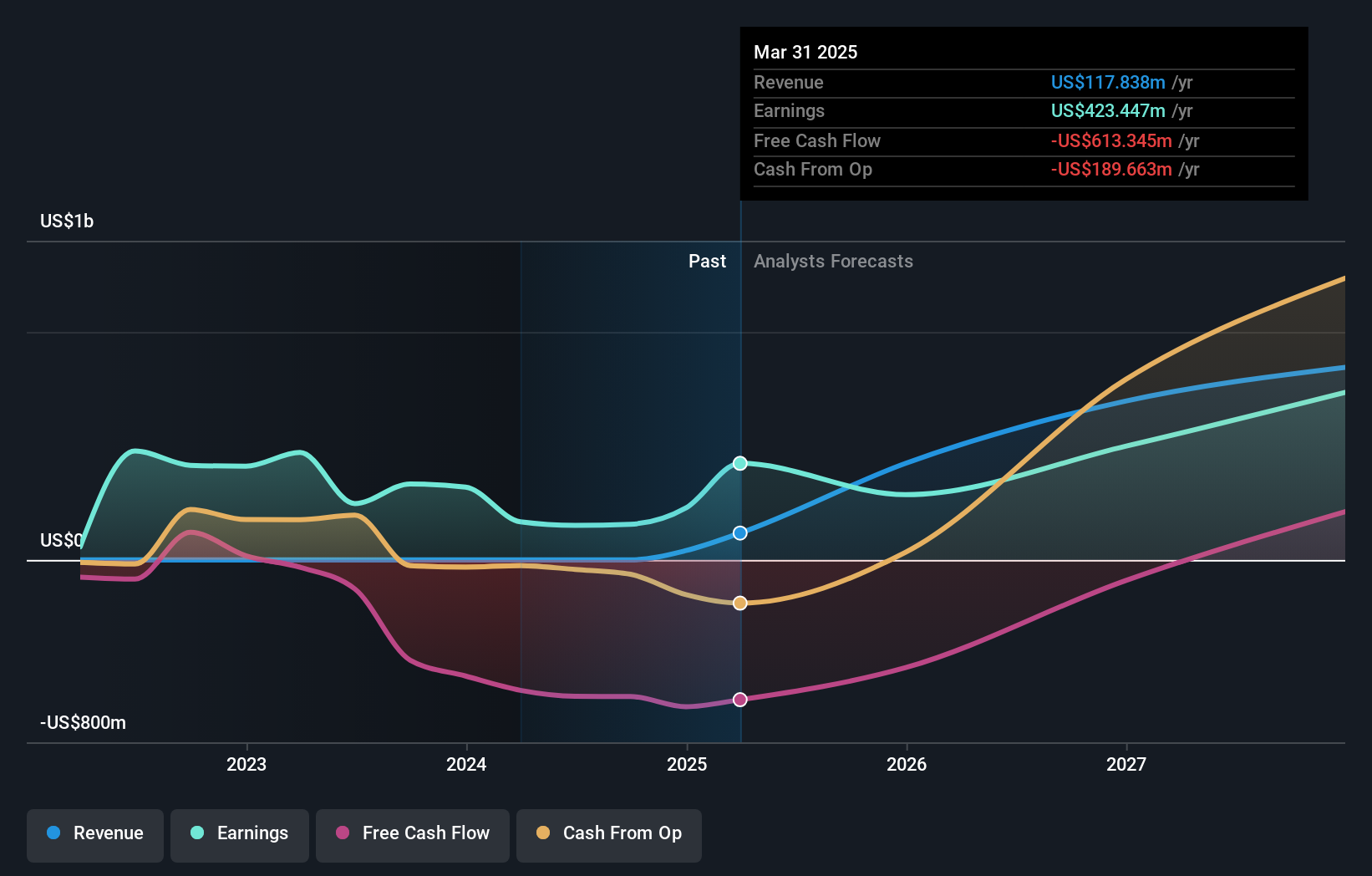

Artemis Gold is progressing rapidly with its Blackwater Mine, now over 95% complete, targeting first gold pour by late Q4 2024. Despite wildfire-related delays and increased costs, the project remains fully funded. The company anticipates significant revenue growth at 45.9% annually, surpassing market averages. However, past shareholder dilution and less than a year of cash runway pose challenges. Artemis trades significantly below estimated fair value but expects profitability within three years.

- Dive into the specifics of Artemis Gold here with our thorough growth forecast report.

- The valuation report we've compiled suggests that Artemis Gold's current price could be inflated.

Where To Now?

- Discover the full array of 33 Fast Growing TSX Companies With High Insider Ownership right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:IVN

Ivanhoe Mines

Engages in the mining, development, and exploration of minerals and precious metals primarily in Africa.

High growth potential and slightly overvalued.