- Canada

- /

- Metals and Mining

- /

- TSXV:ARTG

How Artemis Gold’s Earnings Recovery and Lowered Guidance May Shape TSXV:ARTG’s Investment Outlook

Reviewed by Sasha Jovanovic

- Artemis Gold Inc. recently reported strong third quarter earnings, achieving sales of C$308.11 million and net income of C$110.85 million, while reaffirming its 2025 gold production guidance towards the lower end of the original range due to operational challenges.

- The company is also advancing a large-scale exploration drill program in central British Columbia, utilizing machine learning to identify over 30 new exploration targets and further refining its growth opportunities.

- Let's examine how Artemis Gold's earnings turnaround and operational guidance could influence its investment narrative going forward.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

What Is Artemis Gold's Investment Narrative?

For anyone considering Artemis Gold, the big picture rests on the company's shift from past losses to strong profitability, supported by consistent operational improvements and ambitious exploration. The latest quarter’s significant earnings turnaround affirms that recovery, but production guidance towards the lower end of the earlier range signals some caution. Operational challenges, notably unexpected mill downtime and lower recoveries, have led management to temper short-term expectations, which could affect confidence in near-term results or projections of rapid profit growth. On the flip side, Artemis is proactively expanding exploration in British Columbia, applying machine learning to identify dozens of new drilling targets. This move could set up new growth catalysts, but also adds execution risk and capital allocation questions in a high-debt environment. Overall, the recent news makes both the potential and the operational risks more immediate for shareholders. In contrast, investors should not overlook the impact of higher debt and production risks.

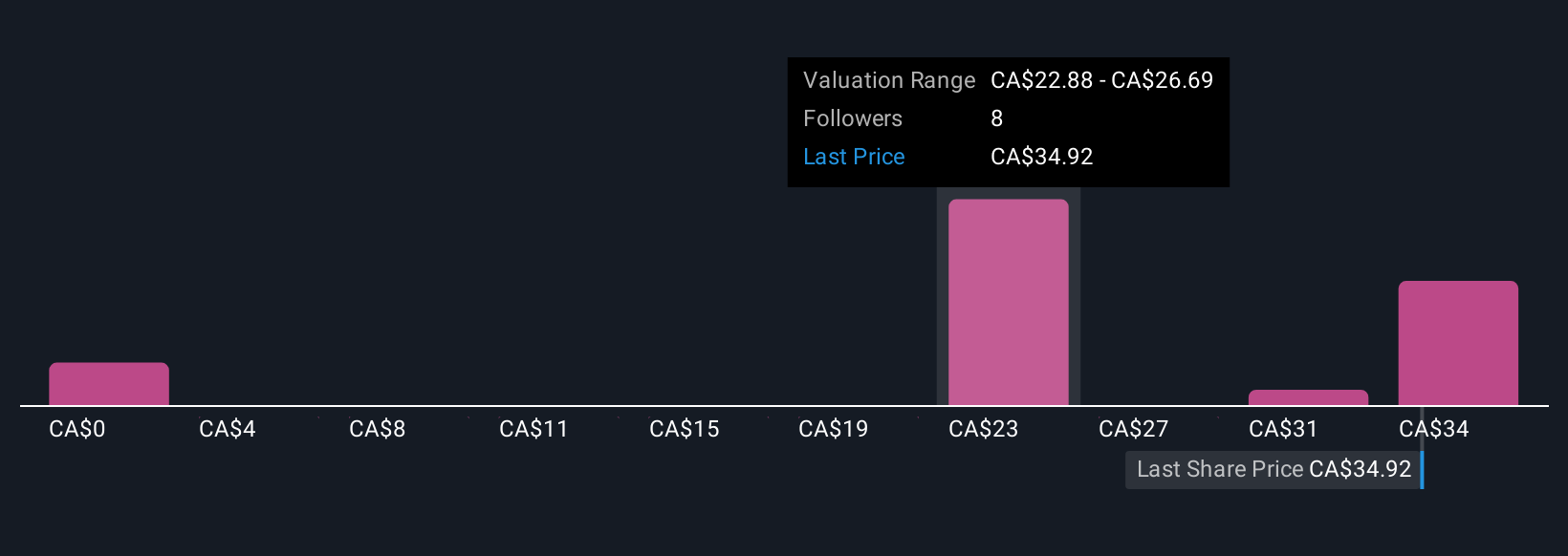

Despite retreating, Artemis Gold's shares might still be trading 41% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 6 other fair value estimates on Artemis Gold - why the stock might be worth as much as 70% more than the current price!

Build Your Own Artemis Gold Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Artemis Gold research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Artemis Gold research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Artemis Gold's overall financial health at a glance.

Interested In Other Possibilities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:ARTG

Artemis Gold

Focuses on the identification, acquisition, and development of gold properties.

Exceptional growth potential and fair value.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Positioned to Win as the Streaming Wars Settle

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion