- Canada

- /

- Metals and Mining

- /

- TSXV:ARTG

Artemis Gold (TSXV:ARTG) Valuation After Expanded Phase 2 Plans at Blackwater Mine

Reviewed by Simply Wall St

Artemis Gold (TSXV:ARTG) has grabbed fresh attention after its board signed off on an expanded Phase 2 at the Blackwater Mine, aiming to lift processing capacity and long term annual gold output.

See our latest analysis for Artemis Gold.

That growth story has not gone unnoticed, with the 90 day share price return of 22.79 percent feeding into a powerful year to date share price gain of 166.17 percent and a three year total shareholder return of 758.95 percent. This suggests momentum is very much building around Artemis as Blackwater advances.

If this kind of re rating has you thinking more broadly about opportunities in the sector, it could be worth exploring fast growing stocks with high insider ownership for other fast moving names with aligned insiders.

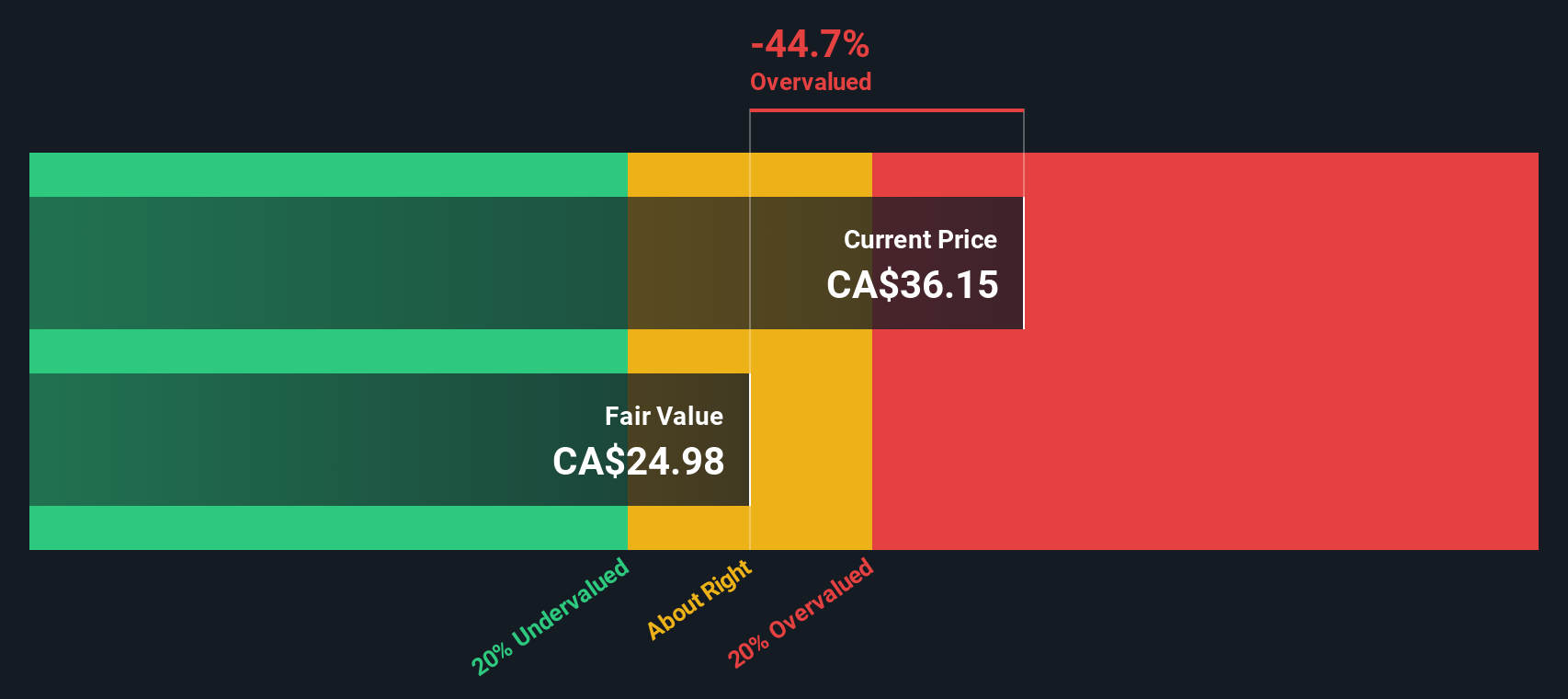

With Artemis still trading at a sizable discount to analyst targets and cash flow from a much larger Blackwater on the horizon, investors now face a key question: is this a genuine value opportunity, or is future growth already fully priced in?

Price to earnings of 41.8x: Is it justified?

Artemis Gold trades at CA$37.45 with a price to earnings ratio of 41.8 times. This level points to a share price that appears elevated compared to peers.

The price to earnings multiple compares the current share price with per share earnings. A higher ratio usually reflects strong growth expectations or a quality premium. For a newly profitable gold developer transitioning into production, a rich multiple can indicate that investors are already paying up for a long runway of forecast earnings growth at Blackwater.

For Artemis, the 41.8 times earnings level stands well above both the Canadian Metals and Mining industry average of 21.4 times and our estimated fair price to earnings of 33.4 times. This suggests the market is pricing in more optimism than either the sector benchmark or our regression based fair ratio imply. If sentiment moves closer to that fair ratio, there could be meaningful multiple compression even if profits continue to rise.

Explore the SWS fair ratio for Artemis Gold

Result: Price to earnings of 41.8x (OVERVALUED)

However, Artemis still faces execution risk at Blackwater and potential cost overruns. Either of these could quickly challenge today’s premium valuation.

Find out about the key risks to this Artemis Gold narrative.

Another View on Value

Our SWS DCF model paints a very different picture. On this view, Artemis looks deeply undervalued, with the shares trading around 62 percent below an estimated fair value of roughly CA$98.50. If the mine delivers as planned, is the current earnings multiple really the number that matters?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Artemis Gold for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 100+ undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Artemis Gold Narrative

If this take does not fully align with your own view, you can quickly dig into the numbers yourself and shape a custom story in minutes, Do it your way.

A great starting point for your Artemis Gold research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, put Simply Wall St to work for you by hunting for fresh, high conviction opportunities that match your risk profile and return goals.

- Capitalize on mispriced opportunities by scanning these 100+ undervalued stocks based on cash flows where strong cash flows meet attractive entry points.

- Ride structural growth trends by targeting next generation innovators using these 26 AI penny stocks shaping the future of automation and intelligence.

- Lock in potential income streams by focusing on reliable payers through these 13 dividend stocks with yields > 3% that can strengthen your portfolio’s cash yield.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:ARTG

Artemis Gold

Focuses on the identification, acquisition, and development of gold properties.

Exceptional growth potential and fair value.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)