- Canada

- /

- Metals and Mining

- /

- TSXV:ARTG

A Fresh Look at Artemis Gold (TSXV:ARTG) Valuation After Securing a $700 Million Credit Facility

Reviewed by Kshitija Bhandaru

Artemis Gold (TSXV:ARTG) has closed a $700 million revolving credit facility, using part of the funds to pay off its previous project loan. This move strengthens its financial flexibility and supports future expansion plans.

See our latest analysis for Artemis Gold.

Shareholders have seen modest traction recently, with Artemis Gold’s 1-year total shareholder return at 1.8%. The positive sentiment around the new credit facility has added to the company’s steady long-term performance, and momentum could build further as expansion projects progress.

If you’re watching for other potential movers in the resources and mining space, now is the perfect time to broaden your investing outlook and discover fast growing stocks with high insider ownership

With shares posting a steady but unspectacular gain and most analysts just a shade above the current price, the key question is whether Artemis Gold remains undervalued or if the market is already pricing in its next phase of growth.

Price-to-Earnings of 98.6x: Is it justified?

Shares in Artemis Gold currently trade at a price-to-earnings ratio (P/E) of 98.6x, which is substantially higher than both its industry peers and what the market might consider reasonable for a mining company at its current stage.

The price-to-earnings multiple reflects how much investors are willing to pay today for a dollar of ongoing earnings. For Artemis, this figure suggests the market is anticipating an exceptional pace of profit growth or is factoring in expectations far beyond recent performance. High P/E ratios in the mining sector are uncommon and typically reserved for companies on the cusp of explosive earnings growth or those with exceptionally robust outlooks.

Relative to the Canadian Metals and Mining industry average of just 24x, Artemis appears richly valued. Even when measured against its estimated fair price-to-earnings ratio of 65.1x, the current P/E stands out as significantly elevated. If market assumptions do not play out as strongly as anticipated, this level could adjust accordingly.

Explore the SWS fair ratio for Artemis Gold

Result: Price-to-Earnings of 98.6x (OVERVALUED)

However, shifts in commodity prices or slower than expected revenue growth could challenge current valuations and lead to investor reassessment in the near term.

Find out about the key risks to this Artemis Gold narrative.

Another View: What Does the DCF Model Suggest?

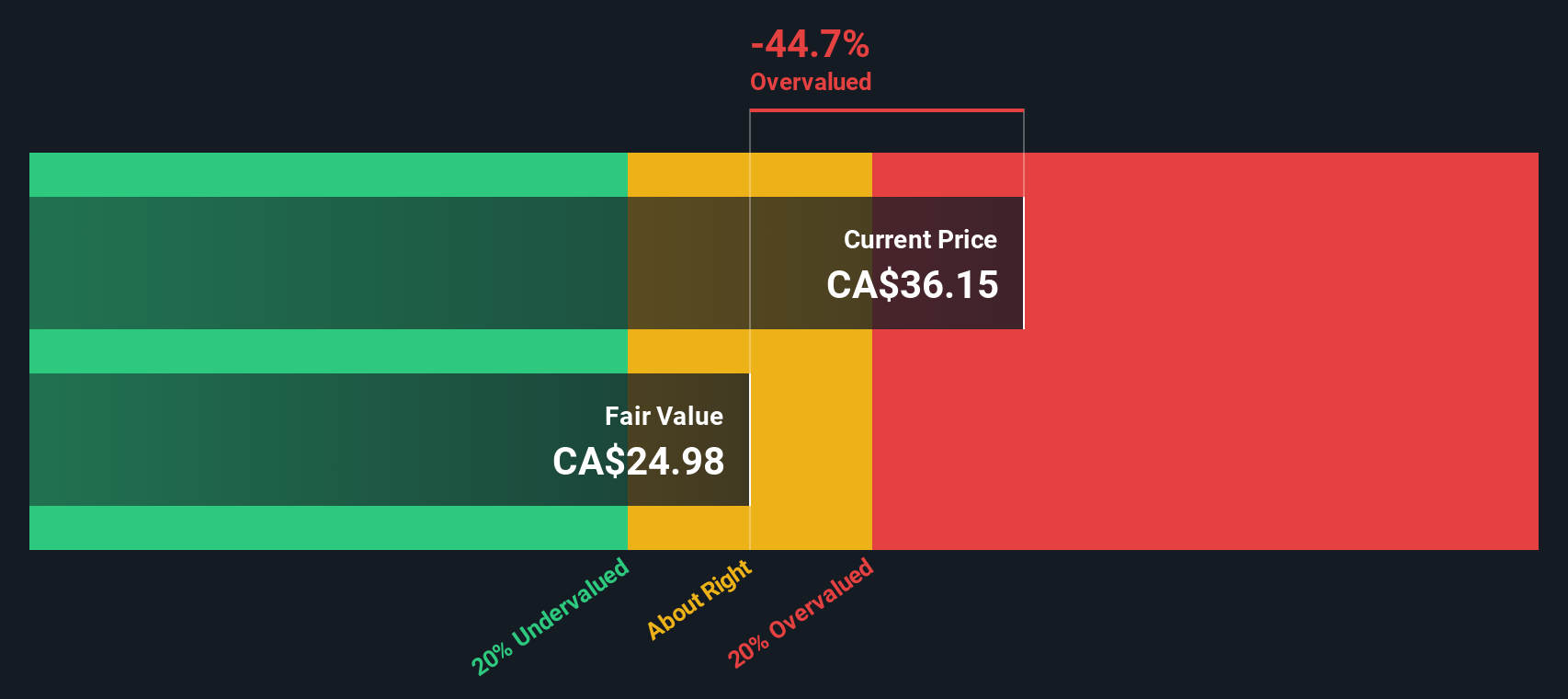

While Artemis Gold appears overvalued when looking at the price-to-earnings ratio, our DCF model offers a different perspective. The SWS DCF model estimates the fair value at CA$29.8, which is lower than the current price of CA$36.64. This suggests the shares may also be trading above their intrinsic value. Does this reinforce the market’s caution, or is the crowd missing a potential upside?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Artemis Gold for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Artemis Gold Narrative

If you have a different perspective or want to see where your own analysis leads, it only takes a few minutes to dive into the numbers and shape your own story. Do it your way

A great starting point for your Artemis Gold research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Let smarter stock picks work for you. Open new possibilities in your portfolio by acting on unique trends and breakthrough technologies. Find your next opportunity before others do.

- Grow your returns with access to reliable income streams by checking out these 19 dividend stocks with yields > 3% offering attractive yields and financial resilience.

- Unlock potential in the next wave of healthcare innovation by tapping into these 32 healthcare AI stocks which is driving advancements in patient outcomes and medical AI.

- Supercharge your search for undervalued gems with these 896 undervalued stocks based on cash flows, based on strong cash flow metrics and untapped market potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:ARTG

Artemis Gold

Focuses on the identification, acquisition, and development of gold properties.

Exceptional growth potential with low risk.

Market Insights

Community Narratives